Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 03, 2025

By Heike Doerr

Regulatory Research Associates is tracking several base rate proceedings and a handful of other regulatory matters in the water sector, including the approval of two multistate transactions.

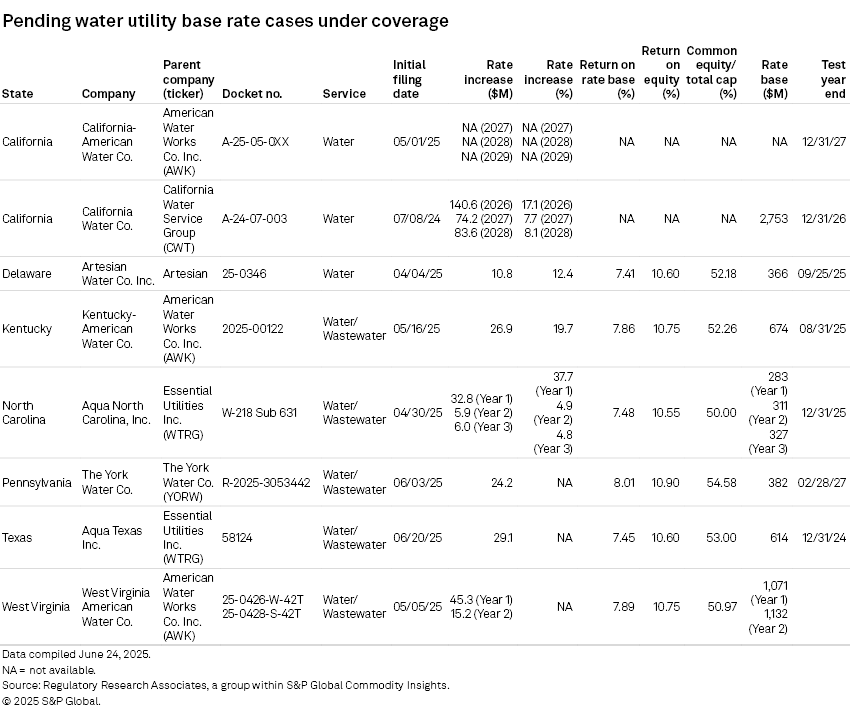

➤ Six water utility rate cases were initiated in May and June, consistent with the historical trend of spring being the busiest time for utility rate case filings.

➤ American Water Works Co. Inc. initiated a rate case in Kentucky and saw a settlement approved in Iowa. Essential Utilities Inc. has filed for increased water rates in North Carolina and Texas and filed a notice of intent in Ohio.

➤ Regulatory filings for two multistate transactions have also gotten underway. Eversource Energy and Unitil Corp. filed across New England for approval of a transaction involving Aquarion Water Company Inc. and American Water. Also, Nexus Water Group Holdings Inc. filed in the eight states where American Water is taking over water and wastewater systems from Nexus.

RRA evaluates water utility regulation in more than 20 state jurisdictions and monitors rate proceedings involving rate change requests of at least $1.0 million for the 10 largest investor-owned and privately held water utilities.

For additional details regarding water utility rate cases from Jan. 1, 2010, through March 31, 2025, refer to this Excel companion.

Recent base rate case filings

Pennsylvania — On May 30, The York Water Co. filed for a $20.3 million water and $3.9 million wastewater rate increase based on a 10.9% return on equity (54.58% capitalization) and an 8.01% overall return. The company projects that it will have placed into service $86.3 million of water infrastructure and $13.0 million of wastewater investments through the end of the rate case's test year.

The company's last base rate case was decided in January 2023 when the company was authorized a $11.6 million (21.6%) rate increase. The settlement and order were silent regarding cost of capital parameters and rate base.

York Water provides water and wastewater service to approximately 80,000 customers in southeast Pennsylvania.

Texas — On June 20, Aqua Texas Inc. filed with the Public Utility Commission of Texas to increase base rates by $29.1 million. The rate case is based on a 10.6% return on equity (53.00% of capital) and 7.45% overall return on rate base of $614 million. This filing marks the first for a major water utility with the PUC since the sector's regulation was transferred from the Texas Commission on Environmental Quality in 2013.

Aqua Texas serves approximately 76,000 water and 25,300 wastewater customer connections. Its systems are unique compared to the contiguous service territories in other jurisdictions. Almost a quarter of Aqua Texas' systems serve fewer than 50 customers, and only 15 systems serve more than 1,000 customers.

Recent rate decisions

Idaho — On May 30, the Idaho Public Utilities Commission approved a settlement for Veolia Water Idaho Inc. (VWI) for a $7.0 million rate increase based on a 7.05% rate of return. The decision does not include additional cost of capital parameters or rate base. The settlement included a rate stay-out provision, with the company agreeing to not file another case such that new rates would become effective before Jan. 1, 2027.

On Nov. 22, 2024, VWI initially filed for an $11.2 million (19.8%) rate increase based on a 10.8% return on equity (52.78% of capital) and 7.79% overall return on rate base of $306 million. The company had proposed a two-phase rate plan, with 70% of the requested increase to be effective Dec. 23, 2024, and the remaining 30% to be effective a year later.

VWI services approximately 108,000 customer connections and is a subsidiary of Veolia Utility Resources LLC.

Iowa — On May 21, the Iowa Utilities Commission issued a final order in Iowa-American Water Co. Inc.'s (IAWC's) base rate case authorizing a $12.7 million rate increase, based on a 9.6% return on equity (52.78% of capital) and an average rate base of $262 million for a test year ending March 31, 2026.

The commission did not allow IAWC to implement a revenue decoupling mechanism or reallocate some of its wastewater revenue requirement to water customers. The commission allowed some revisions to the company's qualified infrastructure plant mechanism; however, it did not authorize the company to earn a full weighted average cost of capital return on these investments. Iowa remains the only state that utilizes cost of debt as the return for an infrastructure surcharge.

The company initially filed a $26.9 million rate increase on May 1, 2024, based on a 10.75% equity (52.57% capitalization) and an 8.15% return on a rate base of $214 million.

IAWC provides water service to nearly 69,000 customers and water and wastewater service to 832 customers. It is a subsidiary of American Water.

Rate case developments

California — On June 10, California Water Service Co. (Cal Water) filed a request for oral arguments in its pending rate case, stating "there are several significant disputes on complicated ratemaking issues between Cal Water and the Public Advocates Office ... At this time, the parties have not reached a settlement agreement on the disputed issues in this proceeding and are anticipating the need to address these complex issues in lengthy written briefs."

On June 13, Cal Water filed a request for interim rates. Interim rates in California have historically been set at existing rates and allow the utility to implement the rate increase retroactively. Cal Water's new rates are to be effective Jan. 1, 2026; however, the PUC has taken longer than the 18-month statutory period for recent water utility general rate cases.

On June 17, the PUC extended the deadline for filing opening and reply briefs to July 7 and July 28, respectively. The deadline for filing a motion for approval of a settlement is now Aug. 1.

Delaware — On May 14, the Delaware Public Service Commission authorized Artesian Water Co. Inc. (AWC) to implement temporary rates, subject to refund, of $2.5 million annually, effective June 3, 2025.

AWC, the largest subsidiary of Artesian Resources Corp., serves approximately 97,500 water connections throughout Delaware.

North Carolina — On June 17, Aqua North Carolina, Inc. filed a motion to consolidate its base rate proceeding with the company's docket for approval of a customer assistance program (Docket W-218, Sub 631).

Aqua North Carolina serves approximately 87,300 water connections and 23,300 sewer connections.

West Virginia – On June 19, the Public Service Commission of West Virginia consolidated the water and wastewater proceedings of West Virginia-American Water Co., suspended the proposed rate increases until March 1, 2026, and requested that parties submit a proposed procedural schedule by June 27, 2025.

Other regulatory activity

California — On June 12, the California Public Utilities Commission further extended the statutory deadline in California-American Water Co.'s (Cal-Am's) proceeding related to the Monterey Groundwater Replenishment Project. The initial 18-month statutory deadline was May 29, 2023. It is now suspended until Oct. 31, 2025.

The proceeding was initiated on Nov. 29, 2021, when Cal-Am requested PUC approval of an amended purchase water agreement and associated cost recovery. The company also requested to update its supply and demand estimates for the Monterey Peninsula Water Supply Project. The amended agreement would increase the amount of water purchased by Cal-Am from the Pure Water Monterey Groundwater Replenishment Project by 2,250 acre-feet per year (afy), from 3,500 afy to 5,750 afy.

California — On June 4, Cal Water submitted an application to use rate changes effective Jan. 1, 2027, and Jan. 1, 2028, to recover costs in six of its 19 ratemaking areas as part of its per- and polyfluoroalkyl substance (PFAS) Compliance Program.

Maine — The Maine Public Utilities Commission authorized surcharges in June for The Maine Water Company, totaling $0.5 million, effective July 1, 2025.

Maine Water is a subsidiary of H2O America (formerly SJW Group).

New Jersey — On June 18, the New Jersey Board of Public Utilities approved a settlement authorizing New Jersey-American Water Co. Inc. to purchase Hopewell Borough's water system for $6.4 million. The system serves approximately 900 customers.

New Jersey — In May, the BPU approved Veolia Water New Jersey's proposed cost recovery mechanism related to the replacement of customer-owned lead service lines. The company indicated that it had replaced approximately 3,930 property owner-side lead service lines as of June 2024, incurring deferred costs of approximately $23.8 million.

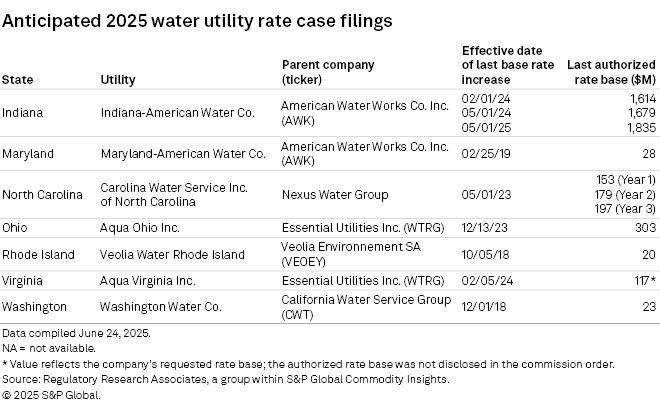

Anticipated regulatory filings

Based on comments from utilities and RRA's insights into the rate case cycles of various companies, the following water utilities are expected to file a base rate case in 2025. In Maryland, Rhode Island and Washington, water utilities have not implemented rate increases since 2018.

On May 30, Aqua Ohio Inc. filed a notice of intent with the Ohio PUC. On June 30, the PUC approved the company's proposed test year of Dec 31, 2025. In Ohio, a utility is required to give 30 days' notice prior to requesting a base rate increase.

On May 27, Carolina Water Service, Inc. Of North Carolina, a subsidiary of Nexus Water Group, filed with the NCUC stating its intent to file a base rate case on or about June 30, 2025.

Regulatory status of transaction approvals

On May 19, American Water announced that it would be purchasing multiple water and wastewater systems from Nexus Water Group for a total of approximately $315 million. The transaction spans eight states and would add nearly 47,000 customer connections within American Water's existing footprint. In late May and early June, the companies filed for transaction approval in Illinois, Kentucky, New Jersey, Tennessee and Virginia. The companies have likely made similar filings with commissions in Maryland, Indiana and Pennsylvania, but they were not publicly available.

On Jan. 27, Eversource Energy said that it would sell its water operations, Aquarion Water, to the Aquarion Water Authority, a newly created Connecticut water authority. The $2.4 billion transaction consists of $1.6 billion in cash and $800 million of net debt. Aquarion Water is New England's largest private water company, serving approximately 230,000 customers through its subsidiaries Aquarion Water Co. of Connecticut Inc., Aquarion Water Co. of New Hampshire Inc. and Aquarion Water Co. of Massachusetts.

On May 6, Unitil Corp. announced that it would acquire the smaller Massachusetts and New Hampshire systems for $100 million with the assumption of about $30 million of debt. Aquarion serves approximately 10,000 customers in New Hampshire and 12,000 customers in Massachusetts.

Public comment hearings related to the proposed sale will be held on June 25 in Connecticut. In New Hampshire, the procedural calendar states that the companies must submit settlement agreements by Aug. 19, and evidentiary hearings have been tentatively scheduled for Sept. 9. On May 23, Unitil filed in Maine, requesting an exemption of regulatory approval on the transaction, as Aquarion does not have a presence in Maine. In Massachusetts, evidentiary hearings, if needed, have been set for Aug. 4.

Relevant legislative actions

Connecticut — On June 17, House Bill 6777 was enacted, having passed in the Senate on June 4 and the House on May 31. This legislation allows water companies to charge a water quality and treatment adjustment to recover costs for capital projects required to comply with state and federal water regulations. The Connecticut legislature adjourned on June 4.

New Jersey — On May 12, Senate Bill 4304 was introduced, which would require the BPU to determine and consider the lowest reasonable return on equity before approving electric, gas and water public utility base rate cases. On June 12, the bill was reported from the Senate Economic Growth Committee and had a second reading. Similar legislation in the Assembly (Assembly Bill 5436) is progressing at the same pace.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Theme

Location

Products & Offerings

Segment