Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 18, 2021

2020 proved to be a challenging year for many, with the impact of the coronavirus pandemic causing a variety of issues; from reductions in trade in the initial months of the year, to port congestion as the wheels of industry began spinning again. Despite the hardships faced by industry, it is difficult as such to imagine that certain products in industry thrived in the face of the pandemic.

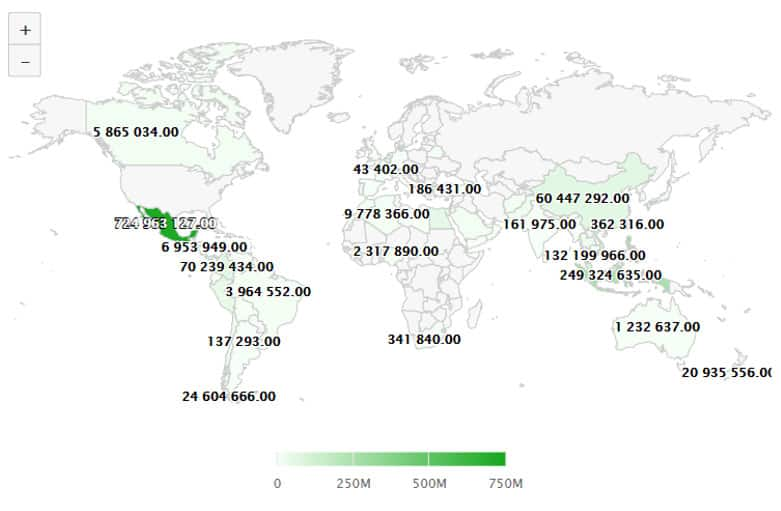

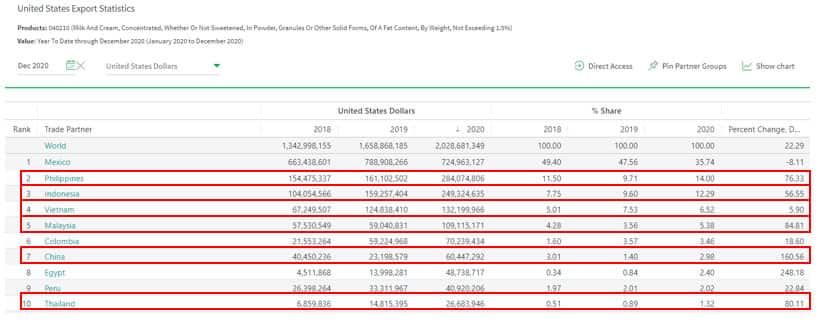

For instance, a review of the United States export trade of skim milk powder or SMP (HS 040210), for calendar year shows a resounding increase of 22.29% in trade between 2019 and 2020, coming in at just slightly over $2 billion. This increase is made all the more impressive by the fact that the price per ton increased as well, at a healthy 5.22% so those in the industry were not only able to export larger volumes but were also able to do so at for a better price.

Driving this increase in export activity was an equally strong demand in Asia, with six of the top ten U.S. markets being in Asia.

Source: IHS Markit Global Trade Analytics Suite

Source: IHS Markit Global Trade Analytics Suite

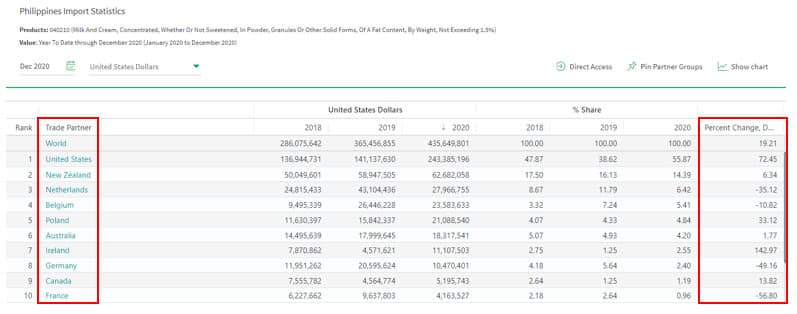

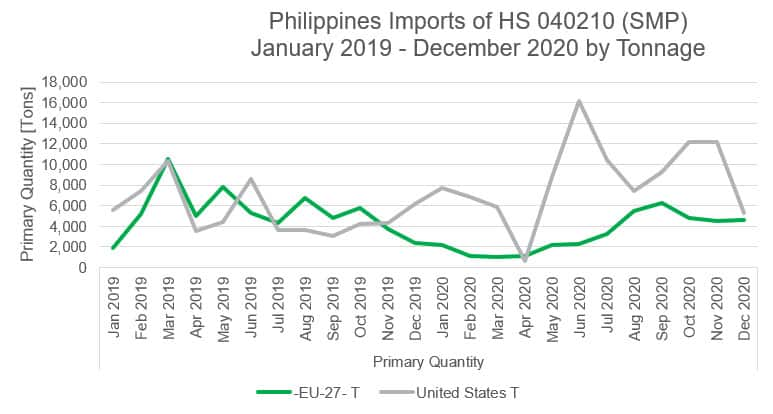

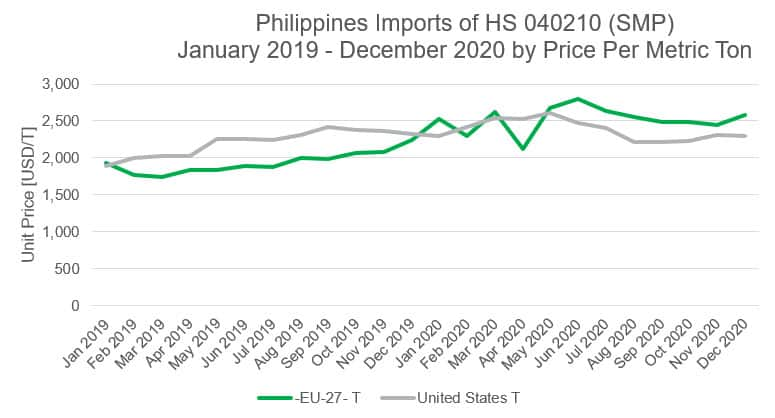

A closer look at the Asia markets shows that the increase in demand for U.S. SMP is possibly a result of supplier diversification, as a weakening of imports from Europe can be observed over 2020, where many of the formerly strongest suppliers are now seeing double digit percentage drops in imports for markets like the Philippines.

Source: IHS Markit Global Trade Analytics Suite

Source: IHS Markit Global Trade Analytics Suite

This shift to imports from the U.S. over the European suppliers is mainly driven by how the price for U.S. SMP is lower even with the increases in price per ton.

Source: IHS Markit Global Trade Analytics Suite

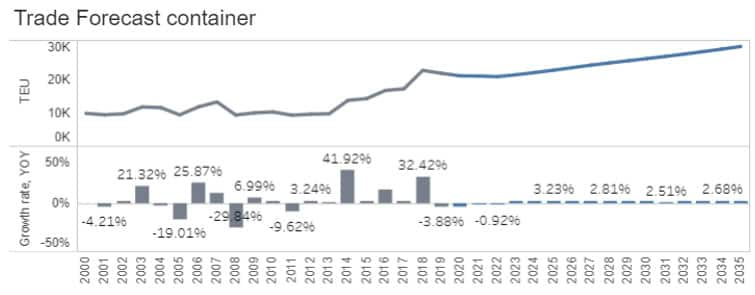

This marked increase in the Philippines imports of SMP belies the expectation of forecasts which had predicted a contraction of their imports and then a steady growth over the next few years.

Source: IHS Markit Global Trade Analytics Suite

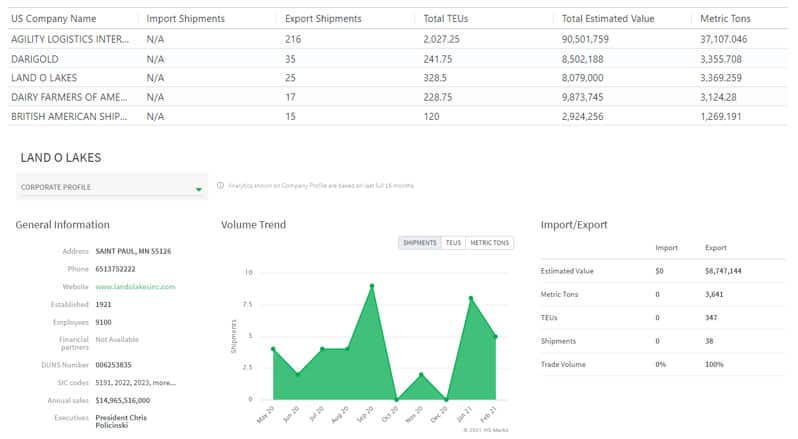

This unforeseen growth has created opportunities for producers like Darigold, Land O' Lakes, & Dairy Farmers of America to export into this new and growing market.

Source: IHS Markit Global Trade Analytics Suite

If the past year has highlighted anything, it is that the marketplace is a constantly changing landscape, one that requires companies to have the best tools and insights to allow them to stay competitive. Data without analysis won't be sufficient in the face of shifting supply chains or price volatility and only the type of analysis that takes into account both market and supplier perspectives, allows for the tracking and comparison of pricing, gives insight into the companies involved, all while keeping an eye on what the future holds through market forecasting will position companies to take advantage of opportunities when they arise. This kind of analysis is hard won using a combination of trustworthy data and years of experience and industry knowledge, both of which can be hard to come by, but IHS Markit has leveraged both in the creation of its Global Trade Analytics Suite (GTAS) that provides users the agility to gain decision ready intelligence built on a foundation of trusted data.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

Posted 18 March 2021 by Russell Patterson, Subject Matter Expert, Maritime, Trade & Supply Chain, S&P Global Market Intelligence

How can our products help you?