Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 30, 2025

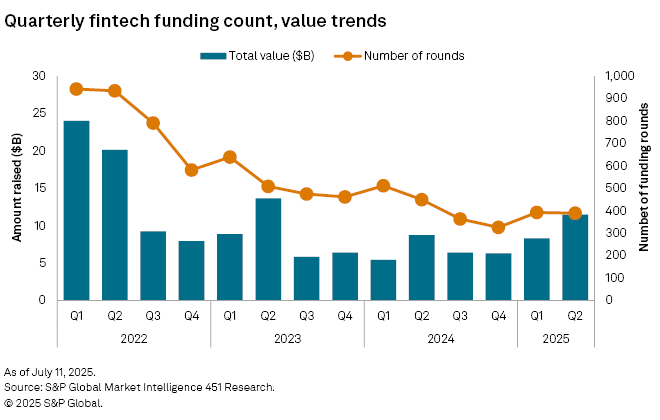

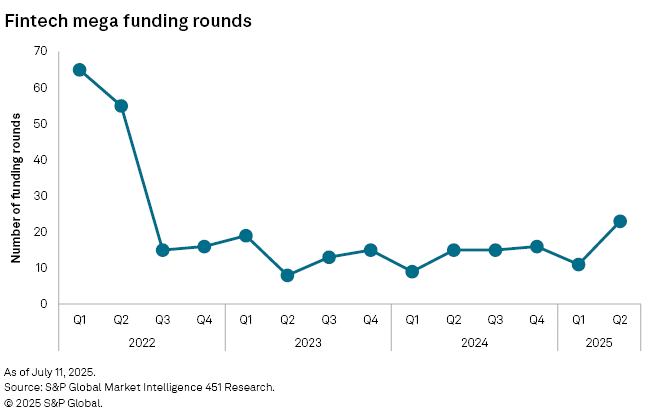

Fintech funding rebounded sharply in the second quarter of 2025, reaching $11 billion globally across 390 funding rounds, according to our analysis of S&P Global Market Intelligence data. It was the first time fintech funding surpassed $10 billion since the start of the venture capital downturn in the third quarter of 2022. While deal volume continued to decline, investor appetite for high-quality opportunities grew, with average deal sizes hitting a two-year high of $28.2 million. Mega rounds surged to 23 deals, also the highest in three years, signaling renewed confidence in growth-to-mature-stage fintechs.

The second quarter of 2025 funding data tells a story of capital concentration, sector rotation and investor discipline. It offers clear signals that fintech is entering a new phase — one defined more by quality than quantity. Investors are rotating out of risk-heavy models like lending and into capital-efficient, defensible verticals like payments infrastructure, data and insurance platforms. More money is going to North America, while other regions have yet to arrest the investor retreat. If US success stories continue to demonstrate profitability and scale, other regions could ride that momentum in the coming quarters.

Cross-border payments continued to attract capital, driven by ongoing demand for infrastructure that solves fragmentation in global money movement and investor interest in niche, tech-enabled corridors. At the early stage, the themes are more experimental but focused: Funding rounds led by startups specializing in agentic payments, QR-based fleet systems and bitcoin-native insurance show that infrastructure remains a fertile area for innovation.

Q2 2025 value rebounds but deal count slips

In the second quarter of 2025, global fintech funding reached $11 billion, marking a 22% increase from the first quarter of 2025 ($9 billion) and a 22% year-over-year rise from the second quarter of 2024 ($9 billion). This is the strongest quarterly performance since the third quarter of 2022 and the first time funding has crossed the $10 billion mark in nearly three years. However, deal volume continued to decline, with 390 deals recorded, down 13% from the second quarter of 2024 (450 deals) and flat compared with the first quarter of 2025 (393 deals) as investors remain selective and focus on high-quality startups.

There were 23 mega rounds (over $100 million) in the second quarter of 2025, up from 11 in the first quarter of 2025 and 15 in the second quarter of 2024. This 109% quarter-over-quarter and 53% year-over-year increase highlights the growing influence of large late-stage rounds in lifting overall funding levels.

Key funding rounds and emerging themes

Acrisure LLC raised a record $2.1 billion, making it the largest fintech funding round of the second quarter of 2025. The deal, led by Bain Capital, lifted the US-based insurance broker's valuation to $32 billion, which marks a nearly 40% increase since its last institutional round in 2022. Acrisure is positioning itself as a tech-enabled financial services platform, with capital earmarked for strategic M&A and continued investment in AI, data and analytics infrastructure. The firm's earlier acquisitions, including Tulco LLC's AI-powered insurance arm ($400 million) and QuickInsured.com LLC, underscore its technology-first strategy.

Cross-border payments represented a major funding theme, with over 10 deals globally. Singapore-based Airwallex (Singapore) Pte. Ltd. and Thunes each secured $150 million in late-stage rounds. Airwallex plans to deepen its global infrastructure, while Thunes aims to scale in the US, bolstered by recent regulatory approvals across 50 states. US-LatAm remittance startup Felix Technologies Inc. raised $75 million to expand its WhatsApp and stablecoin-powered money transfer network. Other noteworthy rounds include Fuse Financial Technologies Inc. ($6.6 million, Middle East and North Africa focus), OpenFX ($23 million for transparent FX rails), Payall Payment Systems Inc. ($1.5 million seed) and Pexx Technology Pte. Ltd. ($4.5 million seed for stablecoin-to-bank transfers).

AI is also reshaping the expense management fintech space, with Brazil's Clara Lending Co. and US-based Ramp Business Corp. raising capital to automate finance workflows. Ramp raised $200 million at a $16 billion valuation, noting that AI drives over half of its research and development output.

On the seed-to-early-stage frontier, the following funding rounds caught our attention:

– Meanwhile, a bitcoin-denominated life insurance startup ($40 million series A).

– Nekuda, building agentic payments infrastructure ($5 million seed).

– Piston Technologies Inc., QR-based systems for fleet payments ($6.1 million seed).

– P2P.me, enabling cryptocurrency QR code payments ($2 million seed).

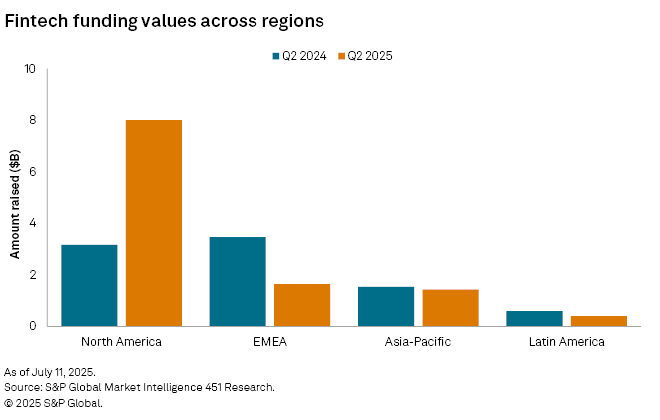

North America surges, other regions pull back

In the second quarter of 2025, North America drove the recovery in global fintech funding activity, raising $8.0 billion, up 150% from the same period in 2024. The US alone accounted for $7.8 billion, making it the dominant destination for fintech-focused venture capital by a wide margin.

In contrast, Europe, the Middle East and Africa experienced a sharp decline, with funding dropping by more than 50% year over year to $1.6 billion. The UK and the Netherlands were the region's leading markets, raising $513 million and $245 million, respectively.

Asia-Pacific remained relatively stable, bringing in $1.4 billion. India and Singapore remained the region's key bright spots, each attracting half a billion dollars in funding. Latin America, meanwhile, saw funding fall to $400 million, as VC activity in the region slowed amid macroeconomic uncertainty.

Overall, the second quarter of 2025 funding trends show capital consolidating in North America and select Asia-Pacific markets, while Europe and Latin America continue to face headwinds. Notably, renewed VC optimism in North America is driven by ongoing innovation and improving exit prospects as a number of fintechs listed (Circle Internet Group Inc., Chime Financial Inc., eToro Group Ltd. and Webull Corp.) or are planning to list on US stock exchanges. Historically, North America serves as a bellwether for global fintech investment, so a sustained recovery in the US could eventually ripple into other regions.

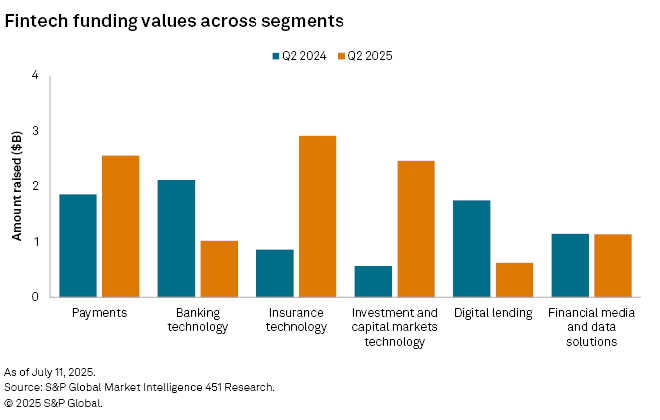

Payments, insurance technology have a decent outing

Insurance technology led all segments with $2.9 billion, more than tripling year over year, as investors bet on digital underwriting, AI-driven risk assessment and embedded insurance models. Investment and capital markets technology followed closely with $2.5 billion, reflecting renewed interest in platforms serving institutional and retail traders.

Payments remained a stronghold, attracting $2.6 billion, up 37% from the second quarter of 2024, driven by demand for cross-border and real-time payment solutions. In contrast, digital banking and lending saw sharp pullbacks. Banking technology funding fell by over 50%, while digital lending plummeted 67%, indicating investor caution amid margin compression and rising credit risk.

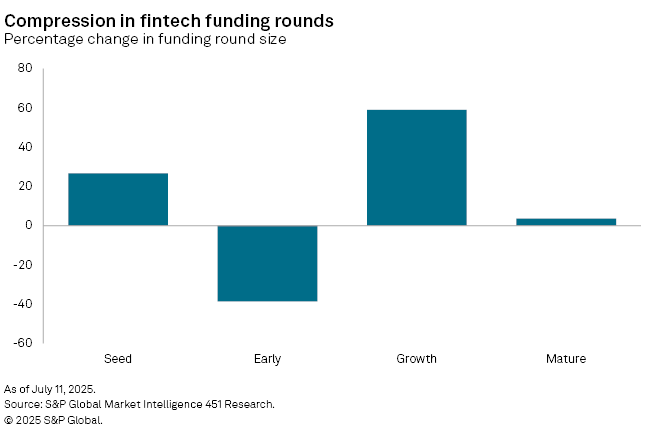

Stage-wise analysis: VCs write larger checks, but pull back at early stage

Fintech funding in the second quarter of 2025 showed a strong return of investor confidence at the mature and growth stages, while activity at the seed and early stages revealed a shift in strategy toward caution and selectivity.

– Mature-stage funding surged 86% to $5.2 billion, with average round sizes rising modestly by 3.5%, suggesting a return of late-stage capital with valuation discipline.

– Growth-stage funding rose 11%, but deal count dropped 30%, pushing average round sizes up 59%, driven by larger, selective bets.

– Early-stage funding fell 17%, even as deal volume increased 35%, resulting in a 39% drop in average round size, reflecting cautious deployment. Seed-stage activity declined, but average round size rose 27%, showing capital concentration around high-quality early teams.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Market Intelligence 451 Research is a technology research group within S&P Global Market Intelligence.

Location

Products & Offerings

Segment