Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 27, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Worldwide manufacturing and services PMIs offer the first comprehensive look at economic conditions around the globe in August next week. A busy economic calendar also finds US August labour market update and flash eurozone inflation figures. Several countries, including Australia, Canada and India, also release Q2 GDP.

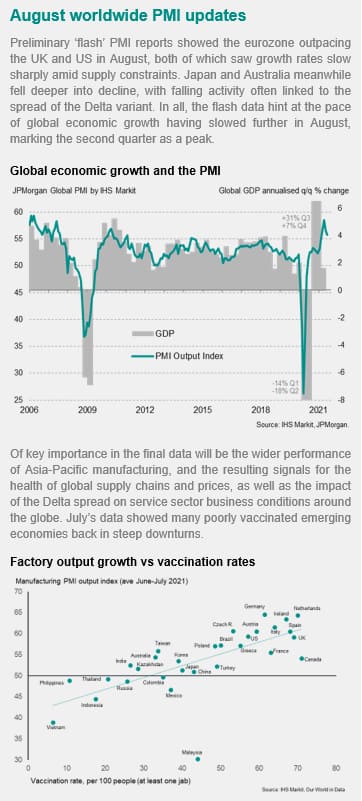

With the number of global COVID-19 cases yet to peak into end-August, the worldwide manufacturing and services PMIs will be watched in the coming week for the first indication of how the global economy has fared in the past month. Recent surveys have shown the emerging markets coming under particular pressure from the Delta variant, with resulting supply issues also hitting worldwide production and driving up prices, notably where demand is rebounding sharply.

August US non-farm payrolls will also be due alongside unemployment and wage growth data. As the Fed has indicated, the tapering of asset purchases could be on the cards before the year-end, so each set of labour market data will be studied for clues as to how aggressive the Fed may be with their taper.

On prices, inflation indications will be expected from a number of regions including the flash August CPI reading from the eurozone. The IHS Markit Flash Eurozone PMI preluded with sustained price pressures for the bloc, supporting an expectation of higher readings for August, one to watch for confirmation with the release.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.