Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 02, 2023

By Michael Dall

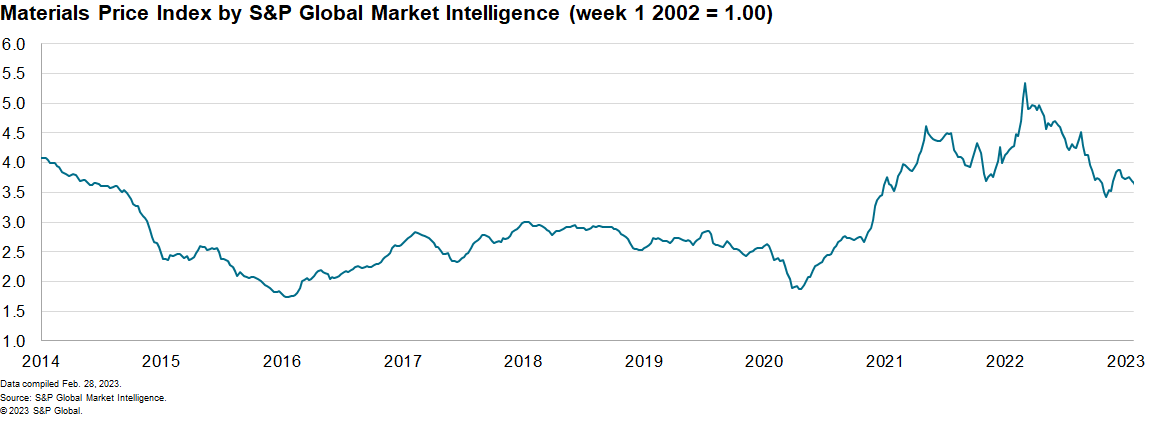

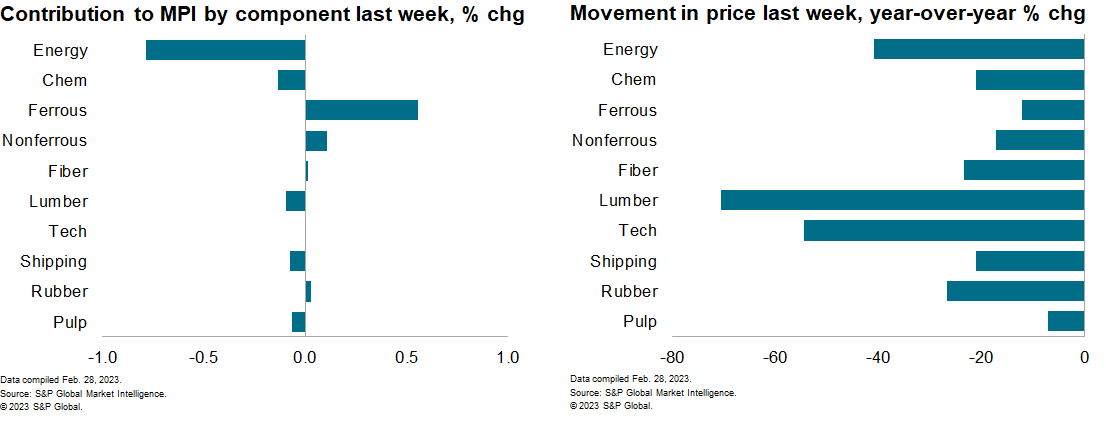

The Material Price Index (MPI) by S&P Global Market Intelligence fell 0.5% last week, its fifth consecutive decline. The decrease was mixed with only five of the ten subcomponents down. The MPI now sits 25% lower year on year (y/y). Prices, however, remain far higher (40%) than the pre-pandemic levels of the fourth quarter 2019.

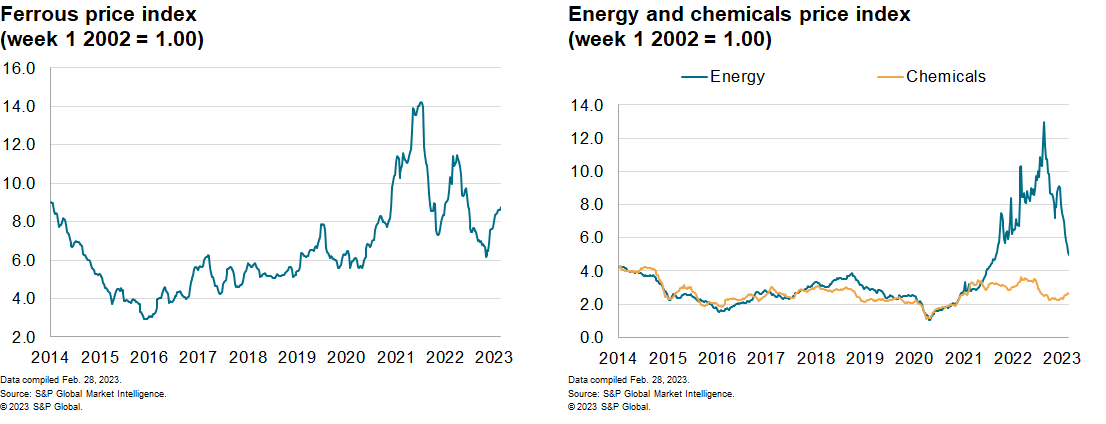

Falling energy prices were again the major driver of the decline in the MPI. In fact, the MPI excluding energy increased 0.4% last week. The energy sub-index posted a 3.7% decrease, with both oil and natural gas prices sliding. Brent crude oil, the international benchmark, fell to $80/barrel having been as high as $85/barrel the previous week. Prices were reacting to the latest release of the Federal Open Market Committee (FOMC) meeting minutes which showed "almost all" members supported the latest interest rate rise. This was taken as a bearish signal for near-term oil demand and sent prices lower. The downward momentum continued in natural gas markets last week. Spot prices of Liquefied Natural Gas (LNG) in Europe stood at $13.38/MMBTu, having peaked at a record $70/MMBTu in August 2022. A combination of milder-than-average winter temperatures, a strong inventory build and successful replacement of Russian supplies have caused this significant downward price correction. Lower global natural gas prices are driving down energy costs across commodity markets and helping to ease overall producer price inflation. There were elements of strength in commodity markets last week with the steel making raw materials sub-index increasing 1.6%. Iron ore prices reached $126.34/tonne, a five-month high, after the mining company BHP stated renewed optimism for near-term Chinese demand in its latest financial statement.

Markets continue to grapple with mixed signals on global economic growth with traders again taking a broadly bearish view last week. Particular attention was paid to the rise in US core inflation after the personal consumption expenditures (PCE) price index jumped 0.6% in January. Its 12-month change edged up to 5.4% and core PCE (excluding food and energy) prices also surged an uncomfortable 0.6% and are up 4.7% over the past 12 months. This was taken as a sign that central banks will continue to implement aggressive interest rate rises in 2023. In the US, we expect three more quarter-point rate hikes that will take the top of the target range for the federal funds rate to 5½% by midyear. The latest readings on inflation and underlying strength in spending and income suggest upside risks to this revised interest rate forecast and increase the odds of a 50-basis-point increase at one of the next few meetings of the FOMC. In addition, Chinese growth signals remain weak compared to pre-pandemic levels and this, combined with falling energy costs for producers, will ultimately lead to lower commodity prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.