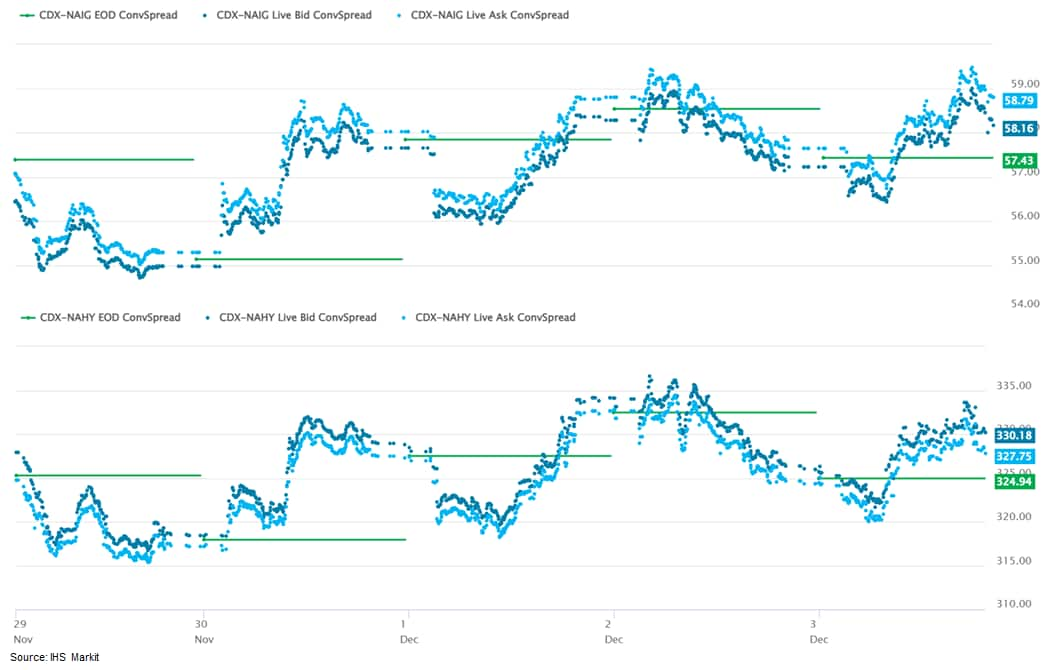

Major APAC and European equity indices closed mixed on the week, while all major US indices were lower. US and benchmark European government bonds closed higher on the week. CDX-NA closed slightly wider on the week across IG and high yield, while iTraxx-Europe was flat and iTraxx-Xover was tighter week-over-week. The US dollar closed higher, while natural gas, oil, gold, silver, and copper were lower week-over-week.

Americas

All major US equity markets closed lower on the week; DJIA -0.9%, S&P 500 -1.2%, Nasdaq -2.6%, and Russell 2000 -3.9% week-over-week.

10yr US govt bonds closed 1.36% yield and 30yr bonds 1.68% yield, which is -12bps and -15bps week-over-week, respectively.

DXY US dollar index closed 96.12 (+0.1% WoW).

Gold closed $1,784 per troy oz (-0.1% WoW), silver closed $22.48 per troy oz (-2.7% WoW), and copper closed $4.27 per pound (-0.4% WoW).

Crude Oil closed $66.26 per barrel (-2.8% WoW) and natural gas closed $4.13 per mmbtu (-24.6% WoW).

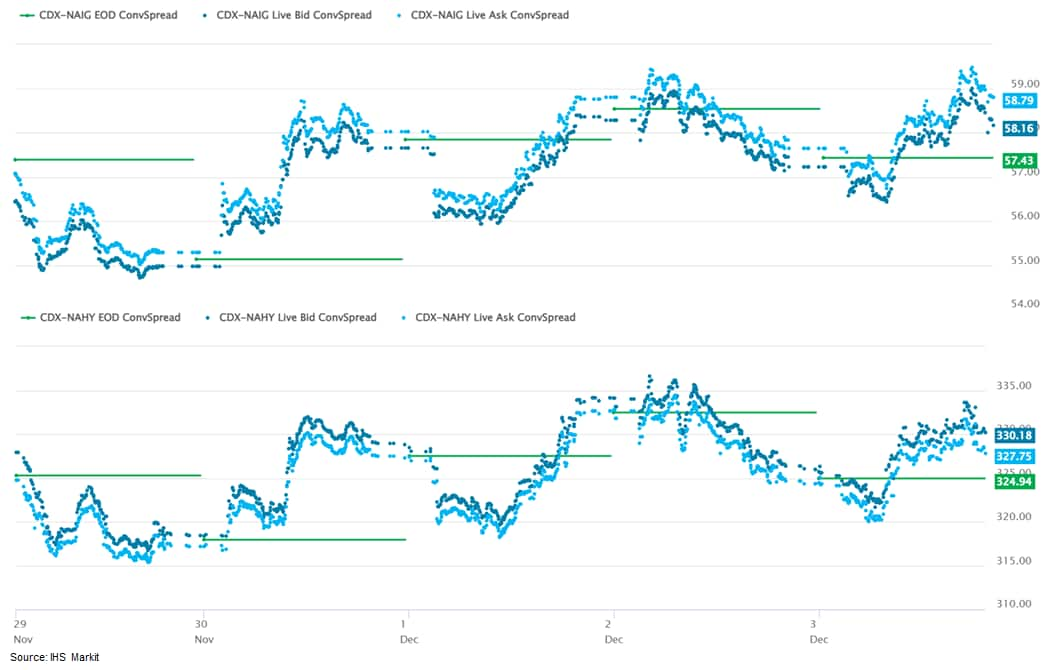

CDX-NAIG closed 59bps and CDX-NAHY 329bps, which is +1bp and +4bps week-over-week, respectively.

EMEA

Major European equity indices closed mixed; UK +1.1%, France +0.4%, Italy +0.3%, Germany -0.6%, and Spain -1.9% week-over-week.

All major 10yr European government bonds closed higher on the week; UK closed -8bps, Spain -6bps, France/Germany -6bps, and Italy -4bps week-over-week.

Brent Crude closed $69.88 per barrel (-2.4% WoW).

iTraxx-Europe closed 58bps and iTraxx-Xover 282bps, which is flat and -9bps week-over-week, respectively.

APAC

Major APAC equity markets closed mixed; Mainland China +1.2%, South Korea +1.1%, India +1.0%, Australia -0.5%, Hong Kong -1.3%, and Japan -2.5% week-over-week.

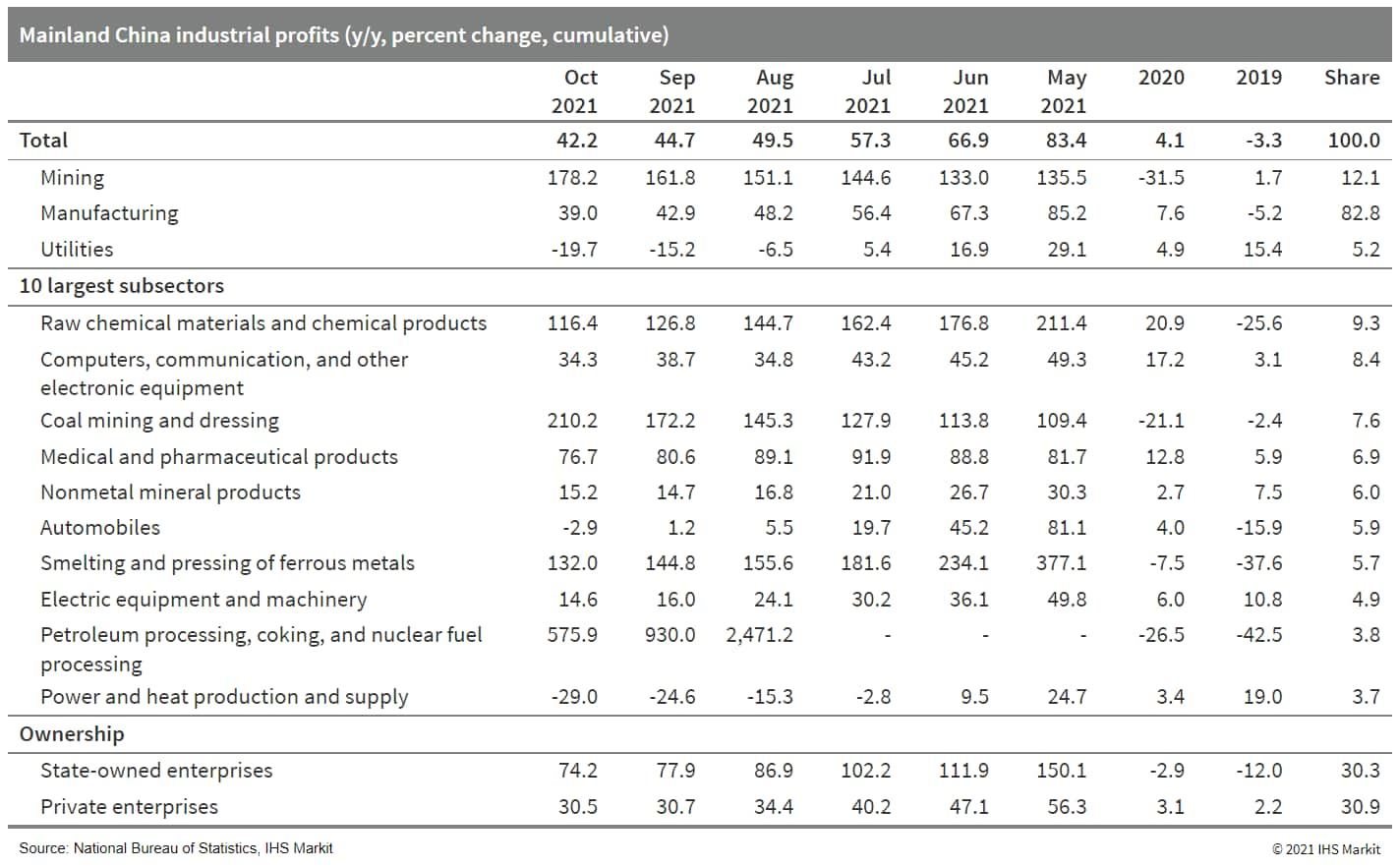

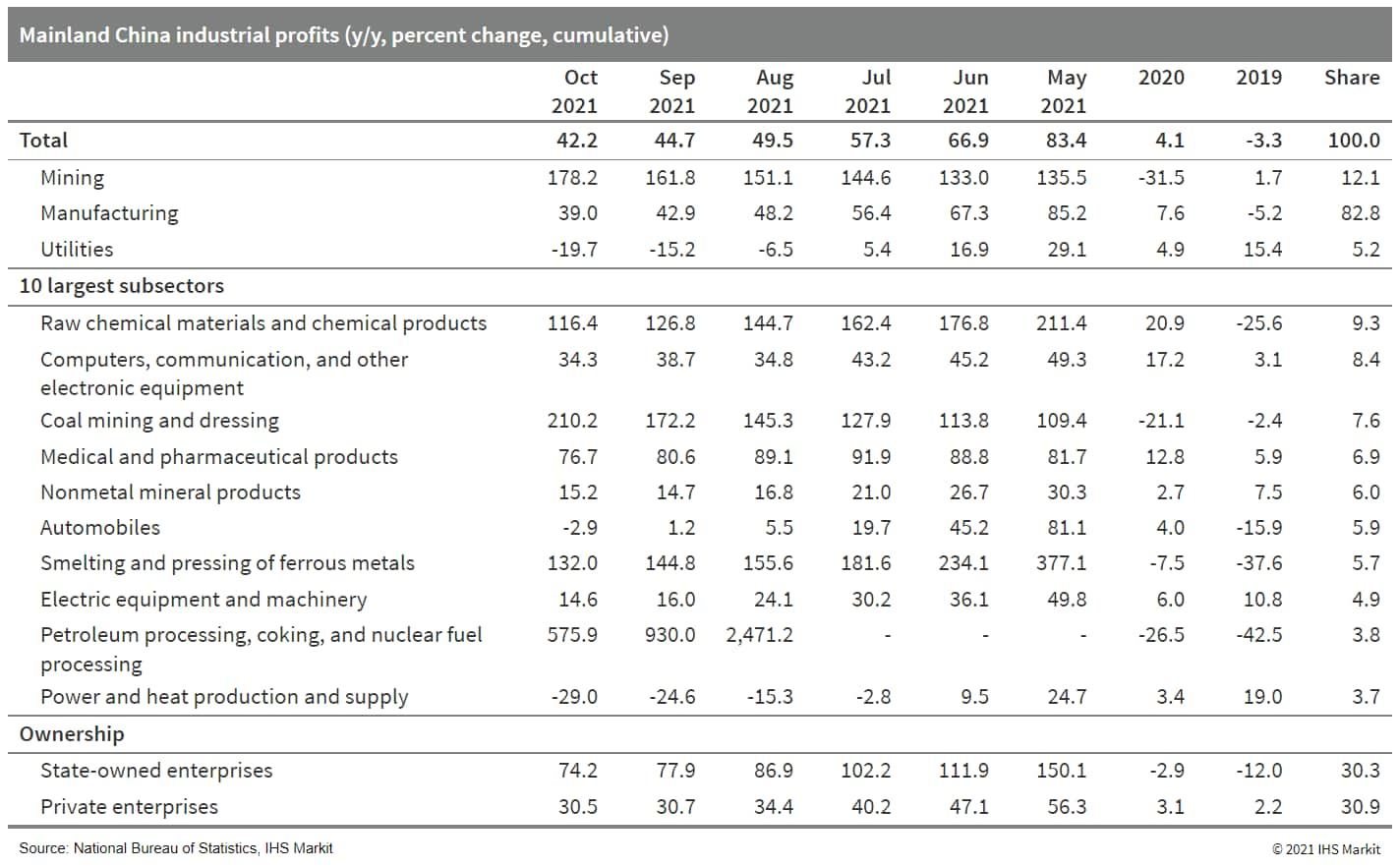

- Mainland China's industrial profits expanded by 42.2% year on year (y/y) through October, lower by 2.5 percentage points from the first three quarters. On a two-year (2020-21) average basis, industrial profits increased by 19.7% y/y in the first 10 months, up by 0.9 percentage point from the month-ago reading. For October alone, industrial profits recorded growth of 24.6% y/y, accelerating from 16.3% y/y in September, according to the National Bureau of Statistics (NBS). (IHS Markit Economist Lei Yi)

- The cumulative profitability ratio came in at 7.01% by the end of October, ending the three-month consecutive decline over the third quarter. While the profitability ratio of the upstream mining sector posted larger increases - rising by 1.07 percentage points to 19.32% in October - that of manufacturing and utility sectors also recorded smaller declines than previous months, edging down by 0.01 percentage point and 0.17 percentage point to reach 6.57% and 4.92%, respectively.

- By sector, industrial profit strength held up for mining and raw material manufacturing in October, owing to eased production curbs and elevated raw material prices. With the authorities ramping up coal production to ensure power supply, industrial profits of coal-related sector surged by 438% y/y in October, up by 69.6 percentage points from the September reading. Thanks to rising demand driven by the "double 11" shopping season along with increasing inflation pass-through, industrial profit growth of consumer goods manufacturing recorded a rise of 3.6% y/y in October compared with a year-on-year decline in September. The high-tech manufacturing sector continued to report double-digit profit growth, 17.4% y/y in October, led by vaccine and computer products.

- The economic sentiment indicator (ESI) for the eurozone showed the first decline in four months in November, slipping from 118.6 down to 117.5, matching the market consensus expectation. The breakdown by key sector, however, showed unusual divergence. (IHS Markit Economist Ken Wattret)

- Consumer sentiment (accounting for 20% of the ESI) dropped by just over two points, the fourth decline in five months and the biggest for a year. Weakness was evident across all the main sub-components in November, particularly the economic outlook and unemployment expectations.

- In contrast, services, retail, and construction sentiment indices all improved in November and industrial sentiment was unchanged at its second highest level on record. The industry sub-survey of orderbooks, including for exports, remained elevated, suggesting that recent supply-chain constraints on production have not fundamentally damaged demand.

- Eurozone employment expectations indices also held firm across all key sectors in November, which is indicative of confidence among businesses that economic prospects will remain favorable despite the various growth headwinds at present.

- At the member state level also, November's ESI data showed pronounced divergence, reflecting recent COVID-19-related developments. Sentiment fell markedly in Austria, the Netherlands, and Germany, for example, where new cases have surged recently, leading to the reimposition of restrictions, but improved in France, Italy, and Spain.

- The US Pending Home Sales Index (PHSI) shot up 7.5% in October from September to 125.2, its highest reading in 11 months. The index is up 18% since May. All four regions saw month-on-month gains. (IHS Markit Economist Patrick Newport)

- According to Lawrence Yun, the National Association of Realtors' chief economist, "Motivated by fast-rising rents and the anticipated increase in mortgage rates, consumers that are on strong financial footing are signing contracts to purchase a home sooner rather than later… The notable gain in October assures that total existing-home sales in 2021 will exceed 6 million, which will shape up to be the best performance in 15 years."

- The Mortgage Bankers Association (MBA)'s Purchase Index (four-week moving average)—which had been sliding since January but turned three months ago, growing 13% since—is pointing to higher sales in the fourth quarter than in the previous two quarters.

- The PHSI leads existing home sales by a month or two. The latest two PHSI readings point to higher existing home sales in November or December or both.

- Pending home sales rose sharply in October, in contrast to IHS Markit analysts' expectation for a decline, implying more brokers' commissions and residential investment in the fourth quarter. As a result, we raised the tracking forecast of fourth-quarter GDP growth by 0.1 percentage point to 7.5%.

- China is seeking to kickstart its hydrogen economy by subsidizing fuel-cell vehicles and their infrastructure in three major city clusters. But industry experts said Beijing has to refine policy instruments and stimulate more investment to put the country on a sustainable decarbonization pathway. (IHS Markit Net-Zero Business Daily's Max Lin)

- To reach an official target of carbon neutrality by 2060, the world's largest GHG-emitting nation has been aiming to replace fossil fuels with hydrogen in parts of its economy.

- In September 2020, Chinese policymakers said they would provide subsidies for the value chains of automobiles powered by hydrogen fuel cells around eligible city clusters. Three metropolitan areas were selected earlier this year: Beijing, Shanghai, and Guangdong.

- Each of them can receive up to ¥1.5 billion ($235 million) for fuel-cell vehicles and ¥200 million for hydrogen supply during a four-year demonstration period. Shanghai unveiled a detailed grant scheme in early November, while others are expected to follow suit soon.

- Observers believe the scheme is targeting fuel-cell heavy trucks with a gross vehicle weight of 31 metric tons (mt) or more. Battery-driven electrical passenger cars and light trucks already enjoy high market penetration because their charging network is well under development.

- While the steelmaking, cement, aluminum, and petrochemical sectors can all make great progress in decarbonization by replacing fossil fuels use with clean hydrogen, trucks provide another entry into this fledgling market. Fuel-cell trucks are already in the market, and the infrastructure costs for refueling them are relatively low compared with other hard-to-abate sectors.

- On November 29, Capital Power Corp. and Enbridge Inc. announced a memorandum of understanding to collaborate on carbon capture and storage (CCS) solutions in the Wabamun area west of Edmonton, Alberta, near Capital Power's Genesee Generating Station. (IHS Markit PointLogic's Barry Cassell)

- Enbridge would serve as the transportation and storage service provider and Capital Power as the CO2 provider for this project, subject to the Government of Alberta's competitive carbon hub selection process and a future final investment decision. Enbridge, with the support of Capital Power, is applying to develop an open access carbon hub in the Wabamun area through the Government of Alberta's Request for Full Project Proposals process, which is expected to start as early as December 2021.

- Capital Power's Genesee Generating Station near Warburg currently provides over 1,200 MW of baseload electricity generation. Capital Power is currently repowering the Genesee 1 and 2 units with natural gas combined-cycle power generation units. The Genesee CCS Project is expected to capture up to 3 million tons of CO2 annually from the repowered units, which would be transported and stored through Enbridge's open access carbon hub that could also serve several other local industrial companies. Subject to the award of carbon sequestration rights and regulatory approvals, the proposed project could be in service as early as 2026.

- In October, with Capital Power's support, Enbridge responded to the Government of Alberta's call for Expressions of Interest to construct and operate carbon storage hubs. Within its proposal, Enbridge outlined its plans to develop an open access carbon storage hub with cost-effective, customer-focused CCS solutions in the Wabamun area while minimizing any infrastructure footprint to protect land, water and the environment, the companies said.

- Several polyester producers in China announced production rate cuts of 20%, in order to preserve margins, according to Chinese analysts and traders on Monday. Polyester producers said in a joint statement that they ran sales promotions at loss-making levels last week, which eroded their profits from the first half of this year. In order to remain profitable for 2021, polyethylene terephthalate (PET) producers in Xiaoshan, Zhejiang province, spearheaded by the chemical fibers sector, will cut operating rates to preserve margins. Four-to-five producers will participate, involving 23 million mt of capacity, industry participants reported. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- These plants decided late-week to reduce production by around 20%, with details to follow, according to industry participants.

- "Polyester producers have been lowering their prices in order to promote sales early last week. Inventory might be high at the moment. Margins are fine, if we disregard the high inventory," said an analyst.

- According to a trader, it is doubtful if polyester producers will carry through on their threat. "They are not making losses, although the inventory is high. Their customers are just not buying feedstock. So, it's only when polyester producers run promotions, do they see some turnover," said the trader. End-users of polyester in the textiles sector are not under pressure, as inventory levels are normal and margins are fine, said the trader.

- "The main issue is that their sales have been weak," added the trader.

- A broker said that polyester producers Hengli, Tongkun, Xinfengming and Tiansheng have not announced timelines for operating rate cuts yet.

- Production cuts in polyester will reverberate upstream to paraxylene, which hit a 24-week low last Friday to close at $864/mt CFR. Despite rising crude prices, PX gains have been capped by dwindling margins against PTA.

- Samsung Electronics has announced plans to construct a semiconductor manufacturing facility in Taylor, Texas (United States). According to a company press release, the estimated USD17-billion investment in the US will aid in the production of advanced logic semiconductor solutions that power next-generation innovations and technologies. Samsung Electronics Device Solutions Division vice-chairman and CEO Kinam Kim said, "As we add a new facility in Taylor, Samsung is laying the groundwork for another important chapter in our future." The executive added, "With greater manufacturing capacity, we will be able to better serve the needs of our customers and contribute to the stability of the global semiconductor supply chain." The new facility is to produce products based on advanced process technologies for use in mobile, 5G, high-performance computing (HPC), and artificial intelligence (AI). Samsung says it remains committed to assisting customers around the world by making advanced semiconductor fabrication more accessible and meeting rising demand for cutting-edge products. (IHS Markit AutoIntelligence's Jamal Amir)

- The US government bond 2s10s basis closed at +92bps, which was the flattest point since 26 January.

- The lira depreciation has contributed to the narrowing of Turkey's merchandise-trade deficit. Exports are more competitive and imports more expensive, diminishing demand. After narrowing in 2021, the trade gap will widen once again in 2022 due to high commodity prices and interrupted exports. However, further lira losses will mitigate this widening. (IHS Markit Economist Andrew Birch)

- The lira's depreciation continued to buoy Turkish exports while discouraging imports in October 2021 according to data from the Turkish Statistical Institute (TurkStat). That month, the merchandise-trade deficit was USD1.44 billion, nearly USD1 billion smaller than it had been in the same month of 2020. Cumulatively, the trade deficit fell by over USD6.4 billion year on year (y/y), to USD33.86 billion in January-October 2021.

- Turkish exports of raw and minimally processed commodities have grown particularly rapidly in 2021, helping to limit the trade deficit. Through the first 10 months of 2021, iron and steel, gold, energy, aluminum, and plastics were all among the fastest growing commodities. Meanwhile, the export growth rates of high- and medium-high technological products lagged overall expansion rates.

- Meanwhile, high international commodity prices sent energy and iron and steel import growth rates soaring in January-October 2021. However, high prices are dissuading import volume increases, subsequently keeping import growth rates lower than those of exports.

- The sharp depreciation of the lira is exacerbating both export competitiveness and import costs, further fueling the narrowing of the trade deficit. As of end-October, the lira had depreciated by over 28% against the US dollar - the worst performing currency among the major developed economies.

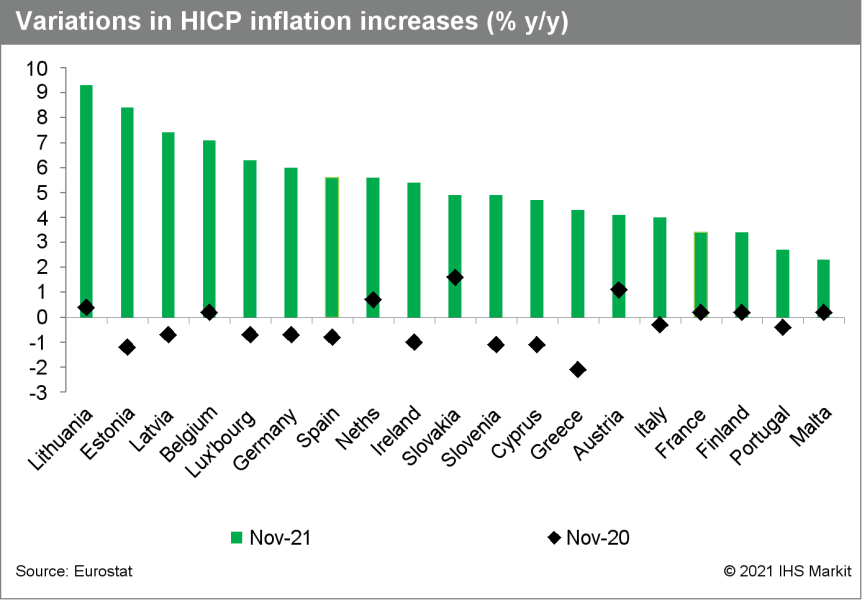

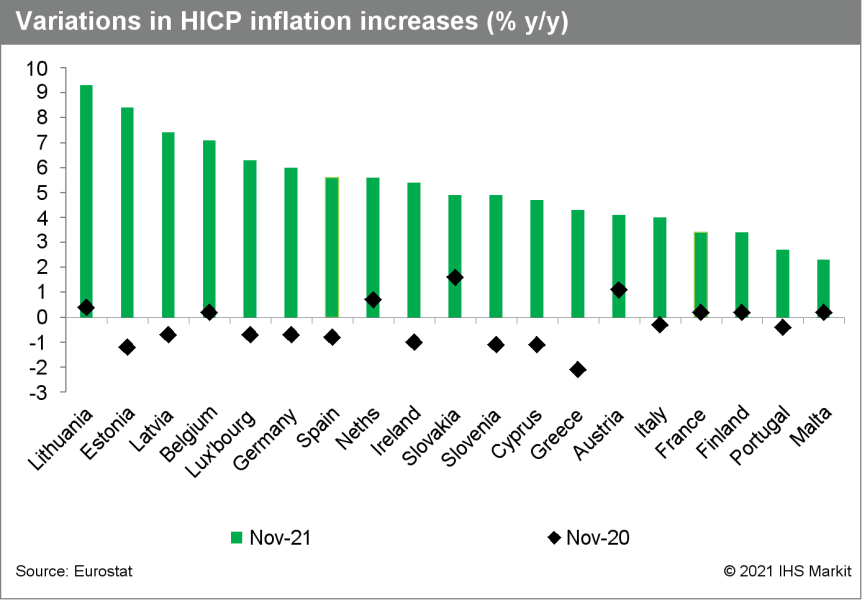

- November recorded yet another stronger-than-expected increase in eurozone Harmonised Index of Consumer Prices (HICP) inflation. Based on Eurostat's "flash" estimate, it increased from 4.1% to 4.9%, well above the initial market consensus expectation of 4.4%, according to Reuters's survey. The latest figure is the highest headline inflation rate since the eurozone's inception in 1999 by some distance; the prior peak in 2008 was 4.1%, with the cumulative increase during 2021 to date now in excess of five percentage points. (IHS Markit Economist Ken Wattret)

- Energy inflation was again a key driver, with the year-on-year rate of increase rising by almost four percentage points to reach another record high of 27.4%. With a weight of just over 9% in the HICP, energy inflation is contributing more than half of November's overall inflation rate (2.6 percentage points).

- Core HICP inflation rates, while less elevated, also rose markedly in November. The rate excluding food, energy, alcohol, and tobacco prices jumped from 2.1% to 2.6%, again well above the market consensus expectation of 2.3%. This is also a record high for the series.

- The two constituent parts of the core rate above both showed strong increases in November. Services inflation rose from 2.1% to 2.7%, well above the 1.6% recorded in February 2020 before the COVID-19 pandemic, and the highest rate since 2008. The most COVID-19-sensitive areas of services inflation, such as restaurants and hotels, fell markedly in 2020 and are rebounding as economies have reopened, although the momentum is likely to fade given the recent pandemic trends.

- Non-energy industrial goods (NEIG) inflation increased from 2.0% to 2.4%. The rate has been rather volatile in recent months because of COVID-19-pandemic-related influences on the timing of seasonal price discounts. Nevertheless, the trend has been strongly upwards and the upward pressure has further to go (discussed below). NEIG inflation has risen by almost three percentage points since December 2020 and is almost two percentage points above its pre-pandemic rate of 0.5%.

- While higher inflation rates this year have been broad-based across the eurozone's member states, there are some variations. Among the larger economies, inflation is particularly high in Germany (6.0%) but much less pronounced in France (3.4%).

- The US Conference Board Consumer Confidence Index fell 2.1 points to 109.5 (1985=100) in November. The index is down 15% from a June peak. (IHS Markit Economists James Bohnaker and William Magee)

- "Concerns about rising prices—and, to a lesser degree, the Delta variant—were the primary drivers of the slight decline in confidence", according to the Conference Board.

- The index of views on the present situation lost 3.0 points to 142.5. The expectations index dropped 1.4 points to 87.6.

- The labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) increased 1.5 percentage points to 46.9%, its strongest reading on record (dating back to 2000).

- Fewer respondents planned to buy homes, automobiles, or major appliances over the next six months.

- Consumers were less optimistic about income growth. The net percentage of respondents expecting higher incomes in the next six months lost 1.3 points to 5.9%.

- Consumers also viewed business conditions less favorably: 17.0% of consumers saw business conditions as "good," down 1.3%; 29.0% viewed business conditions as "bad," up 3.3%.

- Bottom line: Consumer confidence has been slipping since June. Rising prices and the Delta variant (not the Omicron variant) are to blame.

- US-based Clean Energy Fuels Corp. and French oil major TotalEnergies said their partnership, announced in March 2021, has started construction on a biomethane production unit, in Friona, Texas. Located on the Del Rio Dairy farm, the facility will utilize livestock manure to produce more than 40 GWh of biomethane per year. The biomethane will be distributed in the United States by Clean Energy through its network of fueling stations, enabling the supply of RNG to between 200 and 300 trucks per year. (IHS Markit PointLogic's Kevin Adler)

- The project will avoid about 45,000 metric tons of CO2-equivalent emissions per year, they said.

- Through the acquisition of an interest in Clean Energy in May 2018, TotalEnergies became the largest shareholder, with a stake of 19%.

- TotalEnergies is the largest biomethane producer in France, with close to 500 GWh of production capacity, and said it "aims to become a major player in biomethane internationally by partnering with market leaders in other geographies, such as Clean Energy in the United States and Adani in India."

- The company is active across the entire biomethane value chain, from project development to marketing of biomethane and its byproducts such as biofertilizers. It aims to produce 2 TWh of biomethane per year by 2025, equivalent to the average annual consumption of 670,000 U.S. consumers, and a reduction in CO2 emissions of 400,000 mt.

- Clean Energy says it is the largest provider of RNG in North America.

- Indian ride-hailing firm Ola is considering raising over USD500 million in debt from US investors through a Term Loan B (TLB) deal, reports Livemint. According to the report, international ratings agency Moody's Investors Service has assigned a B3 rating to Ola's proposed senior secured term loan. Ola's wholly owned subsidiaries, Ola Netherlands B.V. and Ola USA Inc., are the borrowers. The capital infused from the loan will be used for general corporate purposes. Ola reportedly plans to conduct a USD1-billion initial public offering in the next few months. The company, which operates in over 100 cities in India, has expanded to several international markets, including Australia, New Zealand, and the United Kingdom, in a bid to improve its valuation. It has also expanded into offering cars on lease and into the electric vehicle space. (IHS Markit Automotive Mobility's Surabhi Rajpal)

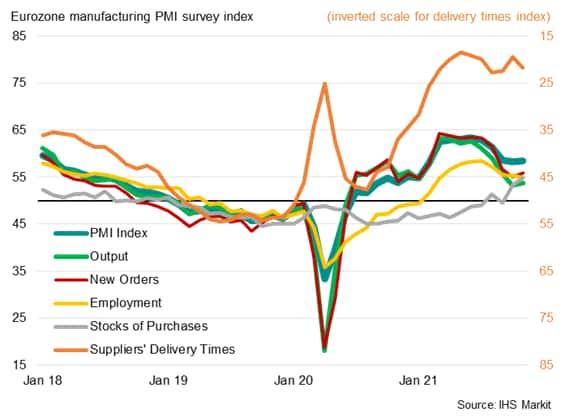

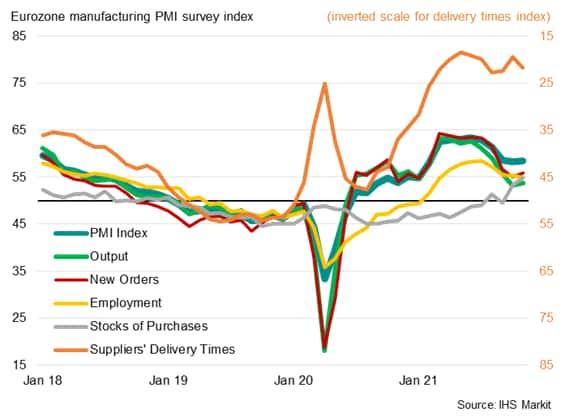

- A strong Eurozone headline PMI reading masked just how tough business conditions are for manufacturers at the moment. Although demand remains strong, as witnessed by a further solid improvement in new order inflows, supply chains continue to deteriorate at a worrying rate. Shortages of inputs have restricted production growth so far in the fourth quarter to the weakest seen over the past year and a half. (IHS Markit Economist Chris Williamson)

- At first glance, manufacturers in the eurozone had a bumper month in November. The IHS Markit Eurozone Manufacturing PMI increased from 58.3 in October to 58.4, marking the first rise in the headline index since June. The latest reading was not only far above the 50.0 no change level, but also almost seven points higher than the survey's per-pandemic long-run average of 51.7

- The details behind the headline PMI tell a far more worrying picture. Although demand remained strong, as witnessed by a further solid improvement in new order inflows during November, supply chains continued to deteriorate at a worrying rate. Supply delays spiked to a record high in May 2021 and have since continued to deteriorate at rates surpassing anything ever seen prior to the pandemic.

- These shortages of inputs have restricted production growth so far in the fourth quarter to the weakest seen over the past year and a half. At 53.5, the average output index reading for far in the fourth quarter is only slightly above the pre-pandemic long-run average of 52.9.

- A record rise in inventories meanwhile reflected increased efforts by manufacturers to build safety stocks, in turn driven by fears of ongoing shortages of inputs in coming months.

- November PMI data from IHS Markit signaled the second-weakest rise in production recorded over the past 14 months as producers reported further near-record supply delays and a slowing of new order inflows to the softest so far this year. Jobs growth also waned amid difficulties filling vacancies. (IHS Markit Economist Chris Williamson)

- Longer lead times, supplier shortages and higher energy prices meanwhile pushed the rate of cost inflation to a fresh series high. Although firms still sought to pass on greater costs to clients, the pace of increase in prices charged slowed to the softest in three months amid signs of push-back to higher prices from customers.

- The seasonally adjusted IHS Markit US Manufacturing Purchasing Managers' Index™ (PMI™) posted 58.3 in November, down fractionally from 58.4 in October and lower than the earlier release 'flash' estimate of 59.1. The latest reading was the lowest since December 2020.

- Although remaining well above the 50.0 neutral level, the PMI was boosted in particular by the further near-record lengthening of supplier lead times and increased inventory building. While normally considered positive developments associated with an expanding manufacturing economy, the lengthening of lead times reflected an ongoing supply shock and inventory building often reflected concerns over the future supply situation.

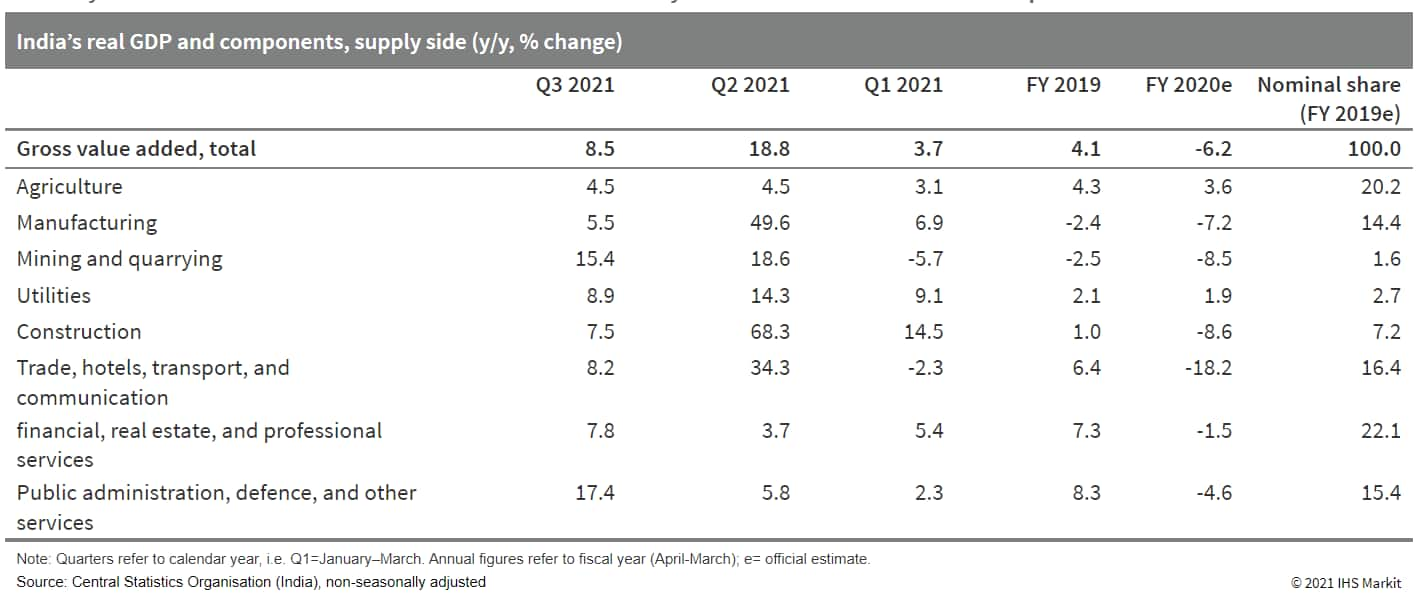

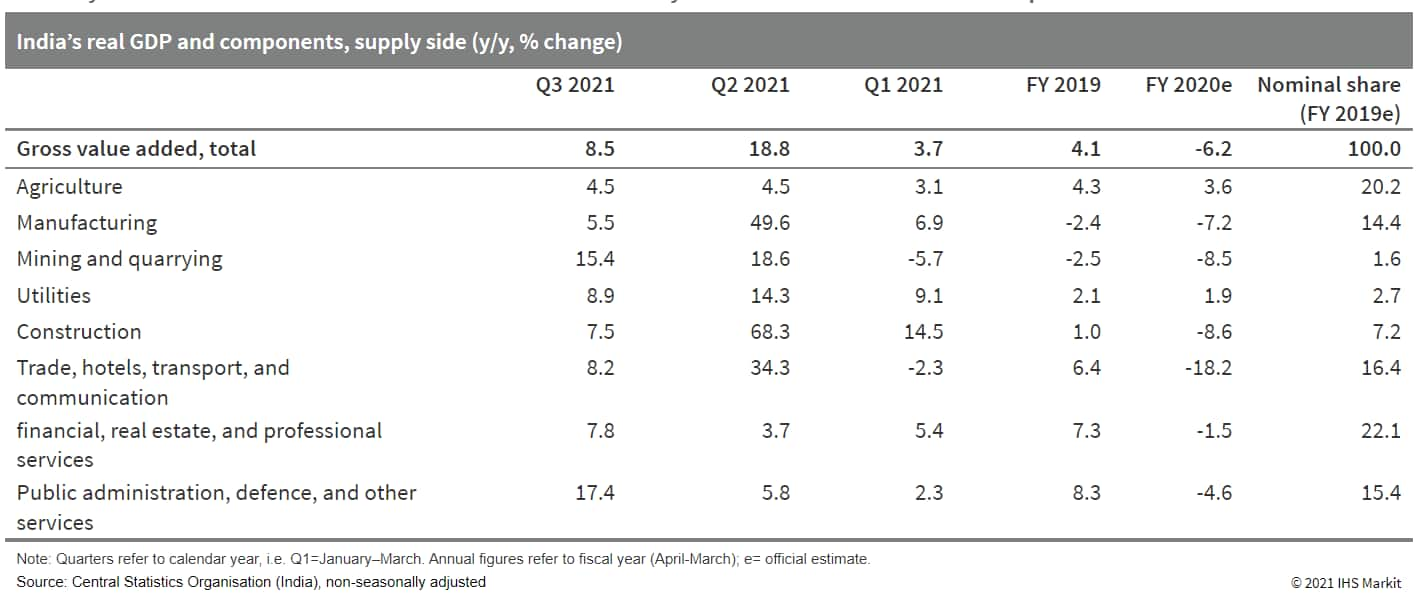

- India's GDP growth rebounded to 8.4% y/y in September quarter as disruptions ease after second wave of COVID-19. Easing lockdown restrictions, faster vaccination progress, and improving sentiment moved India's economy towards greater normalization in the June-September quarter - the second quarter of the fiscal year 2021 - after the recovery was interrupted by the second wave of the COVID-19 pandemic in the first fiscal quarter. The recovery is set to continue in the second half of the fiscal year, but momentum may slow amid persistent supply constraints and rising prices, particularly in the energy sector. The resurgence of the pandemic also remains a risk. (IHS Markit Economist Hanna Luchnikava-Schorsch)

- Private consumption, which constitutes the bulk of the demand-side GDP, grew by 8.4% year on year (y/y), while also showing a sequential recovery of 9.2% from the first fiscal quarter. With the second wave of the pandemic receding, vaccination rates rising, and the employment situation improving, consumer sentiment rebounded solidly towards the end of the quarter, with the household sentiment survey conducted by the Reserve Bank of India (RBI) showing the indices for the current situation and future expectations either exceeding or nearing their levels prior to the second wave.

- Improved manufacturing capacity and domestic approval of several foreign vaccines significantly boosted the vaccination drive during the quarter, with the double-dose vaccination rate sharply rising to approximately 17.5% of the total population by the end of the quarter from about 4% at the start. Vaccination rates have improved further since, with nearly 32% of the population being fully vaccinated at the end of November.

- Investment activity as measured by real gross fixed capital formation grew by 11.0% y/y and 11.8% sequentially, supported by the lifting of curbs, ample liquidity conditions, and improving demand. In absolute terms, however, investment levels remained below those observed prior to the second wave.

- Both real exports and imports grew strongly at 19.6% y/y and 40.6% y/y respectively, reflecting improvements in external and domestic demand. Sequential gains were also strong, but the pace of imports' recovery was nearly double that of exports, resulting in a negative contribution of net exports to growth.

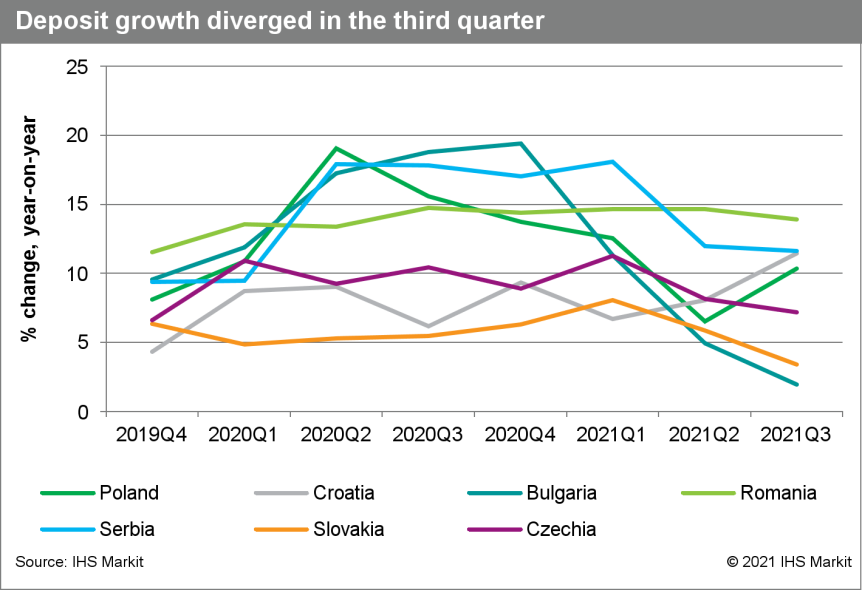

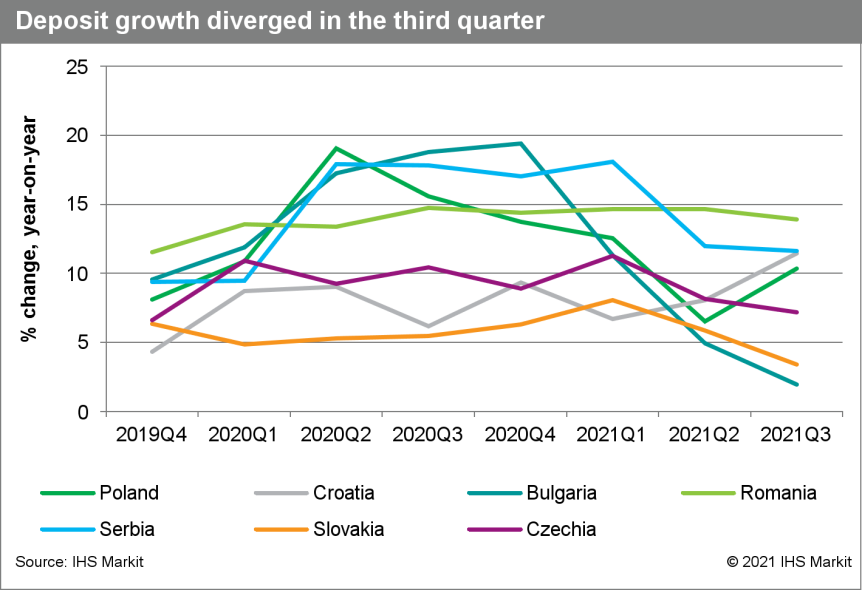

- Third-quarter 2021 data for banking sectors in Emerging Europe, including Bulgaria, Croatia, Czechia, Romania, Serbia, and Slovakia, highlight strong household lending, generally slowing deposit growth, improved asset quality, and robust capital positions. (IHS Markit Banking Risk's Natasha McSwiggan)

- A strong demand for credit and easing supply conditions in the household segment have sustained loan disbursements across Emerging Europe in the third quarter of 2021. Credit remained strong in most regions; IHS Markit estimates that the regional credit growth average was maintained at around 10% year on year (y/y) in the third quarter with the exception of Serbia, where the lending pace slowed slightly, reflective of tightening in the corporate loan segment. Credit surveys in the region have signaled an easing of standards in the household segment in the third quarter, yet the corporation (particularly the small and medium-sized enterprise [SME]) segment did not experience a strong credit easing.

- Non-performing loan (NPL) ratios have fallen in the banking sectors across the region and capital positions appear strong. Third-quarter NPL data for Czechia, Bulgaria, and Poland indicate that NPL ratios have fallen compared with the quarter before. Most sectors have returned to or fallen below their pre-COVID-19 pandemic levels. Czechia's NPL ratio stood at 2.59% as of the third quarter, although it had decreased since its fourth-quarter 2020 peak of 2.75%. In some countries, quarter-two data are the latest datapoint available but they also indicate a decrease in the rate across the board, largely supported by moratoria uptake. According to the European Investment Bank's Central, Eastern, and South-Eastern European (CESEE) Autumn Bank Lending Survey, 35% of banks indicate that 10-20% of outstanding loan portfolios were still affected by the moratoria. For other 15% of banks, moratoria covered between 20% and 70% of total outstanding loan portfolios. Serbia seems to be still particularly affected by the measure, with the same survey indicating that for 70-80% of banks in the region, over 70% of their household loans are still under moratoria, while more than 60% of corporate loans are still under moratoria in 40-60% of banks.

- Deposit growth developments have been mixed and appear highly dependent on macroeconomic prospects and uncertainly related to COVID-19-pandemic-related restrictions in the fourth quarter. Deposit growth developments were quite mixed, but appear to have slowed in many countries since the mid-2020 peak growth rates in the third quarter. Croatia and Poland are two exceptions to this, where deposit growth reached 10.4% year on year (y/y) and 11.5% y/y, respectively.

- Both Mercedes-Benz and Stellantis have announced agreements on the development of solid-state battery technology with startup Factorial Energy. In the separate statements, each automaker also announced investment in Factorial, with the amounts undisclosed. Mercedes-Benz said it has the goal of testing prototype battery cells as early as 2022, looking to develop next-generation technology jointly with Factorial. Mercedes added that it aims to integrate the technology into a limited number of vehicles in a small series within the next five years. Mercedes said its goal for the partnership is to "start with the cell and extend development to include entire modules and integration into the vehicle battery". In a statement, Markus Schäfer, member of the board of management of Daimler AG and Mercedes-Benz AG, and responsible for Daimler Group Research and Mercedes-Benz Cars chief operating officer, said, "We will also play a leading role in the field of battery technology. With Factorial as our new partner, we are taking research and development in the field of promising solid-state batteries to the next level. To this end, we are investing a high double-digit million-dollar amount in Factorial. With this cooperation, we combine Mercedes-Benz's expertise in battery development and vehicle integration with the comprehensive know-how of our partner Factorial in the field of solid-state batteries. (IHS Markit AutoIntelligence's Stephanie Brinley)

- VinFast parent Vingroup is reported to be seeking about USD1 billion in new investment and considering a possible US stock listing, according to media reports. Reuters has reported that Vingroup has been in talks with investor groups, including the Qatari sovereign fund Qatar Investment Authority (QIA) and BlackRock, as well as global private equity firms. Reuters has said that if the effort is successful, it could be the largest fundraising round for a Vietnamese company to date. Reuters sources have also reportedly said there is consideration for taking VinFast public with a US stock listing as soon as early 2022. The sources have declined to be identified as talks are reportedly ongoing, Reuters said. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The US flavor and essential oil processor IFF, listed on the New York stock exchange, has reported that its sales increased by 11-12% on a currency-neutral basis to $3.07 billion (+147% y/y) in Q3 2021, bringing incomes between Q1-Q3 to $8.6 billion (+126% y/y) after completing its merger with Nutrition & Biosciences (N&B). (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Sales were led by nourish, scent and health & bioscience divisions.

- Nourish division sales grew by 15% y/y to $1.66 billion (combined basis) in Q3 2021; health & biosciences rose by 5% to $618 million; scent rose by 9% to $580 million.

- "While the global supply chain environment remains volatile, we are confident in our long-term value creation opportunity as we execute our strategy and drive our business forward," the chief officer of IFF, Andreas Fibig, said.

Report was not published on Thursday, December 2, 2021

- US nonfarm payroll employment rose 210,000 in November, shy of expectations. That's where the "bad news" ends. The balance of this report was encouraging. (IHS Markit Economists Ben Herzon and Michael Konidaris)

- Civilian employment surged by 1.1 million, outpacing a healthy (594,000) increase in the labor force, driving the unemployment rate down 0.4 percentage point to 4.2%.

- The gain in the labor force was perhaps the most encouraging development in this report. The labor-force participation rate rose 0.2 percentage point to 61.8%. This was the highest level so far in the recovery.

- Continued gains in labor-force participation, were they to occur, would go a long way toward easing supply constraints.

- Turning back to the Establishment Survey, private payrolls expanded by 235,000 in November (below expectations) but prior months' gains were revised higher. The private workweek, moreover, rose 0.1 hour to 34.8 hours.

- Average hourly earnings rose 0.3% in November and are up 4.8% over the last 12 months.

- Taken together, data on private employment, hours, and hourly earnings point to a solid increase in private wages and salaries in November, which we estimate are now on track to rise at a 10.5% annual rate in the fourth quarter.

- The recovery in payroll employment has come a long way, but payrolls still remain 3.9 million below the February 2020 level, with employment in leisure and hospitality accounting for about one-third of the shortfall.

- The year-on-year (y/y) rate of increase in the eurozone producer price index (PPI) increased by almost six percentage points in October to 21.9%, a new record high by a very large margin and well above the market consensus expectation (of 19.0%, according to Reuters' survey). (IHS Markit Economist Ken Wattret)

- Although base effects have played an important role in boosting y/y inflation rates during 2021, this is not the whole story. The month-on-month (m/m) increases in the eurozone PPI have also been exceptionally large. October's 5.4% m/m jump was the biggest in the series' history by a huge margin, almost double the largest previously recorded m/m increase (of 2.8%, in the prior month).

- Soaring energy prices, particularly for gas, were the main reason behind the large PPI increases in September and October. In October there was a surge of almost 17% m/m, an unprecedented rate of increase, again by a huge margin. On a y/y basis, energy prices rose by more than 60% in October, triple the previous high in 2011.

- PPI inflation rates beyond energy have also been picking up, led by intermediate goods, prices of which rose by almost 17% y/y in October.

- Further along the price formation chain, eurozone PPI inflation rates have risen to a much lesser extent. Still, at 3.4% in October, y/y consumer goods inflation was not far short of its record high of 3.8% in 2011, with further gains likely.

- Overall, the eurozone PPI inflation rate excluding energy prices hit a new record high in October, rising to 8.9%, more than double the historical peak in 2011 (of 4.2%).

- IHS Markit forecasts 2022 exploration & production company (E&P) operating cash flow surpluses to be large, and E&P shares still trade at modest price to 2022 cash flow multiples (3.4 times at $75/bbl WTI versus 2.4 times in early September), which continues to create huge potential for share buybacks and other forms of returns of capital. (IHS Markit Energy Advisory's Raoul LeBlanc and Companies and Transactions' Sven del Pozzo)

- At $75/bbl WTI, oil-weighted E&Ps can still deliver similar yields on current share price as prior to the E&P share price run-up that began in early September at $65/bbl WTI.

- Pioneer Natural Resources, EOG Resources, Diamondback, Coterra, and Devon Energy lead the group by our forecast 2022 dividend yields of 6.5‒10.0% at $75/bbl oil, $3.50/Mcf gas, and $28/bbl NGLs.

- If all 2022 surplus operating cash flow after our forecast debt reduction were to buy back shares, the drop in share count would be huge, ranging from 10% to 27%.

- Continental Resources' recent acquisition from Pioneer allows the former to initiate a larger, more repeatable return of capital program and the latter to add a buyback program.

- Unhedged, Occidental Petroleum shows up as having the most potential to return capital via share repurchases after debt reduction because credit risk compresses its cash flow multiple, but first it needs to raise dividends.

- Callon Petroleum is also heavily indebted, but upside in its 2022 EBITDA is limited by commodity derivatives.

- Among Bakken E&Ps, Oasis Petroleum now trades among the sector's most highly regarded, while Whiting Petroleum lags despite having very similar assets and no debt.

- Global installations of new renewable power will set a record in 2021 of about 290 GW, compared with the 2020's record of about 280 GW, but the pace of deployments won't be enough to meet a global net-zero carbon goal by 2050, according to the latest report from the International Energy Agency (IEA). (IHS Markit Net-Zero Business Daily's Kevin Adler)

- The Renewables Market Report said growth will accelerate to average 305 GW per year for 2021 through 2026. By the end of 2026, global renewables capacity will reach 4,800 GW, or 60% greater than at end-2020. Renewables will represent about 95% of the new power capacity installed worldwide from now through 2026.

- At that point, renewable generation worldwide of just over 5,000 GW will be equivalent to the current total power capacity of fossil fuels and nuclear energy combined, IEA said.

- The sobering news, however, is that IEA calculates that installations would have to be about 550 GW annually, or 80% higher than its projections to keep the world on track for 2030 interim goals and the 2050 Net-Zero Scenario it laid out earlier this year.

- It also noted an uneven commitment to renewables, with 10 nations accounting for almost 80% of the projected growth in renewables.

- Daimler's supervisory board has announced a new EUR60-billion (USD68-billion) five-year investment plan, which will underpin the biggest period of transformation in the history of the world's oldest carmaker. The plan provides the full details of funding for a previously announced plan for Mercedes-Benz to become a fully electric brand by the end of the decade. The plan has been agreed as a new financial roadmap for Daimler's Mercedes-Benz unit; a new and clear investment strategy was needed for Daimler's light vehicle business following the decision to spin off Daimler Trucks, with the separate listing due to be completed on 10 December. The idea behind this strategy is that both the passenger car and truck business will be able to operate more efficiently and responsively with separate listings and more management autonomy, while they will also be able to raise money from the capital markets independently and with more clearly communicable investment plans, while creating more value for shareholders. A large component of this investment plan for Mercedes-Benz's newly independent light-vehicle business will be to achieve the previously communicated plan of becoming an all-electric brand by the end of the decade - with the important caveat 'wherever market conditions allow'. This condition would appear to indicate that the company will plan to become an all-electric brand in Western Europe, North America and China by the end of the current decade, using three new previously announced battery electric vehicle (BEV) architectures. (IHS Markit AutoIntelligence's Tim Urquhart)

- Toyota will unveil a new electric vehicle (EV) developed jointly with Chinese automaker BYD next April, reports Reuters. The new EV will feature BYD's core technologies, including its lithium iron phosphate (LFP) batteries. The report, citing people familiar with the matter, says that the model could be priced at less than CNY200,000 (USD31,396) to aim for a market in China that Tesla could target with a smaller car in the next two years. Toyota entered into a joint venture (JV) with BYD in April to develop EVs for the Toyota brand. According to the Reuters report, the upcoming new model is likely to be a compact EV similar in size to the Corolla sedan. The news that this new EV will be equipped with BYD's LFP batteries does not come as a surprise. The Chinese automaker has rolled out its self-developed Bland LFP batteries to several of its new launches, including the Han EV and Qin Plus EV. Both of these models are in high demand in China as LFP batteries are less prone to overheating and are more affordable compared with lithium-ion batteries. (IHS Markit AutoIntelligence's Abby Chun Tu)

Posted 06 December 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.