All major European equity indices closed higher on the week, while US and APAC markets were mixed. US and all benchmark European government bonds closed sharply lower. European iTraxx and CDX-NA closed wider on the week across IG and high yield. Oil, silver, and copper closed higher, the US dollar was flat, and gold and natural gas were lower on the week.

Americas

All major US equity markets closed higher on the week except for Russell 2000 -0.4%; DJIA +1.2%, S&P 500 +0.8%, and Nasdaq +0.1%.

10yr US govt bonds closed at a 1.61% yield and 30yr bonds 2.17% yield, which is +15bp and +14bps week-over-week, respectively.

DXY US dollar index closed 94.07 (flat WoW).

Gold closed $1,757 per troy oz (-0.1% WoW), silver closed $22.71 per troy oz (+0.7% WoW), and copper closed $4.28 per pound (+2.1% WoW).

Crude Oil closed $79.35 per barrel (+4.6% WoW) and natural gas closed $5.57 per mmbtu (-1.0% WoW).

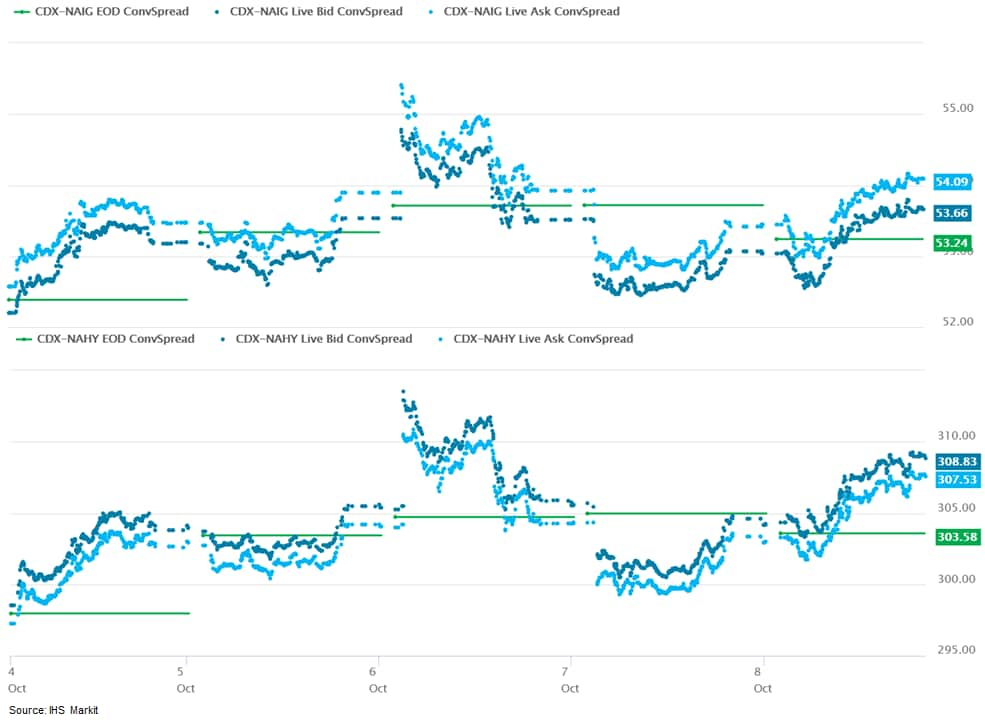

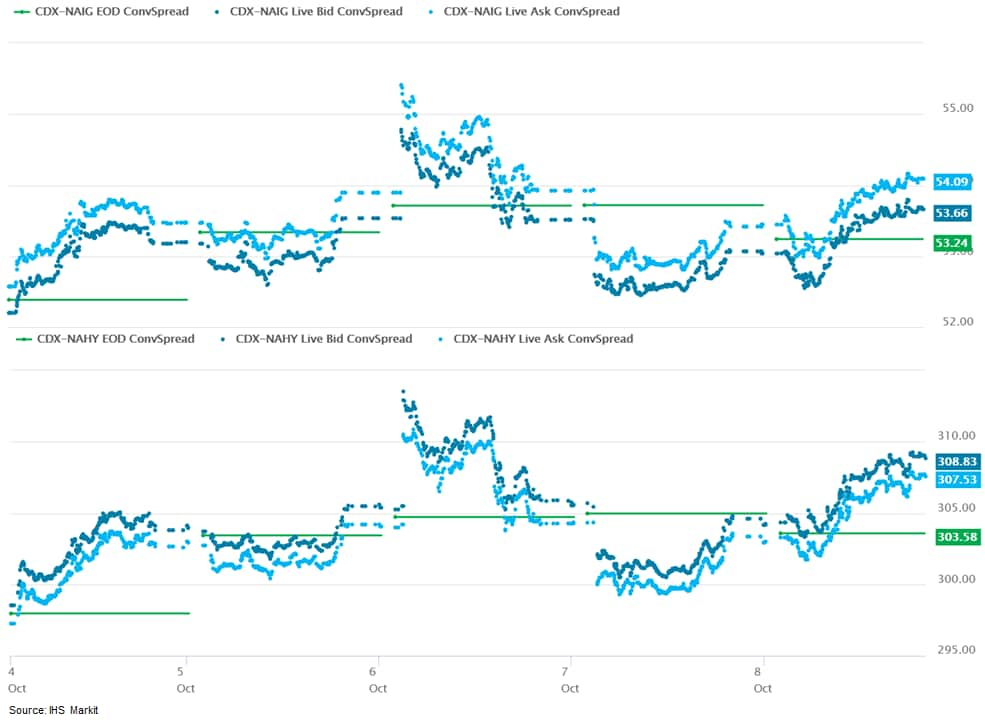

CDX-NAIG closed at 54bps and CDX-NAHY 308bps, which is +2bp and +10bps week-over-week, respectively.

EMEA

All major European equity indices closed higher on the week; Spain +1.8%, Italy +1.7%, UK +1.0%, France +0.6%, and Germany +0.3% week-over-week.

All major 10yr European government bonds closed lower on the week; Italy/Spain+6bps, France/Germany+7bps, and UK+16bps week-over-week.

Brent Crude closed $82.39 per barrel (+3.9% WoW).

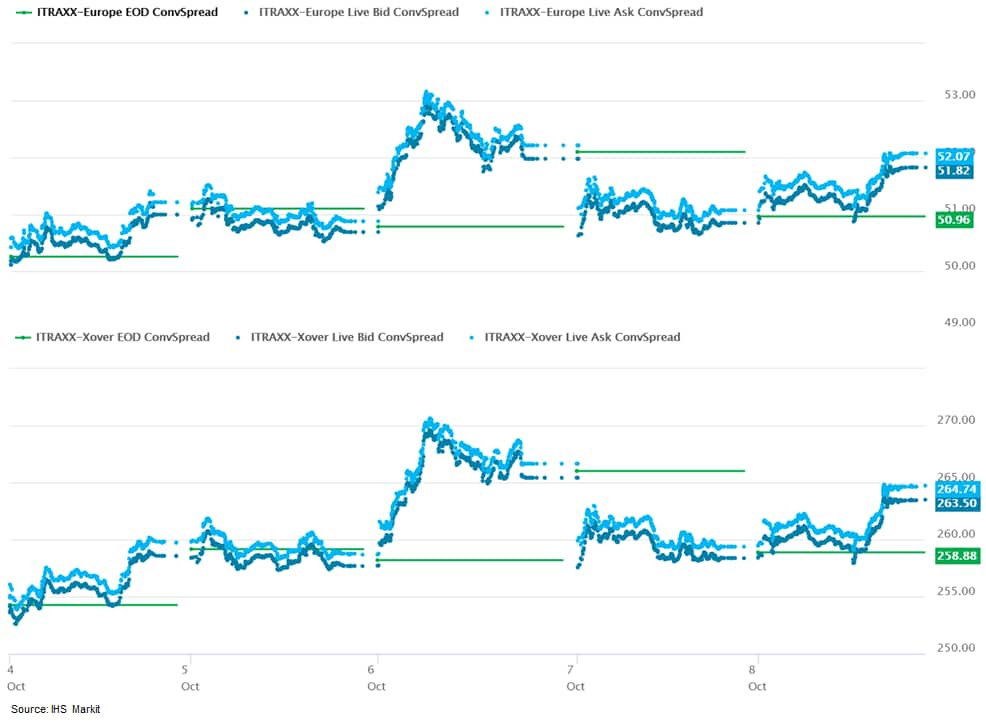

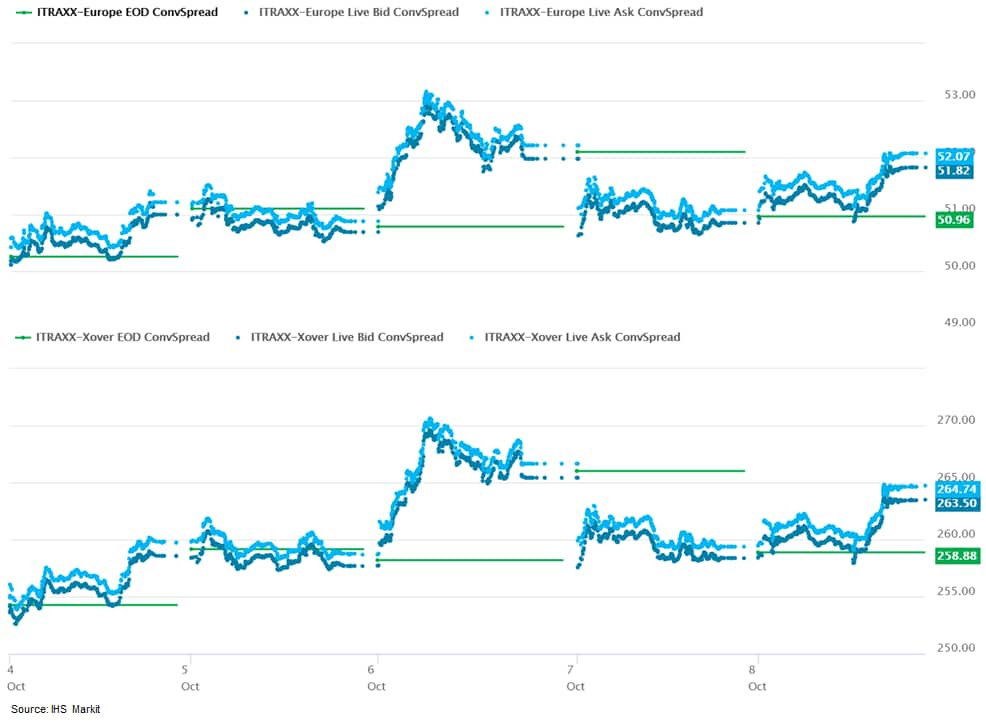

iTraxx-Europe closed 52bps and iTraxx-Xover 264bps, which is +2bp and +10bps week-over-week, respectively.

APAC

Major APAC equity markets closed mixed on the week; India +2.2%, Australia +1.9%, Hong Kong +1.1%, Mainland China +0.7%, South Korea -2.1%, and Japan -2.5% week over week.

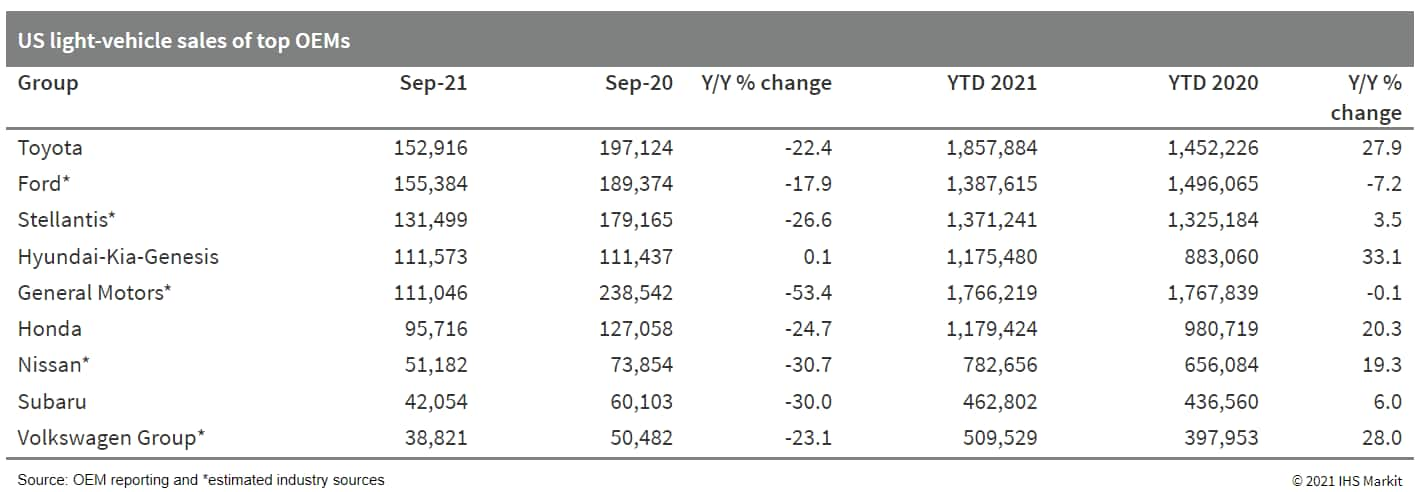

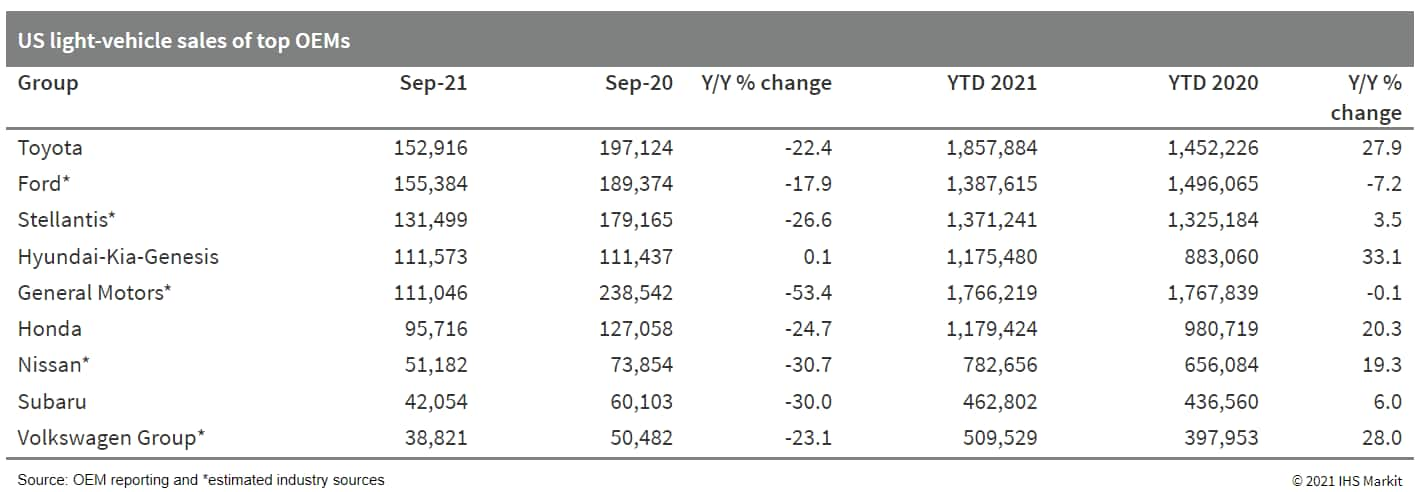

- US light-vehicle sales were impacted more sharply by low inventory levels in September than in August and y/y sales dropped 26.1%. In the year to date, the sales improvement has been constrained at 13.2%. Light vehicle sales in September were at the lowest monthly level since April 2020, during the depths of the COVID-19 lockdown period of last year. The lack of inventory is holding down the sales volume despite favorable consumer interest and buying conditions. This situation is expected to continue through 2021 and into 2022. IHS Markit has decreased its forecast for US light-vehicle sales in 2021 to 15.55 million units. This figure is up from 14.59 million units in 2020, but less than the over 16 million units in prior forecasts. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Foxconn and Lordstown Motors have announced an "agreement in principle" for the two to "work jointly" on Lordstown electric vehicle (EV) programs at the EV truck startup's Ohio (US) manufacturing facility. In addition, Foxconn has agreed to buy USD50 million of Lordstown stock, according to press statements from both companies. The two companies say the "goal of the partnership is to present both Lordstown Motors and Foxconn with increased market opportunities in scalable electric vehicle production in North America." There are four key elements of the tentative agreement. First, the two will use "commercially reasonable best efforts" to negotiate the sale of Lordstown's Ohio plant to Foxconn for USD230 million. That would, however, exclude Lordstown Motors' hub motor assembly line, battery module and packing line assets, as well as other undefined intellectual property rights and other excluded assets. Second, the two will negotiate a contract manufacturing agreement under which Foxconn would manufacture the Lordstown Motors Endurance; this would be a condition of closing any sale of the plant. Under this condition, Lordstown would also agree to provide Foxconn with certain rights to future Lordstown vehicle programs. Third, Lordstown Motors would issue warrants to Foxconn for 1.7 million shares of common stock at an exercise price of USD10.50 per share; this would be exercisable until the third anniversary of the deal's close. Fourth, the two have agreed to explore licensing arrangements for additional pick-up truck programs. Fifth, following closing, Lordstown would enter into a long-term lease for a portion of the facility for its current Ohio-based employees, and Foxconn would offer employment to agreed-upon Lordstown operational and manufacturing employees. Although the deal does have potential for both companies, as Lordstown has a larger plant than it needs now and the facility could speed up Foxconn's automotive production aspirations, these are early negotiations, and it is unclear when or if the talks will ultimately bear fruit. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Brent prices zoomed past $80/bbl this morning as OPEC+ announced an agreement to continue increasing production in November by 400,000 b/d, in line with recent monthly increases. Continued production increases were largely a foregone conclusion given recent price action and shortage fears spreading through energy markets like wildfire. Despite some rumors over the weekend of a potential pro-active acceleration of the unwinding to alleviate market anxiety, the group issued a remarkably swift decision to stick to schedule, maintaining the reactive and lead-from-behind posture championed by Saudi Energy Minister Abdulaziz bin Salman and adopted by the group through much of this year. While the move will keep the OPEC+ production cursor pointed higher over the next few months and likely into the winter, it may fall short of disproving spare capacity naysayers or responding to what is likely an increasingly loud chorus of consuming countries. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, and Sean Karst)

- Communication is key: With prices above $80/bbl, OPEC+ is now walking a delicate line between what could be described as pragmatic reactive management and either intentional or unintentional under-supplying of tightening markets amid a global energy crisis. Where markets interpret OPEC+ actions along this spectrum can have dramatically different price implications. Whereas pragmatic reactive management implies an ability to respond to market needs if the stability of physical markets is threatened, undersupplying markets implies either willingly or, more bullish still, unwillingly, squeezing markets at a time when oil demand is liable to benefit from the unexpected switching boon from gas.

- A full increase of 400,000 b/d would put more oil into the system than our current base case, which calls for flatter OPEC+ output as some gulf members step back to make way for more Russian and Kazakh increases, with other members beginning to reach production ceilings. In November we forecast a global deficit of 800,000 b/d (with a monthly OPEC+ uplift of 200,000 b/d), which could be closer to 1 MMb/d as switching from natural gas to fuel oil and diesel begins to bite in the northern hemisphere. This risk extends through the winter, with any surprise stock declines starting to have a bigger impact on price now that the huge inventory buffer from 2020 is gone in most markets outside of China.

- Paris-based investment firm Ardian joined forces with Zurich-based FiveT Hydrogen on 1 October to create a €1.5-billion ($1.7 billion) fund known as Hy24 that will be dedicated to accelerating large-scale clean hydrogen projects and infrastructure. (IHS Markit Net-Zero Business Daily's Amena Saiyid and Mark Thomas)

- Hydrogen, especially the "green" variety produced from renewable power sources, is increasingly being viewed as an alternative to carbon-intensive fossil fuels because in liquid form it can be transported in existing pipelines, in solid form it can be used in fuel cells for automobiles, and it can be used to produce steel and cement, two traditionally carbon-intensive industrial processes.

- Expected to secure its first closing before the end of 2021, Hy24 plans to reach its funding goal by drawing on global chemical, energy, engineering, and construction companies as well as institutional investors that are already vested in finding clean hydrogen solutions. The partners say they will be creating "the industry's largest clean hydrogen infrastructure manager."

- Hy24 already has commitments from two sets of investors: Air Liquide, TotalEnergies, and construction group Vinci being one, while New York-based Plug Power, original equipment manufacturer (OEM) Chart Industries, and Baker Hughes form the other.

- The fund has already secured initial commitments of €800 million ($927.5 million), the backers say. Air Liquide, TotalEnergies, and Vinci said 1 October they each will invest €100 million ($115 million). Lotte Chemical and financial services group Axa also have indicated a commitment to participate as anchor investors, according to Hy24.

- The People's Bank of China and the China Banking and Insurance Commission at the end of September held a working seminar with several local government bodies and 24 major banks. The meeting reiterated the importance of several things: stable real estate financing to encourage wider financial stability, "stable land price, stable house price and stable expectations", and the notion of property for living, not for flipping. In addition, the meeting also noted the need to protect homeowners' rights and the need to speed up financing for homes for rent. (IHS Markit Banking Risk's Angus Lam)

- Real estate financing has come into focus since the house price slowdown in China and the issues with Evergrande Group. The current focus is not surprising since about 29% of loans issued by Chinese banks are used towards the real estate sector.

- Chinese authorities have already stepped up their safety net around Evergrande Group through taking control of the pre-sale revenues of housing projects to ensure that the funds are used to develop the projects, therefore allowing their completion. IHS Markit expects that this will affect Evergrande's ability to repay its liabilities to debt holders but will reduce the contagion risk and homebuyers' confidence in terms of property projects that are yet to be completed. It is currently uncertain whether the move will become a permanent feature for all property projects from all developers in China.

- US Trade Representative Katherine Tai spoke about US-China trade relations at the Center for Strategic and International Studies in Washington, DC on 4 October, announcing the US's intention to begin a new round of trade negotiations with her Chinese Counterpart - Vice Premier and Communist Party of China (CPC) Politburo member Liu He - over China's performance under the Phase-one trade agreement. (IHS Markit Country Risk's David Li and John Raines)

- The US policy position appears largely unchanged, with potential for additional measures and stronger scrutiny of Chinese state-owned firms. Although the official restart of negotiations is a risk-positive development for both sides, the US's overall policy position on trade relations with China remains largely unchanged, with US media suggesting that most existing tariffs will remain in place. Tai's speech also raised the possibility of additional levies against Chinese products, following the conclusion of the Phase-one agreement's two-year purchasing commitment timeline. However, Tai also said that the administration of President Joe Biden would reinitiate the process under which US companies can apply for tariff exclusions with the aim of "optimally serving [US] economic interests", suggesting a more targeted approach and greater openness to adjust the current tariff regime.

- The US also indicated that it would move away from a unilateral approach, signaling greater intent to engage with Indo-Pacific allies through bilateral and multilateral channels. Although it remains highly unlikely that the US would directly engage Indo-Pacific countries through multilateral trade agreements (Tai indicated that the US does not intend to rejoin the CPTPP), it is likely to utilize multilateral platforms more actively for dispute settlement, and to provide political support to countries that face discriminatory economic measures from China.

- China is unlikely to make significant concessions regarding its state-led economic development model, and is also likely to continue its combative diplomatic position against the US. Upcoming domestic political events in China will encourage President Xi Jinping and his administration to project strength domestically, bolster unity, and to avoid the risk of being perceived domestically to have yielded to US demands.

- The US position of challenging China from a "position of strength" would threaten Chinese interests if it were accompanied by targeted statements or actions, such as new sanctions or support for allies in areas that Beijing perceives as crossing "red lines", including territorial issues in the South China Sea and the Taiwan Strait.

- If the US applies a more generous tariff exemption mechanism than during the previous Trump administration - particularly in the technology, electronics, and manufacturing sectors - this would indicate US intent to de-escalate trade disputes with China, improving the prospects for a favorable outcome for negotiations.

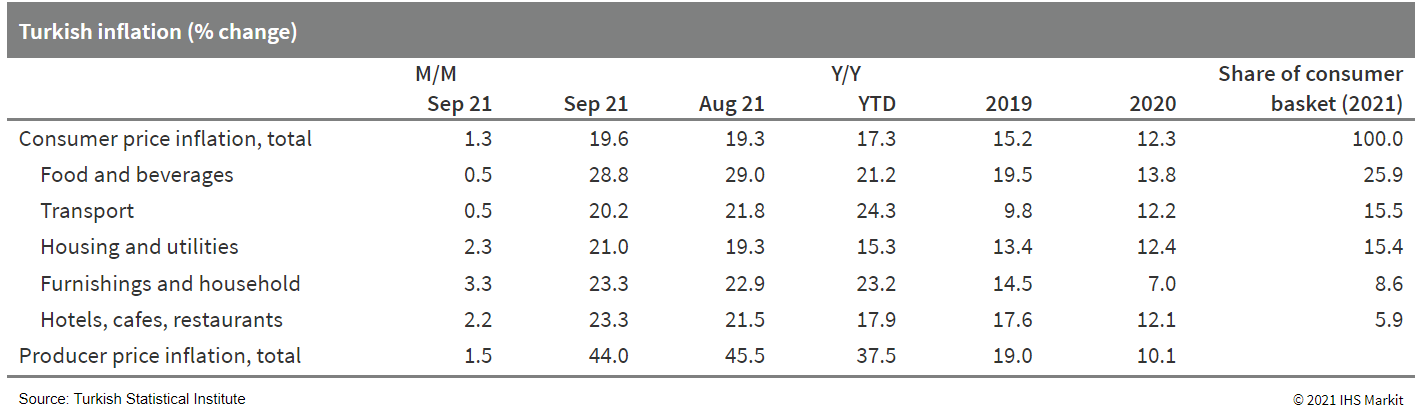

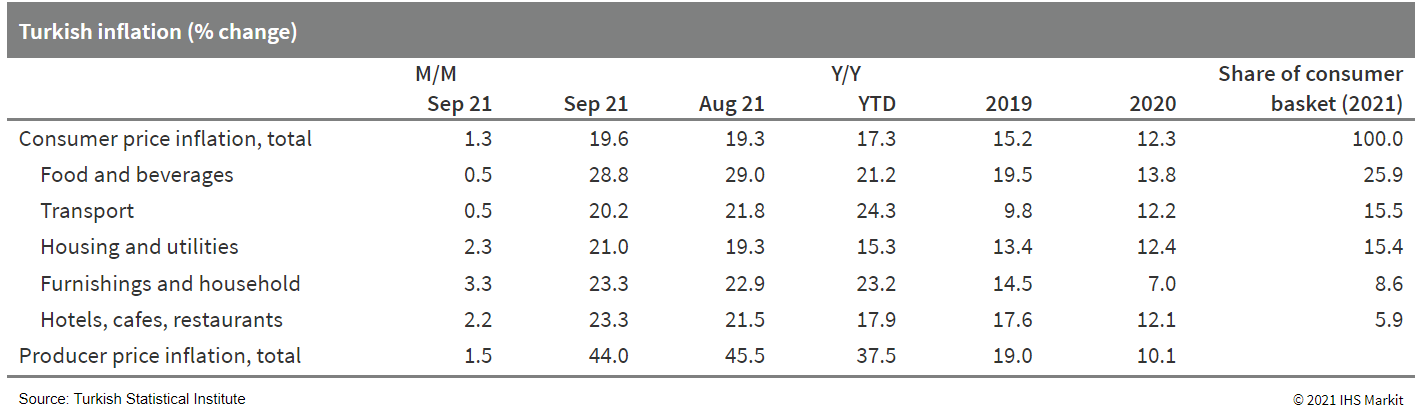

- In September, Turkish annual consumer price inflation continued to rise, pushing to 19.6% according to data from the Turkish Statistical Institute (TurkStat). Inflation has been on an upward trajectory since late 2019, nearly eight percentage points higher than it had been a year earlier. (IHS Markit Economist Andrew Birch)

- The sharp rise of food prices - which comprise more than one-quarter of the consumer price index basket - was the primary driver of overall inflation, up 28.8% as of September. However, transport, housing, and hotel, café, and restaurant prices all also contributed strongly to headline inflation.

- Core inflation also continued to accelerate in September, up to 17.0% according to TurkStat, up from 16.8% the previous month and more than 5.5 percentage points higher than it had been a year earlier. Sharp lira losses over the past year are contributing to the rise of all prices.

- The sharp acceleration of producer price inflation paused in September, though price growth was still substantial, at 44.0%. Soaring input prices are putting upward pressure on producers, who will pass along those added costs, eventually, to consumers.

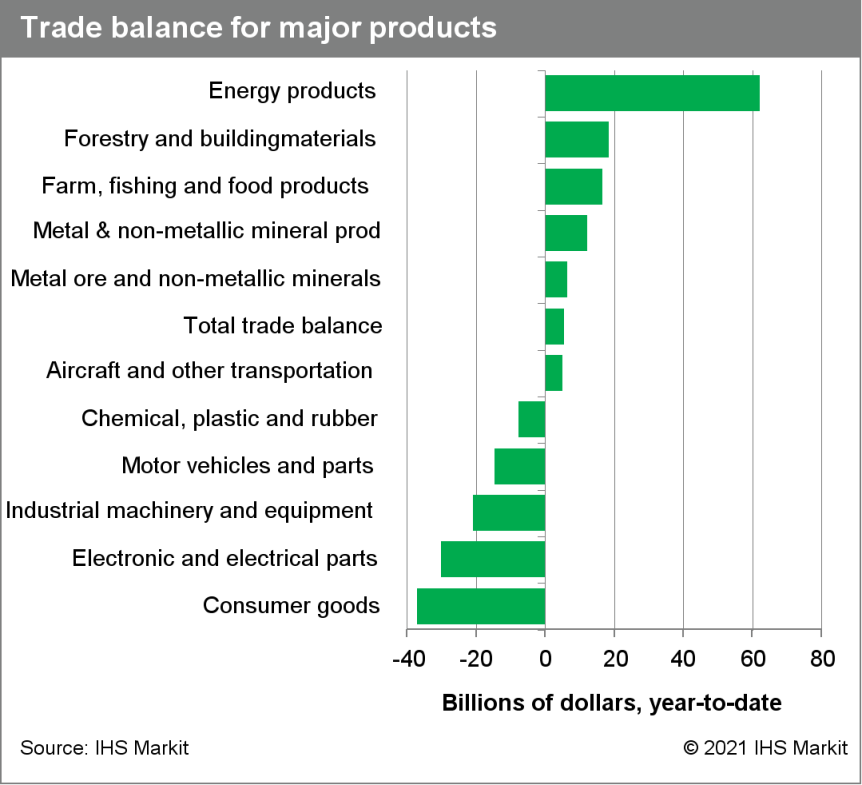

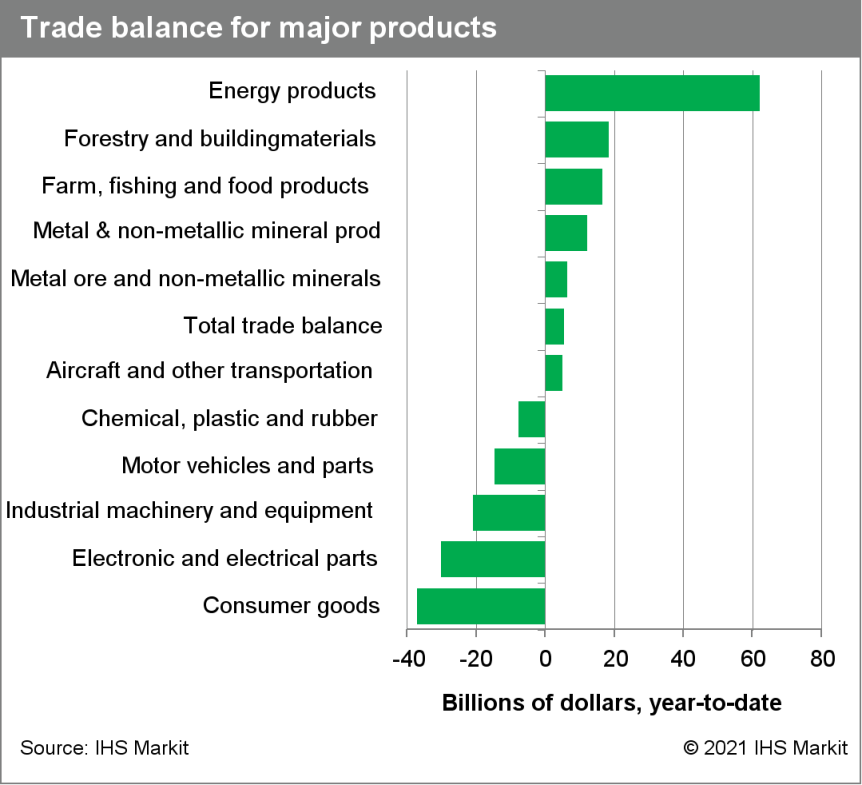

- Canada's merchandise trade balance has registered three consecutive—and six total—surpluses in 2021 so far, after consistent deficits since late 2014.This month's export gain was supported by higher levels of natural gas, crude oil, and coal pushing energy product exports up 5.1% m/m. Intermediate metal products also helped lift exports. (IHS Markit Economist Evan Andrade)

- The merchandise trade balance reached a surplus of $1.9 billion in August, after posting a surplus of $778 million the month prior.

- Nominal exports grew 0.8% month on month (m/m) to $54.4 billion—advancing for a third consecutive month—while imports declined 1.4% m/m to $52.5 billion.

- On a volume basis, real exports advanced a further 2.3% m/m while imports fell 2.5% m/m.

- Automotive trade took a bite out of both sides of the trade ledger, as exports fell 7.3% m/m and imports fell a further 11.1% m/m, driven almost entirely by lower volumes.

- General Motors (GM) and Wolfspeed have reached a strategic supplier agreement on silicon carbide. Under the agreement, the supplier is to develop and provide silicon-carbide power device solutions to the automaker. No financial terms were disclosed. GM's statement said, "Wolfspeed's silicon carbide devices will enable GM to install more efficient EV [electric vehicle] propulsion systems that will extend the range of its rapidly expanding EV portfolio." The silicon-carbide devices will be used in the integrated power electronics in the GM Ultium Drive units in EVs. GM will participate in the Wolfspeed Assurance of Supply Program, a project the company says is intended to secure domestic, sustainable and scalable materials for EV production. The silicon-carbide power device solutions are to be produced at Wolfspeed's 200mm-capable Mohawk Valley fabrication facility in Marcy, New York (United States). The facility is due to open in mid-2022 and will be the world's largest silicon-carbide fabrication facility, according to the announcement. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Geely has begun mass production of low earth orbit satellites to enable accurate navigation data for autonomous vehicle (AV) development, reports The Nikkei. The production takes place in China's Taizhou, Zhejiang Province, with an annual capacity target of approximately 500 satellites. These satellites are independently developed by Geely group company Geespace, which was launched in 2018 to develop and operate low-orbit satellites. This marks the entry of China's largest privately owned automaker into a field long dominated by the military. Low-orbit satellites will help Geely with the high-speed internet connectivity, accurate navigation, and cloud-computing capabilities that are required to develop AVs. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The world's three largest orange juice (OJ) producers, Brazil, the US and Mexico, are expected to produce 1.76 billion gallons of single strength equivalent (SSE) orange juice in 2020-21, according to the final season outlook update published by Florida Department of Citrus (FDOC) on 30 September. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Taking into account the combined beginning inventories that amounted to 604.6 million gallons of SSE OJ at the start of the 2020-21 season and the expected total production of 1.76 billion gallons of SSE OJ in 2020-21, the total availability of OJ will reach 2.36 billion gallons of SSE juice. This represents a 19% y/y drop from the comparative figure of 2.92 billion gallons of total available SSE OJ in the previous season.

- This represents a decrease of almost 500 million gallons of SSE OJ from the previous season, which is largely due to the decline in juice yields and reduced orange production.

- "At the conclusion of the Florida 2020-21 season, preliminary estimates indicate that total supply of orange juice on the world market was forecasted to decrease by 21.8% over the previous period from 2.25 billion SSE gallons to 1.76 billion SSE gallons due to reduced availability in production from leading suppliers, such as Brazil, Mexico, and the United States," stated the FDOC.

- Brazil, the largest global OJ producer, is expected to produce 1.22 billion gallons (-30.9% y/y) of SSE OJ during its season that runs from July 2020 to June 2021, followed by Mexico with 278.5 million gallons (+122.2% y/y) of SSE OJ in its season that runs from October 2020 to September 2021.

- Mexico has overtaken the US in the rankings as the US is projected to produce 263.5 million gallons (-27.7% y/y) of SSE OJ in the October 2020 to September 2021 season.

- Henry Hub natural gas reached a new almost 13-year intraday high of $6.45 per mmbtu Wednesday at 3:20am ET, before dropping precipitously to close -10.1%/$5.68 per mmbtu.

- The Federal Reserve Bank of New York (NY Federal Reserve) for the first time has linked the indirect risks that climate change poses to the banking sector. The staff of the regional reserve bank examined the impact on banks with loans to the oil and gas sector by using a stress test approach that was developed in response to the 2008 global subprime mortgage crisis. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- In a recently released report, Hyeyoon Jung, Robert Engle, and Richard Berner of the NY Federal Reserve found that the exposure for some of these banks arising from indirect climate risk to be "economically substantial."

- "This report shows that this risk is so concentrated in the equity of the world's largest banks that it could threaten their ability to retain prudential capital reserves, and in turn limit their ability to withstand financial shocks that could threaten global financial stability as a whole," IHS Markit CleanTech and Climate Executive Director Peter Gardett told Net-Zero Business Daily.

- The staff reached this conclusion after measuring climate risk in 27 large global banks in the UK, US, Canada, Japan, and France that together hold more than 80% of the syndicated loans made to the oil and gas industry.

- Their report, however, stopped short of recommending any course of action for the US Federal Reserve Board, which plans to include climate change risk as part of its framework to assess the financial stability of banks that it oversees, and is in the throes of completing a study.

- Dow announced several developments related to circular plastics production during its 2021 Investor Day on 6 October. Each of the moves concerns the supply of pyrolysis oil, a naphtha-like steam-cracker feedstock derived from plastic waste. (IHS Markit Chemical Advisory)

- In Europe, Dow has expanded on an initial 2019 agreement with Fuenix Ecogy Group to build a second plant in Weert, Netherlands, with the capacity to process 20,000 metric tons/year of waste plastics. The resulting pyrolysis oil will be used to produce circular plastics at Dow's Terneuzen site in the Netherlands.

- Dow has also finalized an agreement with Gunvor Petroleum Rotterdam, a refinery located in the Port of Rotterdam, Netherlands, to purify pyrolysis oil. Gunvor will supply the cracker-ready feedstock to Dow beginning this year. Dow is separately fast-tracking the design, engineering, and construction of a market development-scale pyrolysis oil purification unit in Terneuzen.

- In the US, Dow has established a multiyear agreement with New Hope Energy (Tyler, Texas) to supply pyrolysis oil. New Hope Energy in May announced a pyrolysis oil supply agreement with CPChem.

- Dow says it has received or is on track to receive International Sustainability & Carbon Certification (ISCC) for each of its major European and US sites. The certification, which must be renewed annually, allows Dow to guarantee the circularity of plastics supplied to customers.

- In April, Dow announced a partnership with Mura Technology to support the rapid scaling of Mura's new Hydrothermal Plastic Recycling Solution (HydroPRS) advanced recycling process. The world's first HydroPRS plant is in development in Teesside, UK, with the first 20,000-metric tons/year line expected to begin supplying feedstock to Dow in 2023.

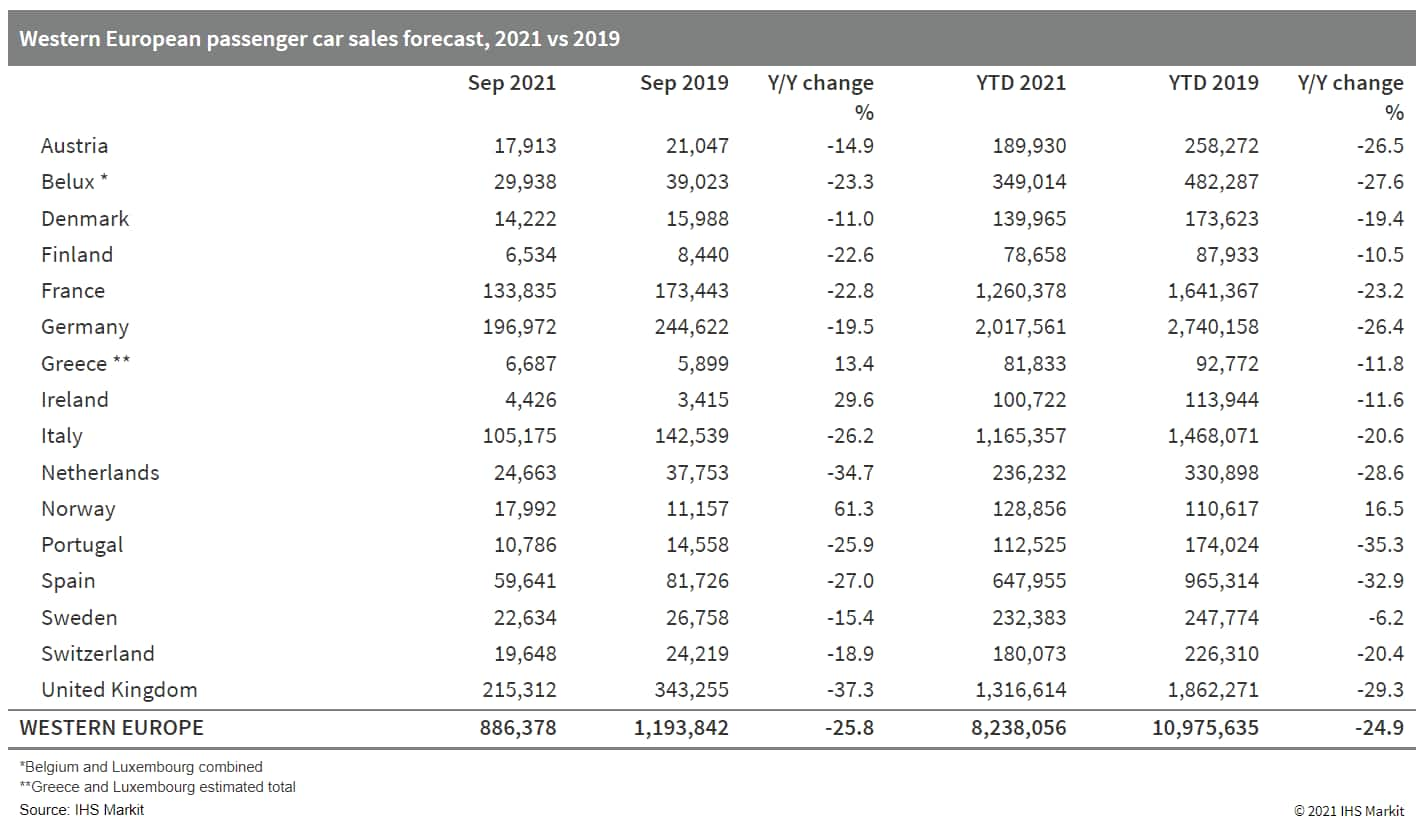

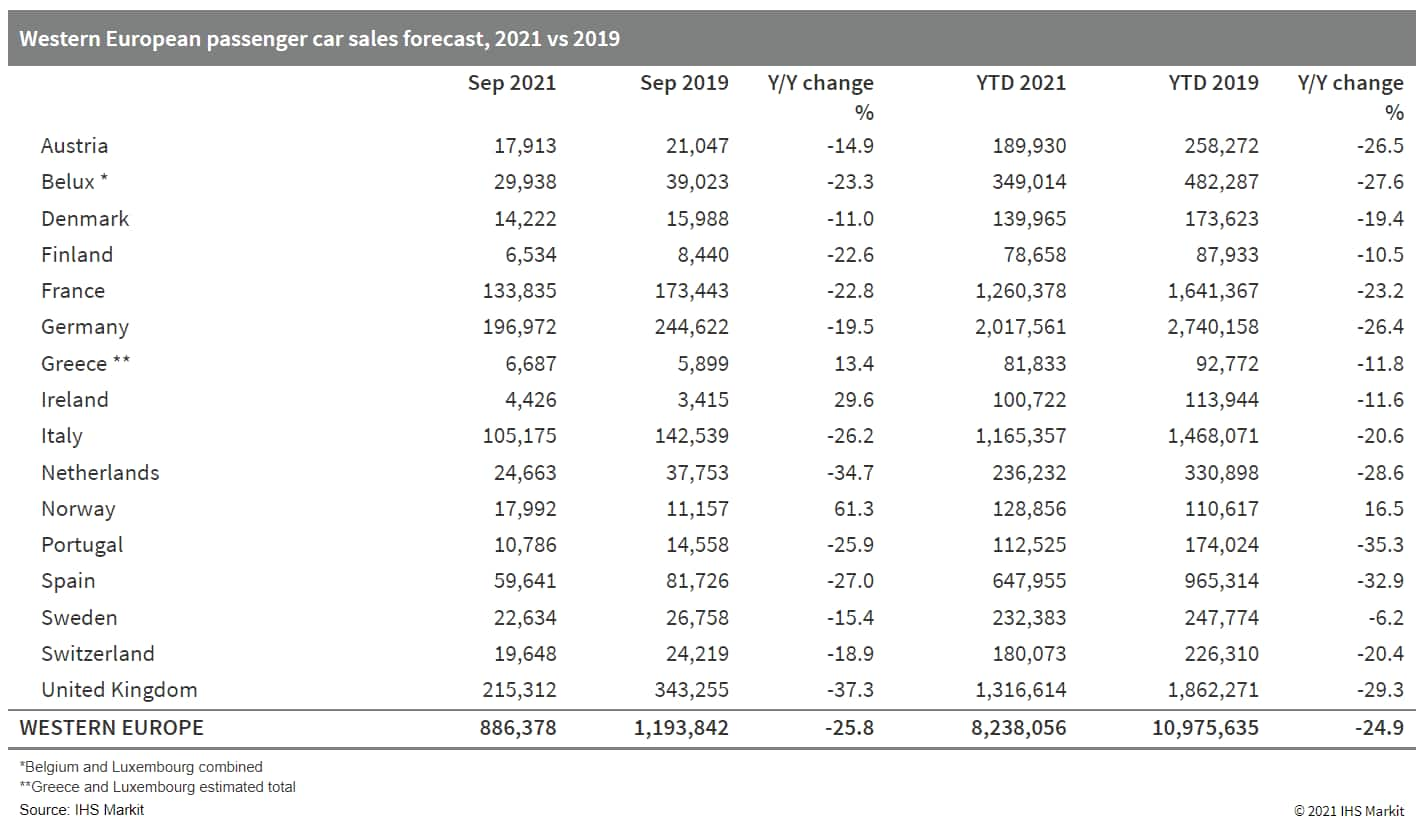

- Western European passenger car registrations fell back further during September. According to our latest forecast, registrations in the region declined by 26% year on year (y/y) last month to 886,378 units. Nevertheless, earlier substantial gains have helped to keep volumes in positive territory in the year to date (YTD). For the first three quarters of 2021, registrations are up 6.5% y/y at around 8.238 million units. The further downswing in the market during September has led to the seasonally adjusted annual rate (SAAR; D11) falling back to 9.643 million units, while the final trend cycle (D12) figure sits at 9.830 million units. We have also published a comparison with 2019 data that underlines the continued weakness of the market compared with pre-COVID-19 pandemic levels, showing a 25.8% decline last month compared with September 2019 and a 24.9% retreat when comparing the YTD 2021 and 2019 figures. Last month was yet another weak one for Western Europe following a relatively flat September 2020. One of the big factors dragging down the performance last month was a lack of supply of vehicles due to the ongoing semiconductor shortage, which has been hitting output around the world and is continuing to do so. Besides the direct impact on the supply of vehicles to customers from factories, the duration of the shortage has depleted inventories to much lower levels than usual as OEMs have been unable to restock. (IHS Markit AutoIntelligence's Ian Fletcher)

- LG Electronics has said that its advanced driver assistance systems (ADAS) front camera will be deployed in the Mercedes-Benz C-Class, reports the Yonhap News Agency. The camera, which is co-developed by LG Electronics and Daimler, enables vehicle assist functions such as automatic emergency braking (AEB), lane keeping assist, lane departure warning (LKA), and traffic sign recognition. It said that the camera is powered by algorithms developed by its vehicle components solutions (VS) business unit, incorporating technologies of telecommunications, telematics, and image recognition, as well as artificial intelligence (AI) and deep learning. It has obtained ISO 26262 certification from independent inspection body TÜV SÜD. LG Electronics is expanding its presence in the future mobility sector with three focus areas: infotainment, powertrain, and auto lighting systems. The VS division reported sales of KRW5.80 trillion in 2020, up by 6.1% from 2019. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- After contracting 26% y/y in the second quarter of 2020 on the back of strict COVID-19 pandemic-related restriction measures introduced in April 2020, Botswana's real GDP expanded by 36% y/y during the second quarter of 2021. The record growth rate largely reflects low base effects and a gradual resumption of economic activities postponed or restricted due to measures taken by the government to curb the spread of the COVID-19 virus. On a quarterly basis, Botswana's real GDP growth decelerated to 0.2% in the second quarter, from 5% in the first quarter. (IHS Markit Economist Archbold Macheka)

- Economic growth in the second quarter was broad-based, with activity in all industries expanding, except agriculture, forestry and fishing, which contracted 8.4% y/y as real value added of livestock farming shrank 17.2% y/y because fewer cattle were marketed during the quarter under review. The public administration and defence sector, which remained the major contributor to GDP, accounting for 18.5%, grew 5.6% y/y in the second quarter of 2021, compared with 1.3% y/y in the second quarter of 2020.

- Mining and quarrying accounted for 14.2% of total GDP by growing 153% y/y in the second quarter of 2021, after declining 60.8% y/y in the corresponding quarter in 2020. The sharp rebound was driven mainly by a significant increase in the diamond industry's real value added of 172.2% y/y. This increase was thanks to diamond production in carats, which surged by 202.8% y/y as rough diamond demand gradually picked up.

- Although still not functioning at full capacity, Botswana's economy is not far off its pre-pandemic growth pace, but various hurdles to maintaining this growth path persist. The country's COVID-19 vaccine rollout has been slow, with only 234,777 people, representing 9.8% of the total population, fully vaccinated as of 4 October. Botswana is securing its vaccines under the World Health Organization-backed COVAX scheme and has signed up for 940,800 doses, but has so far received less than 10% of the total order. Additional agreements to supply vaccines have been reached with mainland China and US pharmaceutical company Moderna, while donations have since come in from India and mainland China.

- Spot sea 40-ft container prices halved to $8,000 in routes from China to the US west coast after many Chinese factories temporarily closed due to power cuts. In addition, spot 40 ft. container prices fell by a quarter to $15,000 between Chinese ports and the US east coast. However, US sea shipping companies are still increasing their long-term contracts, following trends led by the Shanghai Ocean Shipping Exchange (SSE), the Vietnamese Cashew Association (Vinacas) reported. The research company Caixin Global has explained that this sudden fall is due to the combination of manufacturing halt and the Chinese Golden Week (1-7 October) festival, with most players expecting rising prices in mid and long-term contracts until Q1 2022. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- The latest forecast from the US Energy Information Administration (EIA) reinforces messages that have been coming for the past year from international bodies, independent analysts, and climate advocates: at its current trajectory, humanity will fall far short of the Paris Agreement goal of reaching net-zero emissions by 2050. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- EIA's conclusion in its "International Energy Outlook 2021," released 6 October is that global energy demand will rise by 50% between 2020 and 2050, and carry annual CO2 emissions from this sector 24.7% higher.

- Annual energy CO2 emissions in 2050 will total 42.839 billion metric tons (mt) globally, representing a yearly average gain of 0.7% from 2020 onwards.

- EIA projects that renewable energy will make significant inroads in the global power mix by 2050, rising by 3.3% per year (compared with 1% for oil and 0.9% for natural gas). It says that batteries will contribute to reliability. Yet it states that gas and coal will be needed to meet power demand as well.

- Renewable generation will nearly triple from 65.1 quadrillion Btu in 2020 to 191.7 quadrillion Btu in 2050. This will place its share of the power market at about 58.4% in 2050, compared with about 27.6% today.

- Considering all end uses for energy-residential, commercial, industrial, and transportation-fossil fuels still will provide a large share, particularly for industry and transportation in 2050. However, it is worth noting that EIA places renewables' share of energy consumption (235.2 quadrillion Btu) nearly on par with hydrocarbon-based liquid fuels (248.5 quadrillion Btu), and ahead of gas and coal.

- Rising consumption of fossil fuels will overwhelm the improvements anticipated in the carbon intensity of energy production and usage, thus leading to the net gain in CO2 emissions.

- Hyundai Mobis has held a ground-breaking ceremony for its new fuel-cell stacks production plant at the Industrial Complex in Cheongna International City, Incheon, according to a company press release. The company plans to invest KRW1.3 trillion (USD1.1 billion) in this facility and also a new fuel-cell systems assembly plant in Ulsan. The new plants are expected to become operational from the second half of 2023. When fully operational, the facilities are expected to produce 100,000 hydrogen fuel cells every year. Once construction of these facilities is completed, Hyundai Mobis will operate a total of three fuel-cell plants. Hyundai Mobis is part of South Korea's leading automaker Hyundai Motor Group, which has a strong focus on hydrogen fuel-cell technology. (IHS Markit AutoIntelligence's Isha Sharma)

- August was an extremely weak month for German industrial output and orders, driven especially by the automotive and machinery/equipment sectors, which are suffering markedly from material shortages. The plunge in demand was exacerbated by an unwinding effect related to July's big-ticket (ship-building) orders from Asia. Germany's industrial sector will have a significant dampening effect on fourth-quarter GDP growth despite the ongoing support from the recovering service sector. (IHS Markit Economist Timo Klein)

- Seasonally and calendar-adjusted German industrial production excluding construction declined by 4.1% month on month (m/m) in August, representing a setback to levels last seen in September 2020. Furthermore, the latest output level is about 10% below its February 2020 pre-pandemic high.

- Total production including construction similarly posted a 4.0% m/m decline in August, given a comparable 3.1% drop in construction output. In contrast, energy output rebounded by 4.1% m/m, following a cumulative decline of 7.5% during May-July.

- The split by type of good reveals that the investment goods sector, which had outperformed in July, weakened the most during August. Nevertheless, the intermediate and consumer goods sectors also registered sizeable declines. In the case of the latter, this was the first decline since April, as the loosening of COVID-19-related restrictions in May had given consumer goods output a boost.

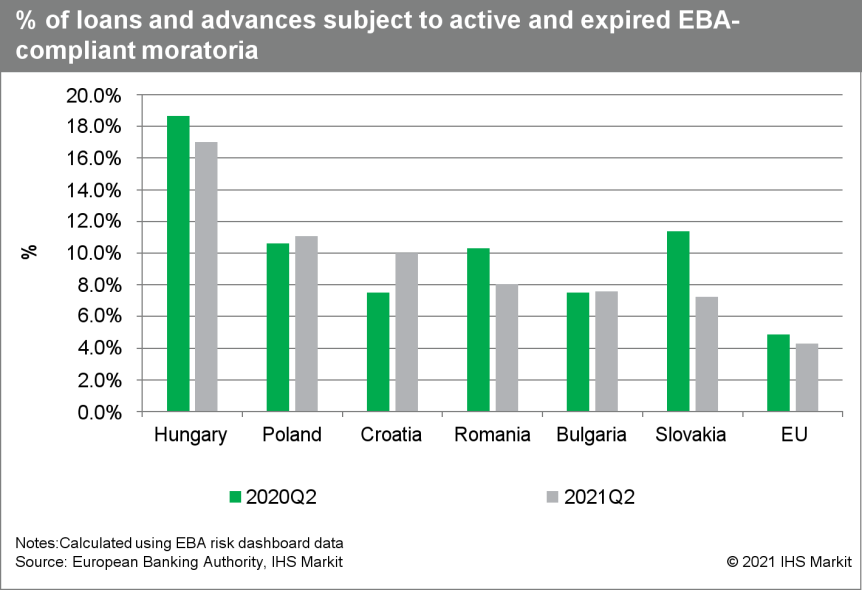

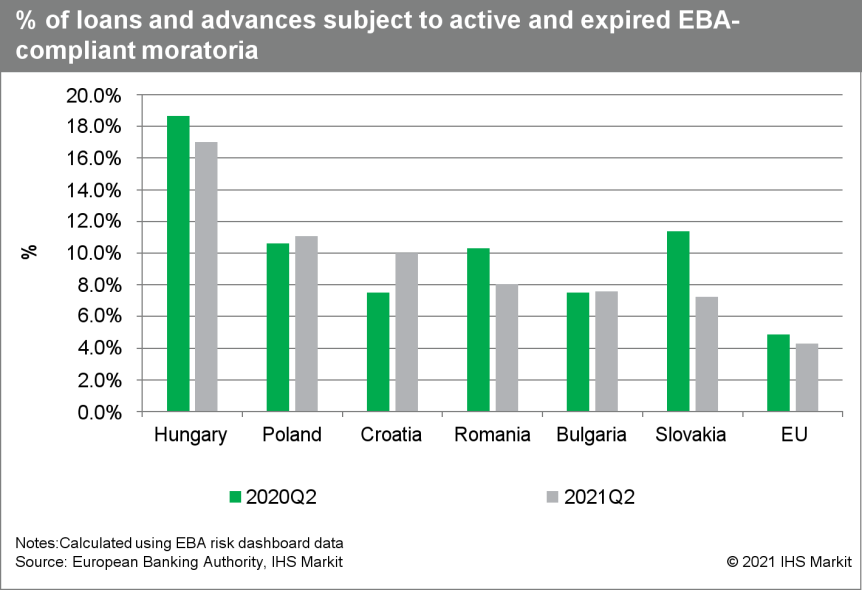

- The European Banking Authority (EBA) published on 6 October its latest quarterly risk dashboard covering banks' positions at the end of the second quarter of 2021. The dashboard was based on a sample of 131 banks covering 80% of the EU banking sector. Reported impairment remained stable - with the sample reporting an average non-performing loan (NPL) ratio of 2.3% - but assets under moratoria and state-relief schemes continued to face quality deterioration. Although there is a divergence at the sectoral level, the latest data reveal overall improving asset quality in Central and Eastern Europe (CEE). (IHS Markit Banking Risk's Greta Butaviciute, Brian Lawson, and Natasha McSwiggan)

- NPL and Stage 2 loan ratios have fallen for many countries but not all. Although NPL ratios have decreased in most countries, they have risen in sectors most affected by the remaining social distancing and travel restrictions measures, such as accommodation and food services, arts, entertainment, and recreation.

- The volume of loans under active EBA-eligible moratoria continued to fall in all countries for which data are available in the second quarter. However, the NPLs for loans still under moratoria rose in some countries, in particular Poland and Croatia, although they decreased in Bulgaria, Romania, and Slovakia.

- The total capital ratio stood comfortably at 19.6% in June 2021, while the leverage ratio rose by 0.1 percent to 5.7%, well above the EBA's recommended minimum of 3% for EU banks. The strong capital position reflected higher capital and a reduction in total assets on a quarterly basis, with the decline "driven by debt securities and derivatives". IHS Markit also assesses that temporary loan forbearance measures have prevented a rise in risk-weighted assets (RWAs), and capital ratios are likely to weaken when NPLs materialize.

- The return-on-assets ratio, despite having returned to a level recorded prior to the coronavirus disease 2019 (COVID-19) virus outbreak, remains very low at just 0.47% in June. At the cut-off date of end-June, 27.8% of reporting banks had a return on equity (ROE) of below 6%, versus 33.4% in the prior quarter; in the last quarter of 2020, 78.8% of banks had reported such low returns.

- Cyber risks and environmental, social, and governance (ESG) are areas of growing concern for financial stability. The EBA notes that no major cyberattack has yet been reported but assesses that banks' information and communication technology (ICT) systems "remain vulnerable to significant disruptions", with cyber risks exacerbated by remote working and extensive use of third-party providers.

- US employers announced 17,895 planned layoffs in September, according to Challenger, Gray & Christmas, up 14% from a 24-year low of 15,723 in August. The total for September is 85% lower than the September 2020 reading. (IHS Markit Economist Juan Turcios)

- For the year to date, 265,221 job cuts have been announced, down from the 2,082,262 job cuts announced over the same period in 2020 and the lowest January-September total on record (Challenger began tracking job-cut announcements in January 1993).

- According to Andrew Challenger, senior vice president of Challenger, Gray & Christmas, "These numbers are still incredibly low. Employers are devising ways to meet the needs of their employees, whether by addressing burnout and the desire for flexibility, raising wages, offering support for child and family care issues, or being more deliberate in their workers' career development plans. They want to retain, not cut."

- So far this year, employers have cited COVID-19 as a reason for 8,684 planned job cuts. In September, only 234 planned job cuts were due to COVID-19 despite the elevated count in new cases due to the Delta variant. Employers have cited other reasons, including closing (53,571), market conditions (48,148), restructuring (47,297), demand downturn (45,614), and acquisition/merger (12,225) more frequently than COVID-19 as causes of job-cut announcements this year.

- Aerospace/defense has announced 33,646 job cuts this year, the highest number of any industry. Rounding out the five sectors that have reported the most job cuts this year are telecommunications (25,148), services (22,505), energy (19,545), and health care/products (18,936).

- US Nonfarm payroll employment rose 194,000 in September, short of expectations. Prior months' gains, though, were revised higher. The unemployment rate declined 0.4 point to 4.8%, reflecting a large increase in civilian employment and a decline in the civilian labor force. (IHS Markit Economists Ben Herzon and Michael Konidaris)

- The deceleration in payroll employment was more than accounted for by a sharp decline in employment in education services (public and private), a sector with strong seasonal patterns and, hence, subject to seasonal distortions.

- In the typical September before the pandemic, employment in public and private education services would rise by about 1.5 million before seasonal adjustment. Employment in this sector rose 1.3 million this September, leading to a 180,000 decline after seasonal adjustment.

- Outside of this sector, payrolls expanded 374,000 in September, up from a gain of 303,000 in August. These are reasonably solid gains but are down from considerably stronger gains earlier in the year.

- The Delta wave of new COVID-19 infections is taking a toll on employment in accommodation and food services. After rising an average of 282,000 per month over the six months ending in July, employment in this sector has risen only a cumulative 20,000 since.

- Voyager Therapeutics (US) has announced that it has entered into an agreement giving Pfizer (US) the option to license novel capsids generated from its proprietary RNA-driven TRACER (Tropism Redirection of AAV by Cell-type-specific Expression of RNA) screening technology, using two undisclosed transgenes to treat certain neurologic and cardiovascular diseases. Under the terms of the deal, Voyager will receive USD30 million upfront, and stands to receive up to USD20 million in exercise fees for two options, which Pfizer can select within 12 months. In addition, Voyager could potentially earn up to USD580 million in total development, regulatory, and commercial milestones associated with licensed products incorporating the two Pfizer transgenes together with a Voyager licensed capsid. Voyager is also eligible to receive mid- to high-single-digit tiered royalties based on net sales of Pfizer's products incorporating the licensed capsids. Voyager's TRACER system is an RNA-based functional screening platform that is designed to enable rapid in vivo evolution of adeno-associated virus (AAV) capsids with enhanced tropisms and cell- and tissue-specific transduction properties in multiple species, including non-human primates (NHPs). Initial data have demonstrated that the capsids that are produced can effectively penetrate the blood-brain barrier. For Pfizer, the deal with Voyager aligns with its efforts to develop, manufacture, and commercialize gene therapies. (IHS Markit Life Science's Milena Izmirlieva)

- The African Union's top health official, John Nkengasong, said yesterday (7 October) that the organisation will soon begin discussions with the World Health Organization (WHO) and Gavi, the Vaccine Alliance, to facilitate the rollout of GlaxoSmithKline (GSK, UK)'s RTS,S/AS01 (RTS,S; Mosquirix) malaria vaccine. According to Reuters, Nkengasong, who is the director of the Africa Centres for Disease Control and Prevention (Africa CDC), told a news conference: "We will be engaging with GAVI and WHO in the coming days to understand first of all the availability of this vaccine." His comments were made following the announcement of the WHO's recommendation for the malaria vaccine to be deployed for widespread use among children in Sub-Saharan Africa and in other regions with moderate to high P. falciparum malaria transmission, deeming it to be a useful complementary tool on top of existing tools to prevent malaria. The health official indicated that the African Union intends to work swiftly with the WHO and Gavi to clarify costs and funding required to facilitate access to the vaccine in member states. Nkengasong stated that it is currently unclear when the vaccine will be accessible in countries where malaria is endemic, "because the cost per dose is not known and it is not clear how quickly production can be scaled up", according to Reuters. Although GSK has so far committed to produce 15 million doses of the vaccine annually up to 2028, at the cost of production plus no more than a 5% margin, this volume falls well below projected demand, and methods of financing remain uncertain. (IHS Markit Life Sciences' Sacha Baggili)

- Among the topics at the GM Investor Event on 6 October was an update on the Cruise business by Cruise president Dan Ammann. The key takeaways from the event are that Cruise is very close to being ready to offer paid rides to consumers and sees opportunity to generate a revenue of USD50 billion in 2030. Cruise sees that once the cost per mile of these rides falls to about USD1.00 (or the average cost of US low-mileage car ownership), the total addressable market (TAM) reaches USD500 billion per year, with Cruise and GM expecting that they can capture at least USD50 billion of that. Once the cost can be pulled down to USD0.60 per mile, which is close to the US average mileage car ownership cost in many areas today, the TAM reaches USD1 trillion. Many of Cruise's fundamental cost expectations remain consistent, although the pandemic has changed the development pace and could alter consumer behavior. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The historic drought conditions plaguing much of the Western US look unlikely to change any time soon and farmers and ranchers should brace for further water restrictions in the coming year, state and federal officials told a Senate panel on Wednesday (October 6). (IHS Markit Food and Agricultural Policy's JR Pegg)

- More than 90% of West is suffering from drought and water levels at two major reservoirs ─Lake Mead and Lake Powell─hit record lows in August, triggering a water conservation plan that will impact all eight states within the Colorado River Basin.

- "The likelihood of deeper cuts in the future is high," said Tom Buschatzke, director of the Arizona Department of Water Resources.

- Arizona alone could lose 18% of its Colorado River allotment next year, he said, and farmers will likely suffer from the reduction despite state programs intended to mitigate the reduction. Those programs may help in the short-term, but the lingering drought could force lasting changes, Buschatzke told the Senate Energy and Natural Resources Subcommittee on Water and Power.

- The future is "going to be very different" for farmers in the West, he said. "They're not going to be able to farm the way they have farmed historically and it's a real paradigm shift for the agriculture community."

- Federal and state officials are going to have to work cooperatively to figure out how to deal with impacts of the "megadrought" and ensure water is stored responsibly and distributed fairly, said subcommittee Chair Mark Kelly (D-Ariz.), who tried to sound a voice of optimism.

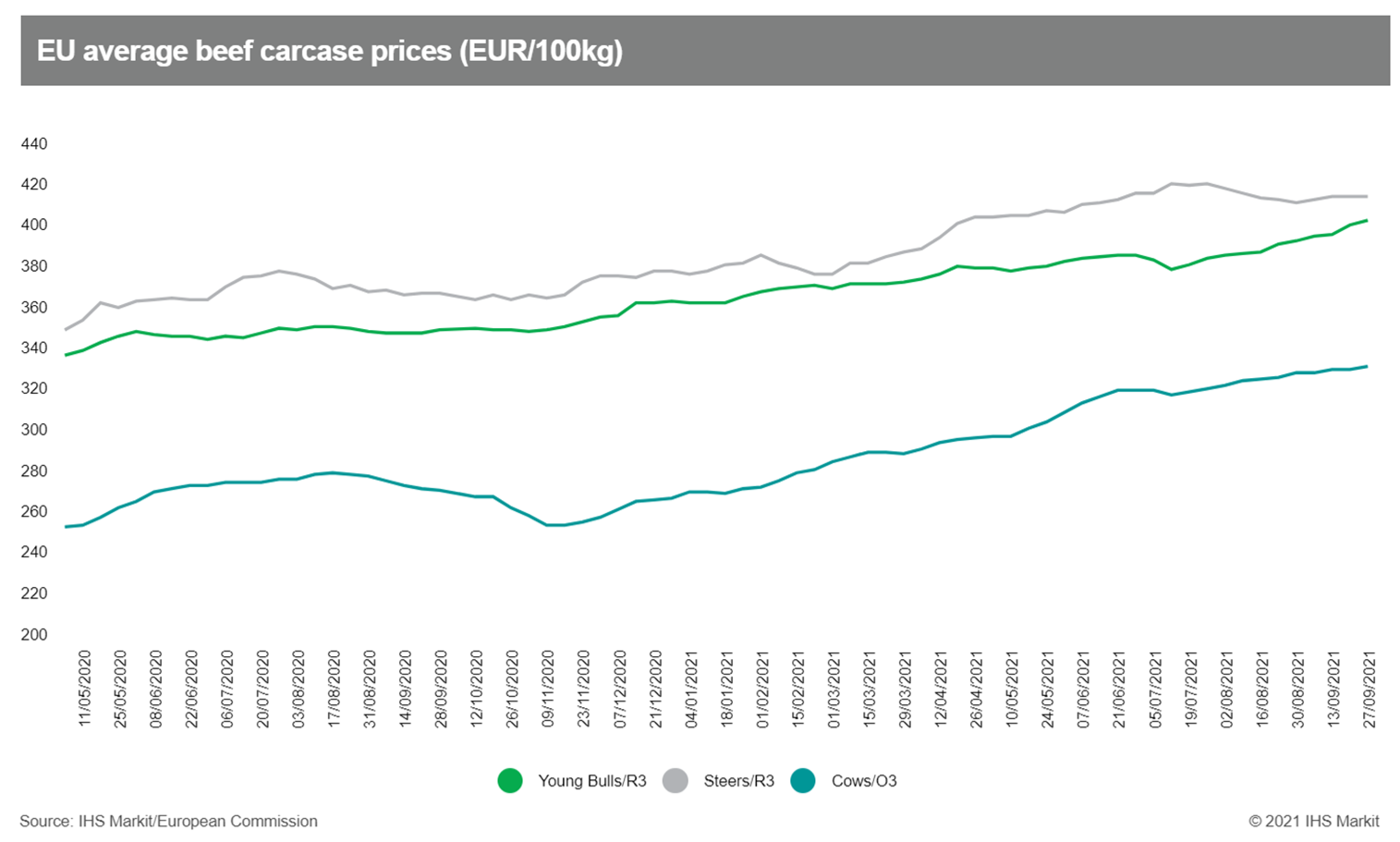

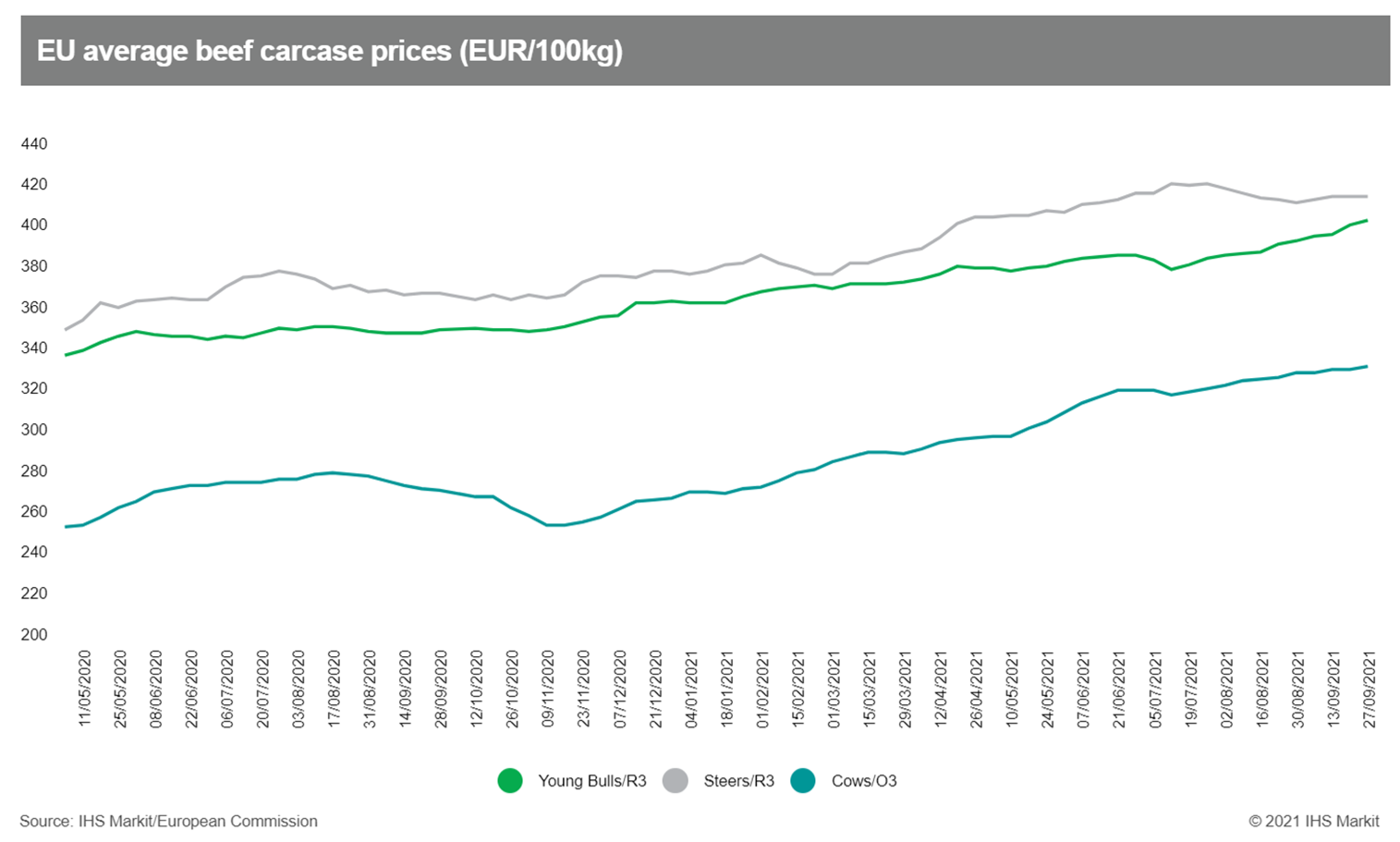

- European cattle prices have risen over for the eleventh week in a row, as short supplies in a number of member states continue to dominate market conditions. The EU's benchmark price is now knocking at the door of EUR400 per 100kg for the first time in over three years, as processors and wholesalers compete for access to scarce livestock resources. Official data for the first six months of 2021 show that total beef production was down by 0.5% year-on-year across the EU - but this figure masks substantial regional variations. While output was substantially higher in some of the less significant markets across the EU, output for the first half-year was down 8.8% year-on-year in Ireland, by 4.1% in Austria, by 1.5% in Germany, and by 0.4% in the Netherlands. France saw an increase in output of just 0.6%, while production in Italy was stable year-on-year. With imports from South America constrained by a combination of Covid, transport bottlenecks and high energy costs - and with UK competitors still adjusting to life outside the Single Market - the EU beef and cattle sector is characterized by a fundamental shortage of supplies which is now evident for both male and female cattle. In the week ending 3 October, the Commission's overall benchmark price for A/C/Z R3 cattle was EUR398.35 per 100kg, up by 0.6% on the previous week. (IHS Markit Food and Agricultural Commodities' Chris Horseman)

- Repsol has hiked its planned low-carbon investments by €1.0 billion ($1.15 billion) in 2021-25, to €6.5 billion, and increased its emission-reduction targets to achieve net-zero emissions by 2050. The company says the additional €1.0 billion will raise its total investments for the five-year period to €19.3 billion. The low-carbon spending increase compares with figures given by Repsol in its last strategic plan, issued in November 2020, and represents 35% of the company's total planned expenditure in 2021-25. This proportion of expenditure will rise to 45% in 2030, the company says. (IHS Markit Chemical Advisory)

- Repsol has raised its intermediate decarbonization milestones to 15% by 2025, 28% by 2030, and 55% by 2040, up from 12%, 25%, and 50%, respectively. "The upgrade of our targets demonstrates the solid progress the company is making towards becoming carbon neutral by 2050. Ambition, technology, and project execution are enabling us to increase the speed at which we will achieve this target," says Repsol CEO Josu Jon Imaz.

- The company has also announced an absolute emission-reduction target for the first time, committing to a 55% reduction in emissions from its operated assets (Scope 1 and 2) and 30% cut in net emissions (Scope 1, 2, and 3) by 2030. It has also increased its internal carbon price applied to all new investments, with prices per metric ton of carbon dioxide (CO2) differentiated for investments within the EU and rest of the world. Repsol has set a carbon price of $70/metric ton in 2025 and $100/metric ton in 2030 for the EU, up respectively from $40/metric ton and $70/metric ton previously. In the rest of the world, the price has been set at $60/metric ton in 2025, up from $40/metric ton. "Establishing a carbon price allows new projects to be designed efficiently and investment decisions to be evaluated, and is made taking all variables into account," it says.

- Repsol says its investment plans for the period 2021-25 include €1.5 billion for its chemicals business, with the company aiming to recycle the equivalent of 20% of its polyolefins production by 2030. It will also progress mechanical- and chemical-recycling projects for polyolefins, polyurethanes, and the production of methanol from waste to incorporate these in the production of materials, it says.

Posted 11 October 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.