Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 12, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link

Meeting minutes from the Fed and RBA will be released in the coming week while a series of economic data will be closely watch, including eurozone and UK inflation data. China will also share more July numbers including retail sales and industrial output figures, while also updating their Loan Prime Rate on Friday.

The spotlight will be on the Fed meeting minutes from the July 27-28 meeting with the timing of the tapering at the top of everyone's mind. While Fed chair Jerome Powell revealed that officials had taken a 'first deep dive' into the scaling back of bond purchases, there were no mentions of any timings. Fed officials have since engaged in some hawkish talks, which alongside data surprises, such as last week's US NFP update, sent the US dollar strengthening. Next week's Fed FOMC minutes could offer some clues on the Fed's thoughts ahead of the August 26-28 Jackson Hole Policy Symposium where more details are expected.

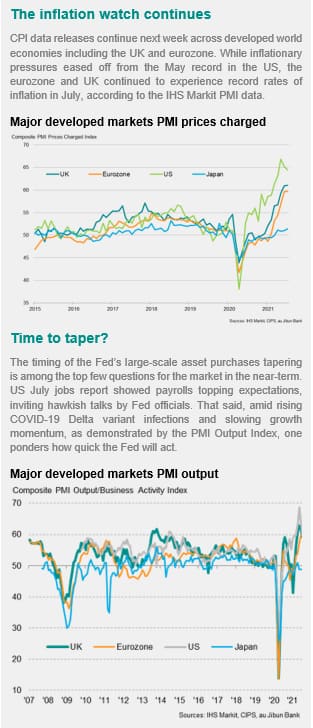

UK and eurozone inflation data will be due next week after the US and China releases this week. July's IHS Markit / CIPS UK Composite PMI revealed inflationary pressures had hit new record high, placing the focus on how the official data would fare. This also comes after the BoE recently revised their inflation forecast upwards for 2021 to 4%, but maintained a transitory view towards inflation.

Finally, in Asia Pacific, central bank meetings will be held in New Zealand and Indonesia. China will also be updating retail sales and industrial output data for July.

PMI commentary: Chris Williamson, Jingyi Pan

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.