Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 02, 2022

Euro area manufacturers continue to struggle against the headwinds of supply shortages, elevated inflationary pressures and weakening demand amid rising uncertainty about the economic outlook. However, the manufacturing sector's deteriorating health has also been exacerbated by demand shifting to services, as consumers boost their spending on activities such as tourism and recreation. There was some better news on supply chain pressures easing, however, in turn taking some pressure off inflation.

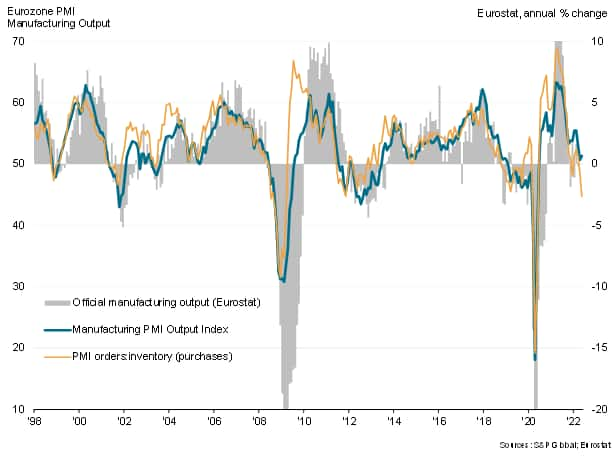

The S&P Global Eurozone PMI survey's output gauge has fallen sharply in recent months, dropping to levels indicative of manufacturing production falling slightly so far in the second quarter. Forward-looking indicators such as the orders-to-inventory ratio deteriorated further in May, suggesting the rate of output decline will accelerate in coming months, absent a sudden revival of demand for goods.

Barring the initial pandemic decline, the eurozone manufacturing new-orders to inventory ratio is now running at its joint-lowest level since 2009, pointing to a potentially severe production downturn.

Eurozone PMI output

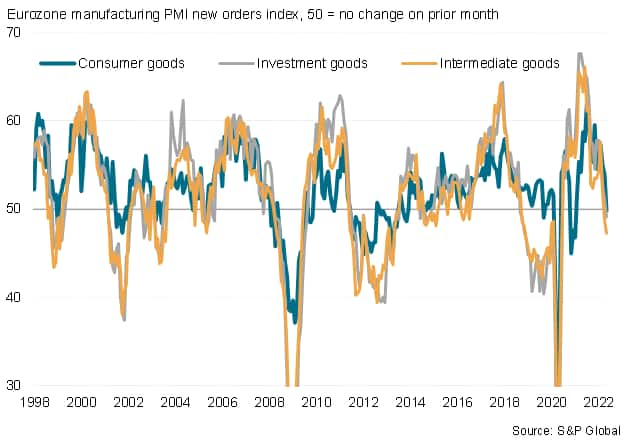

A major driver of the first drop in new orders for almost two years was the ongoing supply crunch and accompanying price pressures, with producers of many goods and raw materials raising their prices yet again alongside a recent surge in energy prices. Spending power has hence been hit hard, and often consumers in particular have shown an eagerness to move spending from goods to services, taking advantage of looser pandemic travel restrictions. New orders for consumer goods fell in May for the first time since the lockdowns of January 2021, though orders also fell for intermediate goods and investments goods such as plant and machinery.

Eurozone PMI new orders

The eurozone economy therefore looks increasingly, and uncomfortably, dependent on the service sector to sustain growth in the coming months.

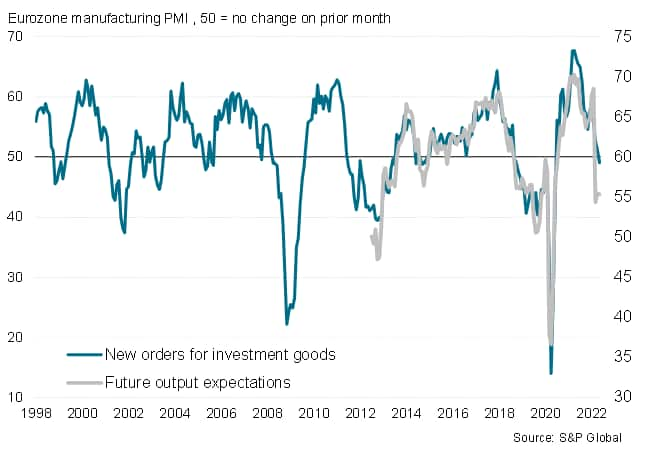

However, the manufacturing survey responses also reveal an undercurrent of growing uncertainty about the economic outlook, linked to Russia's invasion of Ukraine, persistent inflationary pressures and supply disruptions, that is in turn driving increased risk aversion and caution among customers. The survey's gauge of future output expectations is currently signalling further weakness ahead, most notably for business investment spending, which points to deeper underlying downside risks to the overall economic outlook.

Eurozone business optimism and investment goods orders

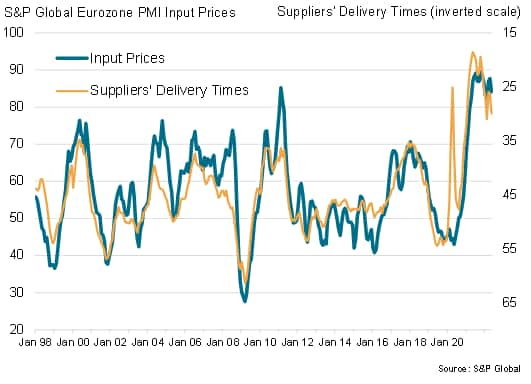

More encouragingly, the May survey found evidence of receding supply-chain pressure, as average input lead times lengthened to a lesser extent than in April. In fact, the deterioration in vendor performance was the second softest since January 2021. These easing supply constraints helped euro area manufacturers add to their inventories of purchases at the quickest pace in three months.

Weaker supply chain pressures also took some pricing power away from suppliers. Although the rate of input cost inflation was among the steepest on record amid widespread reports of surging energy and raw material prices, the rate of increase has shown signs of peaking.

Eurozone PMI input price and supplier delay indices

Sign up to receive updated commentary in your inbox here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.