All major US and European equity indices closed higher on the week, while most APAC markets were lower. US government bonds closed higher on the week, while benchmark European bonds closed mixed. CDX-NA and European iTraxx closed almost unchanged on the week across IG and high yield. Natural gas closed higher on the week, while the US dollar, oil, gold, silver, and copper were all lower.

Americas

All major US equity markets closed higher on the week; Nasdaq +2.7%, S&P 500 +1.3%, DJIA +0.4%, and Russell 2000 +0.3% week-over-week.

10yr US govt bonds closed 1.56% yield and 30yr bonds 1.93% yield, which is -8bps and -14bps week-over-week, respectively

DXY US dollar index closed 94.12 (+0.5% WoW).

Gold closed $1,784 per troy oz (-0.7% WoW), silver closed $23.95 per troy oz (-2.0% WoW), and copper closed $4.37 per pound (-2.9% WoW).

Crude Oil closed $83.57 per barrel (-0.2% WoW) and natural gas closed $5.53 per mmbtu (+4.7% WoW).

CDX-NAIG closed 52bps and CDX-NAHY 305bps, which is flat and +3bps week-over-week, respectively.

EMEA

All major European equity indices closed higher; Spain +1.7%, France +1.4%, Italy +1.1%, Germany +0.9%, and UK +0.5% week-over-week.

Major 10yr European government bonds closed mixed on the week; UK closed -11bps, Germany flat, France +4bps, Spain +9bps, and Italy +22bps week-over-week.

Brent Crude closed $83.72 per barrel (-2.1% WoW).

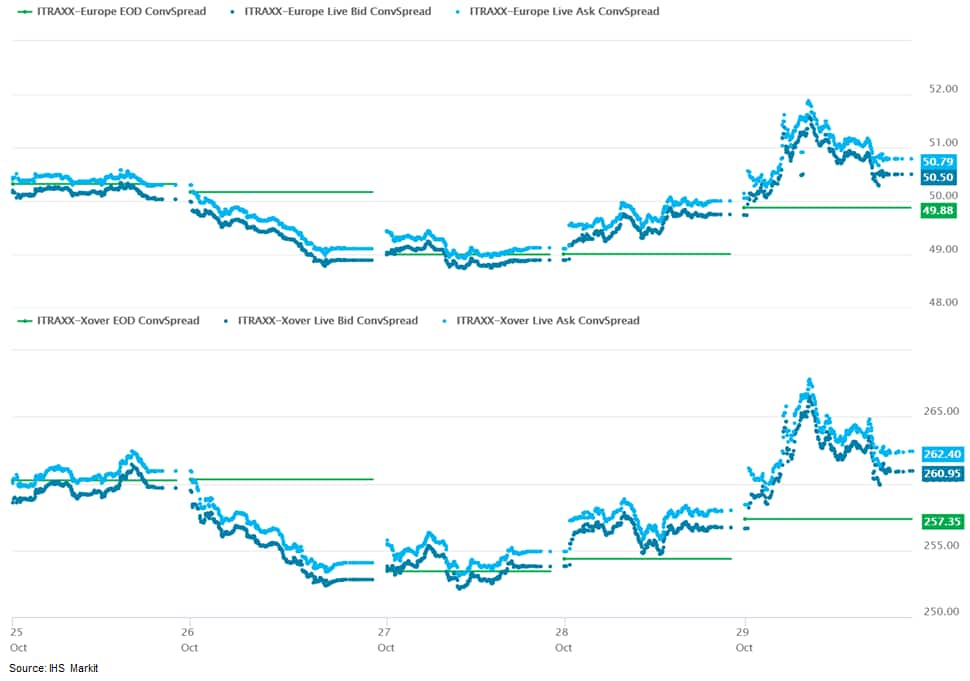

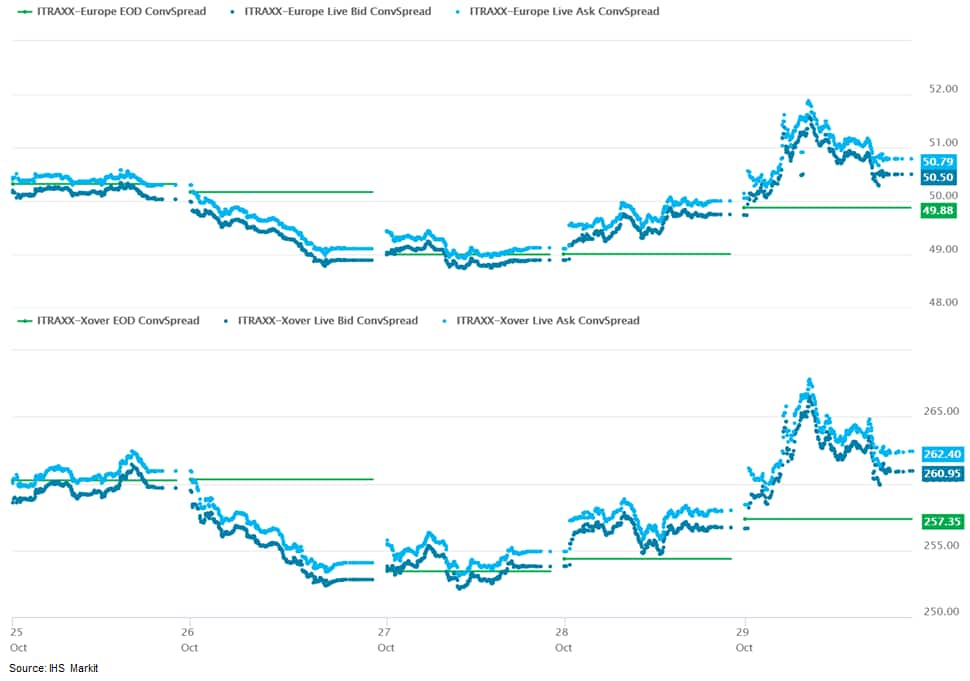

iTraxx-Europe closed 51bps and iTraxx-Xover 262bps, which is +1bp and +2bps week-over-week, respectively.

APAC

Most major APAC equity markets closed lower on the week except for Japan +0.3%; Japan +0.3%, Mainland China -1.0%, South Korea/Australia -1.2%, India -2.5%, and Hong Kong -2.9% week-over-week.

- COP26 will be a conference under pressure from an energy crisis, but this development has only crystalized its transformation into an economic planning conference - as much or more than a climate change conference. (IHS Markit EnergyView Climate & Cleantech's Peter Gardett and Conway Irwin)

- Competing models of infrastructure financing are anchoring bifurcated views of energy transition policy planning heading into the conference, with these positions hardened by widespread price spikes in power, commodities, and oil prices since the end of the summer. Central planning models that governments use to support low risk long-term infrastructure capital allocations are competing for global investment funds with higher-return, higher-risk market-based approaches.

- With estimates of needed investment to hit current Paris Agreement net-zero targets running as high as $27 trillion in the latest IEA report, the shape of future economic pathways is up for discussion at COP26, and the decisions made or not made at the conference will have significant long-term financial and economic impacts over almost every actionable investment horizon.

- Advocates of a faster energy transition away from fossil fuel use have generally aligned with the long-term government-led planning approaches, while advocates of a slower transition that focuses on decarbonizing existing infrastructure are more aligned with the market-based approaches. Both are seeking to leverage climate politics to get government financial support for their preferred solutions, but the recent spike in energy prices has lent additional urgency and weight to each view.

- While some of the broader ambitions for the conference remain unsettled only days before it opens on 31 October in Glasgow, several key policy approaches appear to have generated sufficient cross-cutting appeal to varied constituencies that they remain on track as COP26 is readied. Development finance, highly targeted - though often indirect - fuel-specific financial support, and corporate climate change risk reporting are all still intact measures as the conference gathers.

- Discussions between Apple and its Chinese battery suppliers CATL and BYD on the supply of batteries for its planned electric vehicle (EV) model have stalled, according to Reuters. According to the report, Apple wanted the suppliers to set up teams and battery manufacturing plants in the United States, but neither CATL nor BYD agreed. CATL has cited reasons such as political tensions and cost concerns for not setting up a plant in the US. Meanwhile, Apple is also said to be considering Panasonic as a battery supplier for its EVs. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Tata Motors is to invest INR150 billion (USD2 billion) over the next four years to launch 10 new electric vehicle (EV) models, reports The Times of India, citing a top official at Tata. Shailesh Chandra, president of Tata's passenger vehicle business unit, said, "With just two green products right now (Nexon and Tigor EVs), we are getting bookings of 3,000-3,500 units per month. However, we are able to supply only around 1,000 units… We are now lining up new investments to the tune of USD2 billion just for electrics and this would be used to add 10 new green vehicles, boost production capacity and charging infrastructure, and create IP (intellectual property)." He added, revealing more details about the upcoming EV portfolio, that, "This will surely include the 'born electric' products, which would be exclusively developed EVs." As of 24 September, Tata had crossed the 10,000-unit mark of EVs sold. (IHS Markit AutoIntelligence's Tarun Thakur)

- On October 22, Puerto Rico's Financial Oversight and Management Board announced that it has approved a proposed $606 million fuel contract between the Puerto Rico Electric Power Authority (PREPA) and Puma Energy Caribe LLC for the Aguirre, Costa Sur, San Juan and Palo Seco power plants. (IHS Markit PointLogic's Barry Cassell)

- The contract price adder negotiated under PREPA's enhanced procurement process represents an approximate 33% price reduction compared to the current minimum adder of $4.28, the Board noted. Puma provides PREPA with a credit cap of $200 million and sixty-day credit term. Four companies had provided proposals.

- "The Oversight Board worked closely with PREPA to ensure a transparent and competitive bidding process that achieved the best possible price for the residents and businesses of Puerto Rico," said the Oversight Board's Executive Director Natalie Jaresko. "The Oversight Board has consistently requested improvement in PREPA's contracting practices, to utilize best practices, ensure transparency, promote competition, and ensure the best possible pricing and terms for the benefit of all consumers. The new contract shows that prudent procurement practices achieve the best results. This contract is a big step forward, providing big savings on the adder fee portion of the fuel supply contracts."

- PREPA, accused of pervasive mismanagement, has been in bankruptcy protection for the past few years.

- The contract with Puma is a one-year agreement for the delivery and supply of no more than 1.6 million barrels of No. 6 fuel oil (bunker fuel) per month at market price with a fixed price adder of $2.88 per barrel and includes a provision allowing PREPA, at its sole discretion, to extend the contract for an additional year under the same terms.

- Lotte Chemical Titan (LCT; Kuala Lumpur, Malaysia), an affiliate of Lotte Chemical (Seoul, South Korea), says that "in view of the increase in worldwide COVID-19 vaccinations and opening up of global economies," the conditions are right to start building a previously announced steam cracker and derivatives complex at Cilegon, Indonesia. LCT says that construction work on the Lotte Chemical Indonesia New Ethylene Project (LINE) is expected to commence in 2022 and be completed by 2025. (IHS Markit Chemical Advisory)

- The cost of the project is about $3.9 billion. LCT will own 51% of the planned complex and Lotte Chemical will have 49%.

- Utpal Sheth, executive director/polyolefins at IHS Markit, earlier told CW that the cracker had been due to start up in 2023, but the pandemic and subsequent financial challenges disrupted the plans.

- Lotte Chemical says that the petrochemical complex will consume 3.2 million metric tons/year (MMt/y) of naphtha and liquefied petroleum gas (LPG) as feedstock. The planned cracker at Cilegon will produce 1.0 MMt/y of ethylene and 520,000 metric tons/year of propylene. Lotte Chemical adds that the complex will also manufacture 250,000 metric tons/year of polypropylene (PP) and 140,000 metric tons/year of butadiene.

- Lotte Chemical expects to generate annual sales of $2.06 billion from the LINE project. LCT says that on completion of the project, the facility will provide enhanced operational efficiencies through integration with the company's existing plants in Indonesia. Lotte currently operates a standalone 450,000-metric tons/year high-density polyethylene/linear low-density polyethylene (HDPE/LLDPE) swing plant there, which runs on outsourced ethylene.

- Germany's business climate has deteriorated for the fourth consecutive month in October, led by expectations. Wholesale and retail trade did worst, whereas dips in the manufacturing and services sectors were less pronounced and construction sentiment maintained its upward trend. Supply-chain bottlenecks have become the key restraining force for the economic recovery. (IHS Markit Economist Timo Klein)

- In October, the headline Ifo index, which reflects business confidence in industry, services, trade, and construction combined, again declined moderately from 98.9 (revised up from 98.8) to 97.7. Even now, this exceeds the pre-pandemic level in February 2020 (96.2) and equally the long-term average of 97.1. As in September, the Ifo Institute highlights procurement problems, calling them "sand in the wheels of the German economy".

- Business expectations dipped for the fourth consecutive month in October, and more strongly so than in the preceding month. The decline from 97.4 to 95.4 takes expectations to their lowest level since February, also now undershooting their long-term average (97.6). The main depressing forces for October expectations were the trade and service sectors, somewhat less so manufacturing. In contrast, the construction-sector outlook has now been improving continually since February (briefly interrupted in April).

- Meanwhile, the assessment of current conditions remained almost stable in October, only slipping from 100.4 to 100.1. This is broadly at par with June's level and still exceeds the pre-pandemic 99.0 in February 2020, let alone the long-term average of 96.6. October's outperformance of this sub-index versus expectations was driven by the fact that current conditions not only in construction but also the services sector were seen more positively than a month ago. This underlines that those sectors least vulnerable to supply-chain problems are faring best at present, and that areas like catering and tourism are not seriously hampered by the remaining pandemic-related restrictions.

- Pulling current conditions and expectations together, October's sectoral breakdown reveals declines in all sectors but construction. Most downward momentum at the data edge stemmed from wholesale and retail trade, as delivery problems have become worse, and retailers fear for their Christmas business despite persistently robust consumer demand. In the manufacturing sector, supply-chain issues have depressed capacity utilization by 2.1 percentage points to 84.7%.

- The first official release of the State Job Openings and Labor Turnover Survey (JOLTS) indicated that conditions remained tight in state labor markets during August. While job openings across all four regions declined in August, every region's job openings rate was still close to the series highs they reached in July, and well above pre-pandemic rates. (IHS Markit Economist Alexander Minelli)

- The job openings rate was highest in the South at 7.0%, down from its series peak of 7.2% the month before, reflecting high demand for workers as Southern firms looked to fill open positions amid expanding confidence in the region's economic recovery. Within the South, Kentucky (8.2%), Georgia (8.0%), and South Carolina (7.8%) were among the top five states with the highest job openings rates, which declined in each by less than the national average of 0.4 percentage point in August. The Northeast and Midwest posted the lowest regional job openings rates, at 6.3% and 6.4%, respectively, although they, too, are also well above historical levels. While the Northeast tends to have a lower rate owing to an older and more educated population that changes jobs less frequently, Massachusetts and New Hampshire tied for the seventh highest job openings rate in August, both at 7.4%.

- In August, the quits rate rose in 14 states and was relatively unchanged in the remaining 37 states, although rates remain above pre-pandemic levels after recovering from series lows during the second quarter of 2020. The quits rate in the Midwest and South increased by 0.3 and 0.2 point, respectively, each to a series high of 3.2%, after significant increases in quits in Illinois, Indiana, Georgia, and Kentucky. Meanwhile, the West and Northeast were unchanged from their July peaks of 2.7% and 2.2%, respectively.

- The quits rate traditionally signals the confidence of workers to find a new, and likely better, job, especially during times of labor market tightness when new hiring incentives and higher wages encourage greater job movement. However, health concerns or the need to take care of family may also have contributed to the higher number of quits in August as that month saw a rise in cases of the Delta variant of COVID-19.

- The hires rate decreased in 18 states, with the largest declines occurring in Illinois, Nevada (both down 2.0 points), and West Virginia (down 1.8 points). While the hires rates in every region are still above their pre-pandemic values, they have declined from the series peaks they saw in mid-2020 after many states relaxed or lifted restrictions on business activity, leading to a surge in hiring.

- Argentina's economic activity advanced by 1.1% month on month (m/m) in August in seasonally adjusted terms, posting a third consecutive expansion. The outlook for 2022 remains difficult; the rising inflation rate and the policy uncertainty are driving down growth expectations. (IHS Markit Economist Paula Diosquez-Rice)

- The economic activity index increased by 12.8% year on year (y/y) in August, while the seasonally adjusted data showed a 1.1% m/m increase during the month; the monthly rise in August comes after two consecutive months of expansion. All of the categories in the composite index show an annual rise in August.

- Hospitality and restaurants, construction, manufacturing, and wholesale and retail sales posted the highest annual expansion rates; the hospitality and restaurants sector rose by 35% y/y, although the comparison base was extremely depressed. On the other hand, the primary sector and the financial intermediation services sectors posted the smallest annual expansions in August.

- The Argentine construction costs increased by almost 66% y/y in September 2021; the rise was driven by an 73% y/y increase in the cost of materials, a 60% y/y rise in labor costs, and a 64% y/y rise in general costs. The producer price index rose over 60% y/y in September; the biggest increases were in lumber and non-furniture wood products, oil-refined products, and in non-machinery metal products.

- As the US Congress continues its work on reconciling House and Senate versions of the FY2022 budget, members of the oil and gas industry remain concerned that a fee on methane emissions remains on the agenda, at least for Democrats. (IHS Markit PointLogic's Kevin Adler)

- The American Gas Association (AGA), American Petroleum Institute (API), Independent Petroleum Association of America (IPAA), and Interstate Natural Gas Association of America (INGAA) issued a joint statement on 26 October saying that they are opposed to the fee.

- The Methane Emissions Reduction Act, introduced in both the House and Senate, sets a price of $1,800 per metric ton on methane emissions, which is far above the approximate $20-30/metric ton for carbon that is found in state-led carbon emissions trading programs today. It would begin in FY2023.

- The bill requires Secretary of the Treasury to "levy a fee on methane emissions from oil and gas facilities," using formulas be based on "excess emissions" above a statutory amount, which is 0.1%-0.2% of oil and gas produced, depending on which formula is used.

- The trade groups argued that market forces are driving voluntary actions by oil and gas producers and midstream companies to down methane emissions, and that US EPA regulations on methane from new and modified oil and gas wells that are expected to be published this week will further address methane emissions. At other times, they have pointed out that the formulas are confusing and do not necessarily reflect an accurate way to calculate emissions impacts.

- "This tax on natural gas is not about reducing emissions—it's about forcing American families, regardless of their income level, to help fund the reconciliation package through higher utility bills," said Amy Andryszak, president and CEO of INGAA.

- "With one-third of households already facing challenges affording their energy needs, Congress should not add a new tax on natural gas. Our analysis indicates that the proposed tax could increase natural gas bills from 12% to 34%, depending on the variation of the proposal assessed," said Karen Harbert, president and CEO of AGA.

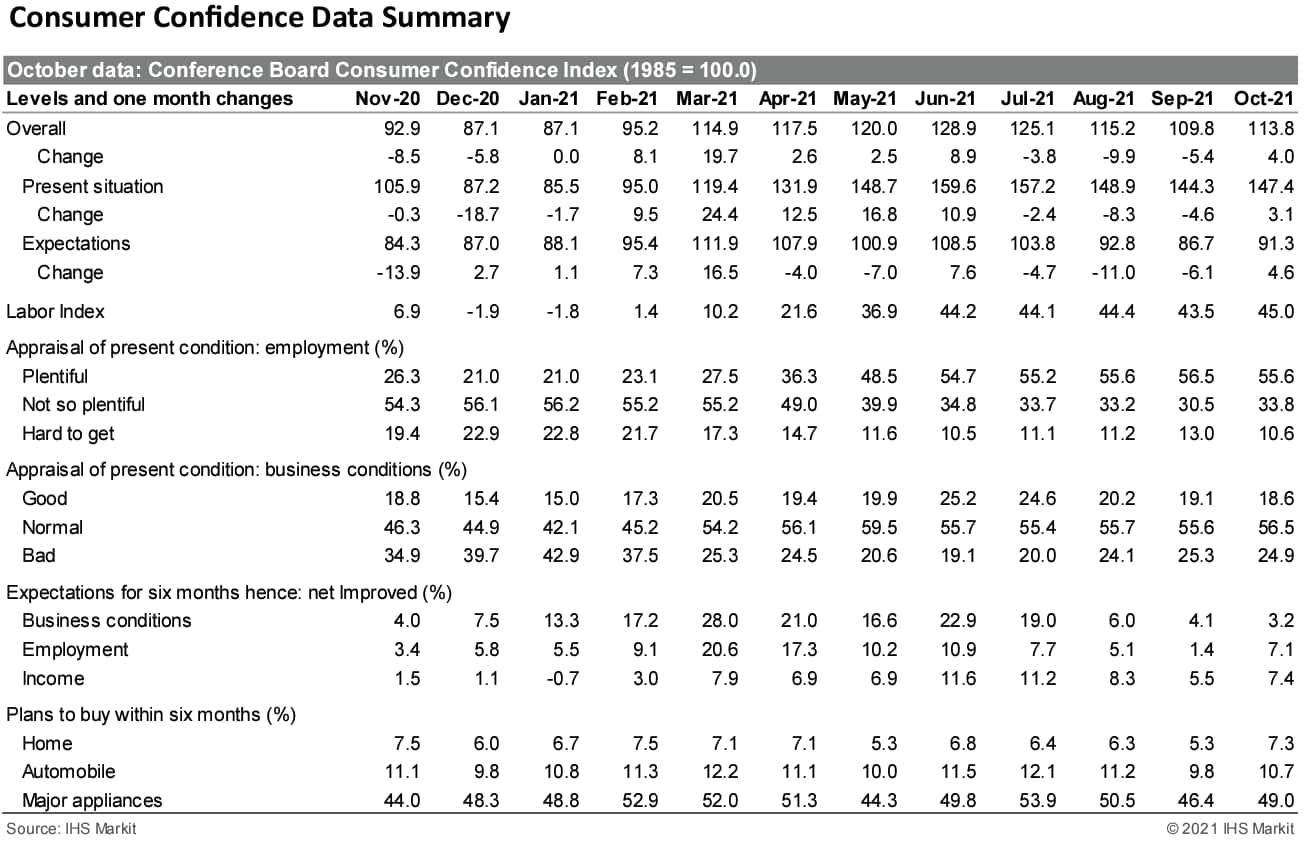

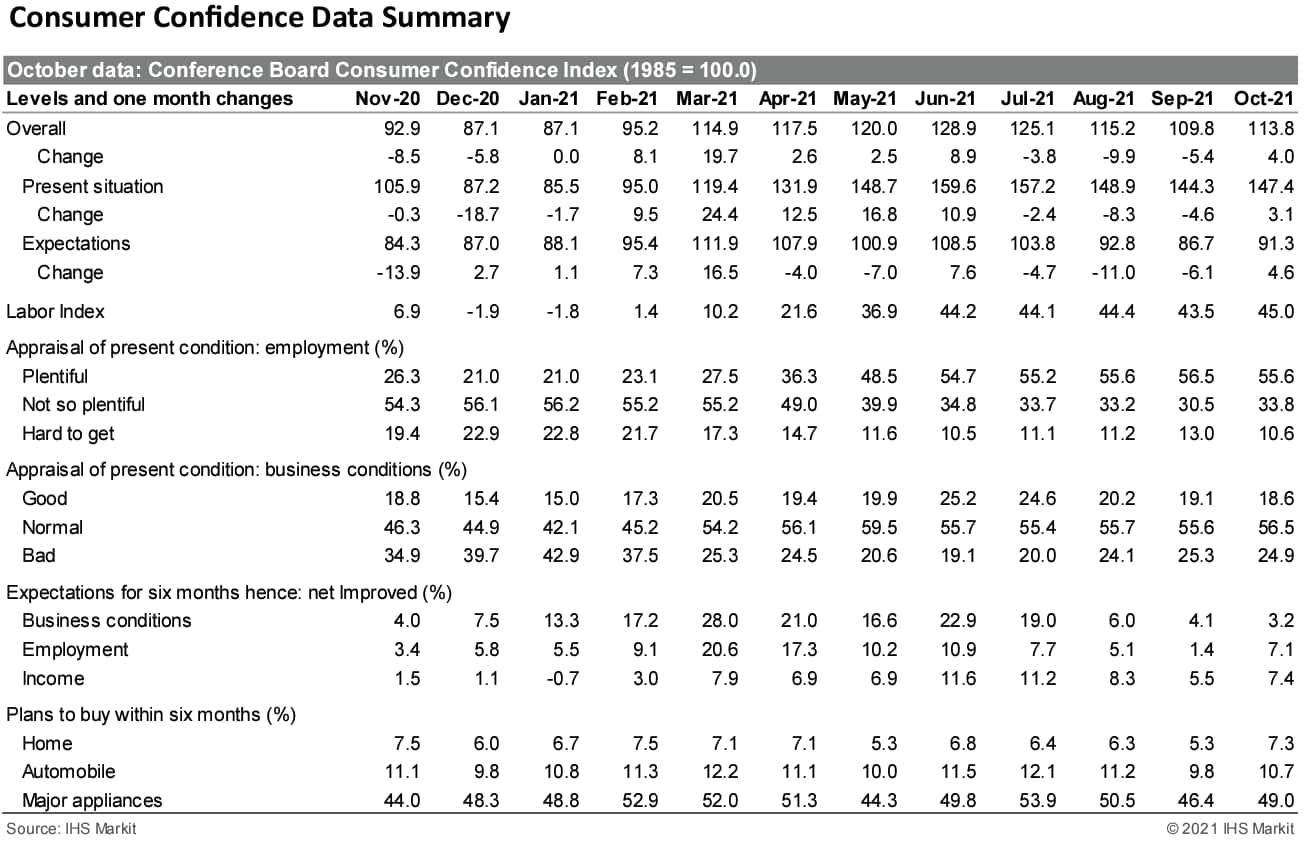

- The US Conference Board Consumer Confidence Index increased by 4.0 points to 113.8 in October, following declines in the previous three months. The index sits 12% lower than its June peak. (IHS Markit Economist James Bohnaker and William Magee)

- The index of views on the present situation increased 3.1 points to 147.4. The expectations index rose 4.6 points to 91.3.

- In October, the labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) increased 1.5 percentage points to 45.0%, among its strongest readings dating back to 2000.

- In addition to improved views on job availability, consumers were also more optimistic about income growth. The net percentage of respondents expecting higher incomes in the next six months increased nearly two percentage points to 7.4%.

- Consumers expected improved buying conditions going forward. The share of respondents planning to buy a home in the next six months improved to its highest mark since February; the share planning to buy automobiles and major appliances increased as well. However, supply-chain disruptions and high prices will likely remain headwinds for some time, particularly in the auto sector.

- Additionally, nearly half of all respondents (48%) reported plans to take a vacation in the next six months, which is the highest proportion since February 2020. The declining number of COVID-19 cases over the course of the month likely supported more positive attitudes regrading travel.

- The spread of the Delta variant was the primary reason for depressed confidence this summer, but consumers are beginning to feel more optimistic now that the number of new cases is on a declining trend. This report supports IHS Markit analysts' expectation for a rebound in personal consumption expenditures (PCE) growth in the fourth quarter after spending growth stalled in the third quarter.

- US new home sales jumped 14.0% (plus or minus 17.9%; not statistically significant) in September to an 800,000-unit seasonally adjusted annual rate. (IHS Markit Economist Patrick Newport)

- Third-quarter sales averaged 738,000, about unchanged from the second quarter. Quarterly sales cyclically peaked at a 973,000 rate in the third quarter of 2020.

- Sales for May through July were collectively revised down by 52,000 units. Note: about one-fourth of new home sales are imputed; these consist of homes sold before a permit is issued and account for the lion's share of data revisions.

- The median and average new home prices in the third quarter soared 21.0% and 15.7%, respectively, from a year earlier. From 2016 to just before the pandemic struck in early 2020, new home prices hardly budged.

- Meanwhile, builders' costs also soared: the Census's construction cost index for homes under construction, which also came out today (26 October), was up 12.9% in the third quarter from a year earlier —its fastest year-on-year pace since the fourth quarter of 1978.

- Inventory—the number of homes for sale at the end of the month—was unchanged in September at 379,000. Only 36,000 of homes classified as inventory were completed; inventory units still in the planning stage were 106,000.

- The Census Bureau also released the state housing permits estimates for September today. These show that five southern states—Texas, Florida, North Carolina, South Carolina, and Georgia—have largely powered the surge in new home construction since the pandemic struck. Collectively, these states accounted for half of the year-to-date increase in permits through September—even though they accounted for 23% of the housing stock in April 2020.

- UK company Ivy Farm Technologies argues that backing cultivated meat would bring huge benefits to the British economy. The company, which is aiming to be UK's first commercial producer of cultivated meat, recently published a report with Oxford Economics. It found that (IHS Markit Food and Agricultural Commodities' Max Green):

- The cultivated meat sector would account for roughly 12% of consumer demand for meat in 2030.

- New figures show lab-grown 'cultivated meat could add £2.1bn to the UK economy by 2030 - 13% of the UK's agriculture sector.

- The British cultivated meat industry could support up to 16,500 jobs across the UK in 2030 - up to 8,300 workers (50%) employed directly by the cultivated meat industry and the rest in the supply chain.

- The industry would also boost tax coffers by £523m - but only if UK regulator the Foods Standards Agency (FSA) rubber stamps its approval for sale in the UK by the end of next year.

- The UK risks losing out to countries such as US, Singapore, and Israel, who are proactively supporting this new industry.

- Daimler has taken a decision to move to more expensive automotive semiconductors in operationally critical areas where shortages are causing bottlenecks, while it has announced it will sell the second-generation EQC in the US. The move to source chips that are more expensive shows that the OEMs are looking at every avenue in terms of mitigating the crisis, although it remains to be seen how this will affect showroom prices, while Mercedes-Benz dealers in the US have been key to the reversal of the decision to sell the EQC there. (IHS Markit AutoIntelligence's Tim Urquhart)

- Xpeng has announced an 800-volt high-voltage mass-production SiC platform with new-generation "X-Power" superchargers. According to the announcement during Xpeng's Tech Day virtual briefing on 24 October, the superchargers can charge the electric vehicle (EV) battery for a range of up to 200 kilometers in just 5 minutes. The automaker also plans to introduce lightweight 480-kW high-voltage supercharging piles with IP67 protection, and safety monitoring. Obtaining a range of 200 km from 5 minutes of charging could be a major breakthrough in the EV segment. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The Reserve Bank of India (RBI) on 22 October introduced a scale-based regulation for non-bank financial companies (NBFCs) that will be effective from October 2022. According to the rule, NBFCs will be regulated based on their classifications, which have been revised to four layers: base layer (smallest), middle layer, upper layer, and top layer (largest and "potential" systemically important"). The base layer will include peer-to-peer lending platforms, while the top layer will be empty for now; the upper layer will include the top-10 largest NBFCs. From a risk perspective, the key changes include a new non-performing loan (NPL) classification norm: from March 2024, loans that are overdue by more than 150 days will be classified as non-performing, while from March 2025, it will be tightened to 120 days, and from March 2026 onwards, it will be further tightened to 90 days. For NBFCs in the upper layer, they will need to adhere to the minimum common equity tier-1 capital ratio of 9%. (IHS Markit Banking Risk's Angus Lam)

- Oil prices find path higher at the intersection of fear and greed. The oil market is gripped by fears: fear of stronger demand as the economic recovery powers through Delta stumbles, fear of contagion from frenzied gas and power markets, and the fear to rule them all - global supply's inability to quickly douse the nascent bullish fire. Combined, these forces have cleared the path for higher prices, breaching out of the short-term band that has held relatively firmly since spring and, more critically, untethering oil from the 2014-2019 range (or the "shale band") and ushering in a new phase of price discovery at higher levels. This process in itself has fueled price upside by creating a fear of missing out on a generational multi-year rally. Unlike the more speculative and anticipation-driven rally of early 2021, this rally is anchored in real signs of accelerating physical tightening due to short-term (temporary) conditions that are perceived as the opening salvo of a structurally tighter environment through the medium-term, with capital (paper) abundance bridging the vision and prices. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, and Sean Karst)

- A series of bullish events upend short- and medium-term oil market narratives. A couple of months ago, oil markets were looking at a markedly less rosy fall and winter amid intensifying Delta variant outbreaks and OPEC+ initiating a year-long process of production restoration that could see renewed bouts of oversupply, especially in 2022.

- Four major developments have unfolded since to definitively shift the trajectory of the market: 1) Disruption-led acceleration in global crude and product inventory draws (especially Hurricane Ida); 2) Contagion from gas and power to oil via demand substitution, shattering perceptions of oil being insulated from broader energy tailwinds; 3) A string of supply disappointments around the world reflecting the impact of under-investment eroding productive capacity, including within OPEC+; and 4) US E&P restraint appears to have weathered its first real-world price test in the face of surging oil and gas prices (so far).

- Physical shortage risks still low but easing of physical market conditions necessary to release some bullish steam. Unlike the gas situation in Europe, we still see supply buffers in oil. OECD inventories have fallen below 5-year averages but remain above 2010-2014 levels, while OPEC+ productive capacity, even with under-investment-induced woes in many smaller countries, remains comfortably above pre-pandemic levels. But OPEC+ producers with spare capacity have been reactive rather than proactive and have not deviated from their slow and methodical approach even after the latest rally.

- From supply complacency to supply anxiety. Despite significantly higher oil (and gas) prices, we have left our US supply forecast for 2022 largely unchanged. Behind that relatively tame revision to supply however lies one of the most significant changes to oil price formation. The past seven years have been defined by the combination of resource abundance and hyper-reactivity, the combination of which have served to anchor the "resource complacency" price regime, with hyper-reactive short-cycle barrels offsetting any investment risks from long-cycle projects into a decelerating demand world.

- We have raised our oil price outlook significantly to reflect the shift in the price regime. Our 4Q2021 ICE Brent price outlook is $84/bbl in our base case compared with $68bbl in our July outlook. We have lifted our price outlooks throughout 2022 to reflect this environment, with Brent and WTI revised to $77.25/bbl and $73.25/bbl, respectively. Our 2023 initial forecast has Brent and WTI set at $70.50/bbl and $67.50/bbl, respectively.

- How effectively can Saudi Arabia manage scarcity going forward? The post-COVID demand outlook remains full of uncertainties as supply chain disruptions, consumption, and travel patterns have significantly shifted from their previous patterns. This winter global energy crisis is likely to extend the exceptional and keep markets on a volatile path.

- Shin-Etsu Chemical reports 57.4% higher net profit for the fiscal first half ended 30 September, to ¥220.9 billion ($1.9 billion), compared with ¥140.0 billion in the same period of the previous year. Operating income increased by 62.0% year on year (YOY) to ¥298.4 billion and sales grew by 32.5% YOY to ¥941.3 billion. Quarterly figures have not been disclosed. (IHS Markit Chemical Advisory)

- Operating income at Shin-Etsu's infrastructure materials business grew threefold to ¥123.2 billion, compared with ¥38.1 billion in the year-earlier quarter, on sales of ¥364.0 billion, up 65.0% YOY. The company says that sales prices for polyvinyl chloride (PVC) grew, supported by strong global demand. It adds that market conditions for caustic soda have improved steadily since June. Increased production at Shintech, the company's US-based PVC business, also contributed to the higher earnings.

- Shin-Etsu's electronics materials business recorded a 12.6% YOY increase in operating income to ¥118.7 billion, on sales that rose 14.7% YOY to ¥335.5 billion. Products including semiconductor silicon, photoresists, and photomask blanks continued to be shipped at high levels for semiconductor device applications. Demand for rare-earth magnets has been strong in all applications, including automobiles, factory automation, and hard disk drives, despite the restrictions on operations in Malaysia, it adds.

- In the company's functional materials segment, operating income rose by 39.4% YOY to ¥22.7 billion, with sales growing 25.3% YOY to ¥188.4 billion. The company executed price revisions to counter higher prices of raw materials. Higher demand boosted the profitability of this sector.

- Shin-Etsu's processing and specialized services business reported operating income 44.3% higher YOY at ¥10.4 billion, on sales of ¥53.3 billion, up 13.3% YOY. Shipments of semiconductor wafer containers were strong, both for transporting use and for manufacturing processes.

- One of Europe's largest pension funds, the Netherlands-based ABP, announced 26 October it will divest more than €15 billion (approximately $17.4 billion) of equity and debt investments in 80 oil, natural gas, and coal companies, saying international reports on the dire need to reduce CO2 emissions played a crucial role in changing its strategy. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- "ABP will divest from the fossil fuel producers in phases; the majority of which is expected to be sold by the first quarter of 2023," the pension fund said in a statement.

- The divestment represents about 3% of ABP's total assets of about €493 billion.

- The May report of the International Energy Agency (IEA) and the August report of the Intergovernmental Panel on Climate Change (IPCC) prompted the portfolio shake-up by the pension fund, which invests on behalf of Dutch teachers and civil servants, a spokeswoman told OPIS on 26 October. "It's these reports that made us think about if we want to contribute to minimizing global warming, then more radical steps are necessary," she said.

- Siemens Gamesa has struck an agreement with the State of Virginia, United States, to establish the first offshore wind turbine blade facility in the country. A USD200 million blade factory, producing the company's Offshore IntegralBlade, will be built at the Portsmouth Marine Terminal to support the delivery of Siemens Gamesa's 15 MW offshore wind turbines to Dominion Energy's 2.6 GW Coastal Virginia Offshore Wind Commercial (CVOW-C) project. The 32-hectare facility will be built on land leased from the Virginia Port Authority and will perform finishing of the offshore blades. Around 310 jobs will be created to support this function, including 50 to provide operations and maintenance services. The announcement comes shortly after Dominion Energy signed an agreement with the Port of Virginia to lease 29 hectares in the same area to use as a staging and pre-assembly area for foundations and wind turbines. The Bureau of Ocean Energy Management (BOEM) is currently performing the environmental review for the CVOW-C project. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- On October 25, the New York Power Authority (NYPA)—on behalf of project partners the Electric Power Research Institute (EPRI), General Electric (GE), Airgas, Sargent & Lundy and Fresh Meadow Power—said it will commence a demonstration project in November to assess the potential of substituting renewable hydrogen for a portion of the natural gas used at its Brentwood Power Station on Long Island. (IHS Markit PointLogic's Barry Cassell)

- The effort to study renewable hydrogen in this application is a part of the state's decarbonization strategy as outlined in New York's nation-leading Climate Leadership and Community Protection Act. Representatives from the project partners were on-site in Brentwood on October 25 to view progress.

- This first-of-its-kind demonstration will evaluate the effects of different concentrations of hydrogen blended with natural gas at regular intervals to assess the blend's effect on reducing greenhouse gas emissions and its overall system and environmental impacts, including NOx emissions. At the close of this project, peer-reviewed results will be shared with the industry and public to better inform what efforts can help New York State reach its goal of reducing carbon emissions 85% by 2050. The project is expected to last six to eight weeks.

- NYPA's Brentwood Power Station, which is equipped with a GE LM-6000 combustion turbine fueled by natural gas, was commissioned in 2001 to increase power generation capacity for Long Island and New York City in anticipation of shortages. As the gas turbine original equipment manufacturer, GE will supply a hydrogen/natural gas blending system and support the project's planning and execution. Sargent & Lundy, acting as the engineer of record, will provide overall engineering and safety reviews. Airgas is the supplier of renewable hydrogen and Fresh Meadow Power is providing piping system design, material procurement and installation services.

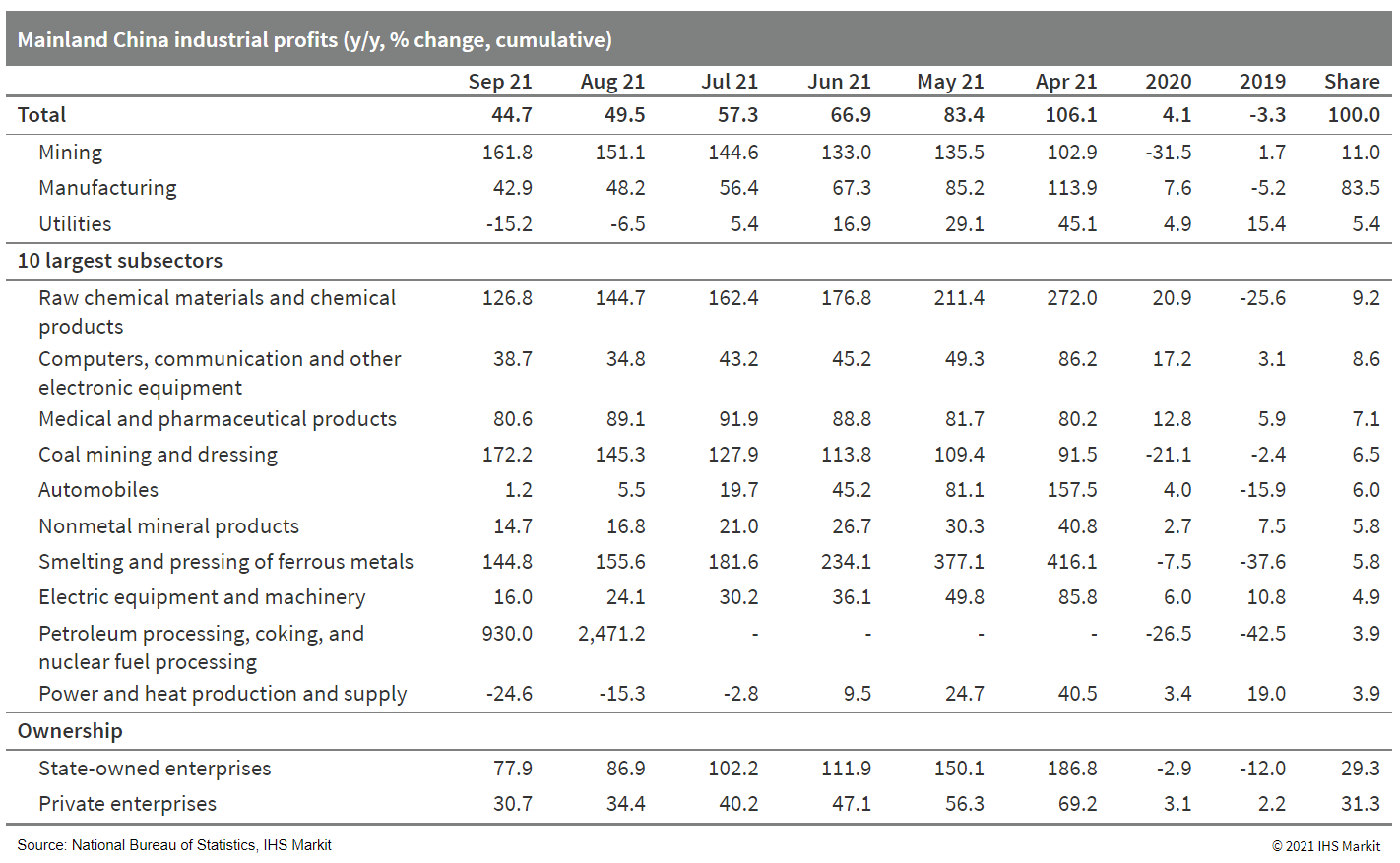

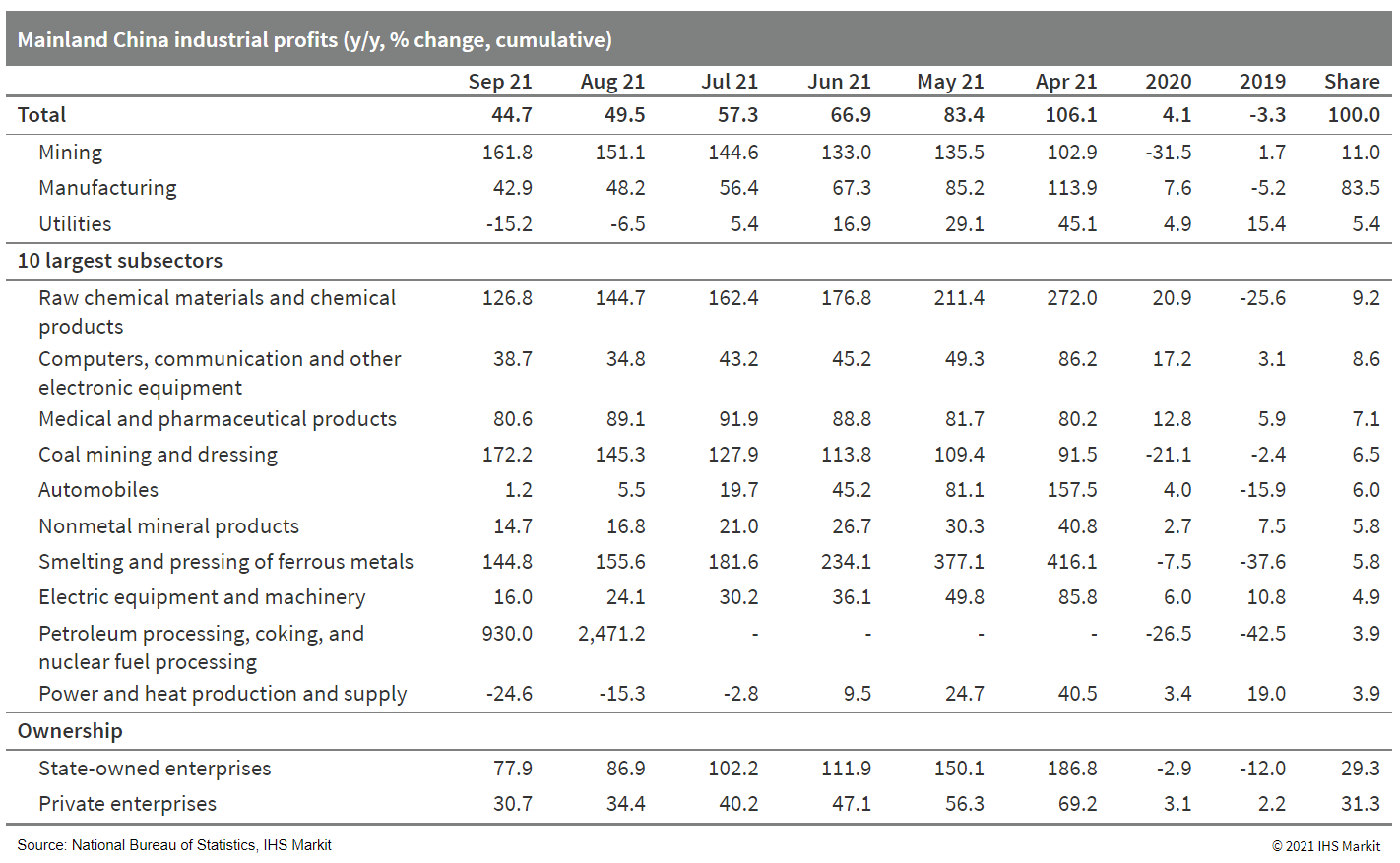

- Mainland China's industrial profits expanded by 44.7% year on year (y/y) through September, down by 4.8 percentage points from the first eight months. On a two-year (2020-21) average basis, industrial profits increased by 18.8% y/y in the first three quarters, 0.7 percentage point lower than the August reading. For September alone, industrial profits recorded growth of 16.3% y/y, ticking up from 10.1% y/y in August, according to the National Bureau of Statistics (NBS). (IHS Markit Economist Lei Yi)

- The cumulative profitability ratio, although still high at 6.96%, has edged down for a third consecutive month through September. While the profitability ratio of the upstream mining sector continued to rise by 0.36 percentage point to 18.25%, that of the manufacturing and utility sectors further declined, falling by 0.05 and 0.43 percentage point to reach 6.58% and 5.09%, respectively.

- Soaring coal prices further dragged on industrial profits of the utility sector, which posted a wider contraction of 15.2% y/y through September. Notably, the profits of the subsector of power and heat production and supply dropped by 24.6% y/y, compared with the decline of 15.3% y/y in the prior month. The coal mining and dressing sector, on the other hand, recorded an even larger jump of 172.2% y/y in profit growth through September, up by 26.9 percentage points from the first eight months.

- Regarding the broader picture, 29 out of the 41 (70.7%) industrial subsectors reported industrial profits exceeding the pre-pandemic level in the third quarter. Profit strength in the high-tech and raw material manufacturing sectors persisted, and profits of consumer goods manufacturing also posted steady recovery, registering a two-year average growth of 12.0% y/y in the third quarter.

- The ECB's quarterly bank lending survey (BLS) for the third quarter was compiled between 20 September and 5 October, based on the responses of 146 banks across the eurozone's member states. The ECB has also released actual loan data for September. Looking first at developments in bank lending to households, the key takeaways from the latest data include the following (IHS Markit Economist Ken Wattret):

- Banks adopted a more cautious attitude towards lending to households for house purchase. The net percentage of banks reporting a tightening of credit standards for this type of loan rose to +8, the highest for four quarters (-1 in the second quarter's survey). For consumer credit, credit standards remained broadly unchanged (net percentage of -1 versus 0 in the second quarter).

- For housing-related loans, the net tightening was related to lower risk tolerance among banks, plus the cost of funds and balance-sheet constraints.

- Banks reported another increase in demand for loans from households for house purchase, although the net percentage of banks reporting an increase in demand for this type of loan moderated in the third quarter (to +11, versus +36 in the second quarter). Demand for consumer credit increased in the second quarter, although the net percentage also moderated (to +7, versus +11 in the second quarter).

- Elevated consumer confidence, the low level of interest rates, and positive housing market prospects all contributed positively to household loan demand.

- September's ECB data on actual bank lending growth to eurozone households for house purchases showed the first deceleration in eight months, from 5.8% to 5.5% y/y. Still, the recent growth rates are the highest since 2008.

- Growth in other types of lending to households, including consumer credit, remained weak.

- Banks again reported broadly unchanged credit standards on loans to enterprises in the third quarter. The net percentage of banks reporting a tightening edged up to +1 (versus -1 in the second quarter's survey), close to what was expected in the prior survey (+2).

- Credit standards remained unchanged for both SMEs (net percentage 0, versus -1 in the second quarter) and larger firms (0, versus -3 in the second quarter). The fact that credit standards for loans to enterprises were unchanged irrespective of the size of firm is indicative of the beneficial impact of government support measures. There was also little difference in credit standards for short-term loans (net percentage +1, versus -2) and long-term loans (+1, versus 0).

- France's consumer confidence headline index has fallen from 101 in September to 99 in October, according to figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). (IHS Markit Economist Diego Iscaro)

- The consumer confidence index peaked at 102 in June 2012, slightly above its long-term average of 100, but has now declined in three out of the last four months. October's reading was also below a consensus of 101 as pooled by Reuters.

- The deterioration of the headline index was driven by households' less upbeat assessment of their future financial situation and the general economic outlook. The number of households considering making a major purchase over the coming 12 months has also declined to its lowest level since March.

- The fall in these indices is likely to be linked to higher expected inflation, as the index measuring households' views on consumer prices over the coming year has risen to its highest level since April 2012.

- On a more positive note for the outlook, the index measuring unemployment expectations has continued to decline substantially in September. It now stands at a level not seen since just the start of the pandemic.

- October's decline in confidence was expected given the sharp increase in energy prices recorded in France and most other European countries.

- The government has frozen natural gas prices, which increased by 12.1% in October, until April 2022. Furthermore, authorities have announced a EUR100 (USD116) grant (to be paid in December) for those earning less than EUR2,000 per month to mitigate the impact of higher energy prices.

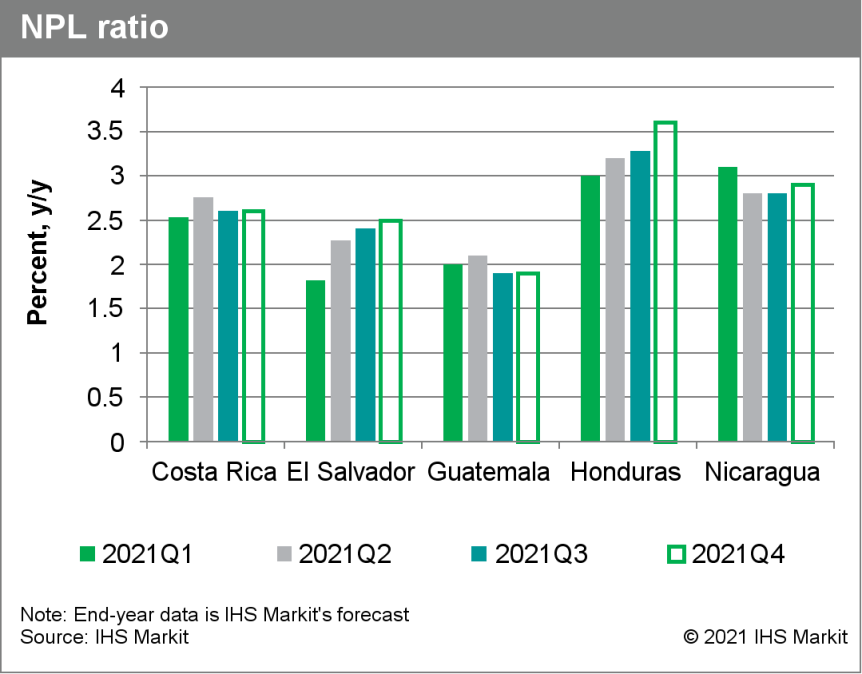

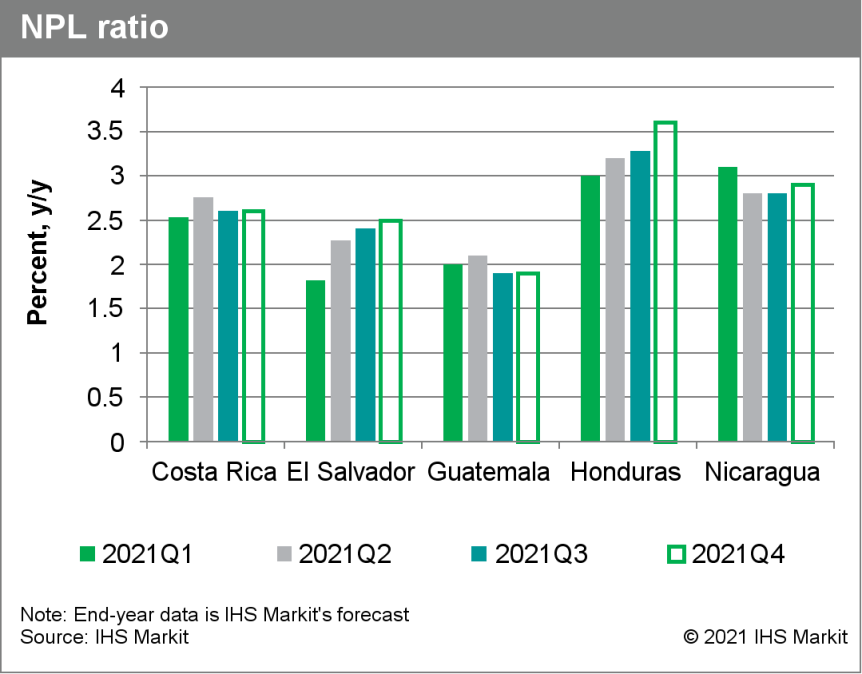

- IHS Markit has analyzed the main banking indicators for Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua for the third quarter of 2021. Our key findings indicate that credit growth remains contained in most of the region; non-performing loans (NPLs) are still slightly rising compared with June 2021, in line with our previous assessment. All averaged figures presented here are calculated using simple (non-weighted) averages. Due to availability, data for Honduras are as of August 2021. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- Credit growth stayed at low levels, although it is still recovering from the 2020 decline. In the third quarter of 2021, the sectors' credit growth levels averaged 4.4% year on year (y/y), slightly above the 3.8% displayed in June. This was mostly led by Guatemala's strong loan growth at 8.9% y/y, primarily driven by a strong economic recovery during the second quarter of 2021.

- NPLs are increasing slowly, and we expect them to edge up slightly at the end of 2021. Averaging 2.6% in September 2021, the sectors' NPL ratio remains contained and relatively close to the 2.4% displayed in June. However, some deterioration in the quality of assets can be observed in other reported metrics, such as Costa Rica's, whose low-quality loans have risen sharply through this quarter, representing 9.9% of total loans, compared with 6.9% in the first quarter of 2020.

- Deposit growth is starting to stall, but liquidity ratios remain stable. The region has continued to display strong levels of deposit growth, although they are slowly returning to normal ratios because of a return of consumer spending. This, in turn, has led to banks increasing their holdings of liquid assets, decreasing the regional average of the loan-to-deposit ratio (LDR) from a high 87.9% in March 2020 to a very moderate 75.7% in September 2021.

- Capitalization remains high and is likely to retain its stability. Shareholders' equity to total assets ratio remained very stable in all the sectors, averaging 11.8% in September.

- US GDP rose at a 2.0% annual rate in the third quarter according to the Bureau of Economic Analysis (BEA)'s "advance" estimate, 0.4 percentage point higher than the latest IHS Markit tracking estimate. GDP growth slowed sharply from 6.7% in the second quarter in response to a resurgence of COVID-19 cases and ongoing supply-chain problems. Federal government assistance to households, businesses, and state and local governments declined materially. (IHS Markit Economists Ken Matheny, Michael Konidaris, and Lawrence Nelson)

- Relative to the IHS Markit tracking estimates, final sales were higher than expected but inventory investment was lower. The former reinforced IHS Markit expectations for robust growth of final sales in the fourth quarter, while the latter suggested a larger increase of inventory investment in the fourth quarter. The combination implied an upward revision to the IHS Markit forecast of fourth-quarter GDP growth to 5.1%. The strength in final sales relative to IHS Markit estimates was primarily accounted for by personal consumption expenditures (PCE) and net exports.

- The slowdown in GDP growth in the third quarter was led by PCE, which grew at a 1.6% annual rate, down from 12.0% in the second quarter. Also contributing to the slowing in GDP growth in the third quarter were business fixed investment (where growth slowed) and net exports. Net exports fell $67 billion (less of a decline than IHS Markit experts had estimated) as exports fell but imports continued to grow. Inventory investment rebounded in the third quarter, contributing 2.1 percentage points to GDP growth.

- Germany's Federal Statistical Office (FSO) has reported, based on data from various regional states, that the country's national consumer price index (CPI) has increased by 0.5% month on month (m/m) in October. This drives up the annual inflation rate from 4.1% in September to 4.5% year on year (y/y), a level not observed since 1993. (IHS Markit Economist Timo Klein)

- The EU-harmonised CPI measure has equally increased by 0.5% m/m, its y/y rate thus even increasing from 4.1% to 4.6% y/y given differing base effects. Unlike during the first eight months of 2021, when different weighting patterns between the two measures provided for large gaps at times, the differential should remain small from now on.

- The detailed breakdown of the German national data will only be published with the final numbers on 10 November, but components are available, for instance, from the largest and most populous state of North Rhine-Westphalia (NRW). The CPI in this state has increased by 0.4% m/m, lifting its y/y rate from September's 4.4% to 4.5%.

- In NRW, energy prices have increased sharply by 3.5% m/m, boosting their annual rate from September's 13.6% to 17.0%. Elsewhere, however, only alcohol/tobacco (from 2.6% to 3.0%) and 'miscellaneous goods and services' (from 3.6% to 3.8%) have posted rising inflation rates, whereas food (down from 4.9% to 4.3%) and - somewhat surprisingly - the recreation/entertainment category (down from 4.0% to 3.0%) have exerted an offsetting dampening influence. The latter partly owes to an above-average softening of package-tour prices after the autumn school holidays.

- With respect to durable goods, prices of clothing/shoes have declined - allowing the y/y rate to drop yet again from 2.1% to 0.8% - but inflation of furniture/household goods remains at an elevated 4.0%.

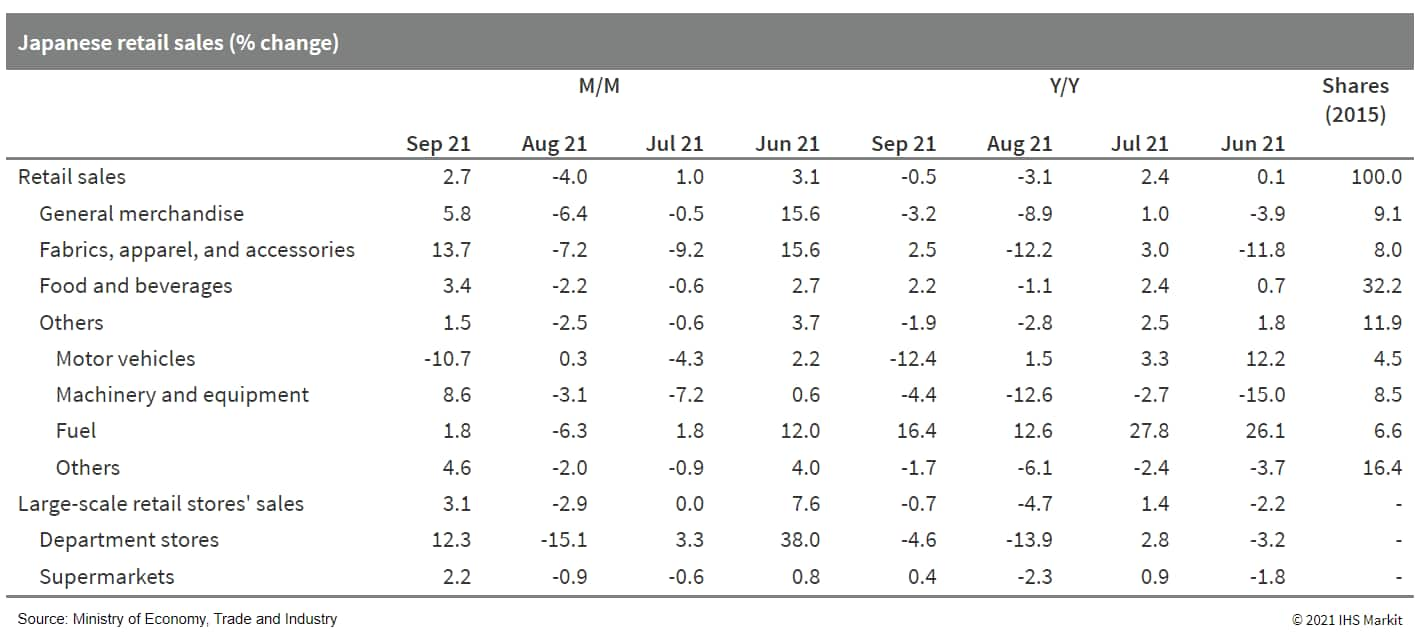

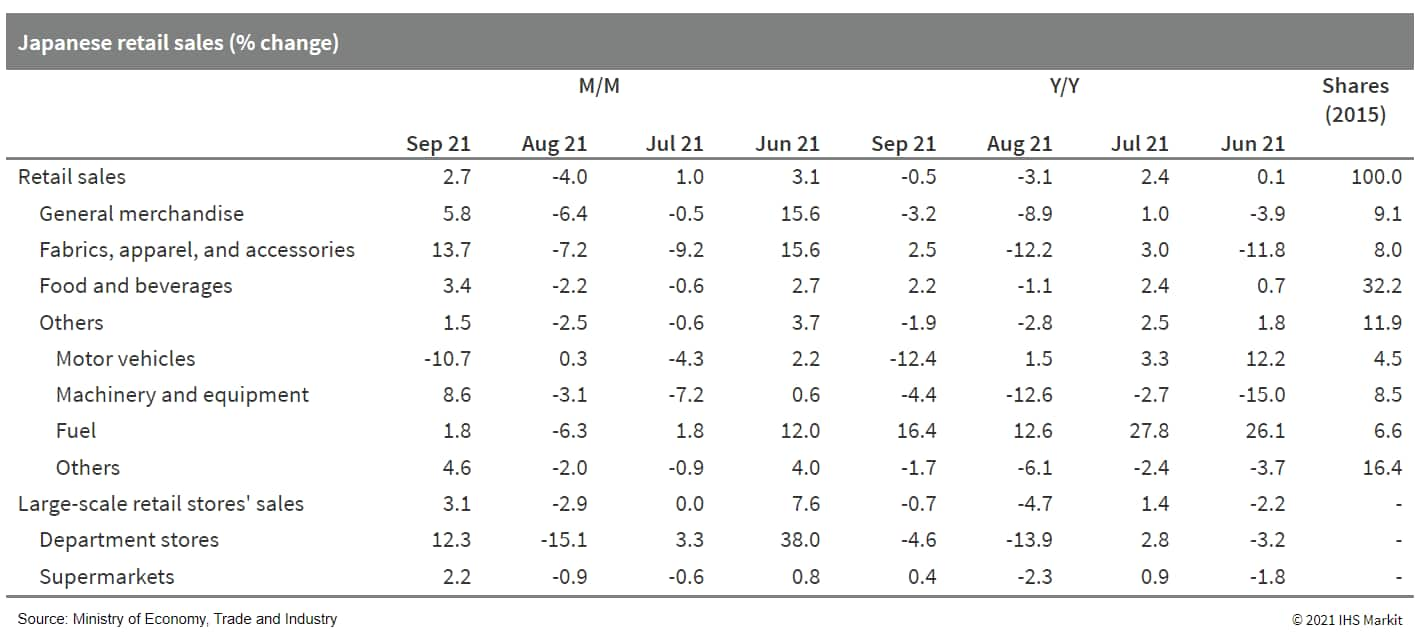

- Japan's retail sales increased by 2.7% month on month (m/m) in September following a 4.0% m/m drop in the previous month. The year-on-year (y/y) figure continued to decline, moving down 0.5%. The improvement largely reflected a notable decrease in Delta-variant infections and improved weather, which drove rebounds in a broad range of retail sales areas. (IHS Markit Economist Harumi Taguchi)

- The major contributors to the improvement were sales of fabrics, apparel, and accessories, as well as food and beverages, which offset a weakness for auto sales due to difficulties in delivering new cars caused by shortages of semiconductors and parts. The improvement also partially reflected higher prices of fresh food and gasoline.

- The September results were better than IHS Markit's expectation, but a rise of only 0.2% for retail sales in real terms (realized by the Consumer Price Index of goods) for the third quarter of 2021 suggests a decline in real private consumption in the national accounts for the quarter (which will be released on 15 November). Private consumption of goods for the third quarter was probably not strong enough to offset the effects of a decline in private consumption on services, which has been more affected by containment measures during the state of emergency that ended on 30 September.

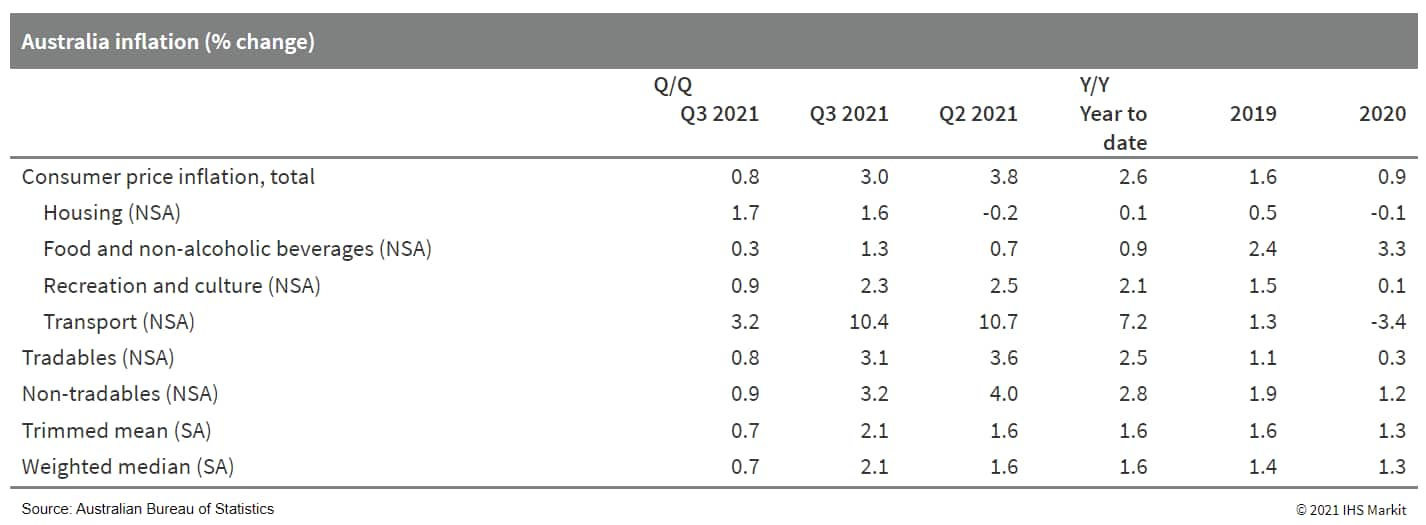

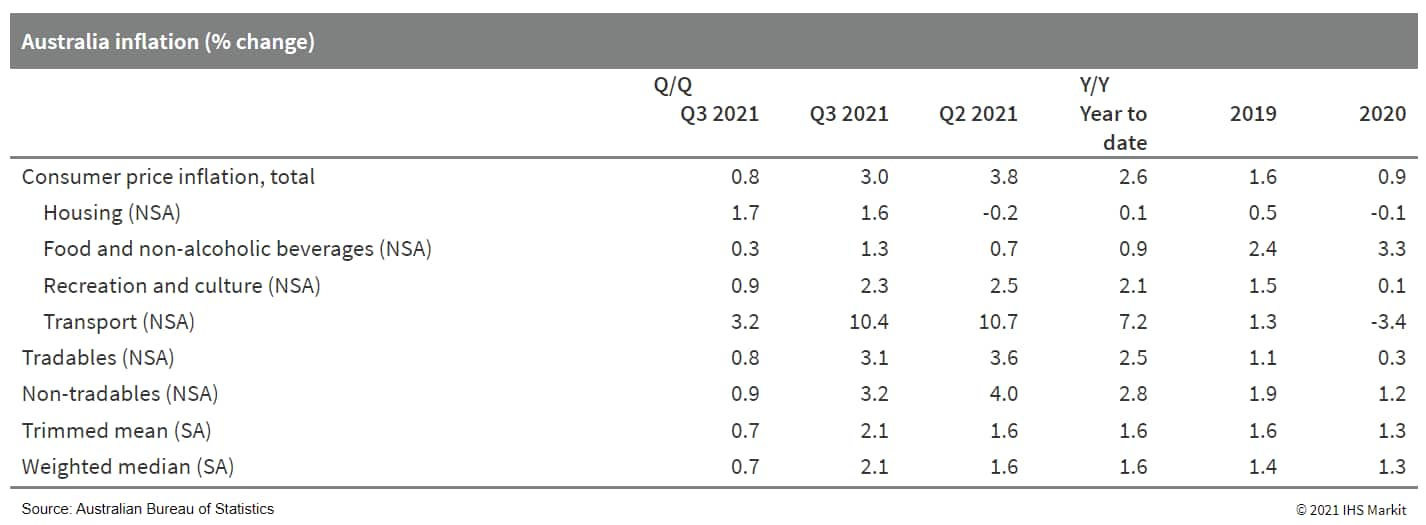

- According to the Australian Bureau of Statistics (ABS), the rise in the headline consumer price index (CPI) was driven by the transport component of the index as automotive fuel prices rose 7.1% quarter on quarter (q/q) and edged close to a record high that was last reached in early 2014. Another key source of inflationary pressure was a 3.3% q/q surge in new home prices, as construction activity boomed but was affected by supply chain disruptions for key materials such as timber. (IHS Markit Economist Bree Neff)

- The greatest downside pressure on prices arose from retailers slashing prices on winter apparel and footwear owing to a milder winter and strict lockdown measures keeping citizens in New South Wales and Victoria states primarily at home during the quarter. Despite concerns about insufficient numbers of workers in the agricultural sector, fruit prices fell by 8.3% q/q due to strong harvests and reduced restaurant demand amid lockdown measures.

- The biggest surprise in the inflation data was the surge in the core inflation measures of trimmed mean and weighted median, which both recorded their largest quarterly increases since the June quarter of 2014 and the largest year-on-year (y/y) expansions since the December quarter of 2015, despite the strict coronavirus disease 2019 (COVID-19) containment measures maintained throughout the quarter for large portions of the population. This is likely related to the rise in new dwelling prices, which drove up the non-tradables sub-component of the consumer price index (CPI), although higher prices for electronics and home furnishings due to supply chain issues also contributed.

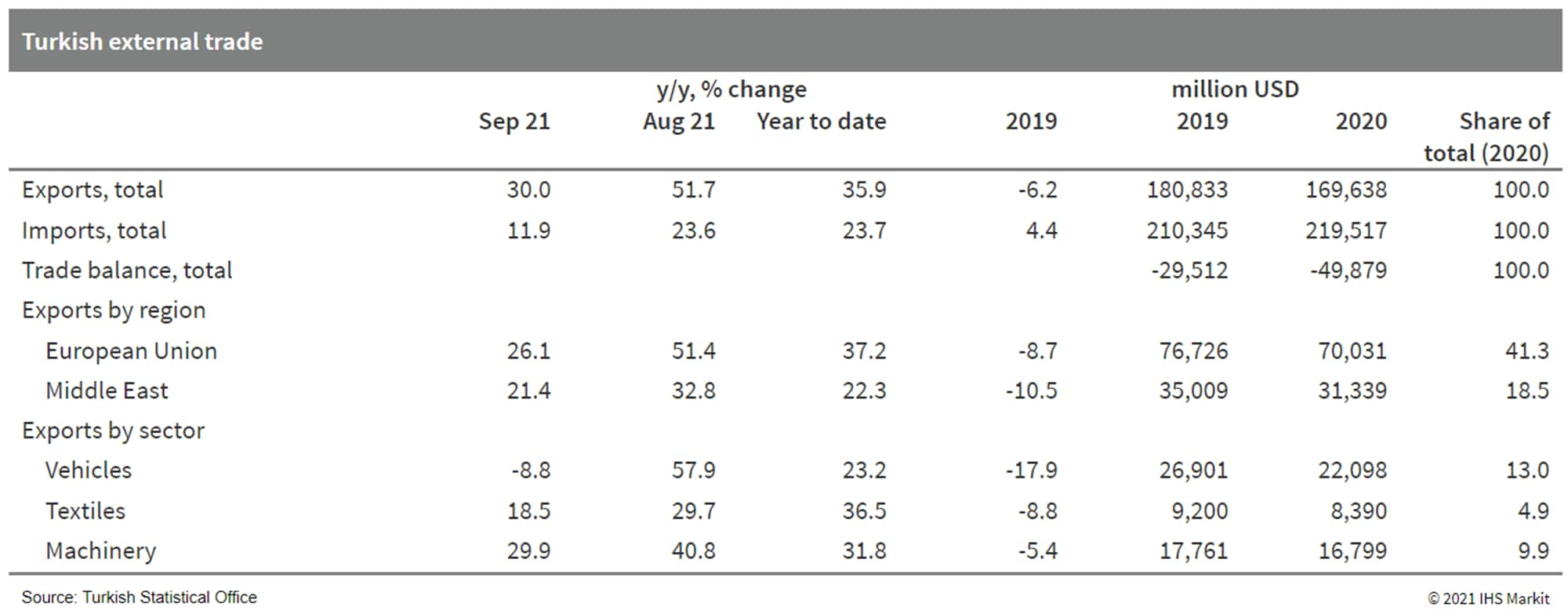

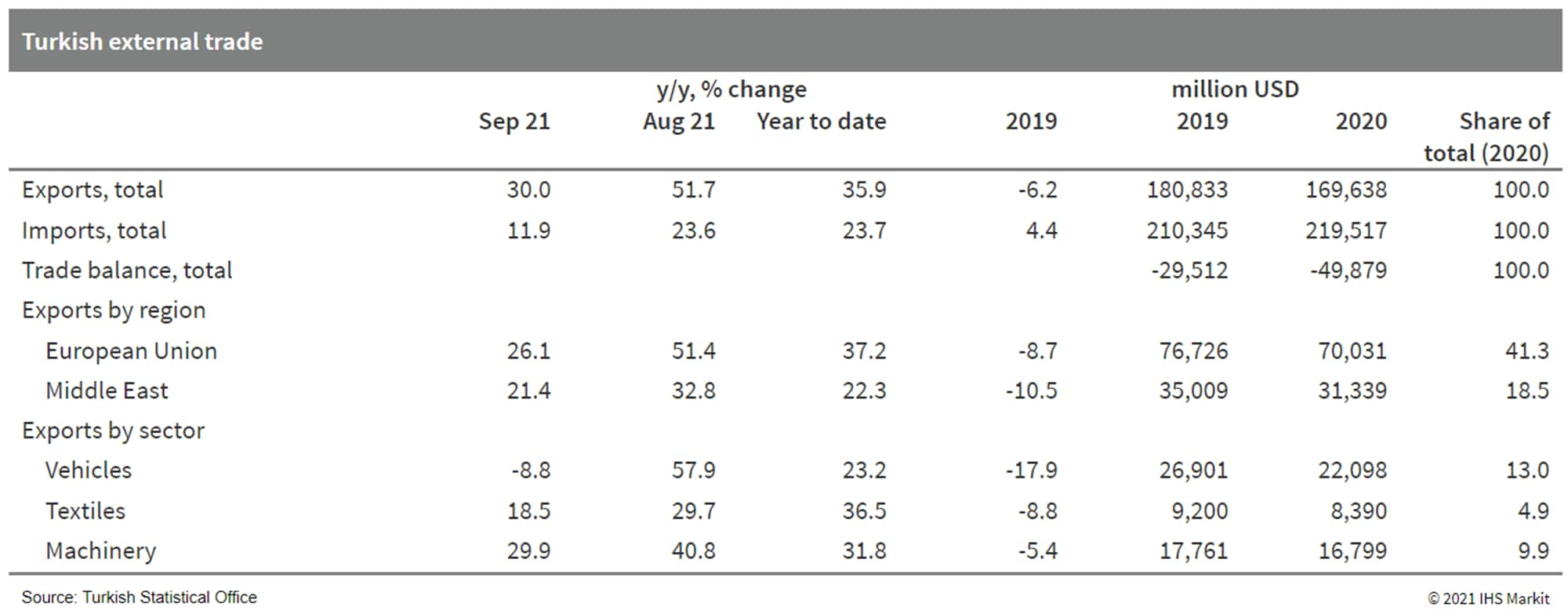

- Through the first three quarters of 2021, Turkey posted a merchandise-trade deficit of USD32.4 billion, down by over USD5.5 billion from the same period of 2020 according to data from the Turkish Statistical Institute. The trade gap narrowed particularly sharply in August and September, down by 32.1% year on year (y/y) and 47.5% y/y, respectively. (IHS Markit Economist Andrew Birch)

- Vigorous export gains that accelerated in August and September were the primary cause for the narrowing of the trade gap. Overall in the first three quarters, exports increased by 35.9% y/y.

- The shipment of intermediate, including low-technology goods has been resilient despite global supply chain and production problems. Iron and steel, plastics, and aluminium exports all grew stronger than the average both through the first three quarters as a whole and in recent months as well. On the other hand, the country's top export commodity, automobiles and their parts, is suffering in the face of the global backlogs, with overall, January-September growth just 22.9% y/y and monthly totals falling against year-earlier levels.

- Import growth was strong through September, but somewhat weaker since mid-year. The lira's sharp depreciation early in 2021 and again beginning in September has undermined import demand.

- The Coca-Cola Company has reported a 16% y/y increase in net revenues to $10.0 billion in the third quarter, resulting in better net revenues than in 2019, while organic revenues grew 14%. In volume terms, the company has reported that Q3 volume this year was ahead of 2019 driven by improved performance in away-from-home (AFH) channels along with continued strength in at-home channels. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Unit case volume grew 6% in Q3, resulting in volume ahead of 2019, primarily led by developing and emerging markets. Growth in developing and emerging markets was led by India, Russia and Brazil, while growth in developed markets was led by the US, Great Britain and Mexico.

- Nutrition, juice, dairy and plant-based beverages grew 12% y/y in volume, a low single-digit acceleration versus 2019, due to solid performance by Minute Maid Pulpy juice drinks in China, the Maaza fruit drink brand in India and Del Valle juice brand in Mexico.

- Sparkling soft drinks grew 6%, resulting in volume ahead of 2019, driven by strong performance across all geographic operating segments. Sparkling flavours grew 7%, resulting in even performance on a two-year basis.

- Concentrate sales were two points ahead of unit case volume in the quarter, primarily attributable to bottler inventory build to manage through near-term supply disruption.

- Prompted by rising spot prices for commodities, Coca-Cola management conceded that juice is the key commodity for The Coca-Cola Company in terms of size.

- "The biggest commodity that flows through the company's P&L (profit and loss) [statement] is actually juice, the cost of buying juice whose spot price is not projected to shoot up as much next year as this year. It has obviously increased in 2021 over 2020 but it is looking more in the range that we've talked about going into 2022. So, from the company's perspective the spot price of our biggest commodity is not wildly projected to be out of line," said Quincey.

- Hertz has announced a partnership with Uber to add as many as 50,000 Teslas to the Uber network by 2023, according to a company statement. Hertz has rented vehicles to Uber drivers since 2016, and recently announced an order for 100,000 Tesla vehicles in 2022. According to the statement, Hertz will begin renting Tesla vehicles to Uber drivers in Los Angeles, San Francisco, San Diego, and Washington DC from 1 November 2021; a national program is planned in the coming weeks, Hertz notes. In the statement, Mark Fields, interim CEO of Hertz, said, "Today's partnership with Uber is another major step forward in Hertz becoming an essential component of the modern mobility ecosystem and executing on our commitment to being an environmentally forward company. We are creating the new Hertz and charting a dynamic, new course for the future of travel, mobility and the auto industry." Although pricing for the rental was not included, Uber has programs to encourage use of EVs for its ride-hailing fleet, including EVgo charging discounts, benefits for Uber's green future program and incentives including USD1 more per trip up to USD4,000 annually for drivers transitioning from gasoline (petrol) vehicles to electric vehicles (EVs). Although the Hertz program starts with up to 50,000 vehicles by 2023, Hertz also says, "If successful, the program could expand to 150,000 Teslas during the next three years." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Vehicle rental company LeasePlan has begun discussions with ALD Automotive about a potential merger, reports Europa Press. According to the report, there is no certainty that these talks will result in a deal. In April, the possibility of these two companies exploring a merger deal was reported. This tie-up is expected to create a European leasing and mobility powerhouse. LeasePlan operates in 29 countries and has a global fleet of about 1.8 million vehicles. By 2030, the company expects to achieve net zero emissions from its fleet. ALD Automotive, which is majority owned by Société Générale, provides full-service leasing and fleet management services across 43 countries and manages 1.76 million vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Installations of renewable energy and sales of electric vehicles (EVs) set records in the US in recent quarters, as the economy rebounded from COVID-19 and the energy transition continued to gain steam. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- The American Clean Power Association (ACP) said the US installed 3,336 MW of new wind, solar, and storage capacity during the third quarter of 2021, with additions totaling 15,317 MW in the first three quarters, a 23% increase compared with 2020.

- There is now 186,674 MW of operational clean power capacity in the US, ACP said. At the start of 2020, less than 140,000 MW of capacity was installed.

- Project owners commissioned a total of 49 new utility-scale projects across 20 states during the third quarter of 2021, representing investments of about $23 billion, ACP said. Breaking it down by category, the trade association identified: 7 wind projects, 34 solar projects, and 8 energy storage projects.

- The number of clean power projects under construction and under development continues to grow significantly. At the end of September, the near-term development pipeline consisted of over 900 projects totaling 109,596 MW of capacity, including 38,122 MW under construction and 71,474 MW in "advanced development," according to ACP.

- The project pipeline is 28% larger than at the end of the first quarter of 2021 and 7% higher than at the close of the second quarter of 2021.

- Solar represents the largest share of capacity in the clean power pipeline, accounting for 54%, followed by land-based wind at 23%, offshore wind at 13%, and battery storage at 9%.

- Also on the rise are hybrid systems that combine renewables and energy storage. ACP said 2,443 MW of solar-plus-storage was added to the grid in the past quarter, bringing the on-the-grid total to 3,574 MW, with another 1,931 MW partially online and 21,185 MW in the pipeline. For wind-plus-storage, 1,892 MW is online. (Hybrid projects are considered partially online if one technology is online, and the other is still under construction or in advanced development.)

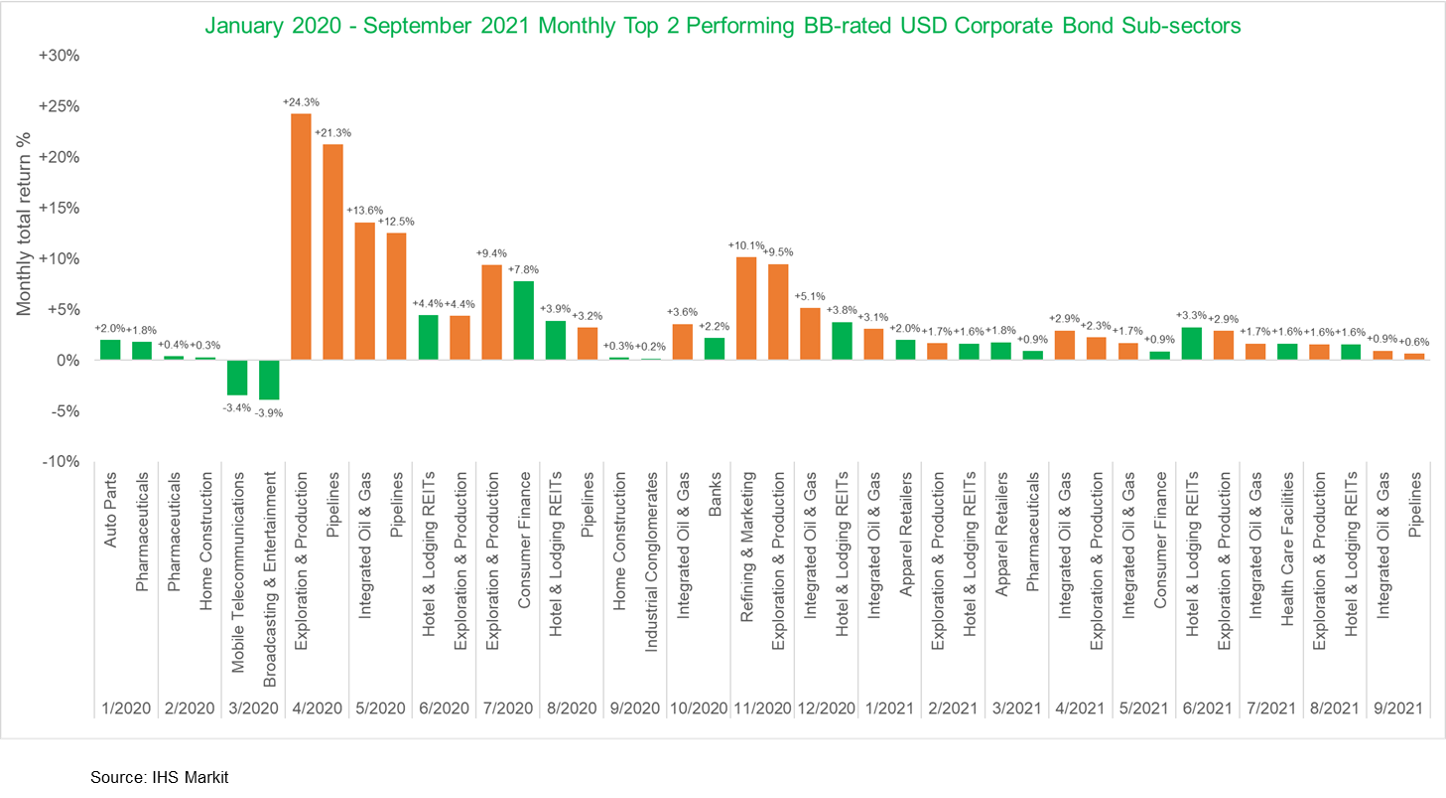

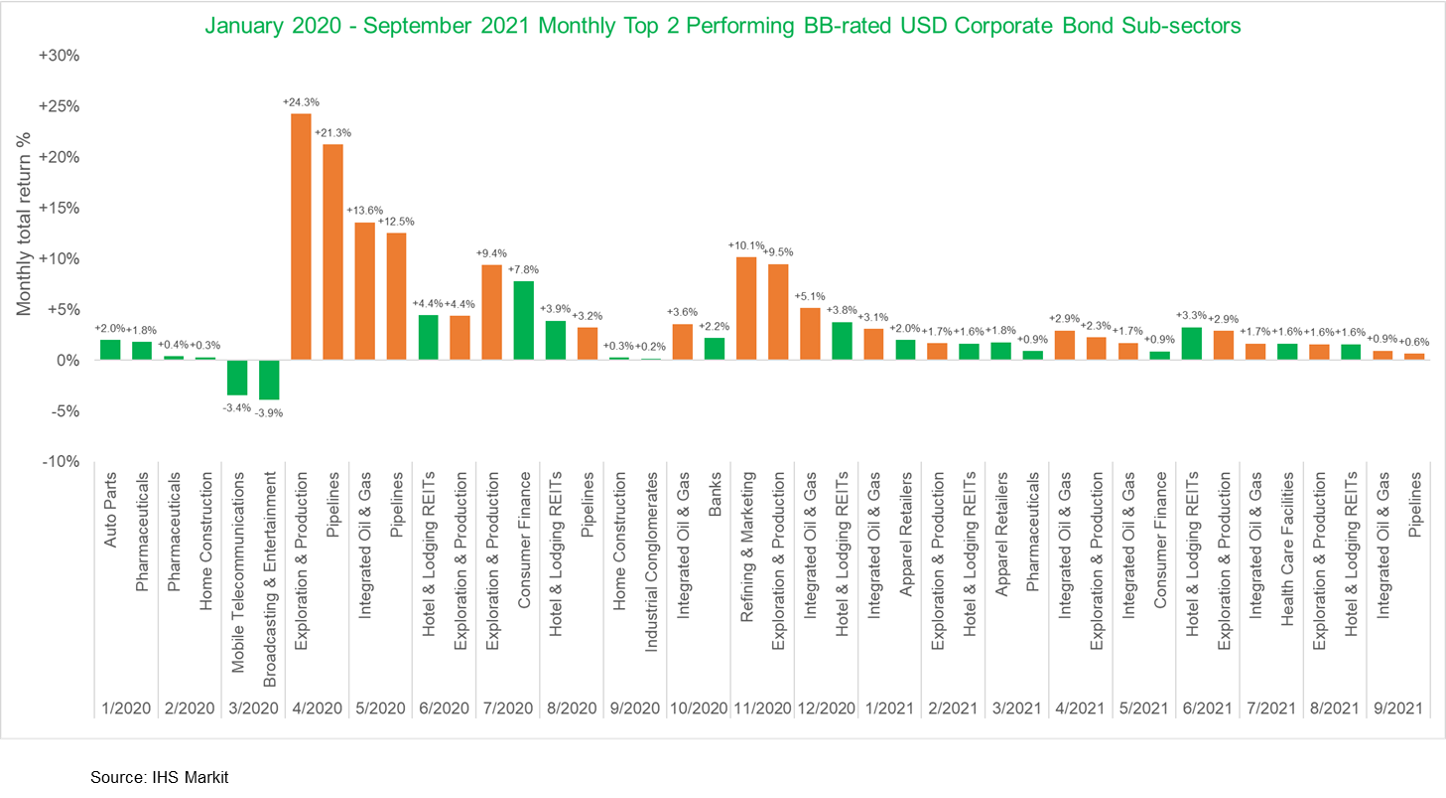

- The below graph shows the top 2 performing BB-rated USD corporate bond sectors each month since January 2020, with energy subsectors indicated in orange. The analysis highlights how the energy sector has outperformed the broader US high yield debt market the majority of months since April 2020.

- Personal income declined 1.0% in September, reflecting sharp declines in unemployment insurance transfer payments, as eligibility for pandemic-era unemployment insurance benefits expired early in the month. The overall decline in personal income also reflected declines in economic impact payments and the Paycheck Protection Program. (IHS Markit Economists James Bohnaker and William Magee)

-

- Wages and salaries rose 0.8% in September, not enough to offset the declines in social benefits. Real disposable personal income decreased 1.6% in September.

- Advance payments of the Child Tax Credit authorized under the American Rescue Plan have provided support to personal income in recent months as other support has waned. In September, they boosted personal income by $219 billion (annual rate).

- Real personal consumption expenditures (PCE) increased 0.3% in September, following an upwardly revised 0.6% gain in August. The monthly profile for real PCE through September implies less momentum for fourth-quarter PCE than we previously assumed, so we lowered our forecast for fourth-quarter growth of real PCE from 5.3% to 5.0%.

- Real PCE for durable goods fell 0.5% in September as spending on new motor vehicles declined 5.7% amid ongoing supply chain disruptions. Real PCE for nondurable goods and services each rose 0.4%.

- The core PCE price index increased 0.2% in September, and its 12-month change was 3.6%. Outside of core, the price index for energy goods and services rose 1.3% and the price index for food rose 1.1%. Over the last 12 months, these indices were up 24.9% and 4.1%, respectively.

- Eurostat's 'flash' estimate for October reveals another large jump in Harmonised Index of Consumer Prices (HICP) inflation from September's 3.4% to 4.1%, well above the market consensus expectation (of 3.7%, based on Reuters' survey). (IHS Markit Economist Timo Klein)

- The inflation rate now matches the eurozone lifetime high recorded in September 2008, having risen by 4.4 percentage points versus December 2020.

- Energy inflation is again the dominating boosting force, standing at 5.5% month on month (m/m) and thus pushing its year-on-year (y/y) rate to 23.5%, a record high.

- Core inflation rates have maintained their upward trend, the rate excluding food, energy, alcohol, and tobacco prices increasing from 1.9% in September to 2.1% in October. This exceeds the market consensus expectation of 1.9% and is the first time since end-2002 that the 2% level has been surpassed.

- Looking at its two key components, eurozone services inflation has extended September's 0.6-percentage-point jump and increased from 1.7% in September to 2.1% in October, now well above its pre-pandemic rate (1.6%). Following the lifting of many restrictions, the rebound of activity in the service sector in conjunction with labor shortages has created both a need and an opportunity for suppliers to raise prices.

- Meanwhile, non-energy industrial goods (NEIG) inflation, which surged to a record high of 2.6% in August before correcting to 2.1% in September, has edged down to 2.0%. The softening during September-October is linked to changes to the timing of seasonal sales and to COVID-19-related base effects, whereas the underlying trend remains strongly upwards owing to various factors. This is underlined by the monthly increase of 0.8% m/m and the fact that the NEIG inflation rate was only 0.5% prior to the pandemic in February 2020.

- The US University of Michigan Consumer Sentiment Index decreased 1.1 points from its September level to 71.7 in the final October reading—still slightly below its nadir in April 2020 and nearly the lowest in a decade. (IHS Markit Economists James Bohnaker and William Magee)

- The final October reading was only 0.3 point higher than the preliminary estimate, suggesting that consumer sentiment was virtually unchanged over the course of the month.

- The decline in October was driven by worsening views on both the present situation and the future. The present situation index fell 2.4 points to 77.7, and the expectations index declined 0.2 point to 67.9.

- Elevated consumer prices are weighing on sentiment. The median expected one-year inflation rate in the University of Michigan survey ticked higher by 0.2 point to 4.8% to its highest level since 2008. This is likely a reaction to higher retail gasoline prices, which averaged a seven-year high of $3.48/gallon during the week-ended 25 October.

- Consumers expect price pressures to ease over the longer term; the expected 5-to-10-year inflation rate declined 0.1 point to 2.9%, which is well within the historical range over the past several decades.

- Views on buying conditions for big-ticket items remained poor. The index of buying conditions for large household durable goods and automobiles slumped further, as high prices and limited inventories continued to be challenges. The index for homebuying conditions improved off of cycle lows but is severely depressed in a historical context.

- Consumer attitudes were roughly unchanged in late October. The low level of sentiment is somewhat at odds with the ongoing recovery in spending. Retail sales and data on credit- and debit-card spending suggest that consumers are spending confidently heading into the fourth quarter. We expect sentiment will soon track spending more closely as the ongoing anxieties about the Delta variant are alleviated and prices ease from their current highs.

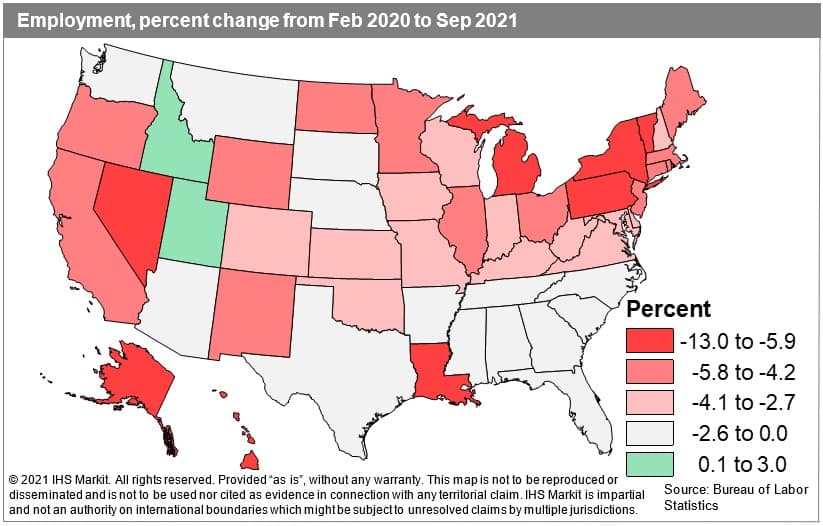

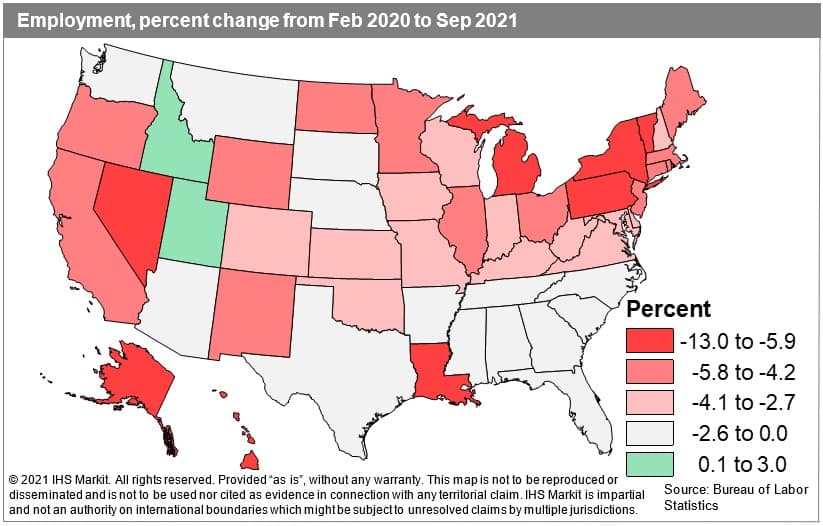

- Although fallout from the surging Delta variant hammered August job gains, the economic recovery's stumble proved to be short-lived, as employment accelerated in most regions during September. Total private nonfarm job growth gained momentum in the Northeast, Midwest, and South. The West's already robust gains continued to ease, but nevertheless remained strong. Consumers, who had pulled back on spending at restaurants, bars, hotels, and attractions during the August Delta surge, began to resume these activities in September, particularly in the South and Midwest. Much of the South experienced a notable pickup in both business services and hospitality services in August, helping these states make further progress toward their pre-pandemic employment levels. The South and Midwest still lag the Northeast and West, though, where deeper job deficits incurred over the course of the pandemic are still fueling stronger overall job recoveries in 2021. While Northeast and West states like Hawaii, New York, and Nevada experienced sharply plunging employment in early 2020 resulting in very large overall job deficits, the August wave proved to be only a transitory slowdown in their job gains. (IHS Markit Economist James Kelly)

- At its 27 October meeting, the monetary policy committee of the Central Bank of Brazil (BCB) decided unanimously to increase the policy rate from 6.25% to 7.75%; this was in response to accelerating inflation and elevated risks of fiscal mismanagement. As of mid-October, inflation amounted to 10.3%, well above the central bank's target (3.75% +/- 1.5 percentage points) and very high by most standards. (IHS Markit Economist Rafael Amiel)

- As in most regions in the world, the drivers of inflation in Brazil are high energy prices, high food prices, supply-chain disruptions, and shortages. The most concerning part of the inflationary picture is that inflation in services is also increasing, which implies that there have been second-round effects or contagion from the price escalation that started in the energy and food sectors.

- A severe drought, which led to increased electricity tariffs, and the depreciation of the currency compound inflationary pressures.

- Malta Inc., a developer of pumped heat energy storage technology, and Canadian utility NB Power on October 28 announced the signing of a term sheet and that they are working toward establishing an Energy Storage Benefits Agreement to advance the first long-duration energy storage facility in the province of New Brunswick's history. (IHS Markit PointLogic's Barry Cassell)

- While still in the planning and development stage, the facility is targeted to be in-service in 2024. A sustainable energy solution, Malta's energy storage facility will help achieve emissions reductions, improve grid stabilization and increase the grid's capacity for the integration of renewables, the companies said. Upon its completion, the 1,000-MWh facility would be one of the largest energy storage systems of its kind in the world.

- The Malta system is a long-duration energy storage system that can store power when it is generated and discharge the power when it is needed. An additional benefit of the plant is that it will produce a large quantity of high-quality heat as a byproduct that can be used in a number of commercial, industrial, and district energy operations, with the potential to reduce greenhouse gas emissions and drive further economic growth.

- Malta is working on grid-scale solutions that can store energy up to 50x longer than typical battery technology. The company is backed by energy industry leaders Alfa Laval, Proman and Chevron Technology Ventures, as well as investors Breakthrough Energy Ventures and Piva Capital. Malta is based in Cambridge, Massachusetts.

- Bosch is planning to invest EUR400 million (USD467 million) in its semiconductor manufacturing facilities in 2022 to expand production to help mitigate the supply shortage for its customers, reports Automotive News Europe (ANE). According to the report, the company's investment is to be made at two plants in Germany, in Dresden and Reutlingen, while it is also said to open a new semiconductor test center in Penang, Malaysia. Bosch chairman Volkmar Denner said, "Demand for chips is continuing to grow at breakneck speed. In light of current developments, we are systematically expanding our semiconductor production so we can provide our customers with the best possible support." The bulk of the investment is to go to the Dresden facility, which the company only opened with an investment of USD1.17 billion in June. (IHS Markit AutoIntelligence's Tim Urquhart)

- Chinese battery-maker Contemporary Amperex Technology Limited (CATL) has broken ground on a lithium-ion battery manufacturing base in the city of Yichun, Jiangxi province, China, reports Gasgoo. The project involves an investment of CNY13.5 billion (USD2.1 billion) and the facility is expected to have an annual production capacity of 50 GWh in new-type lithium-ion batteries. In July, CATL signed a strategic co-operation framework agreement with the Jiangxi provincial government and the Yichun municipal government to locate the project in the city. In September, the company signed a deal with the Yichun government to invest CNY13.5 billion in the construction of the new-type lithium-ion battery manufacturing base. Yichun has the world's largest reserves of lepidolite, a lithium-bearing mineral, amounting to around 2.5 million tons of lithium oxide, highlights the report. Separately, CATL has signed a technology licensing and partnership agreement with Hyundai Mobis. Under the deal, CATL will grant its cell to pack (CTP) technology to Hyundai Mobis and support the company in the supply of related CTP products in South Korea and worldwide. CTP technology has a high level of integration efficiency and allows cells to be integrated directly into packs without the use of modules. The system energy density of the battery pack will be improved, and the production process will be simplified, resulting in cost savings, thanks to this technology, according to CATL. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 01 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.