Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 02, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

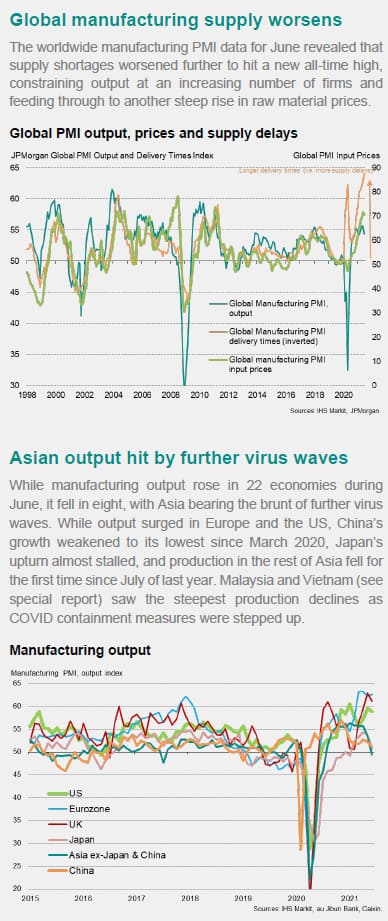

Worldwide services and composite PMIs will be in focus following the release of global manufacturing PMIs, which highlighted the continued divergence in growth amid the resurgence of COVID-19 cases. The impact of further virus waves has been particularly evident across various Asia economies. In contrast, the US and eurozone continue to fare strongly, albeit experiencing supply constraints and price pressures.

On the topic of price spikes, we have again considered the question as to whether this is transitory ( see analysis here). With services inflation gathering speed as well, the price sub-indices will be of interest to shed light on how fast input costs and output charges have increased and the implications for inflation, wage growth and company margins.

Central bank updates are also lined up in the week ahead with the FOMC meeting minutes being one to scrutinise for the Fed's thoughts that led them to project the earlier-than-expected rate hikes through the 'dot plot'. Clues with regards to the expected tapering of asset purchases will also be sought. Meanwhile, central bank meetings will be held in Australia and Malaysia with no changes expected amid varying degrees of COVID-19 resurgences.

Rounding back to inflation, China's June inflation data will also be carefully tracked after the latest NBS and Caixin manufacturing PMIs suggested easing price pressures. We will also get a look as to how inflation amongst sectors changed via the June IHS Markit Sector PMIs.

Contact us

PMI commentary: Chris Williamson, Jingyi Pan

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location