Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 12, 2020

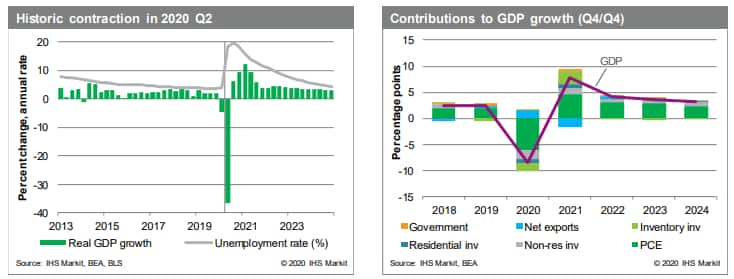

Strict "social distancing" mandates, supply chain disruptions and sharp declines in the energy sector due to plunging oil prices are resulting in a deep global contraction of uncertain depth and duration. Production and employment in the US and global economies are declining sharply in the second quarter, following a decline that began in the first quarter. Social distancing has shut down a broad swath of the global economy, and knock-on effects will impose further economic damage. A gradual re-opening of the economy has begun, limiting the decline in second-quarter production.

Massive and broad-based layoffs totaling over 30 million and sharp declines in many asset prices imply an unprecedented deterioration in household-sector economic wellbeing that further restrains consumer spending in the near- and medium-term.

We assume the daily number of new cases and deaths recorded nationally dwindle to low enough numbers to permit a reasonably broad partial relaxation of social distancing mandates by June. This will put the trough in economic activity in the second quarter, when consumer spending is expected to plunge at an astounding 43% annualized rate. In combination with sharp declines in other components of GDP, this will result in an unprecedented 37% annualized rate of decline in GDP in the second quarter.

We assume the daily number of new cases and deaths recorded nationally dwindle to low enough numbers to permit a reasonably broad partial relaxation of social distancing mandates by June. This will put the trough in economic activity in the second quarter, when consumer spending is expected to plunge at an astounding 43% annualized rate. In combination with sharp declines in other components of GDP, this will result in an unprecedented 37% annualized rate of decline in GDP in the second quarter.

The employment losses will push the unemployment rate to 19.6%; it would have been 6 percentage points higher but for unprecedented declines in the labor force. Core PCE inflation is projected to average about 0.7% over the next six quarters, and remains below 2.0% through 2025.

Thanks to quick cuts in the Federal Reserve's policy rate to near zero, massive injections of liquidity and guidance to banks for exceptional forbearance, credit markets continue to operate; nevertheless, equity and bond markets have seen sharp declines in prices. Equities are rebounding in the second quarter, following a roughly 20% decline in Q1. Ten-year Treasury note yields are projected to average below 1% for much of the next three years before edging higher. Roughly $2.5 trillion in Federal rescue packages will help stabilize the economy in the near-term and fuel the rebound.