All major US and European, and most APAC equity indices closed lower on the week. US and most benchmark European government bonds closed lower on the week. European iTraxx and CDX-NA closed wider on the week across IG and high yield. Natural gas, oil, gold, and silver closed higher, while copper was lower on the week.

Americas

- All major US equity markets closed lower on the week; Russell 2000 -0.3%, DJIA -1.4%, S&P 500 -2.2%, and Nasdaq -3.2% week-over-week.

- 10yr US govt bonds closed at a 1.46% yield and 30yr bonds 2.03% yield, which is +1bp and +4bps week-over-week, respectively.

- Gold closed +0.4%/$1,758 per barrel, silver +0.5%/$22.54 per troy oz, and copper -2.3%/$4.19 per pound week-over-week.

- Crude Oil closed +2.6%/$75.88 per barrel and natural gas closed +8.1%/$5.62 per mmbtu week-over-week.

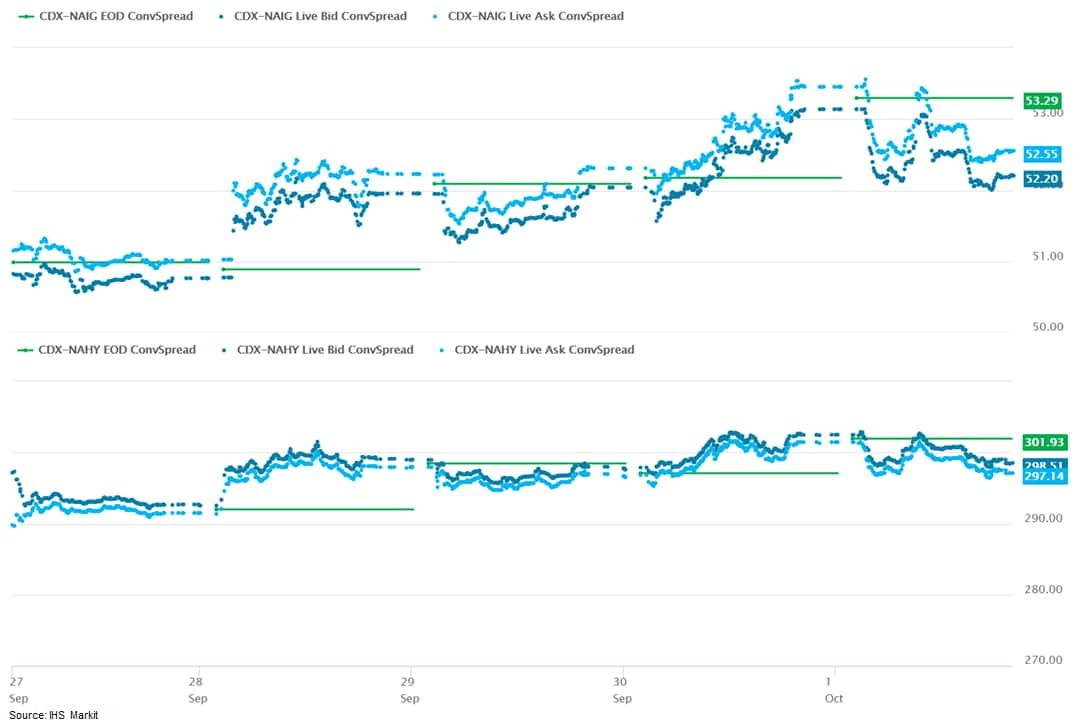

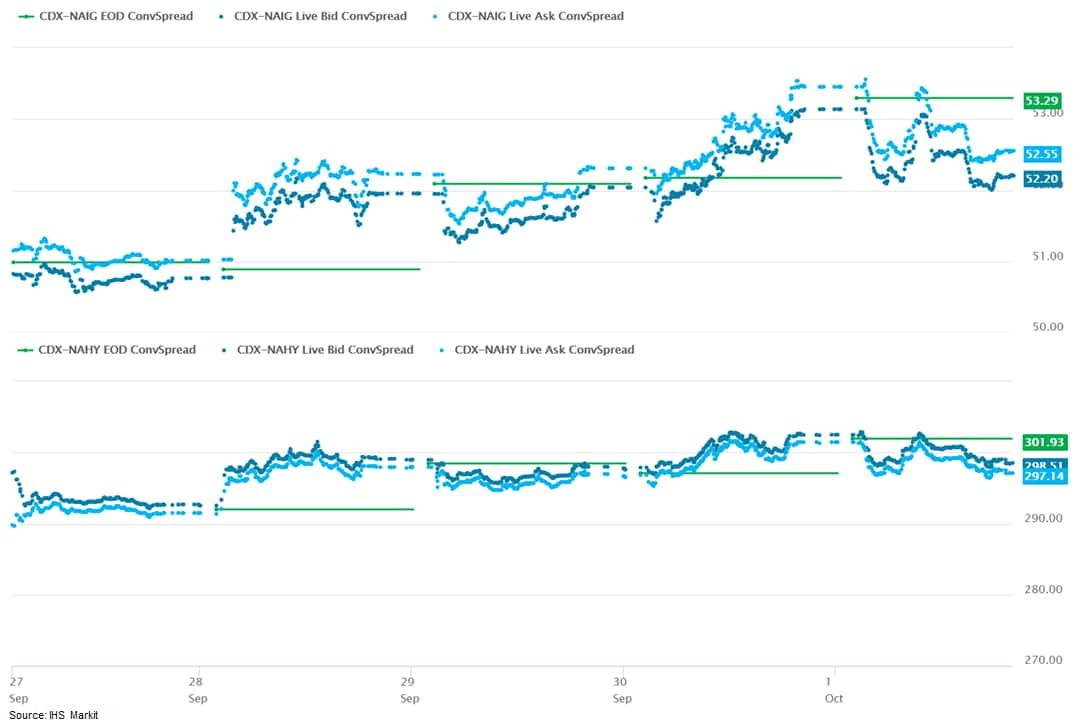

- CDX-NAIG closed at 52bps and CDX-NAHY 298bps, which is +1bp week-over-week for the former (CDX-NAHY 37.1 rolled this week, so there is no week-over-week comparison).

EMEA

- All major European equity indices closed lower on the week; UK -0.3%, Spain -0.8%, Italy -1.4%, France -1.8%, and Germany -2.4% week-over-week.

- Most 10yr European government bonds closed lower on the week, except for Germany being flat; France/Spain +2bps, Italy +3bps, and UK +17bps week-over-week.

- Brent Crude closed +2.7%/$79.28 per barrel week-over-week.

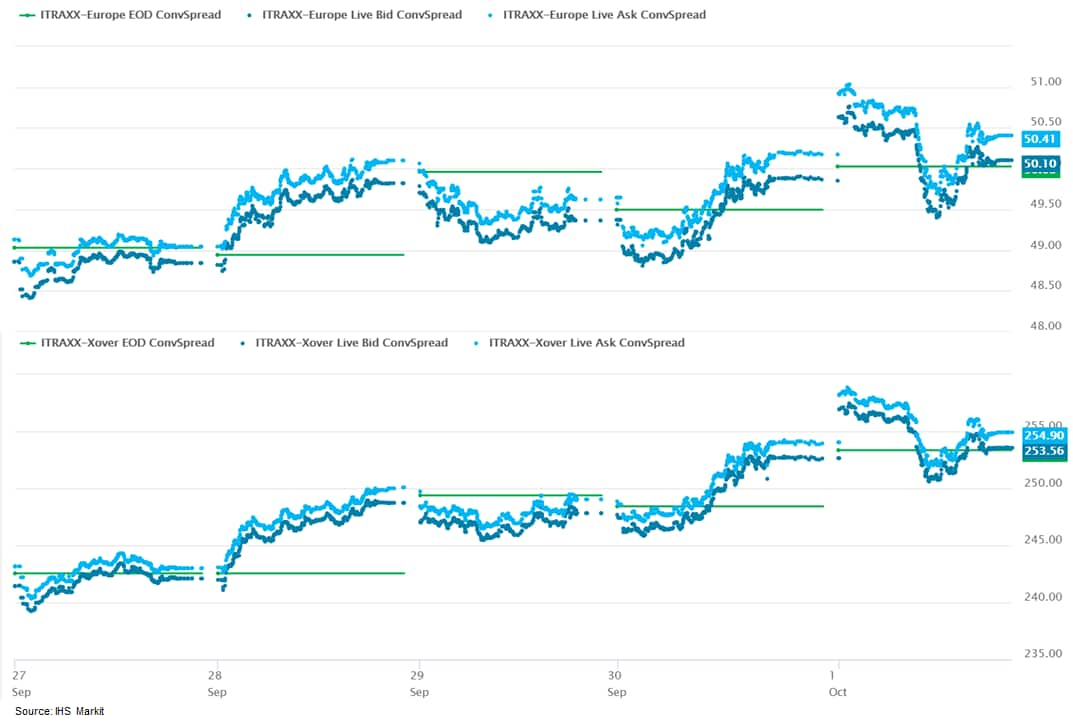

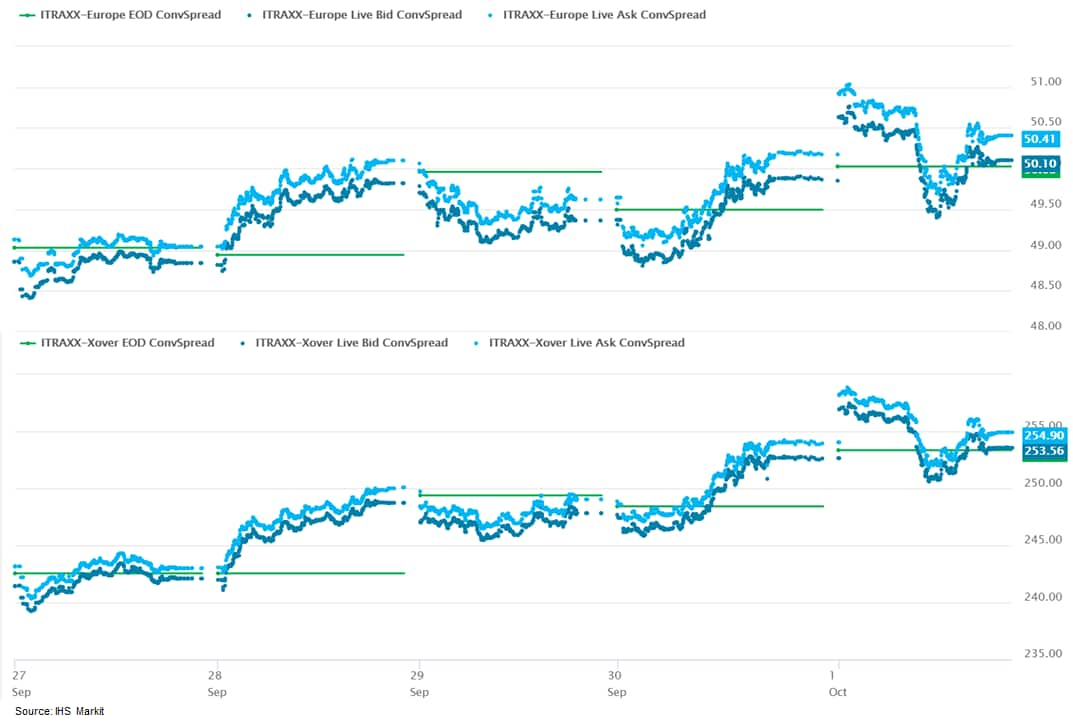

- iTraxx-Europe closed 50bps and iTraxx-Xover 254bps, which is +1bp and +11bps week-over-week, respectively.

APAC

- Most major APAC equity markets closed lower on the week, except for Hong Kong +1.6%; Mainland China -1.2%, India -2.1%, Australia -2.1%, South Korea -3.4%, and Japan -4.9% week-over-week.

- The second quarter of 2021 experienced record declines in US state personal income after a retreat of the fiscal stimulus that pushed first-quarter income to all-time highs. Plummeting transfer payments accounted for the entire decline in personal income for every state, and income from net earnings and dividends, interest, and rents could not come close to making up the difference. Personal income contracted the most in West Virginia (34.0% quarter on quarter: q/q), Mississippi (30.9% q/q), and New Mexico (30.2% q/q), places where transfer payments make up a significant share of total income. Meanwhile, incomes fell the least in the District of Columbia (10.1% q/q), Massachusetts (14.5% q/q), and North Dakota (14.9%), locations where transfer payments account for a lower portion of income and decreased at lower rates. (IHS Markit Economist Alexander Minelli)

- During the second quarter, transfer payments dropped by 72.6% q/q nationally following reductions in direct economic impact payments and state unemployment insurance (UI) compensation. Eighteen Southern and Midwestern states ended participation in federally bolstered UI during June. The East South Central region recorded the largest decline in personal income at 28.8% q/q, following a greater-than-average decrease in transfer payments, which make up just over one-fourth of total personal income, the highest share of any region.

- Net earnings growth was 10.7% q/q in the second quarter, a notable improvement on its second-quarter growth rate of 2.6% q/q, indicating continued strength in ongoing state recoveries. Growth in net earnings was highest in the West North Central (14.5%) region thanks to a robust expansion in farm earnings in North Dakota, South Dakota, and Nebraska. The West South Central and South Atlantic regions were close behind, adding 13.0% q/q and 12.2% q/q to net earnings after healthy earnings growth in accommodation and food services in Georgia, Mississippi, and Florida.

- Over the last year, state personal incomes have been held up by direct economic impact payments and federally bolstered UI, which pushed income growth to record rates during the second quarter of 2020 and first quarter of 2021. Despite the reduction in transfer payments during the second quarter of 2021, personal income still managed a modest expansion of 1.1% year over year (y/y), though income declined in 26 states. Michigan (5.8% y/y), West Virginia (5.6% y/y), and Vermont (4.9% y/y) experienced the largest contractions in state personal income because of severe drops in transfer payments.

- Sasol (Johannesburg, South Africa) has committed to achieving net-zero emissions by 2050, tripled its target for cutting greenhouse gas (GHG) emissions from its energy and chemicals businesses to 30% by 2030, and said it will invest 15-25 billion South African rand ($1.66 billion) on its energy transition by the end of the decade. (IHS Markit Chemical Advisory)

- Sasol says it has increased its previous scope 1 and 2 GHG emissions-reduction target for 2030 from an initial 10% announced last year for its South African operations to 30% for the energy and chemicals businesses, using its 2017 emissions total as a baseline. The company is also introducing a scope 3 reduction target for its energy business, using a 2019 baseline, it says.

- Sasol says its refocused strategy is underpinned by a financial framework that will enable it to grow shared value, while accelerating its transition. In the short-to-medium term, the company says a first phase up to 2025 will see it strengthen its balance sheet and improve its cost competitiveness and ability to increase cash-flow generation in a low oil price scenario. It is targeting a return on invested capital (ROIC) of 12-15% during this period.

- A second phase, through 2030, will prioritize balancing returns and investing in Sasol's transition plan, it says. "In this period up to 2030, Sasol plans to invest between R20-25 billion per annum to maintain its asset base, comply with all relevant environmental and air-quality regulations, as well as fund the transition to reach the 30% GHG emissions-reduction target. This includes a total of R15-25 billion in aggregate transformation capital up to 2030, while targeted ROIC is anticipated to be above 15%," it says.

- Sasol, one of the world's largest producers of grey hydrogen, says it aims to leverage its expertise to decarbonize through lower-carbon feedstocks and increase production of cost-competitive sustainable fuels and energy.

- Siemens Gamesa has started installation of the SG 14-222 DD prototype offshore wind turbine at the test center in Østerild, Denmark. As of now, the wind turbine's tower has been erected at the site. The rate output of the Direct Drive SG 14-222 DD wind turbine is 14 MW and can be increased to 15 MW by using the Power Boost function. The model features a 222-metre diameter rotor, 108-metre blades, and a 39,000 square meter swept area. The turbine prototype is expected to be ready in 2021, and the model will be commercially available in 2024. Conditional orders received so far total 4.34GW capacity ― the 300 MW Hai Long project in Taiwan planned by Northland Power and Yushan Energy, the 1,400 MW Sofia project in the UK planned by innogy, and the 2,640 MW Coastal Virginia Offshore Wind project in the USA, planned by Dominion Energy. This product features Siemens Gamesa's new B108 blades, with each 108-metre blade cast in one piece using the company's patented blade technology. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

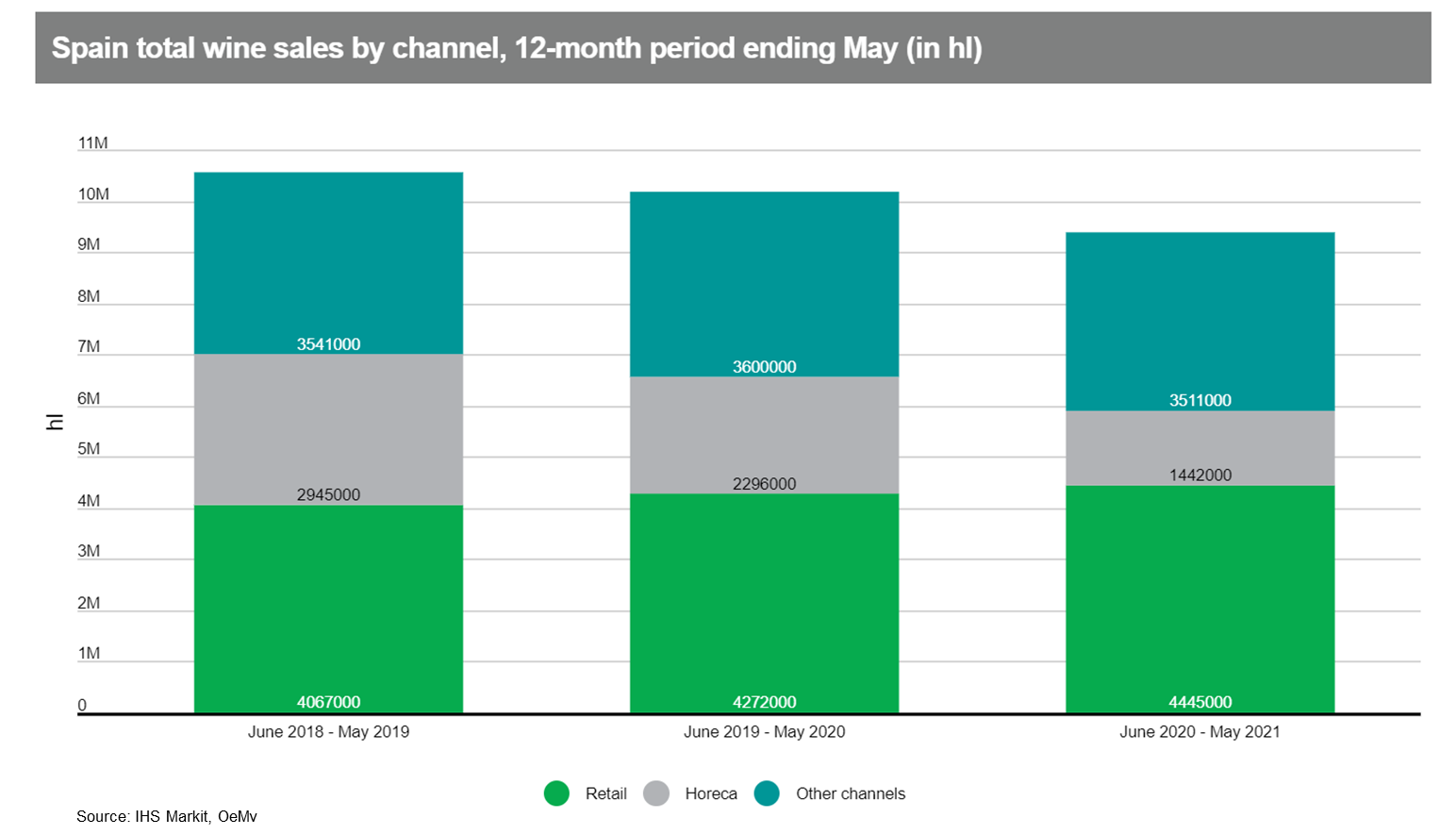

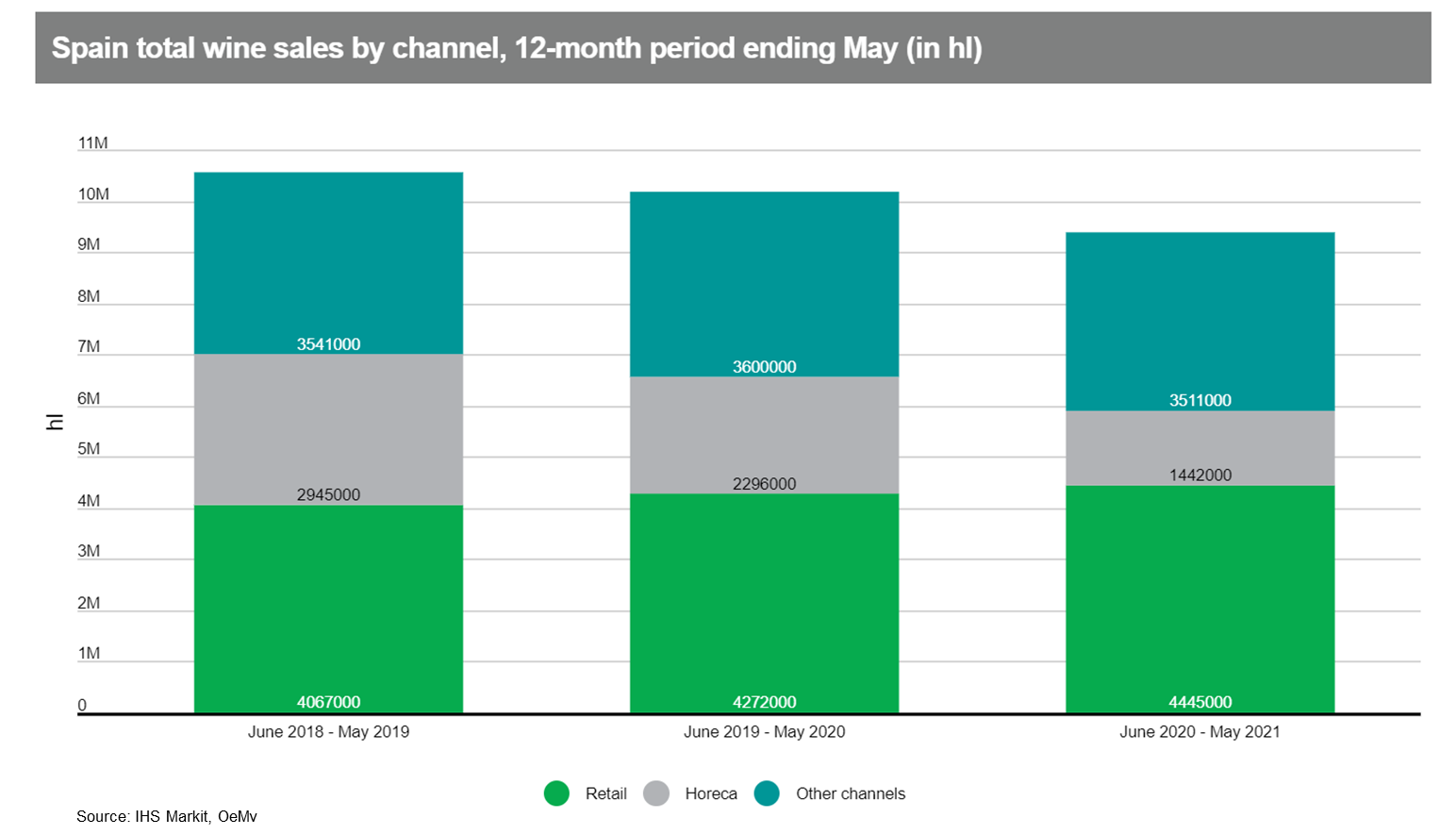

- Spain's wine grape growers are expected to harvest a crop that will yield between 39 and 40 million hectoliters of wine and grape must, depending on the weather conditions during the last few weeks of the season, announced the Spanish Wine Interprofessional (OIVE) on 23 September. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Harvesting of this year's grape crop is expected to last a shorter length of time than usual and the expected wine and grape must production will be 15% lower than the 46.5 million hl that were produced in 2020, said the organization.

- However, given the diversity of Spain's wine-making regions, the production decline is not generalized across all regions. This year, viticulture in Spain has had to face extreme weather events such as the effects of drought, the consequences of the isolated high-altitude depression meteorological (DANA) event, mildew outbreaks in some areas and even fires.

- OIVE added that a decrease in production can also be seen in other leading European wine producing markets and direct competitors, such as France that will have a 30% lower production and Italy with a 9% lower production this season.

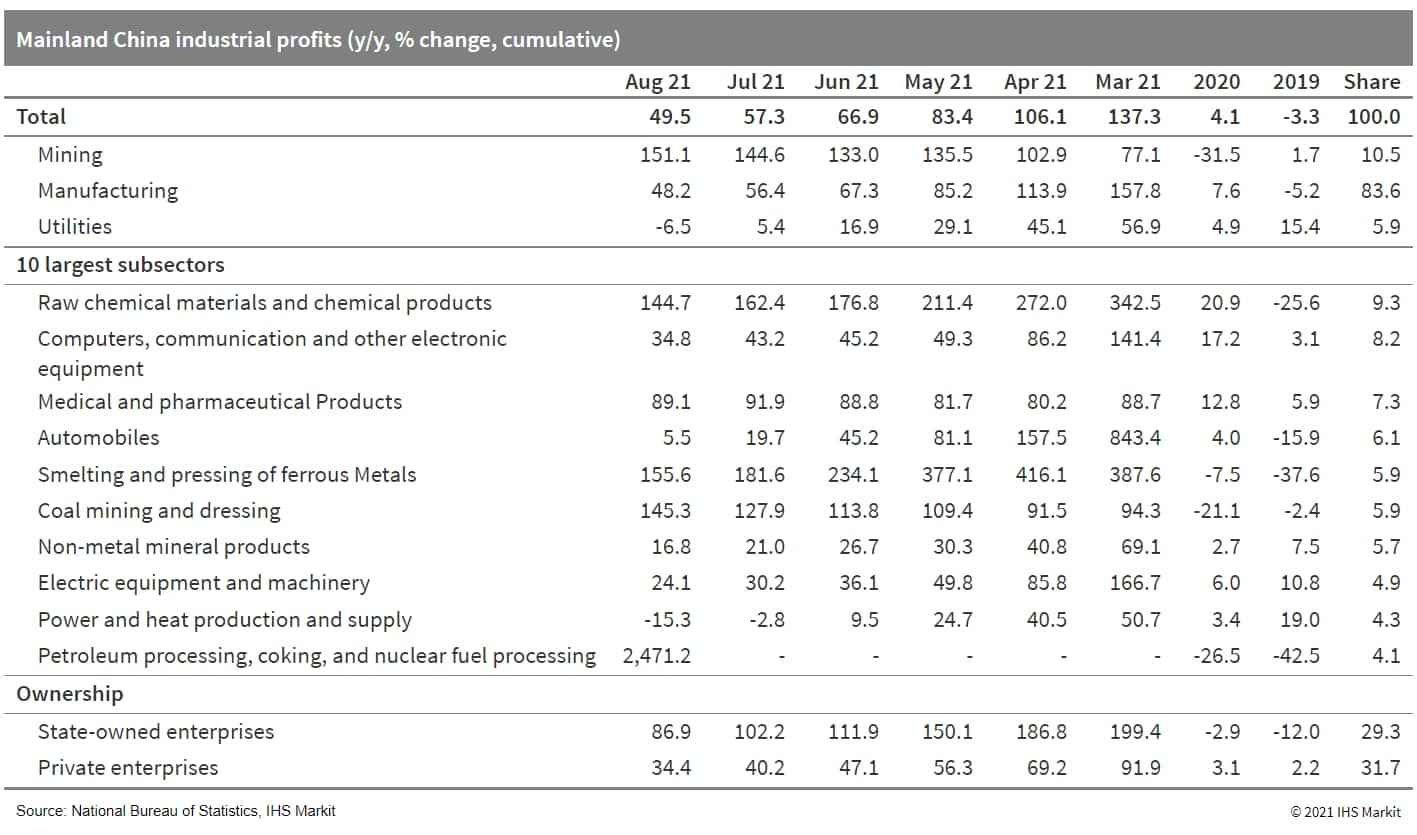

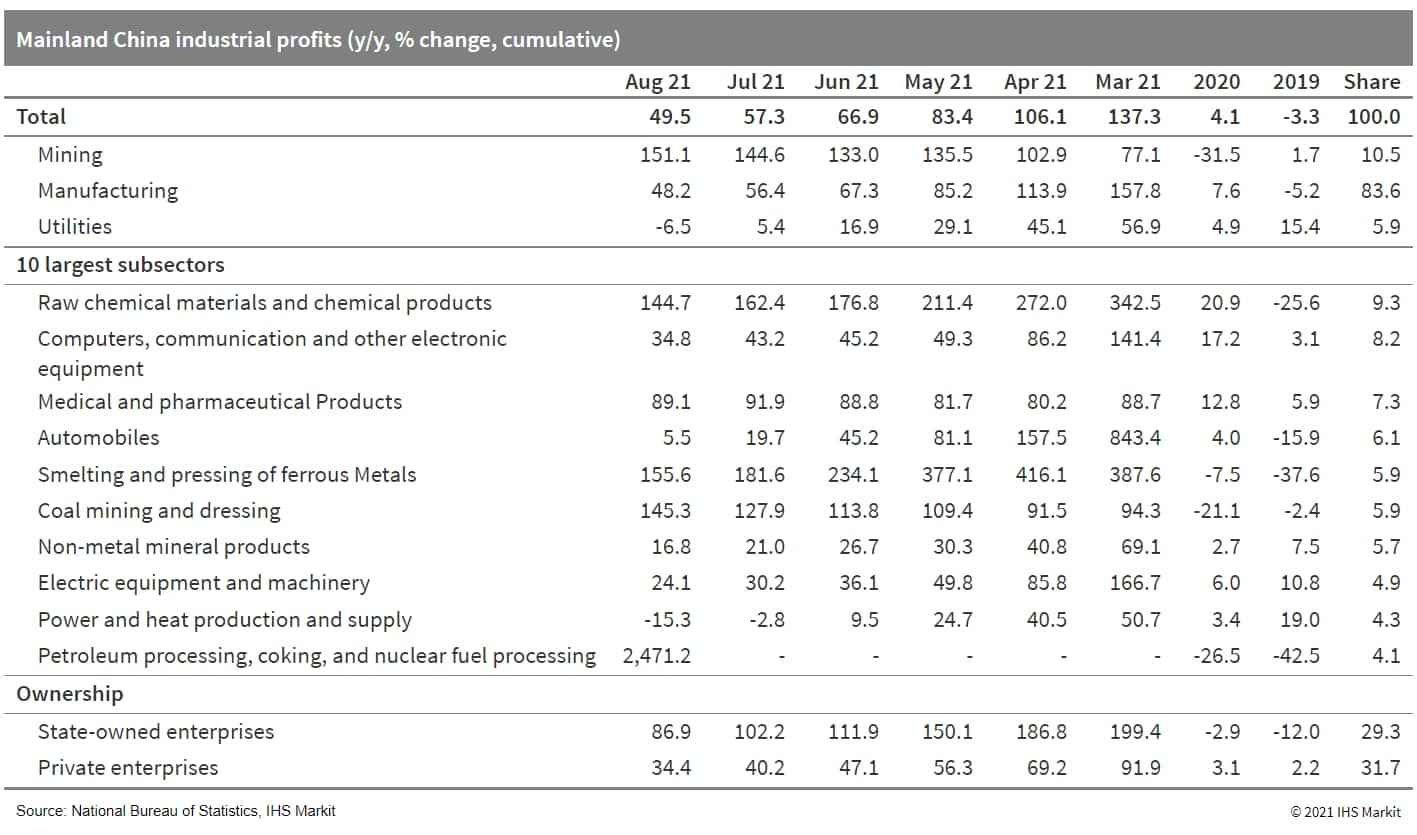

- Mainland China's industrial profits increased by 49.5% year on year (y/y) through August, down 7.8 percentage points from the first seven months as the low-base effect continues to diminish. On a two-year (2020-21) average basis, industrial profits expanded by 19.5% y/y, 0.7 percentage point lower than the July reading. For August alone, industrial profits grew by 10.1% y/y, or 14.5% y/y on a two-year average basis -compared with 18.0% y/y in July - according to the National Bureau of Statistics (NBS). (IHS Markit Economist Lei Yi)

- The cumulative profitability ratio remained elevated at 7.01% through August, yet this marks the second consecutive month of decline from 7.11% by the end of first half of 2021. The sectoral trend through August was similar to that the month before: the profitability ratio in the upstream mining sector continued to rise, by 0.53 percentage point to 17.90%, whereas the manufacturing and utility sectors registered further decline in profitability ratio, edging down to 6.62% from 6.72% and to 5.52% from 5.90%, respectively.

- Notably, the utility sector registered cumulative industrial profit contraction of 6.5% y/y through August, coming entirely from the 15.3% y/y profit drop in the power and heat production and supply subsector. Soaring coal prices may have been a contributing factor here, given the 57.1% y/y increase in prices in the coal mining and dressing sector, in addition to the 241% y/y rise in the coal industry's profits in August. Other than that, the strength of the high-tech manufacturing sector's profits persisted; consumer goods manufacturing logged a profit growth rate of 14.4% y/y, widening the lead over headline figure from 2.2 percentage points in July to 4.3 percentage points in August.

- The average liability-to-asset ratio of industrial enterprises came in at 56.4% by the end of August, up 0.1 percentage point from July, but down by 0.4 percentage point year on year. The inventory of finished goods increased 14.2% y/y in the first eight months of 2021, up by 1.2 percentage points from the end of July.

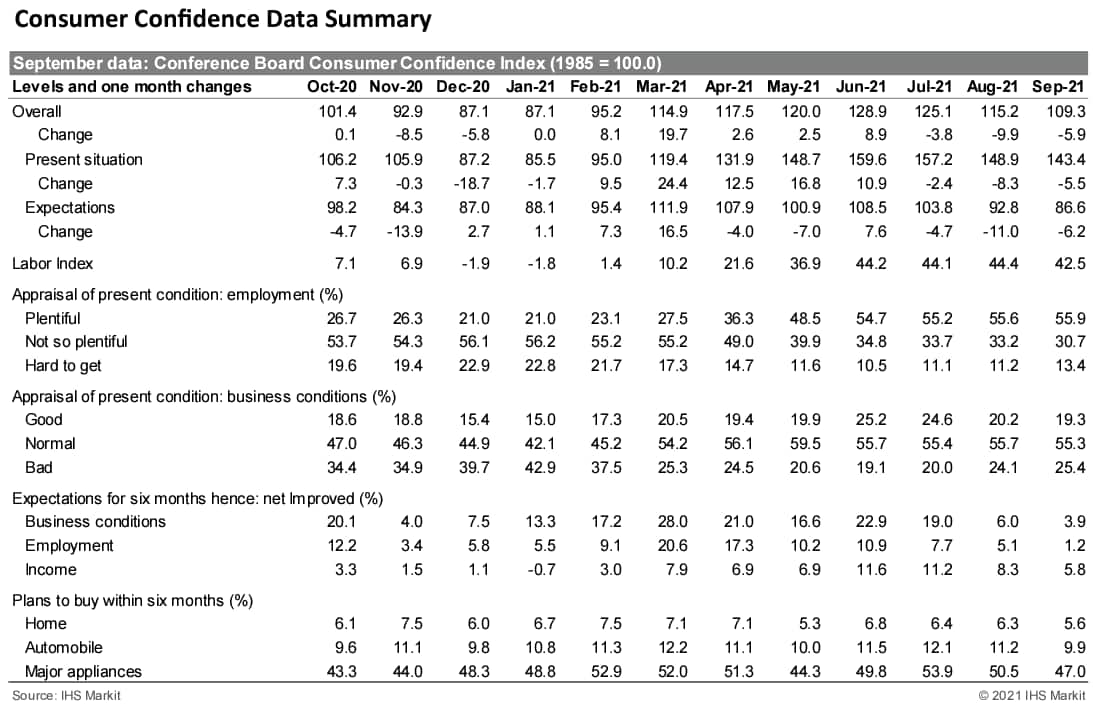

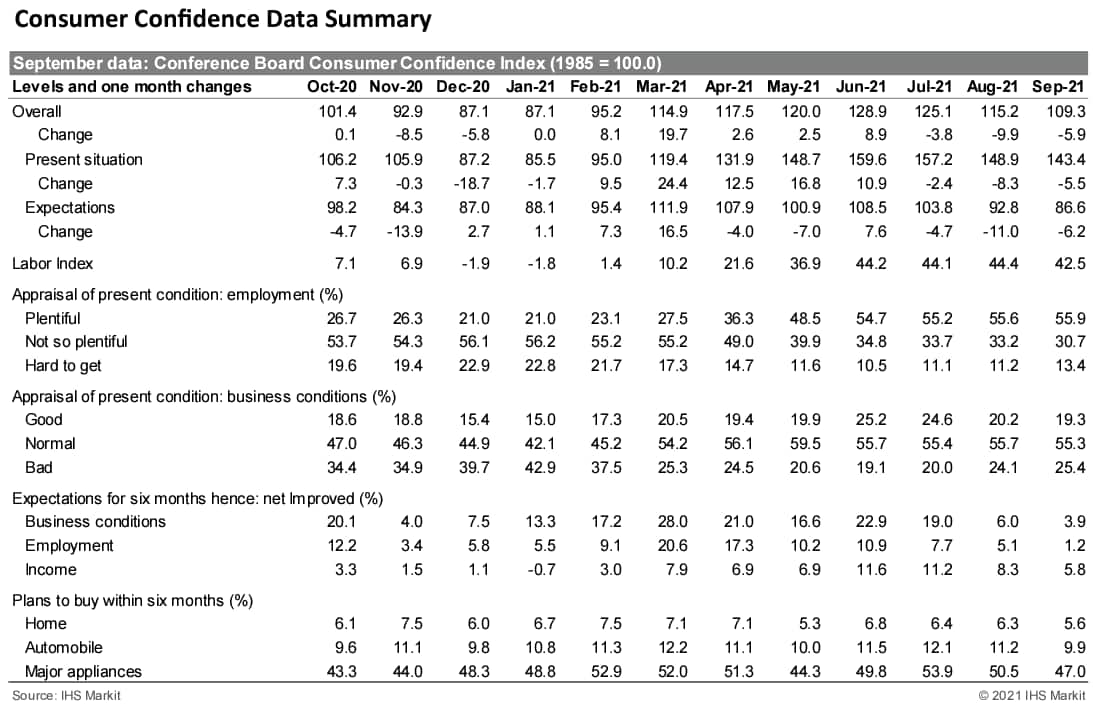

- The US Conference Board Consumer Confidence Index decreased by 5.9 points (5.1%) to 109.3, following declines in July and August. The index is at its lowest level since February. The index of views on the present situation declined 5.5 points to 143.4. The expectations index fell 6.2 points to 86.6. (IHS Markit Economists James Bohnaker and William Magee)

- In September, the labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) decreased 1.9 percentage points to 42.5%, still near its highest levels dating back to 2000.

- Despite the strong job market, consumers are not as optimistic about income growth. The net percentage of respondents expecting higher incomes in the next six months declined 2.5 points to 5.8%, still well below the 15.0% average recorded during the half-year preceding the pandemic.

- Purchasing plans worsened again in September. The share of respondents planning to buy autos in the next six months edged down 1.3 points to 9.9%; the share planning to buy homes fell 0.7 point to 5.6%; and the share planning to buy major appliances declined 3.5 points to 47.0%.

- Survey respondents reported a 6.5% expected year-ahead inflation rate in September, down slightly from the highest reading since 2008 in August (6.7%). Historically, these point estimates bear little resemblance to observed measures of consumer price inflation, but the directional move downward in September could indicate that consumers are becoming somewhat less concerned with inflation.

- The spread of the Delta variant this summer is likely the primary reason for declining confidence over the past three months. But with the number of COVID-19 cases in the US peaking in mid-September, we expect that consumer mood will stabilize in the next couple months and that consumer spending will continue to recover, albeit at a slower pace than during the first half of this year.

- Ford and SK Innovation announced a massive new investment in US manufacturing, supporting two new complexes, including vehicle assembly, new battery plants, and a supplier park. Ford is providing USD7 billion of the investment, with EV and battery production to start in 2025. It is difficult to underestimate the significance of the announcement of the new investment for Ford's future operations. Along with the scale of production involved, the planned Blue Oval City will involve Ford rethinking its manufacturing processes. In the second quarter of 2021, Ford increased the amount of its planned EV investment by 2025 to USD30 billion, up from USD22 billion previously. Given the USD7 billion price tag of the newly announced projects for Ford, this is where a significant portion of the planned increased funding is going. The scale and cost of the investment program, as well as the plan for the F-Series EV to be the cornerstone of Blue Oval City, indicates Ford's commitment both to its EV transition and to the F-Series. (IHS Markit AutoIntelligence's Stephanie Brinley)

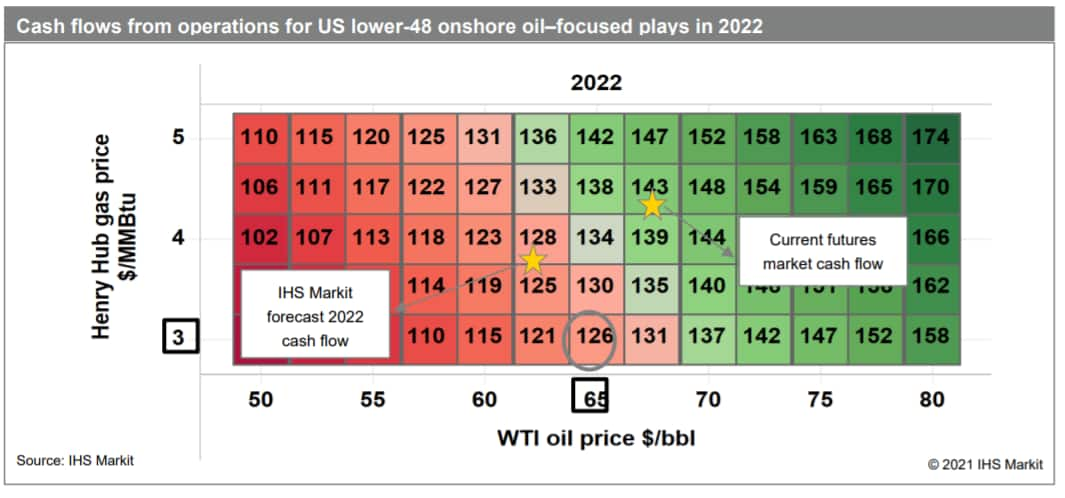

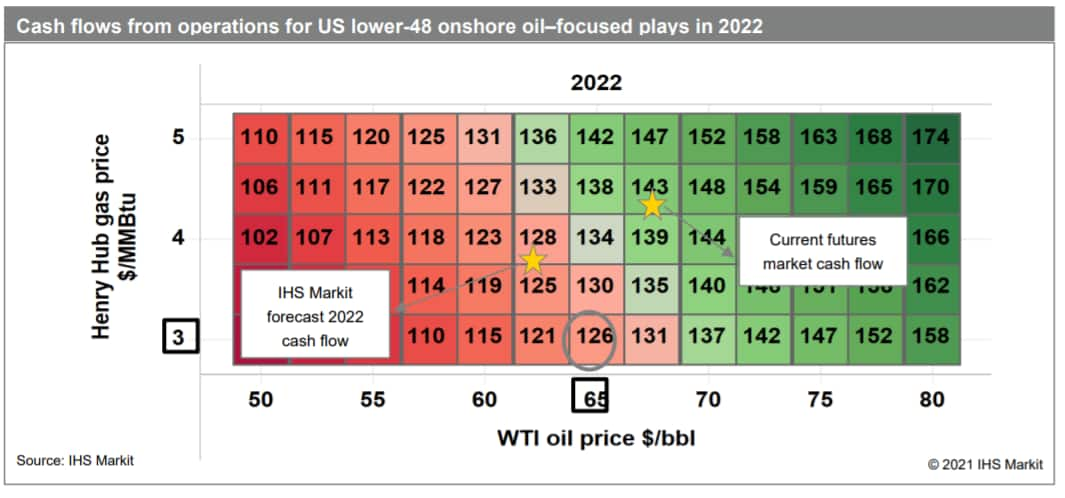

- Rising gas prices will generate significant cash flows for oil-focused operators who are already benefiting from higher oil prices in 2021. Tight storage levels and increasing LNG demand have pressured Henry Hub (HH) to shoot over $5/MMBtu from an average of $2/MMBtu in 2020. Although gas producers are an obvious beneficiary, it is important to remember that virtually all oil producers are also gas producers (the inverse is not true). Given the (rising) gas-oil ratio and the distribution of activity among and within oil plays, a good rule of thumb for 2022 is that $1/MMBtu of Henry Hub is worth about $3/bbl of WTI and generates about $7.5 billion of incremental cash for oil producers. Cash flows were good when the WTI price last breached $70/bbl in 2018, but producers are far better off now, and 2022 promises to move cash flows into another gear (IHS Markit Energy Advisory's Raoul LeBlanc and Narmadha Navaneethan):

- The IHS Markit 2018 cash flow estimate for US lower-48 onshore oil-focused plays (using actual prices of $64.91/bbl WTI and $3.13/MMBtu HH) was $97 billion.

- Commodity prices were similar in 2021, but with higher volumes and lower cash costs forged in the depths of the pandemic, cash flows should improve by 19% versus 2018 to about $115 billion.

- In 2022, cash flows from operations should drive the best performance in many years owing to the gas price impact, with hedge expiration and the year-on-year absolute price rise (based on the current strip) contributing about equally to raise cash flows by another 22% to top $140 billion.

- Market volatility in the UK's CO2 market is expected to continue unchanged for the next two weeks, despite the recent announcement by CF Industries Holdings that it is restarting production at its ammonia plant at its Billingham complex in the UK. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Fertilizer producer CF Industries Holdings had announced the resumption of production on 21 September, following an interim agreement reached with UK authorities to cover the costs to restart the ammonia plant and produce CO2 for the UK market.

- Food and drink grade CO2 is a by-product of the fertilizer industry, specifically a byproduct of the ammonia production process. Safely restarting the ammonia plant at the Billingham Complex is expected to take several days.

- BASF's integrated steam cracker and derivatives complex currently under construction at Zhanjiang, Guangdong Province, southern China, will generate an estimated €4.0-5.0 billion ($4.7-5.8 billion) in annual sales by 2030, according to BASF chairman Martin Brudermüller. (IHS Markit Chemical Advisory)

- The chemicals mega site on Donghai Island is also expected to achieve EBITDA of €1.0-1.2 billion by the end of the decade, with forecast capital expenditure (capex) on the project put at €8.0-10.0 billion, said Brudermüller at a virtual investor update by the company.

- BASF also outlined growth expectations for its worldwide battery materials business, saying it expects to generate more than €1.5 billion in sales by 2023 and more than €7.0 billion by 2030 as electric vehicle (EV) production grows.

- BASF expects to realize capex of about €2.0 billion/year on average in its growth projects, namely Zhanjiang and in the battery materials business, during 2021-25, and will average annual capex of about €2.6 billion to maintain and grow its existing businesses, according to Brudermüller. BASF will provide a new five-year capex plan at the end of February 2022 for the period 2022-26, he said.

- Zhanjiang will ultimately become BASF's third-largest production site, behind Ludwigshafen, Germany, and Antwerp, Belgium, Brudermüller said.

- The Zhanjiang site's initial development phase, focused on producing performance materials for the automotive and consumer industries, features plants under construction that will supply engineering plastics and thermoplastic polyurethanes "that are in high demand in Guangdong," he said. The first of these is expected to start operations by mid-2022, with the others to follow by 2023. Construction began officially in November 2019.

- The "heart" of the site will be the cracker, which together with several other associated downstream plants will be built during phase 1, with these expected to start up in 2025, Brudermüller said. The cracker and downstream plants in phase 1 will supply the C2, C3, and C4 value chains, according to an accompanying presentation. Further product lines will start up as of 2028 during the site's second development phase. "These will mostly consist of downstream plants that will be backward integrated into the streams of the steam cracker, achieving Verbund synergies," he added.

- Key factors in reducing emissions at Zhanjiang include the company having secured 100% renewable power, about 10 megawatts (MW), for the production plants in the site's initial development phase, and another will be replacing steam with electricity, such as in powering the turbines for the cracker's compressors.

- Japan Inc. is picking up its pace in developing offshore wind power projects to help meet the country's decarbonization targets for the decades to come. The Ministry of Economy, Trade and Industry (METI) unveiled a series of measures aimed at streamlining and accelerating site selection processes after proposing in July to target a higher renewable proportion in Japan's power mix by 2030. (IHS Markit Net-Zero Business Daily's Max Lin)

- Among them are the Guidelines for Designation of Offshore Renewable Energy Power Facility Promotion Zones, which pave the way for the Japanese government to secure grid connections prior to auctions. The connections would be transferred to auction winners based on the policy design.

- The positive policy signals came after Tokyo vowed to develop 10 GW of offshore wind power by 2030 and 30-45 GW by 2040 last year. Now, an increasing number of domestic and foreign firms are showing an appetite for a Japanese offshore wind sector that could attract tens of billions of dollars in investments in the coming years.

- On 12 August, Mainstream Renewable Power and Norway's Aker Offshore Wind said they were the frontrunner to acquire an initial 50% stake via a joint bid for Progression Energy's 800-MW Japanese floating offshore wind project. The project has yet to reach the Final Investment Decision.

- PowerX announced in the same month that it would design and build an automated power transfer vessel to carry electricity from offshore wind farms to shore. Designed to have 100 grid batteries with a total storage capacity of 200 MWh, the 2,200-dwt ship is due to be launched in 2025.

- The US Pending Home Sales Index (PHSI) jumped a surprising 8.1% in August to a seven-month high. The regional gains were also (unexpectedly) strong, ranging from 4.6% in the Northeast to 10.4% in the Midwest. (IHS Markit Economist Patrick Newport)

- According to Lawrence Yun, the National Association of Realtors' chief economist, "Rising inventory and moderating price conditions are bringing buyers back to the market. Affordability, however, remains challenging as home price gains are roughly three times wage growth."

- The Mortgage Bankers Association (MBA)'s Purchase Index (four-week moving average), which had been sliding since January but turned six weeks ago, growing 10% since then, is also pointing to stronger near-term sales.

- The August jump in the PHSI suggests that listings have picked up in the past month. Strong demand for houses this year has mostly led to higher home prices—not higher sales—because listings were hovering near all-time lows.

- The PHSI leads existing home sales by a month or two. The latest two PHSI readings point to a modest pickup in existing home sales in September and October.

- UK-based electric truck manufacturer Tevva has revealed a new medium commercial vehicle (MCV). According to a company statement, the vehicle is designed to have a gross vehicle weight (GVW) of 7.5 tons and to have the ability to carry up to 16 euro pallets at a payload of more than two tons. The company has not released any details about the powertrain or battery size, but it has said that the vehicle will offer a range of 250 km as a pure battery electric model, and that technology is being tested that will allow it to be fully charged in just one hour. It has also said that the range can be increased to 500 km with the installation of its "patented range extender technology (REX), which has now been upgraded to use hydrogen fuel cells". As for total cost of ownership (TCO), an important metric for running a vehicle as part of a business, the company says that the model can achieve parity at the level when 3,000 km are driven or 500 liters of diesel are consumed on a monthly basis. Tevva has confirmed that the vehicle will be built at a brand-new facility at London Thames Freeport (United Kingdom). (IHS Markit AutoIntelligence's Ian Fletcher)

- US seasonally adjusted initial claims for unemployment insurance increased by 11,000 to a seven-week high of 362,000 in the week ended 25 September. California reported the largest increase in initial claims among all states for the second straight week—unadjusted claims there rose by 17,978 to 86,792 in the week ended 25 September. Initial claims in Michigan also turned up—rising by 6,432 to 18,727—as the auto industry continues to struggle with supply-chain issues. The recent trend in initial claims is at best flat as the spread of the Delta variant and supply-chain issues weigh on activity. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 18,000 to 2,802,000 in the week ended 18 September. The insured unemployment rate edged down 0.1 percentage point to 2.0%.

- In the week ended 11 September, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 2,652,742 to 991,813.

- In the week ended 11 September, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 3,836,877 to 1,059,248.

- In the week ended 11 September, the unadjusted total of continuing claims for benefits in all programs fell by 6,222,725 to 5,027,581.

- Eli Lilly (US) has announced that it will reduce the list price of its generic insulin lispro injection (100 units/mL) in the United States by 40% from 1 January 2022. The new list price for the generic will be USD82.41 for individual vials and USD159.12 for a pack of five pens. This is 70% less than the branded version of the drug, which is sold by Lilly as Humalog U-100. According to Lilly, the 40% price cut will in effect reduce the price of insulin lispro injection to 2008 levels. The company noted that the greatest benefit would be seen by people who face higher out-of-pocket (OOP) costs, which include those without insurance and those insured under high-deductible plans. The reduction comes amid ongoing political pressure over the high cost of insulin, including Humalog, whose price per vial reportedly rose from USD21 in 1996 to USD275 in 2019. Against this background, in June Walmart launched a new private label analog insulin, ReliOn NovolLog Insulin (insulin aspart) injection, which the company said represented a saving of between 58% and 75% on the cash price of branded insulin products. (IHS Markit Life Sciences' Milena Izmirlieva)

- The European Parliament's Industry, Research, and Energy Committee voted on 27 September to phase out eligibility for natural gas pipelines in the Projects of the Common Interest (PCI) program, but to do so more slowly than advocated by environmental groups. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- According to the EU, "PCIs link the energy systems of EU countries and can benefit from accelerated permitting procedures and funding." Recent examples in the gas sector include a pipeline between Greece and Bulgaria, completed in 2020, and a pipeline between Poland and Lithuania, completed in 2019.

- The PCI criteria is being revised to align the Trans-European Networks in Energy (TEN-E) regulation with the objectives of the European Green Deal. The EU has set a goal of a 55% reduction in GHG emissions by 2030 from a 2005 baseline, as its key measure of progress towards meeting a goal of net-zero emissions by 2050.

- However, coming at a time when gas prices are surging in Europe and dragging power prices up with them, the committee members' vote reflected concerns that moving away from fossil fuels too quickly could be costly. As a result, the new eligibility rules will not go into effect until 2027.

- According to IHS Markit's tracking of international gas prices, the benchmarks in Europe known as the Dutch TTF and the UK NBP showed spot prices this week surpassing €75/MWh. This is up more than 500% from a year ago, when they were about €12/MWh. High demand, low inventories, and inadequate imports are all being credited for the price spike, which is expected to last through the upcoming winter, unless temperatures are unusually warm.

- Germany's Federal Statistical Office (FSO) has reported, based on data from various regional states, that the country's national consumer price index (CPI) is flat month on month (m/m) in September. This has driven up the annual inflation rate from 3.9% in August to 4.1% year on year (y/y), a level not observed since 1993. (IHS Markit Economist Timo Klein)

- The EU-harmonized CPI measure even increased by 0.3% m/m, its y/y rate thus rising sharply from 3.4% to 4.1%. The recent differential between the national and the harmonised measures in y/y terms - linked to the latter using weights derived from the consumer spending pattern of 2020 rather than 2015, thus underweighting package-tour prices that always spike around mid-year - has disappeared now.

- The detailed breakdown of the German national data will only be published with the final numbers on 13 October, but components are available, for instance, from the largest and most populous state of North Rhine-Westphalia (NRW). CPI inflation in this state stands at 0.0% m/m and 4.4% y/y, the latter rising from 4.2% y/y in August.

- In NRW, energy prices have increased by 0.4% m/m, boosting their annual rate once more from 12.6% in August to 13.6% in September. Food prices have added to inflationary pressure as their 0.2% monthly increase has lifted their y/y rate from 4.4% to 4.9%. In addition, loosened restrictions have facilitated price increases with respect to holiday travel and recreation/entertainment in general. The inflation rate for package tours has risen from 1.5% to 3.4% and the overall category of recreation/entertainment/culture from 3.4% to 4.0%.

- Durable goods prices provide a mixed picture as the y/y rate for clothing/shoes has softened once more from 4.2% to 2.1% whereas inflation of furniture/household goods has increased from 3.8% to 4.0% and that of 'miscellaneous goods and services' remains at a historically elevated level of 3.6%.

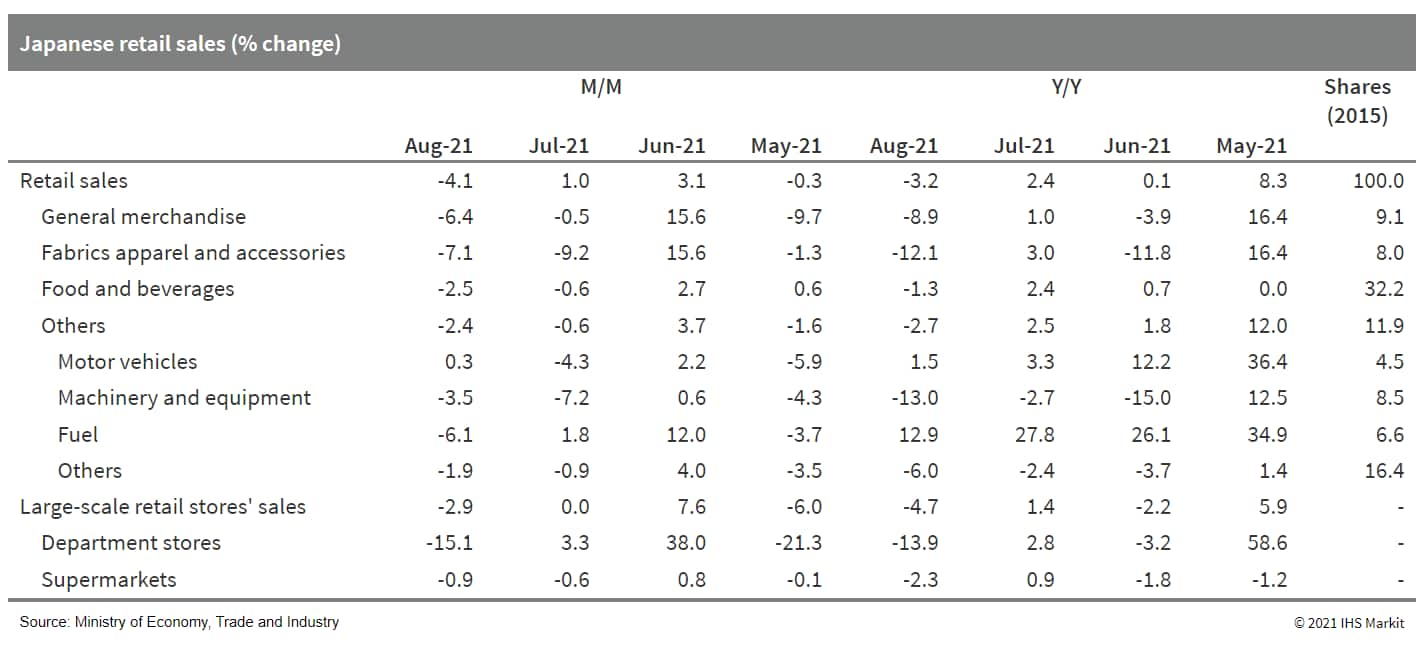

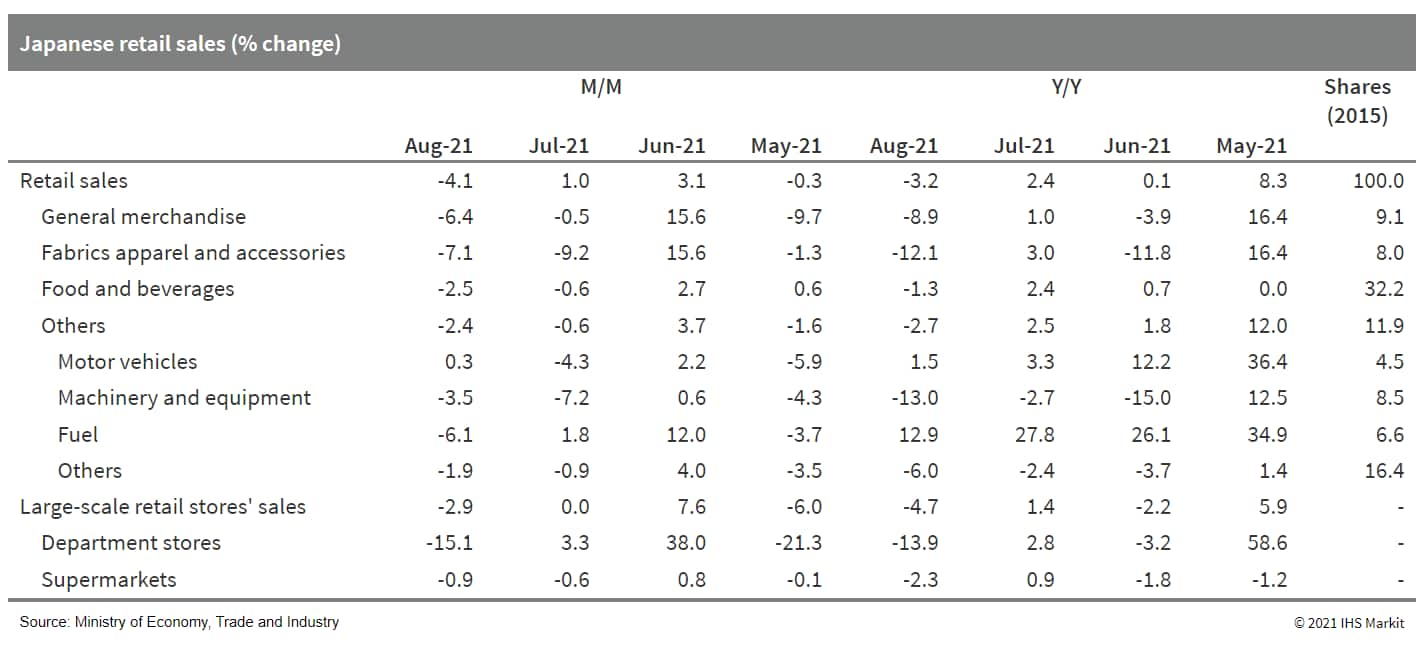

- Japan's retail sales fell by 4.1% month on month (m/m) and 3.1% year on year (y/y) in August following two consecutive months of m/m increases. (IHS Markit Economist Harumi Taguchi)

- The weakness reflected negative impacts from containment measures due to a surge of Delta variant COVID-19 infections and unusually heavy rainfall during the holiday season.

- Sales for all retail store groupings except for autos declined from the previous month. Because of tighter controls and temporary closures following mass infections in several stores, department store sales declined by 15.1% m/m.

- Private equity firm Apollo Global Management has announced that funds managed by its affiliates have entered into a definitive agreement to acquire the thermal and emission control materials (Maftec) business of Mitsubishi Chemical, which produces and sells polycrystalline alumina fiber. Mitsubishi has confirmed that the deal is worth about ¥85 billion ($759 million). (IHS Markit Chemical Advisory)

- Subject to customary closing conditions including regulatory approvals, the transaction is expected to be completed in March 2022. Mitsubishi says it expects to realize income of ¥54 billion related to the deal.

- The Maftec business makes polycrystalline alumina fiber from aluminum and silicon. It is a world leader in thermal and emission control protection materials, primarily for the industrial and automotive industry as original equipment manufacturers (OEMs) adapt their chemical fiber products to reduce emissions in traditional and hybrid vehicles, Apollo says. The business is also developing product applications for electric vehicle batteries, it says.

- US personal income increased 0.2% in August and wages and salaries rose at the same rate. Real disposable personal income (DPI) decreased 0.3%. Real personal consumption expenditures (PCE) increased 0.4% in August as spending recovered from a downwardly revised 0.5% decline in July. However, the increase was less than IHS Markit analysts had assumed, resulting in a downward revision to the forecast for third-quarter growth of real PCE, from 1.7% to 0.4%. (IHS Markit Economists James Bohnaker and William Magee)

- Real PCE for durable goods fell 1.3% in August as spending on new motor vehicles plunged 11.1% amid severe supply chain issues. Real PCE for nondurable goods and services increased 1.7% and 0.3%, respectively.

- Advance payments of the Child Tax Credit authorized under the American Rescue Plan raised personal income by $226 billion (annual rate).

- Unemployment insurance (UI) transfer payments declined by $14 billion (annual rate) in August but remained a key support for personal income. Eligibility for pandemic-era UI benefits expired on Labor Day, so payments under these programs are expected to decline sharply in September.

- The core PCE price index increased 0.3% in August and its 12-month change was 3.6%. Outside of the core, the price index for energy goods and services rose 1.9% and was up 24.9% over 12 months.

- The spread of the Delta variant of COVID-19 likely had a peak impact on consumer spending in August, and continued improvement in labor income and elevated levels of household savings will support moderate growth over the next several months.

- GDP implications (third quarter: down 0.7 percentage point) Real PCE through August was lower than expected, implying less PCE and imports in the third quarter. As a result, we lowered our forecast for third-quarter GDP growth by 0.7 percentage point to 2.9%.

- The UK's ambitious offshore wind target promises to reshape its energy landscape long-term, according to an executive panel at the Global Offshore Wind conference in London on 29 September. In 2020, the UK upped its offshore wind target to 40 GW in the next decade, building on its 2019 strategy for the sector, in a bid to reach net-zero emissions by 2050. Targeting this goal, the UK is gearing up to grant subsidies for 10 GW and 8 GW of capacity in the offshore energy sector, with July's auction bottom-fixed and floating offshore wind seabed leases and a competitive February auction for bottom-fixed offshore wind seabed leases. The Dutch and German governments have recently held auctions for offshore wind that is now set to be built subsidy-free, exposing developers with winning bids to more price volatility and potential price cannibalization. Speakers suggested that taking a Europe-style "zero-subsidy route" in the UK would threaten the viability of its 40 GW offshore wind target. Jim Smith is managing director of the renewables arm of Scottish utility SSE, which has 17 offshore wind assets in operation and another three under construction, and this week announced it would invest £100 million with Japanese major Marubeni into the Scottish offshore wind supply chain. (IHS Markit Net-Zero Business Daily's Cristina Brooks)

- According to German Federal Statistical Office (FSO) data, real retail sales excluding cars increased by 1.1% month on month (m/m; seasonally and calendar adjusted) in August, partially recovering from July's plunge of -4.5% (revised up from -5.1% initially). (IHS Markit Economist Timo Klein)

- The real adjusted year-on-year (y/y) rate has broadly stabilized at 0.4%. This annual rate also applied to the non-calendar-adjusted series given the absence of any shopping-day effects. The positive gap with February 2020 - the last month before the pandemic erupted - was 6.0% in August.

- The stabilization in August suggests that the setback in July was a one-off event related to consumers temporarily concentrating their spending on holiday travel, having satisfied their most urgent retail needs in May-June already, following the lifting of many pandemic-related restrictions for shops selling non-essential items.

- The August breakdown by goods category, based on price-adjusted y/y data (total 0.4% without shopping-day adjustment; see table below), revealed a major divergence between food and non-food sales, unlike in July. An annual drop of food sales by 6.6% contrasts with an increase in non-food sales by 4.9% y/y. Among the latter, pharmaceutical/cosmetic goods again did best (10.5% y/y), as in July. Unusually so, clothing/shoes moved into second place at 8.3% y/y, followed by the traditional leader in recent times, 'internet and mail orders' (7.4%). Specialized shops also enjoyed higher revenues (4.1%), whereas 'furniture/household goods/DIY' (-2.5%) and general department stores (-3.1%) did worse than a year earlier.

- Continental has announced plans to restructure its automotive business. According to a statement, the unit will now become the Automotive Technologies group sector, and is being "comprehensively realigned according to strategic action fields." It is being split into five business areas that will come into effect from 1 January 2022. Safety and Motion will be led by Matthias Matic, while Autonomous Mobility will be managed by Frank Petznick. The company said that these two units will "combine the business for advanced driver assistance systems and for automated driving with the business activities related to safety electronics, sensors, as well as brake and chassis systems." SmartMobility will be led by Ismail Dagli and "will pool the business for mobility services, fleet operators and commercial vehicle manufacturers". User Experience will be taken over by Philipp von Hirschheydt and will combine the business for display and operating technologies, as well as sound solutions. Architecture and Networking will consolidate activities related to connectivity technologies, vehicle electronics and high-performance computers. Continental said that as part of the realignment of Automotive Technologies, the overarching advanced engineering organization, Holistic Engineering and Technologies (he(a)t) under the leadership of future chief technology officer (CTO) Gilles Mabire will be strengthened to include a sixth field known as Software and Systems Excellence. This will draw on the experience and expertise of Elektrobit (including Argus) and Continental Engineering Services. The changes are predominantly focused on the Automotive business, although its Tires and ContiTech units will be standalone group sectors. (IHS Markit AutoIntelligence's Ian Fletcher)

- Honda said it plans to develop a rocket to launch low-earth orbit satellites to be used for its connected cars. To achieve this, Honda will make use of the control and guidance technologies it has created through the development of automated vehicles. The automaker, which has been working on small rockets, plans to reuse them by enabling some of the components to land back on Earth after launching, reports The Japan Times. Low-orbit satellites will help Honda with the high-speed internet connectivity, accurate navigation, and cloud-computing capabilities that are required to develop connected and autonomous vehicles (AVs). Chinese automaker Geely is also working on launching low-orbit satellites in an attempt to enable accurate navigation data for AV development. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 04 October 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.