Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 30, 2022

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

With global recession risks rising, upcoming PMI survey data for the world's major economies will come under close scrutiny in the week ahead, as will Friday's US nonfarm payroll report in providing important guidance on the Fed's policy stance. While a scheduled meeting at the RBA is the main event from a policy-setting perspective, markets will be closely monitoring potential interventions by the Bank of England amid volatility in the gilt and FX markets, as well as UK political developments.

The week commences with a flood of manufacturing PMIs. Markets will be evaluating the potential for an easing of global factory price pressures following a recent moderation of supply chain pressures and the weakening demand environment. However, the softening of demand, ongoing COVID-19 containment measures in mainland China, uncertainty regarding Russia and energy supply issues in Europe all remain major concerns for the economic outlook.

Later in the week come the service sector PMIs, where the impact of the cost-of-living crisis on consumer spending will be a key development to watch. However, the surveys will also help understand the impact of tightening financial conditions on financial services around the world (see box), as well as any pass-through of rising prices to wages.

The week rounds off with the US employment report, for which markets are expecting nonfarm payroll growth to slow from a 315k gain in August to 250k in September. That would be the worst performance since December 2020, though the slowing pace of job gain in part reflects a natural moderation in hiring amid the current tightness of the labour market. The unemployment rate is expected to hold at 3.7%. Average hourly earnings growth is anticipated to hold at 0.3%. Any stronger than anticipated labour market trends will naturally add further to the growing view of a more aggressive Fed tightening, and notably a higher restrictive peak in the funds rate which may need to be maintained for longer.

In a crowded week, also watch out for US factory orders data and industrial production numbers out of Germany, France and Spain, as well as Japan's Tankan survey.

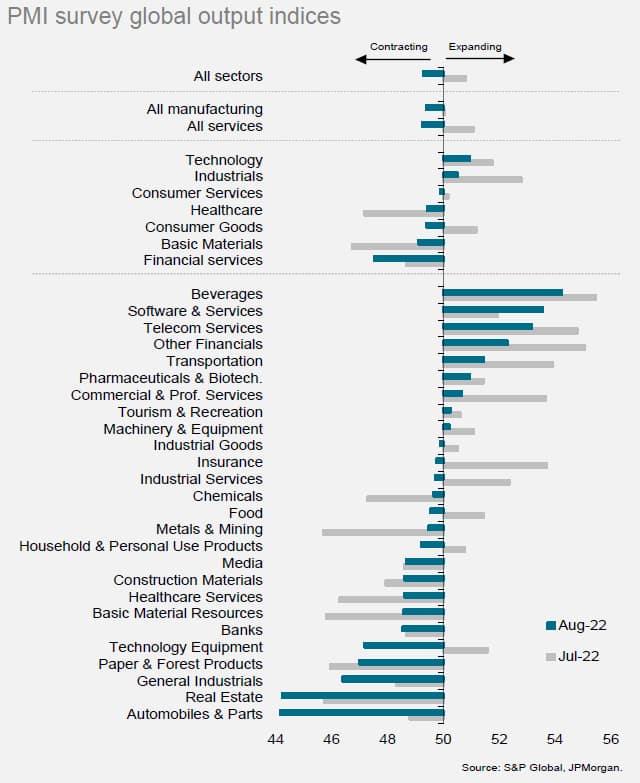

PMI survey data published in the coming week will provide timely insights into macroeconomic trends around the world at the end of the third quarter, covering both manufacturing and services. However, the survey data can also be used to analyse economic trends by industry sector. August's data showed that the industry exerting the biggest drag on global growth is now financial services, with real estate activity falling especially sharply, reflecting the recent tightening of financial conditions. However, there has also been a major deterioration in the performance of consumer-facing service sectors, and notably travel & tourism, where a post-vaccine rebound in demand has stalled globally amid the surge in energy costs and rising cost of living, which has diverted spending away from non-essentials. Autos have also continued to suffer amid supply shortages. September's data will be published by S&P Global.

Monday 3 October

Worldwide manufacturing PMI surveys (Sep)

Japan Tankan survey (Q3)

ISM US manufacturing survey (Sep)

Indonesia inflation (Sep)

Switzerland inflation (Sep)

India trade balance (Sep)

Brazil trade balance (Sep)

Tuesday 4 October

Australia home loans, building permits (Aug)

Australia RBA policy decision

Spain unemployment (Sep)

Eurozone PPI (Aug)

US factory orders, JOLTS (Aug)

Russia GDP (Aug)

Wednesday 5 October

Worldwide services & composite PMI surveys (Sep)

ISM US non-manufacturing survey (Sep)

S Korea inflation (Sep)

New Zealand RBNZ policy decision

Philippines inflation (Sep)

Thailand inflation (Sep)

Australia retail sales (Aug)

Germany trade balance (Aug)

France industrial production (Aug)

ECB non-monetary policy meeting

Spain consumer confidence (Sep)

US MBA mortgage applications/30-year mortgage rate

Brazil industrial production (Aug)

US trade balance (Aug), ADP employment (Sep)

Canada trade balance, building permits (Aug)

Poland policy decision

Thursday 6 October

Detailed global PMI sector data (Sep)

Australia trade balance (Aug)

Taiwan inflation (Sep)

Netherlands inflation (Sep)

Germany factory orders (Aug)

Spain industrial production (Aug)

UK & eurozone construction PMIs (Sep)

Eurozone retail sales (Aug)

France retail sales (Aug)

US jobless claims

Friday 7 October

Japan household spending (Aug)

Germany industrial production (Aug)

UK Halifax house prices (Sep)

France trade balance (Aug)

Italy retail sales (Aug)

Canada labour market statistics (Sep)

US employment report (Sep)

US consumer credit, wholesale inventories (Aug)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here

Americas: US nonfarm payrolls, unemployment & wages, factory orders, consumer credit, PMIs and ISM

The US week kicks off with PMI and ISM surveys and ends with the employment report, providing plenty of fresh insights in the economic growth path and inflation trends.

Flash PMI data showed a weak September rounding off the worst quarter since 2009 - barring the initial pandemic lockdowns - albeit with a cooling of the service sector downturn evident, linked in part to easing inflation pressures and some bottoming out of consumer sentiment. ISM non-manufacturing surveys have meanwhile remained buoyant, so a drop will likely be seen in September.

Slower growth is also expected for non-farm payrolls, with a 250k gain currently the consensus against a 315k August rise. Also watch out for US factory orders, job openings and consumer credit data, plus Canada's labour market statistics.

Europe: Manufacturing, construction and services PMIs, retail sales, industrial production and trade updates

Final manufacturing and services PMIs will be updated for the Eurozone, UK and other struggling eastern European countries, alongside detailed PMI sector indices to provide additional insights into economic trends amid recession risks across the region. Industrial production data for Germany, France and Spain will also be eagerly awaited to gauge the impact of the region's energy crisis on factories. Also look out for UK house price data plus German factory orders and trade numbers, as well as Eurozone retail sales and a policy decision in Poland.

Asia-Pacific: RBA and RBNZ interest rate decisions, mainland China and other APAC PMIs

PMI data for mainland China will be high on the agenda amid concerns that global trade growth is slowing while domestic demand remains subdued due to ongoing COVID-19 containment measures. Other PMI data for APAC economies have shown varying trends, with India and Vietnam notably bucking a wider global slowdown. In Japan, services growth has likely been buoyed by loosened COVID restrictions while the factory PMI and Tankan survey will be scoured for the impact of the weakened yen on goods exports.

The main policy meeting of the week takes place in Australia, accompanied by a rate setter gathering in New Zealand. The RBA has hiked in each of the past five months to take its policy rate to 2.35%, yet inflation has continued to rise and the job market remains tight. Another hike, potentially of 50 basis points, is therefore widely anticipated.

US | Chris Williamson

Singapore | Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.