Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 26, 2021

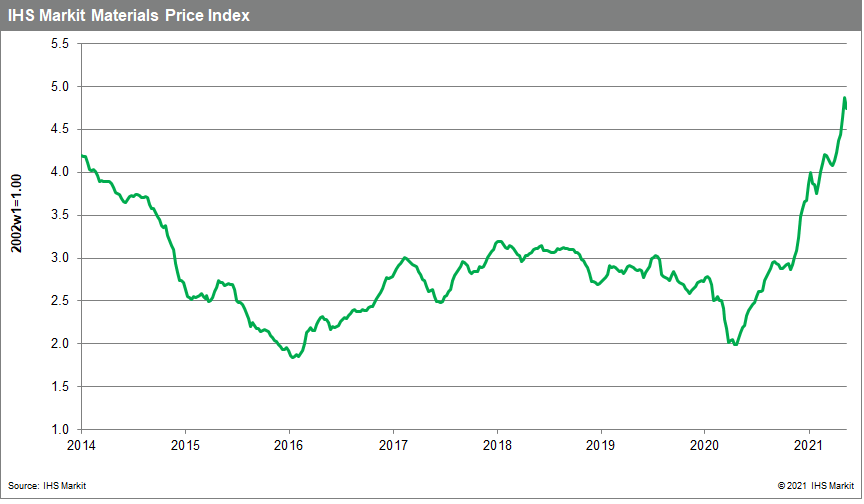

Our Materials Price Index (MPI) fell 2.5% last week, following a 5.2% increase the previous week. Price declines were widespread with nine of the MPI's ten subcomponents decreasing. Commodity prices as measured by the MPI are still up strongly over the past 12 months to more than double their level from May of 2020.

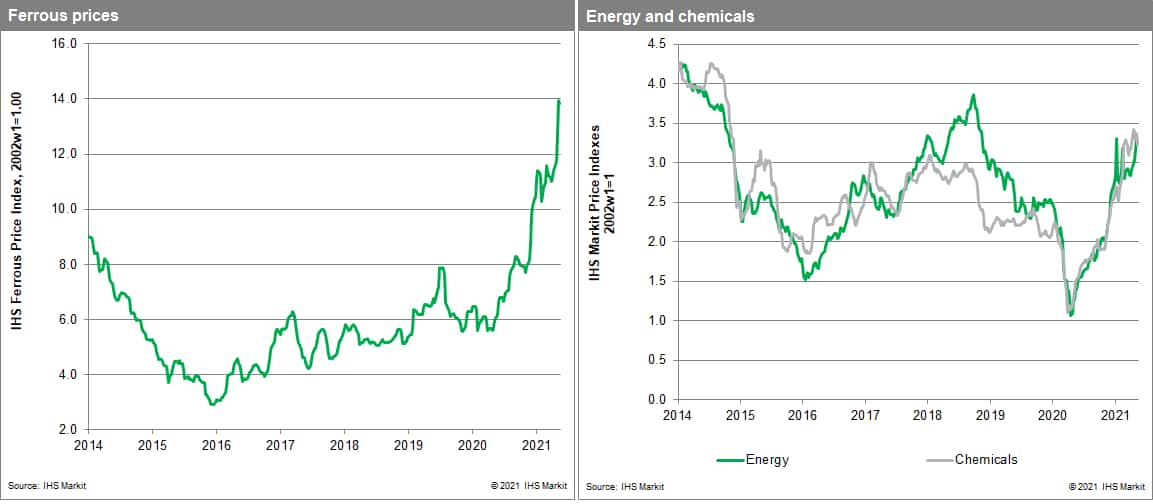

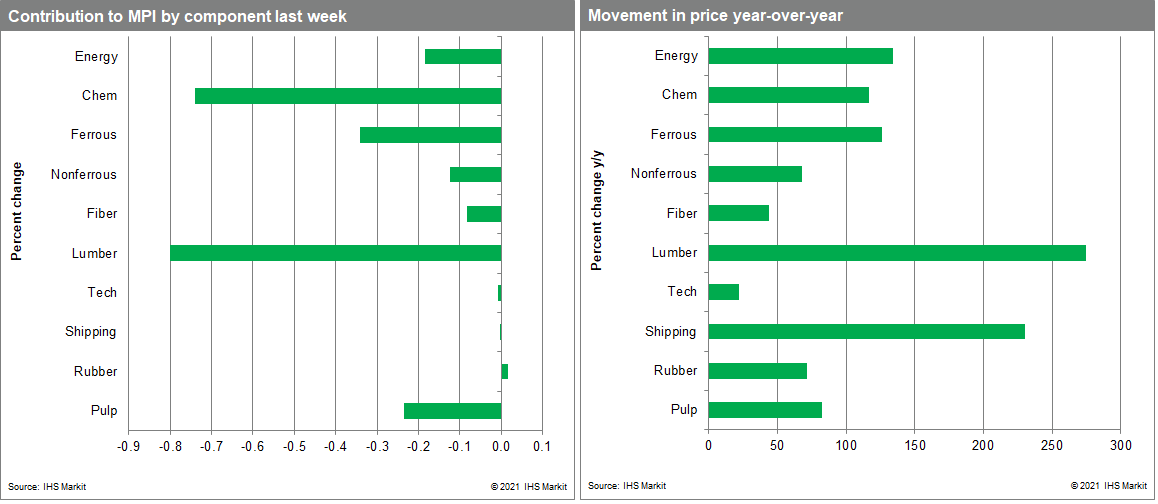

Lumber once again was a standout, falling 13.9% for the week. Markets reacted to news that US April single-family building permits dropped 3.8%, a sign that the white-hot housing market may soften in the months ahead. Housing analysts are also noting indications that high home prices are beginning to meet with some buyer resistance. Pulp prices also recorded a large decline, dropping 6.0% for the week. Increasing supply with rising inventory is undercutting prices. Chemicals were another sector posting relatively large declines, with the MPI's subindex retreating 4.1%. Better availability as capacity comes back on line in the US Gulf Coast is softening prices. One caution is that heavy rains late last week in East Texas and Louisiana do appear to have disrupted operations in the greater Lake Charles area, threatening the industry just as it was putting winter storm Uri behind. Metal prices saw a tumultuous week. Although declines were modest, the MPI's ferrous index dipped 0.8%, while the nonferrous index dropped 1.7%, sharp price swings were triggered by Chinese policymaker statements about possible investigations or interventions to limit speculative behavior.

While commodity markets remain strong, the tone in markets changed last week. The optimism that has characterized markets since last November was checked by several factors: alarm over fresh COVID-19 outbreaks in Asia, growing inflation fears, possible market intervention by Chinese authorities, political resistance to the Biden Administration's infrastructure plan, and finally that high prices are beginning to encounter resistance from buyers. Although the least newsworthy, this last factor may be the most important in eventually ending the now 13-month surge in commodity prices.

Posted 26 May 2021 by Tal Dickstein, Senior Economist, Pricing and Purchasing, S&P Global Market Intelligence