All major US equity indices closed higher on the week, while APAC and European markets were mixed. US and benchmark European government bonds closed lower on the week. European iTraxx and CDX-NA closed almost flat across IG and high yield on the week. Oil, gold, and silver closed higher on the week, while the US dollar, natural gas, and copper were lower.

Americas

All major US equity markets closed higher on the week; S&P 500 +1.6%, Nasdaq +1.3%, Russell 2000 +1.1%, and DJIA +1.1% week-over-week.

10yr US govt bonds closed at a 1.63% yield and 30yr bonds 2.07% yield, which is +6bps and +3bps week-over-week, respectively.

DXY US dollar index closed 93.64 (-0.3% WoW).

Gold closed $1,796 per troy oz (+1.6% WoW), silver closed $24.45 per troy oz (+4.7% WoW), and copper closed $4.50 per pound (-4.9% WoW).

Crude Oil closed $83.76 per barrel (+1.8% WoW) and natural gas closed $5.28 per mmbtu (-2.4% WoW).

CDX-NAIG closed at 52bps and CDX-NAHY 302bps, which is flat and +2bps week-over-week, respectively.

EMEA

Major European equity indices closed mixed; Italy +0.3%, France +0.1%, Germany -0.3%, UK -0.4%, and Spain -1.0% week-over-week.

All major 10yr European government bonds closed lower on the week; UK closed +4bps, Germany +6bps, Spain +7bps, France +8bps, and Italy +10bps week-over-week.

Brent Crude closed $85.53 per barrel (+0.8% WoW).

iTraxx-Europe closed 50bps and iTraxx-Xover 260bps, which is flat and +4bps week-over-week, respectively.

APAC

Major APAC equity markets closed mixed on the week; Hong Kong +3.1%, Australia +0.7%, Mainland China +0.3%, South Korea -0.3%, India -0.8%, and Japan -0.9% week-over-week.

- Total US industrial production (IP) fell 1.3% in September, reflecting decreases in manufacturing (down 0.7%), utilities IP (down 3.6%), and mining (down 2.3%). The change in IP for August was revised down from a gain of 0.4% to a decline of 0.1%. Lingering effects of Hurricane Ida and supply constraints in the automotive industry held back IP in September. (IHS Markit Economists Ben Herzon and Akshat Goel)

- Vehicle assemblies were revised lower for August and were below the assumption for September, implying less third-quarter motor vehicle output and inventory investment. In response, IHS Markit analysts lowered the estimate of third-quarter GDP growth 0.2 percentage point to 1.4%.

- Manufacturing IP fell 0.7% in September as the production of both durable and nondurable goods recorded losses. Hurricane Ida forced plant closures for petrochemicals, plastic resins, and petroleum refining in late August and production was not restored to normal as of September. As a result, large decreases were reported in chemicals (down 2.1%), and petroleum and coal products (down 2.4%). The hurricane shaved 0.3 percentage point from growth of manufacturing output in September.

- Output of motor vehicles and parts (down 7.2%) was the main drag on factory output in September as it continues to be restrained by a shortage of semiconductor chips used in vehicle components. Manufacturing output excluding motor vehicles and parts was down 0.3% in September. Vehicle assemblies fell 1.0 million units to 7.8 million in September, their lowest level since May 2020.

- The output of utilities fell 3.6% in September as demand for air conditioning moderated after an unseasonably warm August.

- Mining activity decreased 2.3% in September as lingering effects of Hurricane Ida continued to stymie oil and gas production in the Gulf of Mexico.

- The Federal Government of Nigeria (FGN)'s official budget deficit, released on 7 October, is expected to end fiscal year (FY) 2022 at 3.4% of GDP, based on the FGN's retained earnings projections. The country's retained revenue and spending projections diverted from the original 2022-24 Medium Term Fiscal Framework (MTFF) to incorporate the terms in the Petroleum Industry Act (PIA) 2021, as well as to allow for critical additional expenditures, particularly defense spending. (IHS Markit Economist Thea Fourie)

- The FGN's retained revenue (including government-owned enterprises [GOEs]) is expected to end 2022 24.8% above the original MTFF estimates, at NGN10.13 trillion (USD24.6 billion). The revenue windfall will stem from stronger earnings assumed from GOEs, the introduction of an education tax and dividend from the Bank of Industry, and the FGN's oil royalty windfall based on transfers to the Nigerian Sovereign Investment Authority under the provisions of the new PIA. Overall oil revenue will make up 34.9% of total FGN revenue.

- FGN spending commitments are expected to exceed the original MTFF by 12.5% to end 2022 at a projected NGN16.39 trillion. Recurrent expenditure will make up 41.7% of the FNG's total spending commitment during 2022, followed by capital expenditure at 32.7% and debt-servicing costs at 22%. The Nigerian government's projections show that debt-servicing costs will take up 35.6% of total retained income of the FGN. The 13% possible deviation in government revenue is, however, not taken into consideration in the calculation.

- Financing of the 2022 budget deficit will depend mostly on external borrowing, with foreign lending financing NGN2.51 trillion of the budget deficit and multilateral/bi-lateral loans NGN1.16 trillion. Domestic financing is expected to end 2022 at NGN2.51 trillion, while privatization proceeds is penciled in at NGN90.7 billion.

- The 2022 FGN budget assumes GDP growth of 2.6% in 2022 while oil production is expected to reach 1.88 MMb/d in 2022, 2.23 MMb/d in 2023, and 2.22 MMb/d in 2024. A Brent oil price of USD57 per barrel is assumed over the MTFF period, while the official exchange-rate projection remains unchanged at NGN410.15 per US dollar over the 2022-24 period. The Nigerian government expects headline inflation to end 2021 close to 15%, slowing to 10% by the end of 2024.

- Stellantis and LG Energy Solution have signed a memorandum of understanding (MoU) to form a joint venture (JV) to produce battery cells and modules for North American market, according to a statement by Stellantis. Under the partnership, the two companies will establish a new battery manufacturing plant in North America that aims to have an annual production capacity of 40 gigawatt hours (GWh). The location of the new facility is currently under review and further details will be shared at a later date. The groundbreaking for the facility is expected to take place in the second quarter of 2022, and it is targeted to start production by the first quarter of 2024. The battery cells and modules to be produced at the plant will be supplied to Stellantis assembly plants in the US, Canada, and Mexico for installation in its electrified vehicles, including plug-in hybrids (PHEVs) and battery electric vehicles (BEVs) that will be sold under the Stellantis family of brands. (IHS Markit AutoIntelligence's Jamal Amir)

- The LPG industry's road to a carbon-neutral bioLPG (also known as bio-propane) future is strewn with feedstock quantity, quality, and cost challenges that do not favor a discounted byproduct in the shade of higher-value cuts of the crude barrel. (IHS Markit Net-Zero Business Daily's Kevin Adler and OPIS' Inge Erhard)

- But industry participants in Europe believe some hurdles could be overcome with the use of eco-friendly substitutes and state support, according to executives participating in the recent European LPG e-Congress.

- LPG is used in Europe as a transportation fuel in the farming sector and, increasingly, for road transportation as well, according to the industry trade group Liquid Gas Europe. In its 2020 annual report, the association said LPG also covers the heating needs of more than 20 million EU citizens and 700,000 businesses.

- In the transport sector, LPG fuels more than 15 million vehicles at 47,000 stations. Demand increased 3% year over year in 2019 to 10.9 million metric tons.

- New energy taxation rules have been proposed in Europe as part of the EU's "Fit for 55" program aimed at achieving a 55% reduction in GHG emissions by 2030 from a 2005 baseline. The new rules would treat LPG as transition fuel, with preferential rates for a decade.

- Top Asian economies may need to spend the most decarbonizing shipping, but industry experts say they are well positioned to create business opportunities from these climate efforts. Taking a look at China, Japan, and South Korea, which together account for roughly a third of the world's CO2 emissions, ING analysts concluded the countries' mid-century net-zero pledges will cost them at least $12.4 trillion in the transportation sectors alone. (IHS Markit Net-Zero Business Daily's Max Lin)

- Of the massive bill, $4.38 trillion is estimated to be devoted to shipping, $3.08 trillion to rail systems, $2.73 trillion to road transportation, and $2.22 trillion to aviation.

- The three countries are among the world's top 10 maritime trade nations by volume, and ING analysts assumed their seaborne cargo would be all carried by vessels running on ammonia generated from renewable energy.

- The scope of ING's study is limited to the capital costs in building sufficient electricity generation capacity that can power the three countries' transportation sectors. To simplify the calculations, spending on other parts of the supply chain is not taken into account.

- For now, green ammonia is produced from hydrogen generated from an electrolyzer powered by solar or wind power, and nitrogen separated from the air.

- South Korea's wine imports nearly doubled to $370.4 million in the first eight months of 2021, up from $188.5 million between January and August 2020, as more people enjoyed drinking at home and alone amid the coronavirus pandemic. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- The country's wine imports in the first eight months are already 12% larger than the total value of South Korea's wine imports in 2020 that amounted to $330.0 million.

- Trade data shows that Asia's fourth-largest economy imported 96.5% y/y more wine in the January-August period. This year's partial wine import value is a record figure for the first eight months of any previous year. Furthermore, demand for foreign wine also overshadowed beer imports, which amounted to $147.8 million in the eight-month period.

- South Korea's industry sources said wine imports soared in the first eight months as people preferred drinking by themselves at home instead of going to bars amid the coronavirus pandemic, reported the country's Yonhap news agency.

- France was the largest exporter of wine to South Korea at $116.6 million (+121.8% y/y), followed by the US at $61.0 million (+85.6% y/y), Italy at $60.0 million and Chile at $50.8 million (+48.1% y/y) in the first eight months of 2021.

- Other countries that reported large increases in exports to South Korea include Spain at $28.5 million (+83.7% y/y), Australia at $21.7 million (+95.8% y/y) and New Zealand at $10.1 million (+174.7% y/y).

- In contrast, beer imports dipped in 2021 as imports of Japanese brands tumbled on a boycott of goods from the neighboring country due to Tokyo's curbs on exports of key materials to Seoul. Also responsible was the growing popularity of homegrown craft beer among local drinkers, according to Yonhap sources.

- The average price of imported wine amounted to $7,085 per ton in 2021, up almost 20% y/y from $5,923 per ton in the period between January and August 2020.

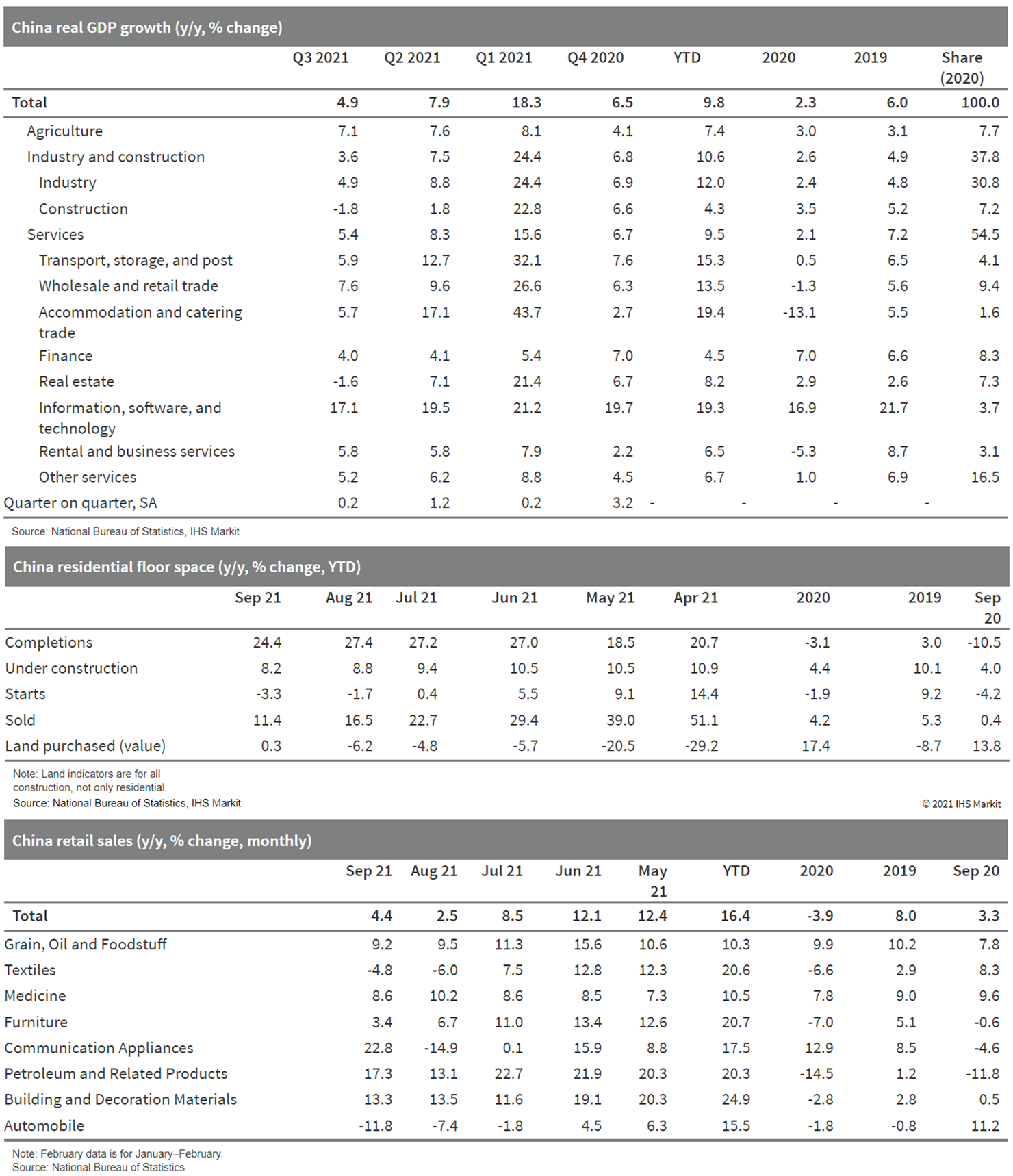

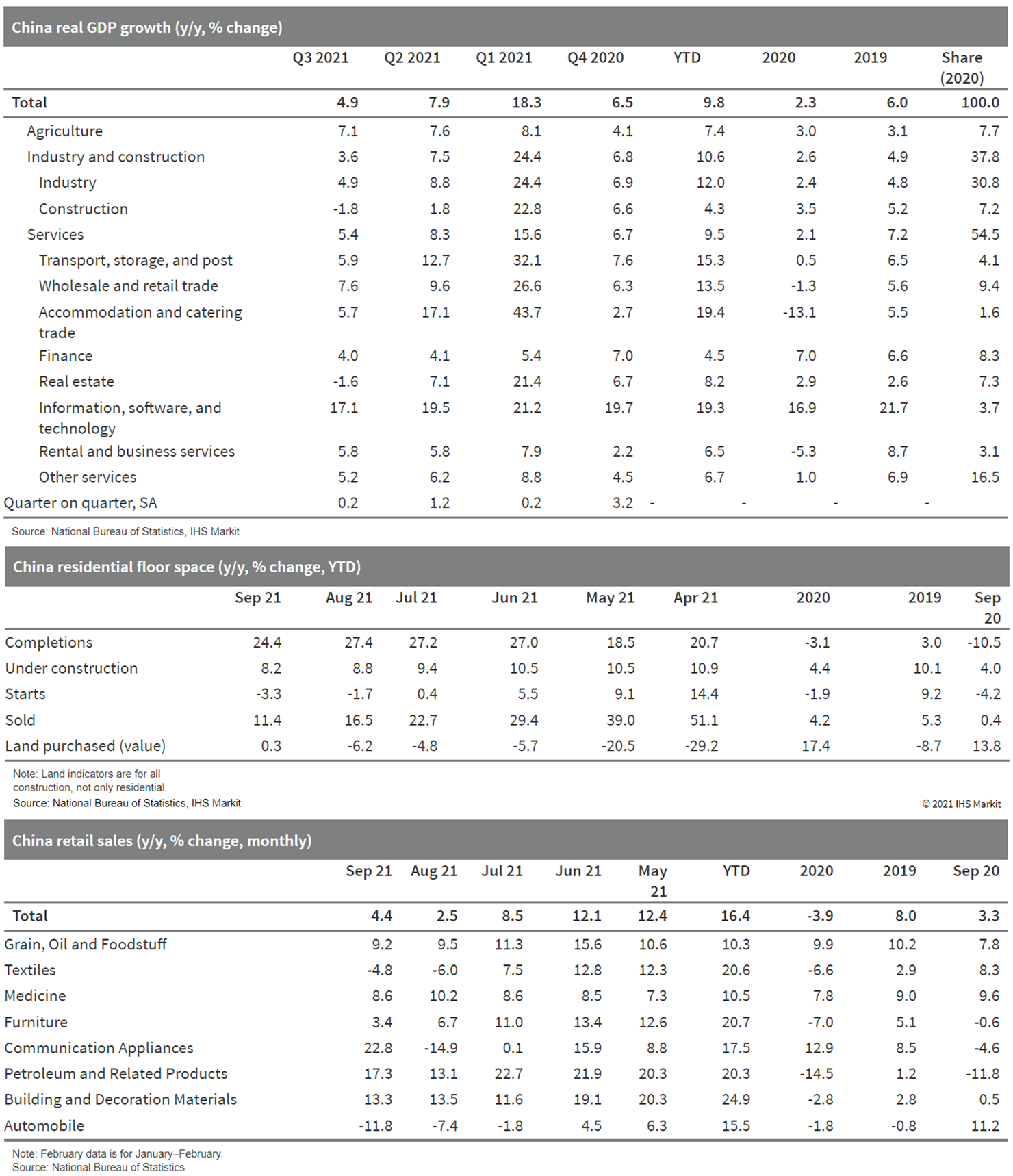

- China's economic expansion lost momentum in the third quarter as the power crunch and soaring commodity prices curbed industrial production, tightening property market regulations and slow local government bond issuance dragged on fixed-asset investment (FAI), and escalating pandemic controls took a toll on retail sales. Further slowdown is expected in the fourth quarter. (IHS Markit Economist Yating Xu)

- Real GDP grew 4.9% year on year (y/y), down from 7.9% in the second quarter. The 2020-21 two-year average growth rate declined from 5.5% in the second quarter to 4.9% in the third quarter. Meanwhile, the cumulative growth for the first nine months of 2021 fell to 9.8% y/y, compared with 12.7% y/y in the first half of the year and 18.3% y/y in the first quarter. Economic recovery continued, but at a much slower pace as quarter-on-quarter (q/q) growth dropped to 0.2% from 1.2% expansion in the previous quarter.

- On the supply side, the headline moderation was broad across the agriculture, industry, and services sectors, with industry and the construction sector leading the deceleration amid the power crunch and impacts from China's decarbonization policy. Industrial value-added growth fell to its lowest over the past five quarters, and construction value-added deteriorated to contraction territory for the first time since the beginning of 2020. Services growth declined by three percentage points, with the accommodation and catering segments hit the hard by the spread of the COVID-19 Delta variant, and real estate value-added falling to contraction amid the tightening of property sector regulations.

- FAI growth on a 2020-21 average basis fell to 3.8% through September from a 4.0% expansion in the first eight months. M/m growth slowed to 0.17%.

- Continuous slowdown in the real estate and infrastructure sectors was the main factor behind the headline weakness in investment growth. Infrastructure investment growth (excluding utilities) declined by to 1.4 percentage point to 1.5% through September, and the IHS Markit estimated de-cumulative changes remained in contraction year on year.

- Nominal retail sales growth rebounded to 4.4% y/y after six consecutive months of moderation and the 2020-21 average growth rate accelerated from 1.5% in August to 3.8% in September.

- US builders are working on new houses at a furious pace. The number of homes under construction—an item commonly overlooked in this report—increased to 1.426 million (seasonally adjusted) in September. That is the highest total since January 1974; it partly explains why builders are finding it hard to locate labor and materials. (IHS Markit Economist Patrick Newport)

- The single-family permits category edged down 0.9% (plus or minus 0.8%; statistically significant) to a 1.041 million rate. Single-family permits have slid 18% since January; their year-to-date totals, nonetheless, are the highest since 2007.

- Multifamily permits tumbled 18% from a six-year high to a 548,000-unit annual rate; the quarterly total, 600,000, was the highest since the fourth quarter of 1986.

- Housing starts edged down 1.6% (plus or minus 11.4%, not statistically significant) in September to a 1.555 million annual rate; single-family starts were unchanged at 1.08 million; multifamily starts dropped 5.0% to a 475,000-unit yearly rate.

- Demand remains strong. But builders are fighting headwinds: high material costs, labor shortages, and building material supply chain issues—on top of the pre-pandemic headwinds of a lack of buildable lots and skilled labor.

- Despite steady declines from January and headwinds, total housing starts and single-family housing starts are on track for having their strongest year since 2006. Multifamily starts will post its highest totals since 1986.

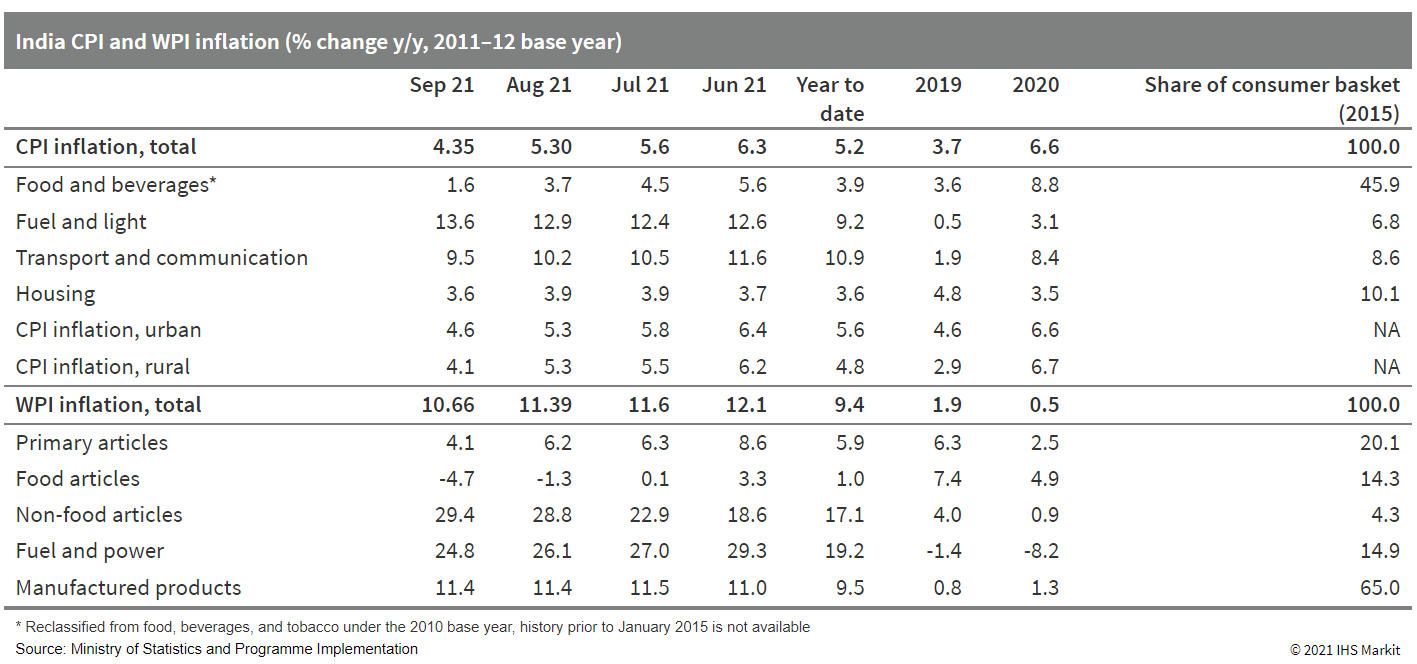

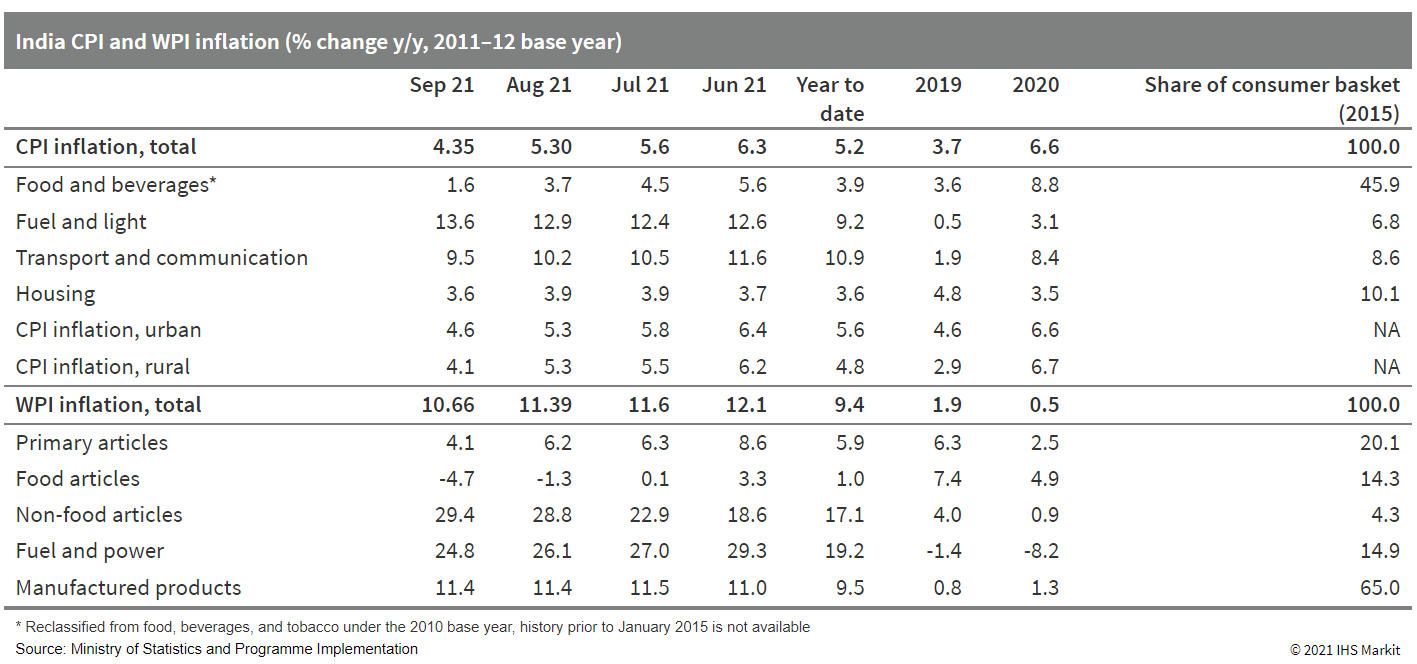

- Moderating food prices and high base effects pushed India's headline consumer price index (CPI) and wholesale price index (WPI) inflation to five-month lows of 4.4% year on year (y/y) and 10.7% y/y respectively in September, while the Reserve Bank of India (RBI) maintained its accommodative policy stance in October. (IHS Markit Economist Hanna Luchnikava-Schorsch)

- CPI inflation eased to 4.35% /y in September from 5.3% y/y in August, brought down by a slower increase in food prices, which account for nearly half of the consumer price basket. By contrast, the fuel and light category of the CPI increased by 13.6% y/y, up from 12.9% y/y in August, reflecting sharp rises in domestic pump and power prices.

- WPI inflation had also moderated since August but remained in double digits for the sixth consecutive month, reflecting high input cost pressures from rising metal and energy prices, acute shortages of key industrial components, and high logistics costs.

- The RBI kept its key policy rates unchanged and an "accommodative" policy stance for the eighth consecutive time during its October policy meeting. The bank was encouraged by rapidly easing food inflation, supported by record summer crop harvests and a favorable outlook for winter crops. However, it acknowledged that core inflation (excluding food and energy) remained sticky at 5.8% in July-August, and that input cost pressures are likely to persist both domestically and abroad.

- Air Products has announced plans for a $4.5-billion blue hydrogen complex in Ascension Parish, Louisiana, its largest ever US investment. The plant, which will produce more than 750 million standard cubic feet/day of hydrogen, will be the largest blue hydrogen facility globally. Air Products will build and operate the site, which is expected to be operational in 2026. (IHS Markit Chemical Advisory)

- The blue hydrogen produced will be split between supplying Air Products' US Gulf Coast hydrogen pipeline network and used to make blue ammonia for local and export markets. Air Products' hydrogen pipeline network stretches more than 700 miles from Galveston Bay, Texas, to New Orleans, Louisiana, and supplies customers with more than 1.6 billion cubic feet of hydrogen per day from approximately 25 production facilities. Blue ammonia can be exported to global markets for conversion back to hydrogen for transportation and other markets, the company says.

- Blue hydrogen still uses hydrocarbons as feedstock, with the carbon dioxide (CO2) in the production process captured for permanent sequestration. Approximately 95% of the CO2 generated at the Louisiana complex will be captured and transported by pipeline to be sequestered inland a mile underground resulting in the removal of more than 5 million metric tons of CO2 per year, making it the largest permanent carbon capture sequestration operation in the world, Air Products says.

- If all the plant's blue hydrogen produced was used to power either long-haul freight trucks or in energy production, the plant would save more than 4 million tons of CO2 per year versus diesel or more than 8 million tons of CO2 per year versus coal, respectively.

- Indonesia's ambitions for cutting its GHG emissions with carbon capture and storage (CCS) moved one step closer to realization after Repsol advanced a project in Sakakemang in South Sumatra. The country, one of the world's top 10 GHG emitters, said in its latest Nationally Determined Contribution that CCS projects could help it achieve net-zero emissions by 2060. While the Indonesian government has yet to develop a regulatory framework for carbon extraction, Repsol earlier this month announced plans to commission a geological CCS plant with a storage capacity of 2 million metric tons (mt) per year in 2027. In an email to Net-Zero Business Daily, the Spanish energy major confirmed the facility would capture CO2 from the Sakakemang natural gas field and store it in nearby depleted gas fields. In 2019, Repsol, Petronas, and MOECO discovered at least 2 trillion cubic feet of recoverable resources in the field's KBD-2X well, the largest gas discovery in Indonesia for nearly two decades. As the project's gas has a high CO2 content of 26%, Repsol said it is developing the CCS project simultaneously to meet the company's target of achieving carbon neutrality by 2050. (IHS Markit Net-Zero Business Daily's Max Lin)

- Researchers have warned that the EU's sustainability ambitions for the agri-food sector could end up causing more food insecurity and biodiversity losses in Africa. On 13 October, the European Centre for Development Policy Management (ECDPM) published a paper that urged EU policymakers to address the possible negative consequences of the Farm to Fork strategy (F2F) for Africa.The think tank said the F2F's potential negative impact on EU agricultural production and exports could lead to higher international food prices and increased global food insecurity - given that the EU is one of the biggest agri-food trade forces worldwide. The researchers argued that this will particularly affect Africa because of its reliance on food imports to feed its fast-growing population. They also refer to an analysis by the US Department of Agriculture (USDA) which found that this could cause tens of millions of people to become food-insecure by 2030, mostly in Africa. The ECDPM further highlights that the F2F could shift EU agricultural production to places outside of Europe with less environmentally friendly food production methods, saying this could increase greenhouse gas emissions elsewhere and undermine the EU's sustainability objectives. The researchers claim that Africa has the potential to fill in a part of this production gap, but fear a local expansion of farming could destroy more biodiversity-rich areas across the African continent. The think tank concludes that EU policymakers should make full use of their policy instruments to help developing countries improve the sustainability of their food systems, including through trade agreements, investment support and development aid. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- The composition of liquid refreshment beverages (LRBs) sold in the US has changed and the share of 100% juice and juice drinks in the product mix has dropped to 8.4% in 2020 from 10.7% in 2014, according to a new report published by economic and public policy consulting firm Keybridge. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- The share of carbonated soft drinks (CSDs) in LRB sales fell to 33.3% in 2020, down from 40.8% of the total beverage mix in 2014.

- The report, prepared for the American Beverage Association and the Alliance for a Healthier Generation, also reveals that average LRB calories per person fell by 10% halfway to the 20% calorie reduction goal that was set for 2025.

- Significantly, the pace of per person LRB calorie reductions has grown every year since 2016. The largest single year decline of 5.0% (or 9.6 calorie per person per day) was in 2020.

- From 2014 to 2020 per person volumes of full calorie CSDs and 100% juices and juice drinks, which are the source of more than 80% of all LRB calories, fell by 11.0% and 18.6%, respectively. Effectively, the LRB product mix in the US is shifting towards low- and no-calorie beverages.

- The daily juice volume consumption per person fell from 3.7 ounces in 2014 to 3.1 oz in 2020. Meanwhile, the daily CSDs consumption fell from 14.0 oz in 2014 to 12.3 oz in 2020.

- The total volume of eight-ounce equivalent servings of juice fell from 53.04 billion in 2014 to 47.08 billion servings in 2020. As regards CSDs, their consumption amounted to 185.67 billion eight-ounce equivalent servings in 2020, down from 202.80 billion servings in 2014.

- Yet, it is not all bad news for the industry. More recently, however, product reformulations and shifting consumption toward lower calorie versions of these beverages have also made major contributions to calorie reductions within these categories.

- Mainland China's average new home prices fell by 0.08% month on month (m/m) in September, compared with a 0.16% month-on-month increase in August, according to the survey conducted by the National Bureau of Statistics covering 70 major cities. The latest reading marked the fourth consecutive month of decline in month-on-month new home price inflation, as tight mortgage rules persistently dampen home sales. (IHS Markit Economist Lei Yi)

- While the weakness in new home price inflation was broad across the three city tiers, the September month-on-month new home price decline came almost entirely from tier-3 cities. New home prices of the 35 surveyed tier-3 cities on average reported deflation of 0.2% m/m in September, down by 0.2 percentage point from the prior month. Tier-1 and tier-2 cities also reported the lowest month-on-month new home price inflation since the nationwide resumption of economic activities last April post the height of the pandemic. Notably, the city of Guangzhou reported new home price deflation of 0.1% m/m for both August and September.

- Up to 36 out of the 70 surveyed cities reported month-on-month new home price declines in September, rising by 16 cities from the month before, the highest number since mid-2015. A total of 27 cities registered month-on-month new home price gains, down by 19 cities from August.

- Average year-on-year (y/y) new home price inflation reached 3.3% y/y in September, lower by 0.4 percentage point from August. Similar to the situation in July and August, the disinflation in September was again broad based and led by tier-3 cities. Through the end of third quarter, year-on-year new home price inflation of tier-3 cities has continuously declined for six months since April.

- The UK National Health Service (NHS) Confederation, which represents NHS providers, has issued a warning statement to the UK government (available here) in light of a worrying recent upturn in COVID-19-related hospitalizations and deaths. The organization has pushed for the government not to waste undue time over implementation of a "Plan B plus" for tightening of public restrictions, including the possible reintroduction of some social distancing measures, in order to avoid "stumbling into a winter crisis". Confirmed cases of COVID-19 in the UK have surpassed 40,000 for the past seven days, with 43,738 recorded on 19 October and 49,156 the previous day, returning levels to those in mid-July. There has been a 10% increase in COVID-19-related hospitalizations within the past week in NHS England, totaling 7,749 cases, with COVID-19-linked mortality (within 28 days of a confirmed positive diagnosis) currently averaging 120 per day, although on 19 October there were 223 deaths. According to NHS Confederation CEO Matthew Taylor in the source, upcoming months could represent "the most challenging winter on record", with the current rise in hospitalizations set to coincide with expected increases in infections from other "winter" viruses to which the public may have lower resistance than in previous years. Taylor has urged that "the government should not wait for COVID infections to rocket and for NHS pressures to be sky-high before the panic alarm is sounded". (IHS Markit Life Sciences' Janet Beal)

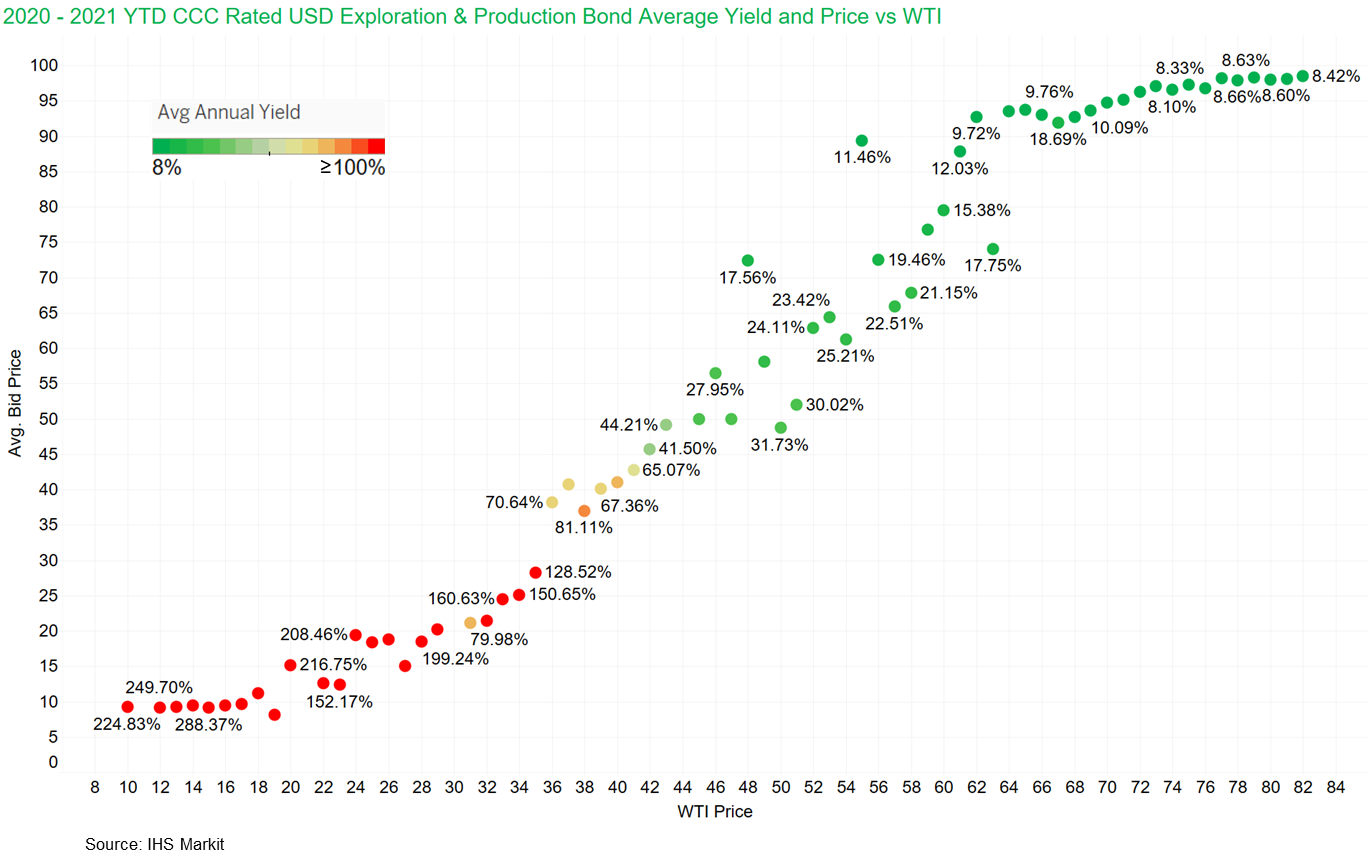

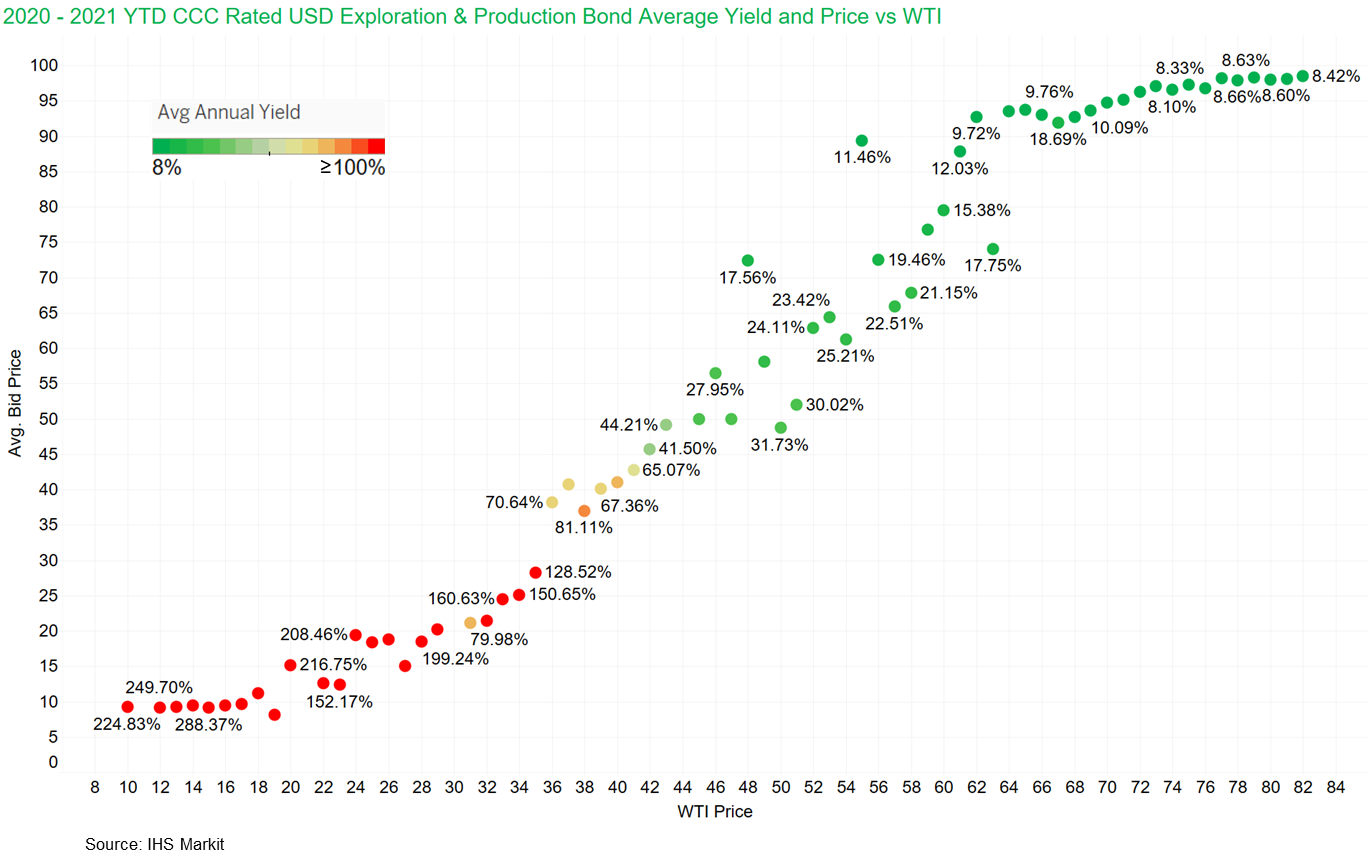

- The below graph shows the relationship between the price of US Crude oil (WTI) vs CCC rated US E&P corporate bond average prices labeled with average bond yields from 2020-2021 YTD (as of October 18), with average bond yields remaining below 20% once WTI breached $59/barrel. Bond yields for this cohort closed at 8.47% on October 18.

- The Biden Administration Roadmap to Build an Economy Resilient to Climate Change Impacts seeks to accelerate government efforts to improve corporate tracking and disclosure of GHG emissions, and illustrates the determination of the administration to use financial regulation to drive companies in this direction. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- As an extension of a "whole-of-government strategy" to protect consumers and the economy from the impacts of climate change, the roadmap places improving the financial system's ability to identify risk atop the agenda. It builds on the 20 May

- Executive Order on Climate-Related Financial Risk that set in motion studies of financial risk by several agencies, and placed GHG emissions as a factor in federal contracting and climate risk into long-term budgeting.

- "Extreme weather has cost Americans an additional $600 billion in physical and economic damages over the past five years alone. Climate-related risks hidden in workers' retirement plans have already cost American retirees billions in lost pension dollars. Climate change poses a systemic risk to our economy and our financial system, and we must take decisive action to mitigate its impacts," the administration said in announcing the roadmap.

- Investors keep moving their money away from risk sectors most immediately exposed. This week, the Ford Foundation announced that its $10-billion endowment will no longer hold stock in fossil fuel companies. It follows September announcements by Harvard University ($52-billion endowment) and the MacArthur Foundation ($8 billion) that they will be divesting their fossil fuel assets, and the announcement in August by the New York State Public Employee Retirement Fund, the third-largest public pension plan in the country, that it may restrict investment in firms it feels are not adequately planning for the energy transition.

- France is to invest €2 billion ($2.3 billion) in three "revolutionary areas" comprising digital technology, robotics and genetics. The investment will be part of "France 2030", which is a €30 billion ($34.8 billion) investment plan unveiled by French President Emmanuel Macron. The France 2030 plan sets ten objectives to be achieved by 2030. One of those objectives is about investing in healthy, sustainable and traceable food. The investment should make it possible to: decarbonize agricultural production; get away from certain pesticides; and improve productivity and food tracing, the President said. (IHS Markit Crop Science's Sanjiv Rana)

- US licensed hemp planted area rose by 24% y/y to 284,790 acres in September 2021, according to USDA data. This means a 44% fall in planted acreage compared to 2019, when the US reached a record of 511,400 acres, after the 2018 Farm Bill fueled optimistic expectations about hemp and CBD industries. This fall is due to a combination of drought and a long-term regulatory uncertainty, especially about fiber processing for textile and construction, trading sources explained. In addition, the US states and territories licensed 9,210 producers in 2020, down from a record of 20,000 in 2019. 021 Hemp Outlook: Licensed acreage tanks 24% in 3rd year of nationwide production. The state of New York was the main origin with 33,034 acres (indoor+outdoor), 11% more y/y. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Fleet and supply-chain company Ryder and autonomous technology company Gatik have announced plans for a new business-to-business (B2B), short-haul logistics autonomous delivery network. In a joint statement, the two announced a "multi-year partnership designed to establish an autonomous logistics network for Gatik's customers in the US and Canada". The deal follows Ryder Ventures' participation in Gatik's latest funding round, which generated USD85 million. It was not disclosed what portion specifically came from Ryder Ventures, although Ryder noted that it was its first investment in an autonomous trucking company. Gatik will lease medium-duty, multi-temperature box trucks from Ryder, integrate its commercial-grade autonomous driving technology into the leased fleet, and create an "Autonomous Delivery as a Service" (AdaaS) business model for new and existing customers. Ryder will service and maintain the trucks, including calibration of autonomous sensors and pre-and post-trip inspections. Under the comprehensive deal, the two will also "explore opportunities" for Ryder to manage the logistics operations of the autonomous fleet. No financial terms or specific timeline targets for expansion have been announced, including specifically when the first trucks will be deployed. The operations are aimed purely at B2B opportunities, rather than the last-mile delivery on which several other autonomous technology companies have focused. The initial fleet is reported to be about 20 vehicles, and it will start in the Dallas-Fort Worth, Texas, area; Gatik and Ryder both expect to expand the service throughout the United States and Canada. (IHS Markit AutoIntelligence's Stephanie Brinley)

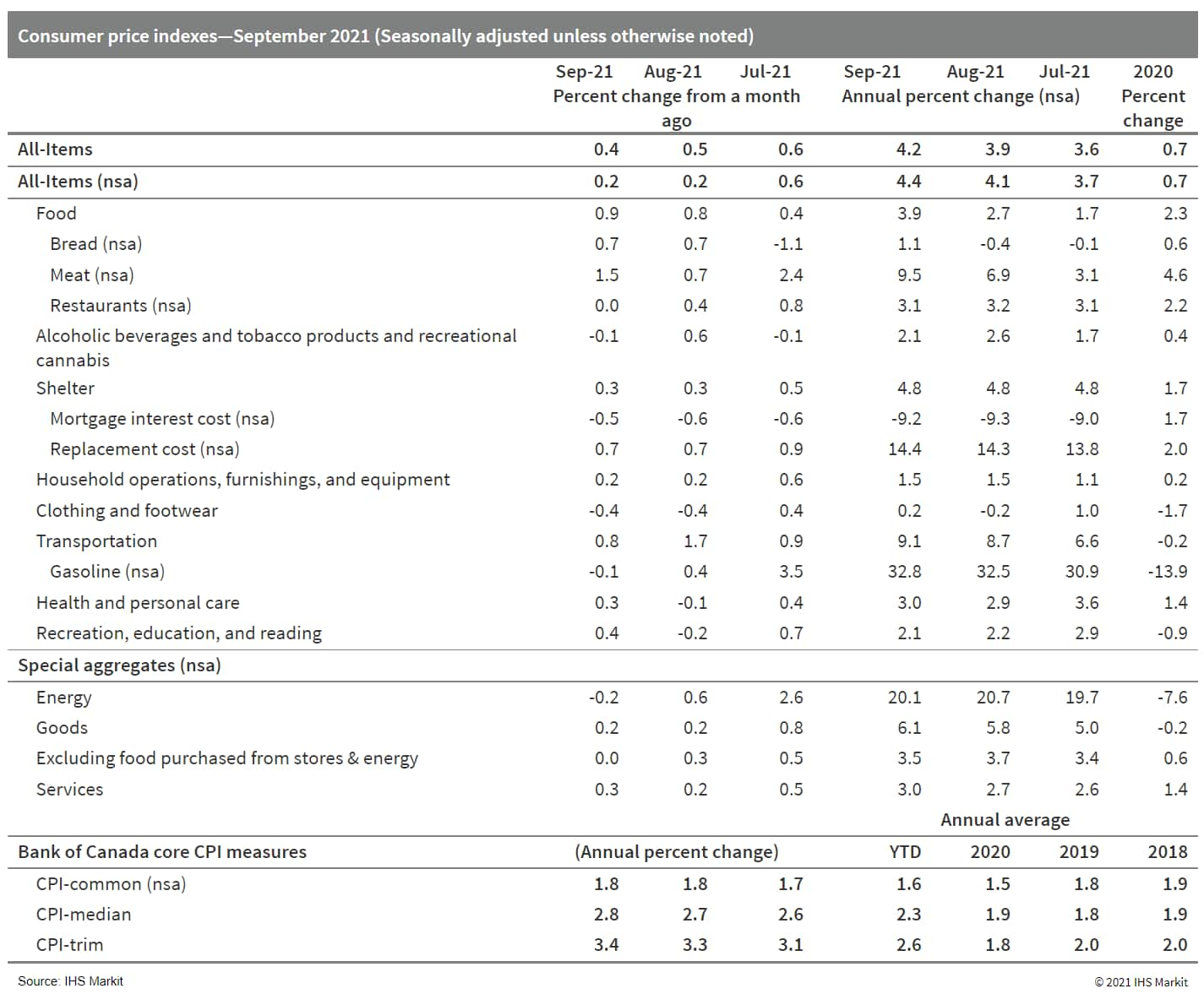

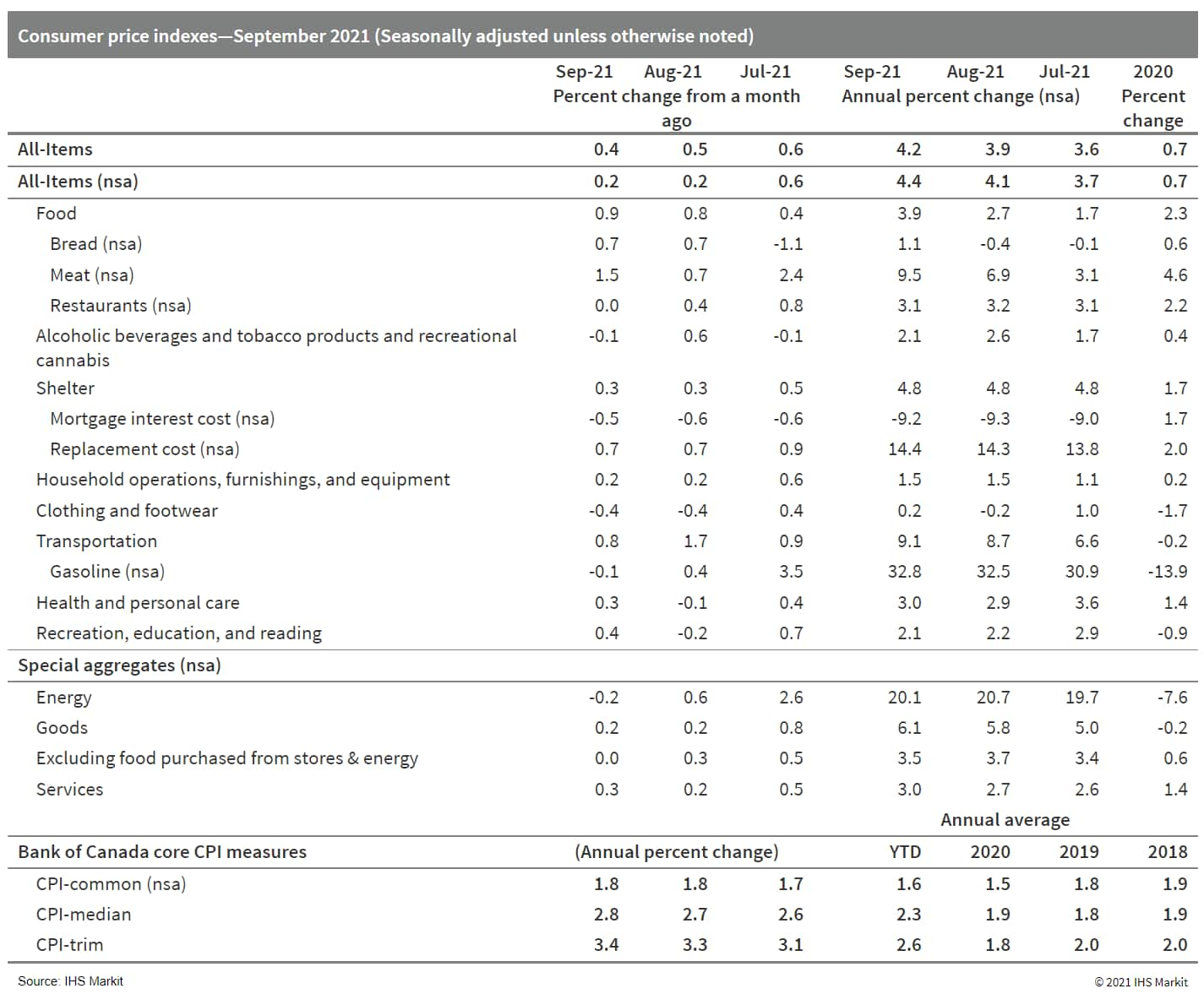

- The top upward contributors to Canada's inflation in September were as expected, particularly costs for gasoline, housing, autos, and food. Gasoline is adding significantly to headline inflation, rising at a similar pace as last month of 32.8% y/y. Yet, when gasoline is excluded, inflation is 3.5% y/y. Homeowners' replacement costs increased by a milder 0.1 percentage point to 14.4% y/y. Other owned accommodation expenses inflation rose to 14.2% y/y, while subtracting from inflation was the 9.2% y/y decline in mortgage interest costs. (IHS Markit Economist Arlene Kish)

- Consumer prices are climbing at a consistent monthly pace, rising 0.4% month on month (m/m) on a seasonally adjusted basis (SA) and 0.2% m/m on a non-seasonally adjusted basis (NSA).

- This increased annual inflation rates to 4.2% year on year (y/y) SA and 4.4% y/y NSA.

- The average core inflation rate edged up to 2.7% y/y, with the Consumer Price Index (CPI)-trim inflation rate remaining above the Bank's 3.0% y/y upper bound of the target range.

- Within the goods categories, non-durable goods inflation is the highest, at 7.8% y/y, followed by durable goods at 5.3%. Semi-durable goods inflation is very mild at just 0.8% y/y. Services inflation quickened to 3.0% y/y.

- The Bank of Canada's inflation drivers remain the same. Some inflation pressures are temporary, like gasoline, and some are not. Deep scrutiny of core inflation drivers will be highlighted in the October Monetary Policy Report and the policy announcement. Price inflation is high, yet excess capacity remains.

Report not published on Thursday, October 21

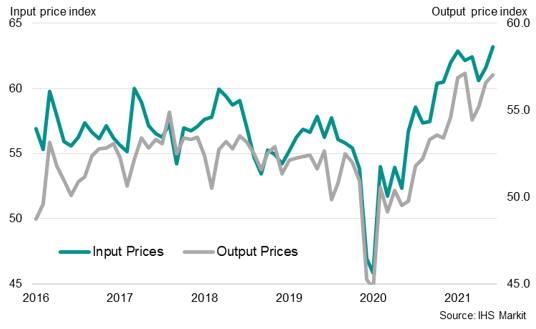

- U.S. private sector businesses recorded a sharp and accelerated upturn in output led by the service sector during October, with growth the strongest for three months, albeit still much weaker than seen earlier in the year. October also saw a survey-record rise in backlogs of work as firms struggled to meet demand due to supply chain bottlenecks and labor shortages, in turn driving the steepest rise in prices yet recorded by the survey. (IHS Markit Economist Chris Williamson)

- Flash U.S. Composite Output Index at 57.3 (55.0 in September). 3-month high.

- Flash U.S. Services Business Activity Index at 58.2 (54.9 in September). 3-month high.

- Flash U.S. Manufacturing PMI at 59.2 (60.7 in September). 7-month low.

- Flash U.S. Manufacturing Output Index at 52.3 (55.7 in September). 15-month low.

- The IHS Markit/CIPS flash manufacturing PMI rose to 57.7 in October from 57.1 in September. However, dig down into the components of the PMI and we can see worrying signals about the health of manufacturing in the UK. (IHS Markit Economist Chris Williamson)

- Drilling down into the reasons provided by those manufacturers who reported a fall in production during October, some 43% reported that output had been hit by shortages of components or supply chain delays. These shortages were highlighted by the survey's suppliers' delivery times index falling further in October, indicating the greatest lengthening of supply lines since the initial global factory closures seen at the start of the pandemic. Worst affected were food & drink producers and manufacturers of electrical and electronic goods.

- However, more worryingly, almost one-in-three firms (some 29%) simply reported that their output had decreased due to weakened demand. Although the survey's new orders index picked up slightly during the month, it remained far below levels seen in the six months prior to September, suggesting the UK factory sector has seen a downshifting of demand growth since the summer. Although some pull-back in spending on goods was to be expected as the service sector continues to open up from COVID-19 restrictions, this weakening of demand growth can also be linked to a second consecutive monthly fall in new export orders during October, which fell at the fastest rate since the January lockdown. Analysis of the reasons cited for falling export orders in October shows that one-in-three firms blamed Brexit.

- The headline IHS Markit Eurozone Composite PMI fell for a third successive month in October, according to the 'flash' reading*, dropping from 56.2 in September to 54.3. The decline indicates a further cooling of the rate of expansion from July's 15-year high. (IHS Markit Economist Chris Williamson)

- Growth slowed especially sharply in Germany, down to the lowest since February, and slipped to the weakest since April in France. The rest of the region as a whole also recorded the slowest expansion since April.

- By sector, services outperformed manufacturing output for a second month running, the factory sector having now reported a slowdown in growth for a fourth straight month to register the weakest increase in production seen over the past 16 months.

- Hiring was stepped up as firms sought to clear backlogs, resulting in a jobs gain that matched July's two-decade high. Jobs growth accelerated in both Germany and France, and notably was one of the fastest in 21 years in the rest of the region.

- Shortages were meanwhile once again seen as the key driver of higher prices for many goods and services in October, leading to a survey record increase in firms' input costs. An unprecedented input cost increase was recorded in manufacturing while service sector costs rose at the sharpest rate since September 2000.

- The Office for National Statistics (ONS) has reported that the UK's 12-month rate of consumer price index (CPI) inflation fell to 3.1% in September from 3.2% in August, the highest rate since March 2012. (IHS Markit Economist Raj Badiani)

- Restaurant and café prices increased by 5.0% year on year (y/y) in September, down from a gain of 8.6% y/y in August. The annual comparisons in August and September 2021 have been distorted by restaurant prices being artificially low in August 2020 when the government launched its 'Eat Out to Help Out' scheme offering diners discounted meals. The latest price developments compare prices to September 2020, after the scheme expired at the end of August.

- Food prices rose at brisker rate, rising by 0.9% y/y in September from 0.2% y/y in August.

- Energy-related prices continued to rise rapidly on an annual basis, with transport fuel and lubricant prices growing by 17.8% y/y, the sixth successive double-digit increase. This was in line with global crude oil prices rising by 82.1% y/y to average USD74.5 per barrel (pb) in September, the ninth successive y/y gain since February.

- The ONS reported that average gasoline (petrol) prices stood at 134.9 pence a liter in September, compared with 113.3 pence a liter a year earlier.

- A further rise in second-hand car prices occurred during September because of the shortage of semiconductor chips disrupting production of new vehicles.

- All-services price inflation retreated to 2.6% in September from 3.0% in August; for goods, it stood at 3.4%, up from 3.3% in August.

- Core inflation, excluding energy, food, alcoholic beverages, and tobacco prices, moved down to 2.9% in September from 3.1% in August.

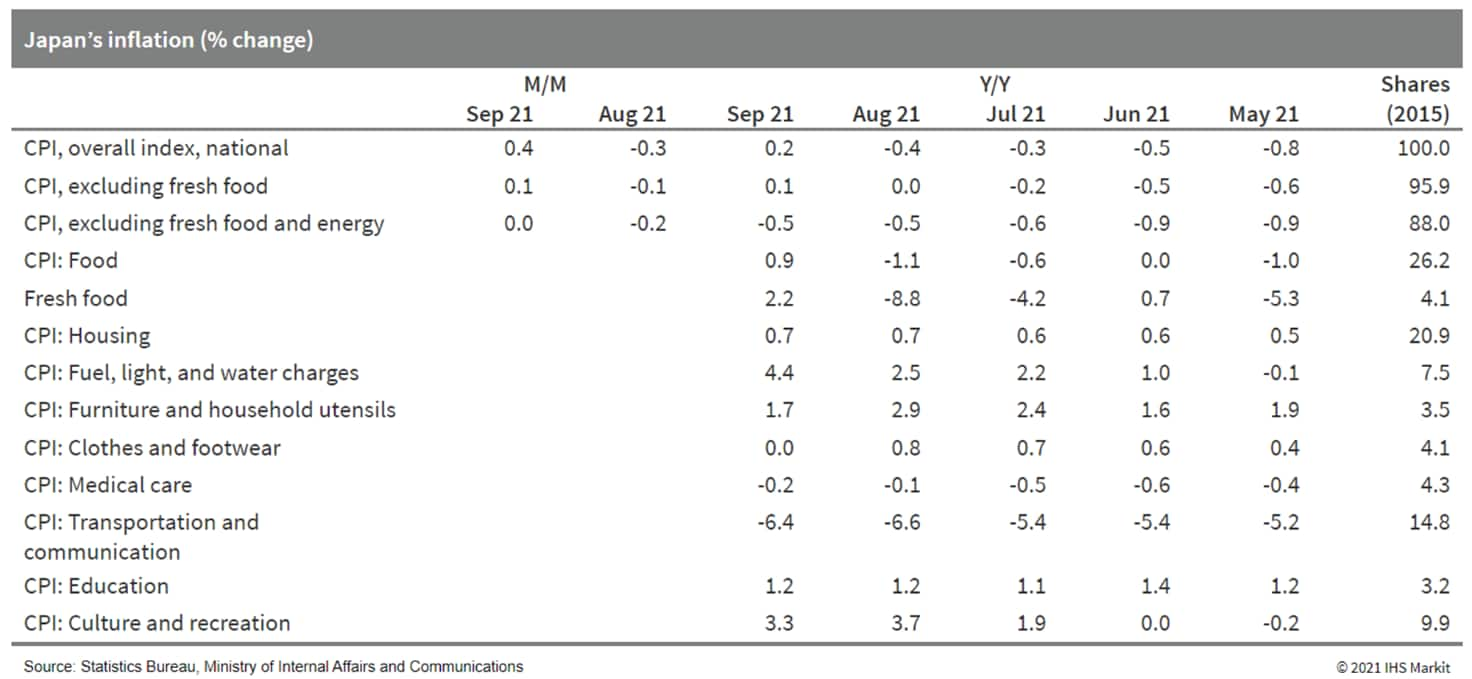

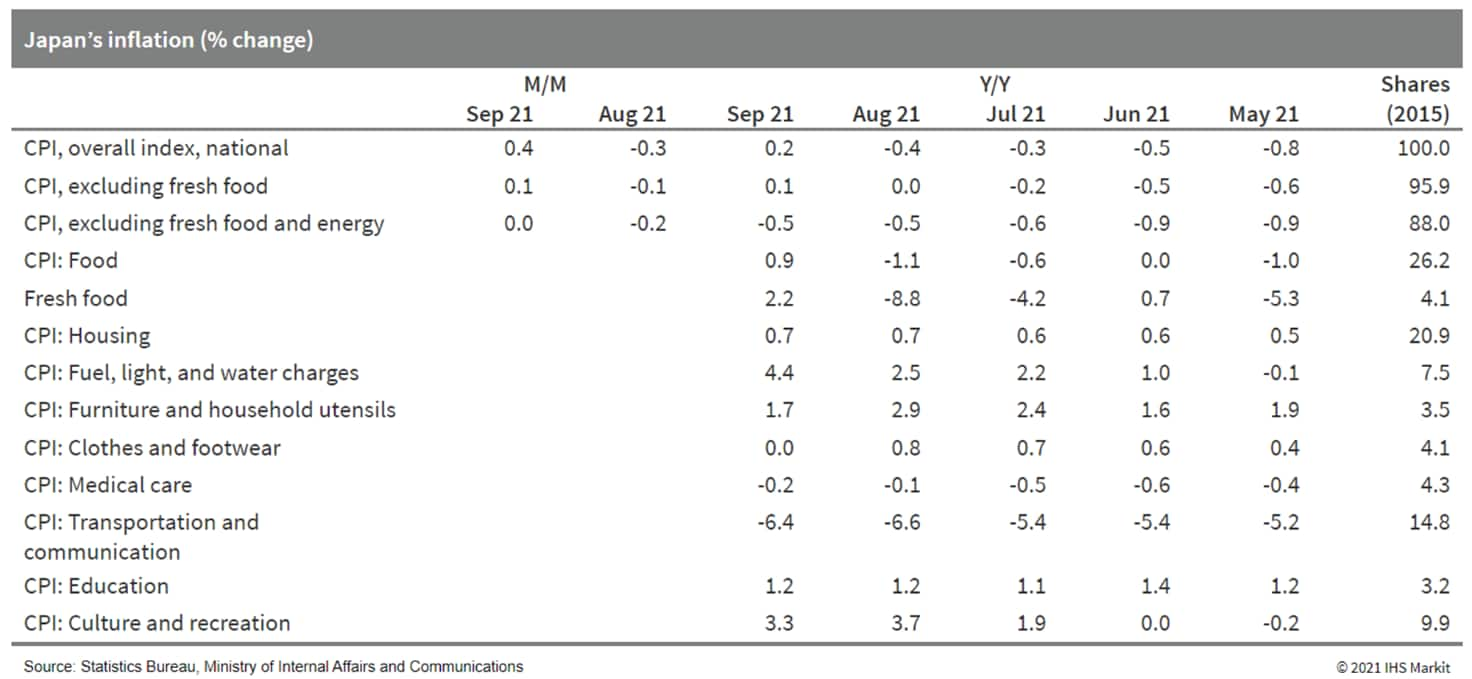

- Japan's CPI rose by 0.4% month on month (m/m) on a seasonally adjusted basis and by 0.2% year on year (y/y) in September. The CPI, excluding fresh food (core-CPI), notched up by 0.1% m/m and 0.1% y/y in September. The CPI, excluding food and energy (core-core CPI), held at the August level in September, but deflation continued at a 0.5% y/y drop. (IHS Markit Economist Harumi Taguchi)

- The first y/y increase since August 2020 largely reflected a 2.2% y/y rise in fresh food prices due to bad harvests caused by unusually heavy rainfall in August 2021. Faster rises in electric and gas charges also contributed to lift the CPI. However, those increases were largely offset by declines in mobile-phone charges.

- The September results were in line with IHS Markit's expectations. Although fresh food prices are expected to stabilize in the coming months, energy prices are likely to lift Japan's CPI inflation at a faster pace than expected, reflecting surging crude oil prices and yen weakening. However, inflation will probably remain moderate over the short term. Inflationary pressures from higher energy prices and the weak yen will be largely offset by the negative effects of lower mobile-phone charges (through March 2022) and the expected reintroduction of travel subsidies.

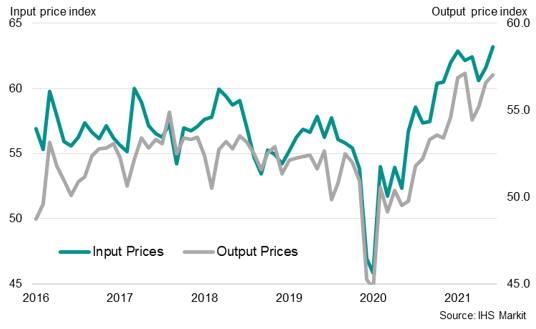

- The latest IHS Markit Flash Australia Composite PMI showed that private sector output returned to expansion in October with the PMI printing 52.2, up from September's final reading of 46.0. This was the first expansion since June 2021, prior to when the Australian economy was hard-hit by the latest COVID-19 Delta wave. (IHS Markit Economist Jingyi Pan)

- Input price inflation notably accelerated to the fastest on record, supported by higher rates of price increases across both manufacturing and service sectors in October. Higher input costs were often associated with supply delays, as reflected in the continued lengthening of suppliers' delivery times in the manufacturing sector, which does not come as a surprise amid recent reports of supply issues across the globe. As such, firms were seeing both longer lead times and higher delivery costs which, alongside issues of input shortages and higher wages, offered no reprieve for the inflation situation in October.

- Concurrently, output price inflation picked up from September and printed the third-highest rate of inflation in the survey history. The wider expectation remains one of transitory inflation even as the June quarter saw inflation rising above the upper bank of the RBA's 2.0%-3.0% target in Australia. That said, the first Q4 indication of prices once again spiking warrants further scrutiny on where prices are headed for the Australia economy.

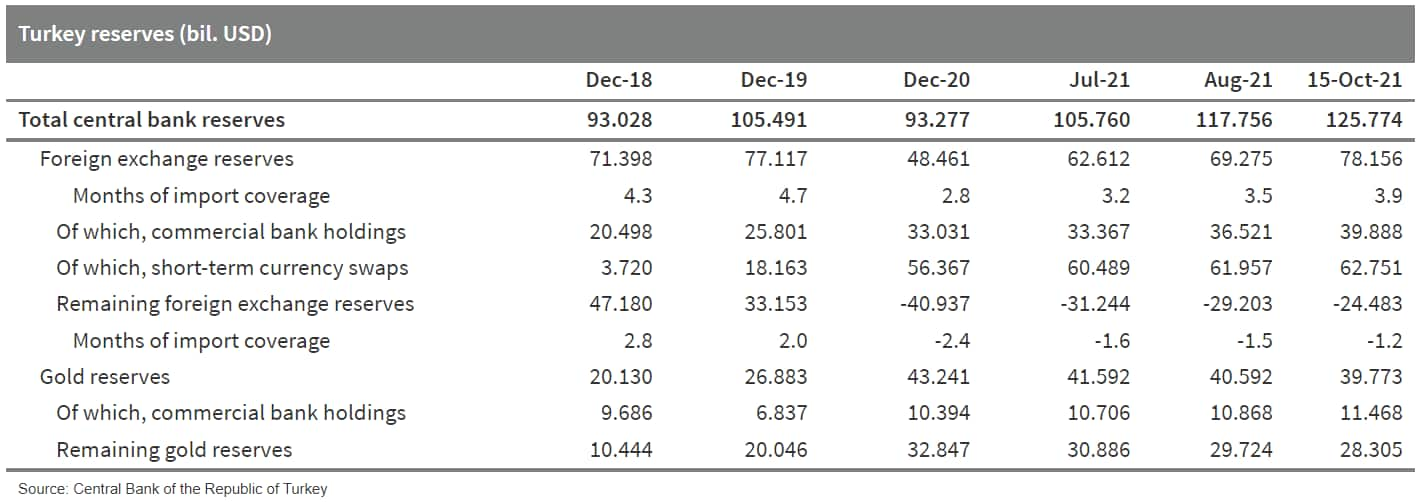

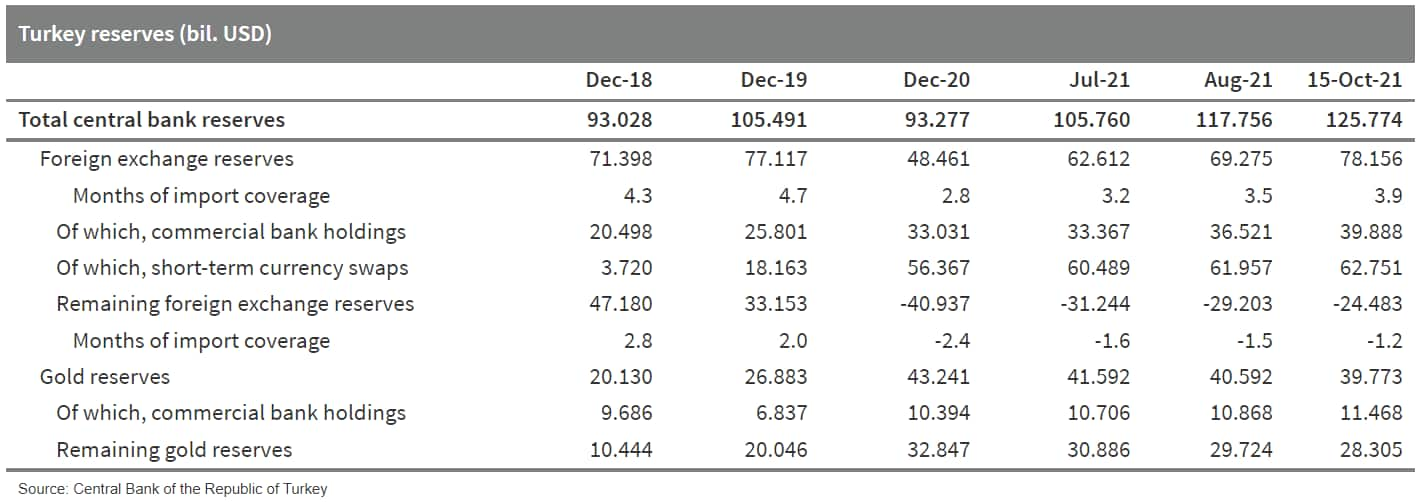

- The Central Bank of the Republic of Turkey (TCMB) cut its main policy rate, the one-week repo rate, by 200 basis points, to 16.0%, at its regularly scheduled, 21 October meeting of the Monetary Policy Committee. The cut was the second consecutive move following a 100-basis-point reduction at the September meeting. (IHS Markit Economist Andrew Birch and Banking Risk's Alyssa Grzelak)

- The TCMB took action despite annual consumer price inflation that stood at 19.6% as of September 2021 and likely further accelerated in October. With this rate cut, the main policy rate is now 360 basis points below the prevailing headline inflation rate. In September, TCMB Governor Sahap Kavcioǧlu shifted the guidance of its future cuts from the headline inflation rate to the lower, core inflation rate. However, the main policy rate is now 100 basis points below even the prevailing annual core inflation rate, which stood at 17.0% as of September.

- It was clear that the TCMB would be cutting rates once again at the October meeting - particularly after President Recep Tayyip Erdoǧan removed three Monetary Policy Committee members that had resisted further rate cuts. However, the size of the cut was surprising given the core inflation rate. IHS Markit had forecast a 50-point cut while many other observers had expected a 100-point cut, a move that would have put the repo rate right at the prevailing rate of core annual inflation.

- Turkey's grey-listing and its now lower interest rates will decimate inflows of foreign capital, destabilizing the lira and thus, enflaming consumer price inflation. After peaking at over USD3 billion in June, the net inflow of portfolio investment trailed off significantly in July (USD1.9 billion) and August (USD1.3 billion). Judging by exchange-rate fluctuations in September and October, portfolio investment flows either further deteriorated or even turned outward on a net basis during those two months. In our view, the October rate cut and Turkey's being added to the FATF's grey list will trigger net portfolio outflows in November and December - potentially totaling USD2 billion or more each month, based on previous shocks - with net losses likely to continue into early 2022.

- US clinical-stage biotech F-star Therapeutics has announced that it has granted Johnson & Johnson (J&J, US)'s Janssen Biotech unit a worldwide, exclusive license to research, develop, and commercialize up to five novel bispecific antibodies directed at Janssen's therapeutic targets using F-star's proprietary Fcab and mAb2 platforms. Janssen will be responsible for all research, development, and commercialization activities. Under the terms of the agreement, F-star will receive upfront fees of USD17.5 million, as well as near-term fees and potential further milestones of up to USD1.35 billion. F-star is also eligible to receive tiered mid-single-digit royalties on annual net sales of any products developed via the collaboration. F-star's proprietary platform allows substitutions in the Fc region of a natural antibody, creating two additional distinct antigen binding sites. The resulting building blocks - known as Fcabs (Fc with antigen binding) - can be rapidly inserted into a natural IgG antibody format to create so-called mAb2 bispecific antibodies that simultaneously bind to two different antigens. F-star's mAb2 bispecific antibodies are designed to have minimal systemic toxicity, a low immunogenicity risk, and to be easy to manufacture. For F-star, the size of the deal comfortably eclipses a USD300-million collaboration signed in July with AstraZeneca (UK) for the development and commercialization of next-generation stimulator of interferon genes (STING) inhibitors. (IHS Markit Life Sciences' Milena Izmirlieva)

- Norway's Labour Party has formed a minority coalition government with the Centre Party after winning a plurality of votes in the 21 September general election. The new center-left coalition has pledged support for the existing offshore exploration framework, which is likely to ensure oil policy continuity over the near-to-medium term. The formation of a minority center-left coalition should reduce the risk of major upstream policy shifts, despite the need for ad-hoc parliamentary support from opposition parties to advance legislation. According to the Hurdal Platform (the governing program of the Labour and Centre Parties), the new government plans to continue to develop the hydrocarbon industry as a key contributor to Norway's economy. The center-left government has ruled out any plans to phase out oil and gas production on the Norwegian Continental Shelf (NCS) and is likely to pursue generally favorable policies in line with the Energy White Paper that was proposed by the previous Conservative-led coalition. To ensure a stable oil policy framework, the ruling coalition is likely to negotiate its legislative proposals with the opposition parties, as the Labour and Centre Parties are nine seats short of a majority (85 seats) in parliament. With smaller left-leaning and centrist parties favoring a more restrictive approach to the upstream sector, the center-left coalition is likely to seek support from the Conservative Party, which remains a strong proponent of E&P activity on the NCS. (IHS Markit E&P Terms and Above-Ground Risk's Aliaksandr Chyzh)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.