Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 18 , 2025

By Ronamil Portes and Zain Tariq

Bank investments in held-to-maturity securities continued to decline in the first quarter as persistently higher interest rates weighed on bond values and that seems unlikely to change soon.

Bank bond portfolios remained underwater in the first quarter and valuations have not improved much in the second quarter as fears of persistent inflation and budget deficits have pushed intermediate rates higher since the recent low point in early April. Many banks have been hesitant to take significant action in their bond portfolios amid market volatility that caused considerable swings in bank stock valuations. The volatility had a chilling effect on bank capital raising activity in April and much of May and new capital has often facilitated investment portfolio restructuring in recent quarters. Bank managers were more likely to let lower-yielding securities roll off their books and reinvest cash flows into higher-yielding options available in the market today, but a sustained rebound in bank stock valuations could foster more activity.

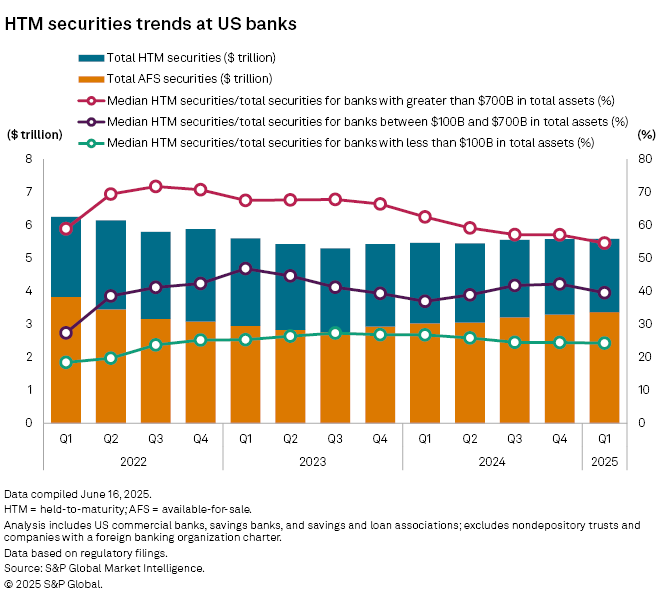

Banks strategically tweak AFS and HTM securities mix

Aggregate HTM securities as a proportion of total securities fell for the sixth consecutive quarter to 39.7% as of March 31, from its peak of 47.9% at the end of the third quarter of 2023 but remains well above the pre-pandemic levels. On the other hand, aggregate AFS securities increased 2.2% or by $72.61 billion during the quarter to $3.364 trillion as of March 31, although the increase largely came from the bigger banks. On a median basis, AFS securities declined 0.2% during the quarter.

Over the last several quarters, the aggregate trends in securities portfolios are notably skewed by bigger banks like Bank of America Corp., which has added more to its total securities balances over the last seven quarters than the industry as a whole. Nearly 1,100 or roughly 25% of the banks reported a quarter-over-quarter decline in HTM securities while 52% reported a decline in AFS securities.

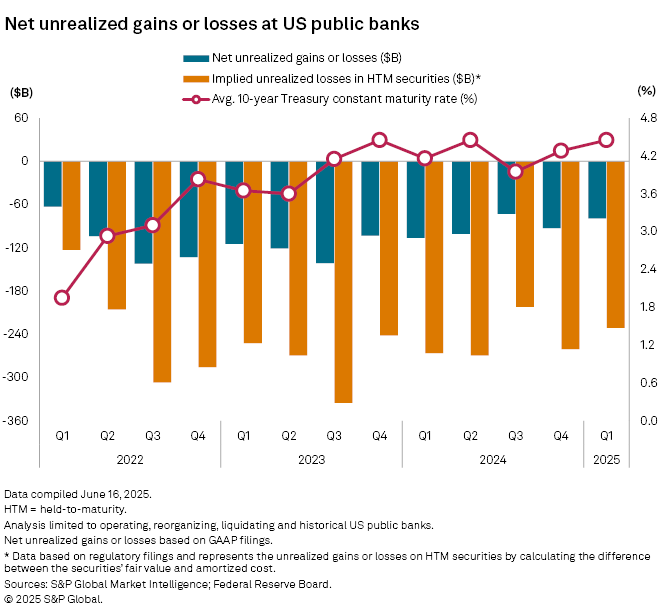

Banks continue to sit on unrealized losses tied to bonds they purchased when institutions were flush with excess liquidity and interest rates were far lower. Increases in interest rates punished the values of many bonds that banks held while their funding costs moved higher, putting pressure on their net interest margins. While peak funding costs are in the rearview mirror, a number of institutions have sought to shed lower-yielding securities by restructuring their bond portfolios. That activity has slowed though as banks battle through the market volatility.

Michael Achary, CFO at Hancock Whitney Corp., discussed the concerns around using excess capital for bond restructuring during the first-quarter earnings call. "..to actually pull the trigger on something like that, we'll need a little bit more stability, especially in the bond markets or a little bit confidence that the bond markets will remain stable if they get there." The company previously executed a restructuring of AFS securities in November 2023, selling $1.04 billion of lower-yielding instruments, realizing a $65.4 million loss, utilizing the proceeds to reinvest in higher-yielding securities and repay borrowings to enhance net interest margin.

Higher for longer rates keep the pressure on bonds

Lower intermediate rates during the first quarter helped net unrealized losses on AFS securities for publicly traded US banks improve to $78.91 billion, down from $92.65 billion in the fourth quarter of 2024. However, the relief was short-lived as tariff announcements in early April renewed economic uncertainty and heightened expectations of prolonged high interest rates, placing further pressure on bond values. Although the investor confidence in the space has soured, the industry remains optimistic, and many banks have repositioned their balance sheets over the last several quarters eyeing net interest income expansion as bonds mature or reset at higher prices.

Changes in market values in banks' AFS portfolios are recorded in accumulated comprehensive income and impacted tangible common equity. In extreme cases, where the tangible common equity ratio falls to critically low levels, restrictions on borrowing from the Federal Home Loan Banks could be imposed against a financial institution.

Some banks have opted to sell underwater securities, realizing the losses while using the proceeds to pay down more expensive borrowings or reinvest in higher-yielding assets. On aggregate, US banks reported net realized losses on securities of $2.02 billion during the first quarter, marking the third consecutive quarterly decline since reaching $8.80 billion in the second quarter of 2024.

Five banks reported a net realized loss of over $100 million during the first quarter with TD Group US Holdings LLC leading the group at $598.0 million. Ally Financial Inc. followed next with $495.0 million while Eastern Bankshares Inc., SouthState Corp., and Wells Fargo & Co. realized net losses of $269.6 million, $228.8 million, and $147.0 million, respectively, tied to securities repositioning.

Michael Rhodes, CEO at Ally Financial, said during the first quarter earnings call that the company executed two repositioning transactions during the quarter. "These strategic moves reduce interest rate risk and immediately increase net interest income," he said.

For larger banks, or advanced approaches banks, the unrealized losses on AFS securities also impact the regulatory capital. Many of those banks have relied more heavily on HTM securities as these bonds are recorded at amortized cost, offering stability and insulation from mark-to-market capital volatility. However, the implied losses on these bonds have surged as the yields on the securities remain well below current market levels, serving as a drag on institutions' profitability.

Moreover, hedge accounting treatment is prohibited for hedges on HTM securities. Since these bonds are not intended to be sold, reclassification of these securities due to changing market conditions is also generally restricted and costly. Most banks are allocating fewer funds into these portfolios and seem to have plans to allow them to mature and roll off their balance sheets.

Through June 12, the average yield has fallen to 4.37% but remains well above the recent low point reached in the weeks before the Federal Reserve began lowering the short-term rates in September 2024. The 10-year yield fell steadily in the third quarter of 2024 ahead of the Fed's planned rate cuts and bottomed in mid-September before rising through year-end 2024.

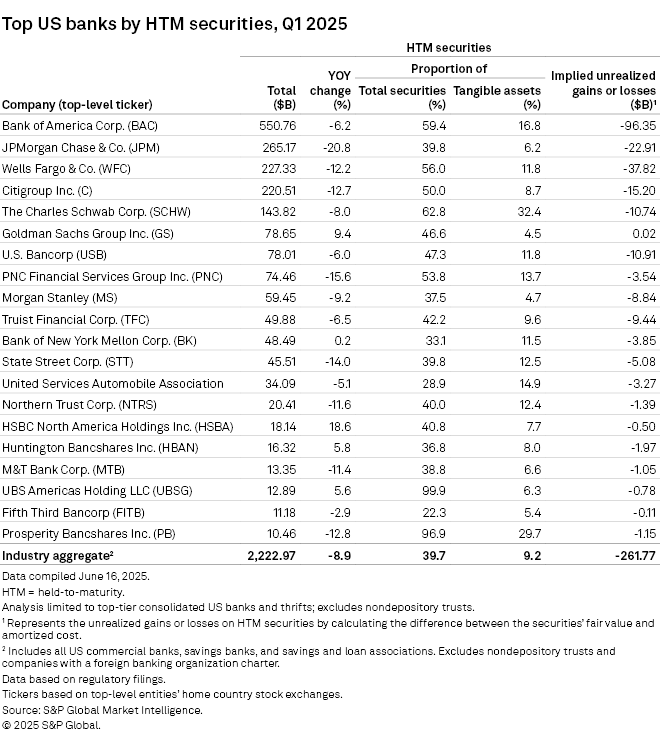

Large banks at forefront of HTM securities decline

While some banks actively engage in reshaping their securities portfolios, others remain cautious amid economic uncertainties.

Among the 20 largest banks by HTM securities, only five reported a year-over-year increase in balances while three reported an increase from the previous quarter. HTM securities at Bank of America Corp. represented 59.4% of its total securities portfolio, despite declining 1.4% during the quarter and 6.2% year-over-year to $550.76 billion. AFS securities at the company grew 8.6% quarter-over-quarter and 20.2% from a year-ago to $376.25 billion.

Despite being the nation's largest securities holder, the higher concentration in HTM securities serves as a drag on yield on securities for the company which declined eight basis points to 2.91% during the quarter and remains well below its peers.

JPMorgan Chase & Co. reported the biggest year-over-year decline in HTM securities of 20.8% to $265.17 billion while Citigroup Inc. led with the biggest quarterly decline of 9.1% to $220.51 billion as of March 31. Wells Fargo saw a 12.2% decline year over year in its HTM securities balances.

JPMorgan, Citi, and Wells Fargo reported a yield on investment securities of 3.79%, 3.71%, and 3.31%, respectively, during the first quarter. Aggregate yield on investment securities for the industry was down 2 basis points to 3.24%.

Securities at domestically chartered US banks are up 2.3% between March 26 and June 11, according to the seasonally adjusted data from the Fed's H.8 report on estimated assets and liabilities. Large domestically chartered banks, which are defined as the largest 25 by domestic assets, reported a 2.8% increase while small banks reported a 0.8% increase during the same period.

Deposits and loans grew by 1.0% each while cash assets are down 0.4%.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.