Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 03, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Inflation data from the US and China will take centre stage next week while central bank meetings will be in abundance across Canada, Australia and India. Over in Europe, UK October GDP data and the German ZEW survey will be due. China meanwhile also releases trade and credit growth data.

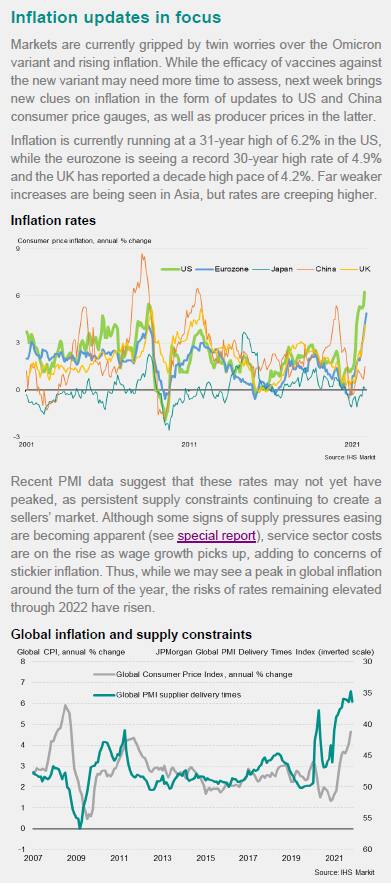

A flare-up of concerns over the COVID-19 Omicron variant come at a time of PMI data painting a picture of global manufacturing facing persistent supply shortages and price pressures. Adding to the market jitters over the new variant had been Fed chair Powell's hawkish comments, acknowledging that inflation should no longer be labelled 'transitory'. One certainly recalls the October CPI surprise, placing the attention on the upcoming November data where quicker inflation could further accelerate the Fed's tapering plans. As far as the IHS Markit US Manufacturing PMI revealed, price pressures have yet to abate, which could add to concerns about stickier inflation. On the other hand, China's PPI data could potentially see some inflation pressures ease in November, according to PMI data, in part due to lower coal prices.

Amid the growing attention paid towards the Omicron 'variant of concern', the German ZEW survey will be of interest. Comments from central bankers across Canada, Australia and India will also be watched keenly even as rates are expected to stay unchanged. As it is, both Canada and Australia reported the detection of Omicron and took backward steps, of varying degrees, towards border reopening.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.