Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 17, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A holiday-shortened week finds US and Japan inflation data alongside US and UK updates to Q3 GDP. US and eurozone consumer confidence data are also due.

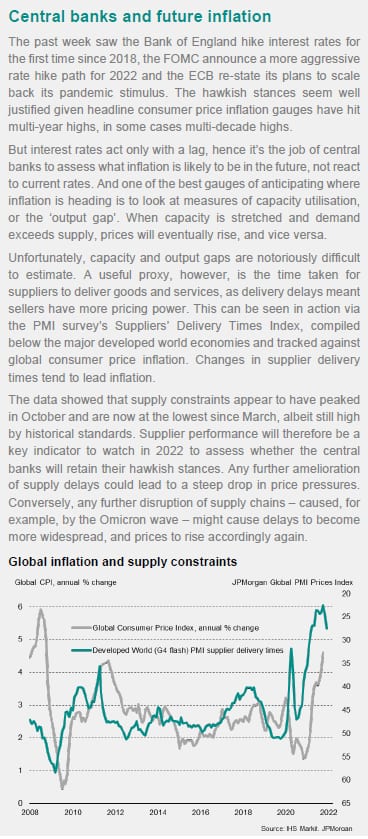

The latest FOMC meeting saw the Fed pivot towards ending additional monetary stimulus. In line with our updated forecast, the Fed also signalled multiple rate hikes in 2022. The market had responded positively to the news with a 'sell the news' reaction, seeing the S&P 500 and tech-heavy Nasdaq Composite up 1.6% and 2.1% respectively on Wednesday, albeit following an earlier sell-off caused by a record jump in US producer prices. Next week's core PCE data and inflation numbers into the new year will therefore be closely watched for alignment with the Fed's forecasts for any potential deviation from the current telegraphed rate path. The latest IHS Markit Flash US Composite PMI for December revealed that price pressures persisted into the year end, with service sector inflation at a record, though supply chain pressures eased, hinting at lower goods inflation in coming months (see box).

Meanwhile G4 economies saw diverging trends with business confidence in the latest set of flash PMI data, detailed in our special report. The US notably saw optimism improve on the back of beliefs that the economic impact from the Omicron variant will be less severe than previous waves. Corresponding consumer confidence levels will be tracked with both US and eurozone releasing their data in the coming week. Meanwhile, we send all of our readers our very best wishes for the holiday season and for 2022.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.