Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 24, 2022

Soaring virus cases have brought the US economy to a near standstill at the start of the year, with businesses disrupted by worsening supply chain delays and staff shortages, with new restrictions to control the spread of Omicron adding to firms' headwinds.

However, despite the survey signalling a disappointing start to the year, there are some encouraging signals for the near-term outlook.

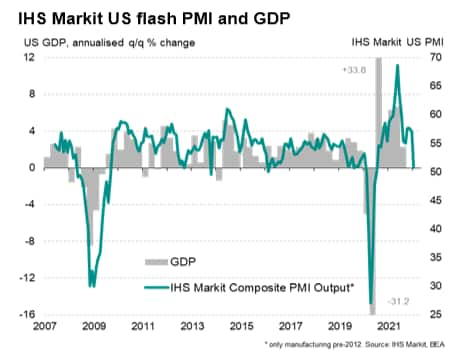

Adjusted for seasonal factors, the IHS Markit Flash US Composite PMI Output Index - covering both manufacturing and service sectors - posted 50.8 in January, down sharply from 57.0 in December. The resulting increase in activity was only marginal, and the smallest since July 2020.

The January flash PMI is therefore indicative of annualised GDP growth close to stalling at the start of 2022, representing a marked contract to the robust growth of 3.25-3.5% signalled for the fourth quarter of 2021.

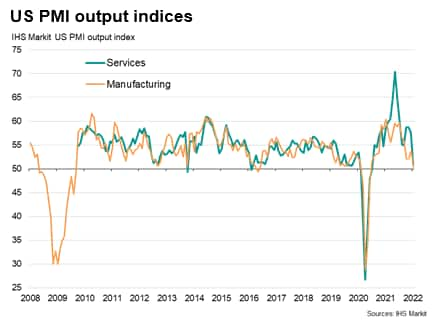

Both manufacturing and service sector firms reported near-stagnant output as the steep spike in virus cases associated with the Omicron wave dented demand and meant ongoing supply issues and labour shortages were exacerbated by renewed pandemic related containment measures.

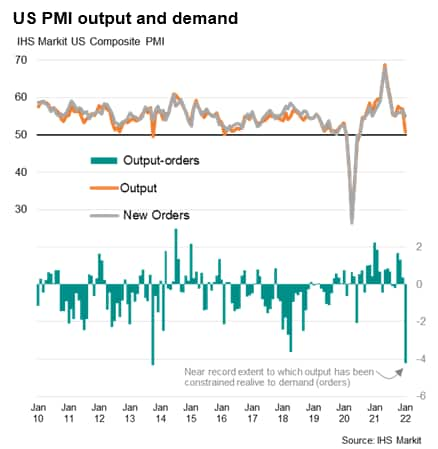

Although output was constricted by the Omicron wave, demand growth remained somewhat more resilient. New orders for goods and services continued to rise strongly, albeit registering the weakest rise since December 2020. The resulting gap between output and new orders was the second largest recorded by the survey to date, exceeded in the last 12 years only by the gap seen in October 2013, reflecting the near-unprecedented constraints on output recorded in January due to the flare up of COVID-19 cases and accompanying virus containment precautions.

IHS Markit's COVID-19 Containment Index registered the tightest degree of restrictions on the economy since last May, albeit indicating an overall containment far below the levels seen in early 2021 and throughout 2020. Encouragingly, the robust growth of new business inflows hints that growth will pick up again once these restrictions are relaxed.

However, prospects differ between the two major sectors of the economy. The upturn in new orders was supported primarily by the service sector, as manufacturers saw new sales growth held back by weaker demand from clients, often amid resistance to price rises. Renewed restrictions in key export markets and raw material shortages also led to a softer upturn in new export orders. Thus, while inflows of new business into the service sector grew at a solid rate that was only slightly weaker than the average seen over the fourth quarter of last year, factory orders growth slowed to the weakest since July 2020.

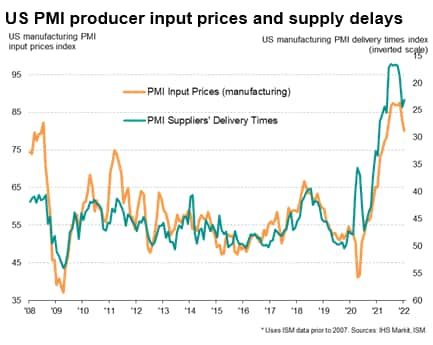

Although demand growth at factories waned, the survey brought some encouraging news on the supply chain crunch. Although supply chain delays continued to prove a persistent drag on the pace of economic growth, linked to port congestion and shipping shortages, the overall rate of supply chain deterioration eased compared to that seen throughout much of the second half of last year. Average supplier delivery times lengthened to a slightly greater degree than in December due to the Omicron impact, but the extent of delays remained far below that seen throughout much of the second half of 2021.

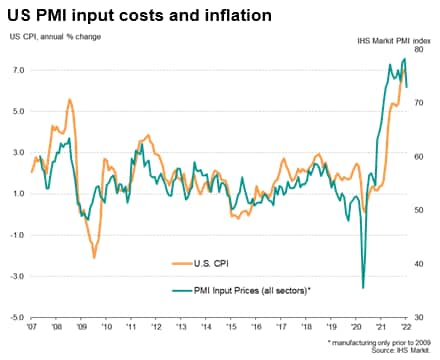

This trend of alleviating supply constraints has in turn helped lift manufacturing optimism about the year ahead to the highest for over a year, and has also helped bring the rate of raw material price inflation down.

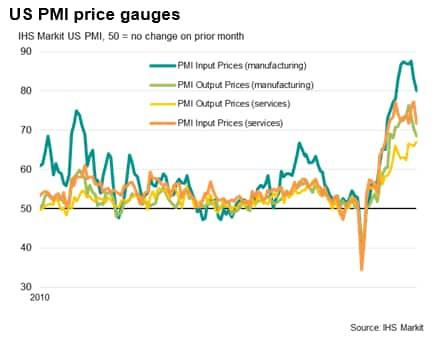

Service sector input cost inflation also slowed in January. The pace of increase was the joint-softest for almost a year despite being marked overall, linked to supplier price hikes and soaring energy and wage bills. The relatively solid demand conditions allowed companies to pass-through some input cost increases, pushing the rate of service sector charge inflation to a series high, but the easing in input cost inflation - if sustained - should help alleviate upward pressure on charges in coming months.

The overall easing of input cost pressures in January therefore provides a tentative signal of a peaking in the annual rate of US consumer price inflation, though it is clear than the rate of inflation signalled remains elevated by historical standards, and far in excess of the Fed's policy target.

The US economy therefore started the year on a disappointing footing of near-stagnation due to the surge in COVID-19 cases associated with the Omicron variant. There were some pockets of encouraging news, however, notably via sustained resilient service sector demand growth and signs of the supply chain crisis easing, albeit exacerbated slightly in the short-term by Omicron. Importantly, these easing supply conditions have helped bring down raw material price inflation, which should in turn feed through to lower consumer price inflation in coming months, if sustained.

But there remain many uncertainties and potential headwinds.

First, a flaring of COVID-19 cases usually dampens service sector spending, notably on hospitality, but we also see a diversion of spending towards goods. This diversion does not seem to have occurred in January. Instead, factories reported even slower demand growth. This suggest that the demand recovery momentum is fading.

Second, although cost inflation has cooled, it remains highly elevated and is being supported by high wages and soaring energy costs, the latter having the potential to remain problematic in the face of rising geopolitical tensions. The impact of Omicron on Asian supply chains is also not yet evident.

Third, the FOMC is embarking on policy tightening with an increasingly aggressive stance being signalled and priced in by markets. This will dampen inevitably demand further.

Upcoming final PMI data should provide further insights into detailed sector trends within the US economy, which will help to assess the strength of demand for different goods and services in particular. The global manufacturing PMIs will also shed light on the Omicron supply chain impact, especially in Asia.

Updates can be received directly into your inbox by subscribing for free here.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location