Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

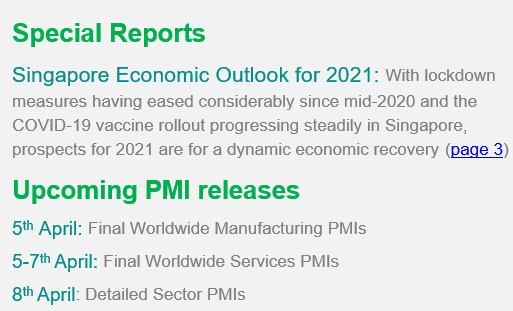

ECONOMICS COMMENTARY — Apr 01, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Service sector PMIs will dominate the week alongside some key updates to trade, industrial production and inflation. The week also sees interest rate decisions at central banks in Australia, India and Poland, while the ECB and FOMC release minutes from their last meetings. The IMF's spring meeting also commences.

Policy is expected to remain on hold when the RBA and RBI meet to set interest rates for Australia and India respectively, despite some encouraging signs from recent economic data and hints of higher price pressures building. Both central banks are keen to ensure policy remains accommodative while COVID-19 uncertainties and restrictions persist, with India in particular concerned about the economic impact from further waves of infections. Elsewhere in Asia Pacific, China's economy also comes under the spotlight with updates to its service sector PMI and inflation data.

The ECB policy meeting accounts will meanwhile provide more colour on its recent decision to step up asset purchases amid concerns over rising bond yields, but it's the FOMC minutes that will garner particular attention. Analysts are eager to assess just how concerned Fed policymakers are about rising bond yields and when US monetary policy may start being tapered. PMI data from IHS Markit and the ISM will give fresh insights in the performance of the service sector, which flash numbers suggest performed well in March, helping the US lead the developed world's recovery. Other key US data releases include US factory orders, trade, job openings and producer prices.

Elsewhere eurozone unemployment and industrial production for Germany and France will be under scrutiny after PMI numbers showed manufacturing booming in the single currency area. The eurozone's service sector has lagged the factory recovery, but even here signs of stabilisation have appeared, so the final PMIs will also be eyed for further signs of greater than expected resilience amid further waves of infections.

Importantly, the release of all PMI data during the week will give an updated view on global economic trends, after February's surveys showed the recovery gaining momentum but price pressures at the highest for over a decade. Detailed global PMI numbers will also highlight industry winners and losers.

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location