Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 24, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank meetings across various APAC countries including New Zealand, South Korea and Indonesia will take place in the coming week and come at a time of varying economic trends around the world.

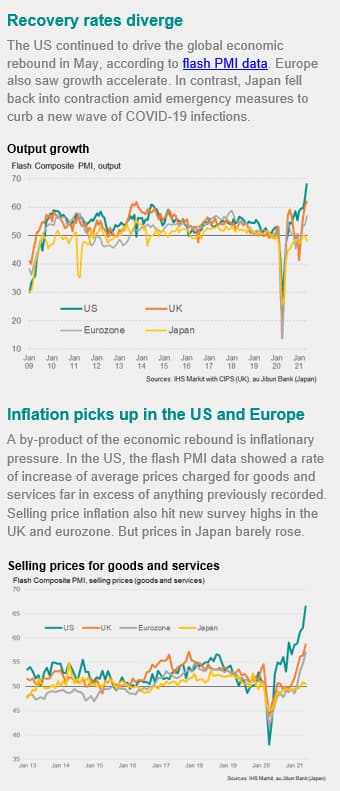

Whereas economies such as the United States and the United Kingdom are enjoying record growth spurts as covid restrictions are relaxed and vaccine progress continues at pace, other parts of the world - notably across Asia Pacific - are seeing their economies wane again as rising covid cases lead to renewed restrictions.

Thus, while the April Fed minutes alluded to potential tapering discussions if the US economy continues to boom in coming months, APAC central banks may be more guarded. However, even in the US we don't expect the interest rate lift-off to occur until 2024 and that large-scale asset purchase will continue at about current rates through this year, followed by a gradual taper next year. A series of Fed speakers commenting in the week ahead will certainly be watched for clarifications on the appetite for tapering.

In the meantime, we'll also look to a series of data releases to affirm the varying economic recovery trends as reflected in the recent slew of IHS Markit Flash PMIs. Specifically, revised US Q1 GDP is set to see an upward revision while consumer confidence further improves in May. Over in Asia, several key industrial production updates will be due across the likes of Singapore and Taiwan ahead of fresh manufacturing PMIs releases the following week.

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location