Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 25 , 2025

By Zain Tariq and Nathan Stovall

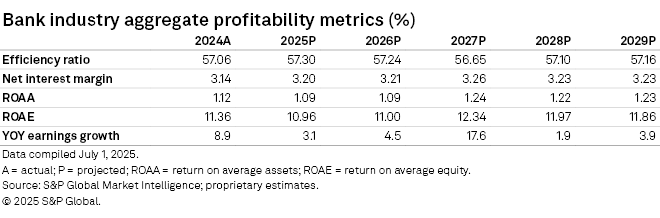

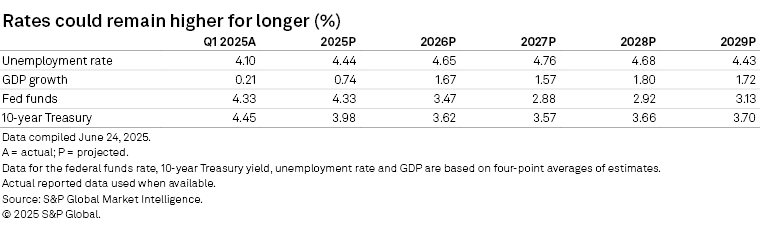

US banks' net interest margins are poised to expand, but higher-for-longer interest rates and uncertainty created by tariffs will push credit costs higher and limit earnings growth in 2025.

Banks' earnings should remain healthy through the first half of the year, buoyed by continued margin expansion, steady loan growth and benign credit quality. Earnings growth could prove more challenging in the second half of 2025 as the lagging impact of tariffs slows growth, weighs on the consumer and pushes delinquencies higher. Those emerging earnings headwinds will be modest but could provide further support for stronger bank M&A activity as institutions seek ways to grow.

Click here to access data exhibits and the US banking industry's projections template.

Banks benefit from remixing balance sheets as time heals all wounds

Banks continue to benefit from the remixing of their balance sheets as higher-cost deposits roll off their books and are replaced with less costly forms of funding, while lower-yielding securities mature and are reinvested at higher yields. That trend should continue this year, but the pace of improvement will slow in the coming quarters.

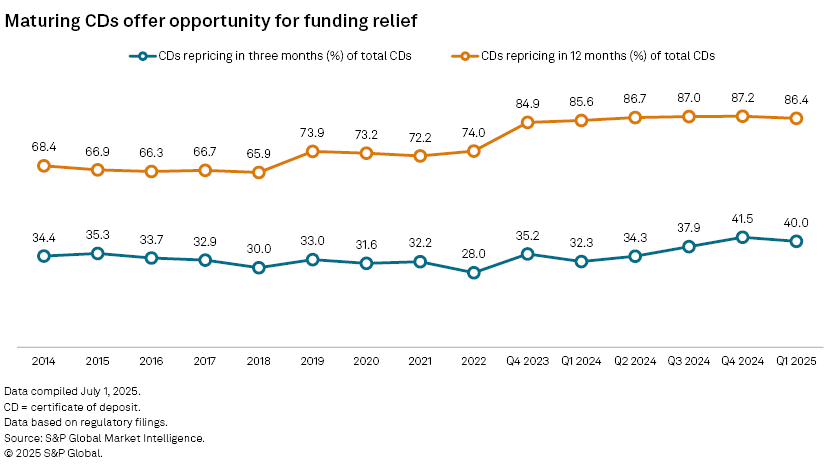

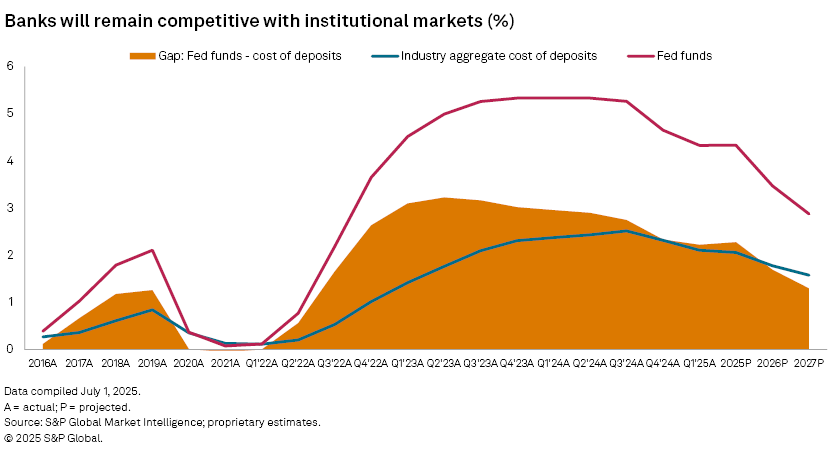

Deposit costs dropped substantially in the fourth quarter of 2024 and the first quarter of 2025, with the cost of deposits falling 20 basis points and 21 basis points, respectively, from the previous quarter. We expect smaller declines in the second quarter, and early reports from JPMorgan Chase & Co. and Wells Fargo & Co. support that thesis. A key driver of deposit costs will be the maturity schedule of certificates of deposits (CDs). Banks, particularly regional and community banks, increased their reliance on CDs for funding during the Fed’s tightening cycle. Many CDs carry one-year terms, so institutions might not feel significant pricing relief until the maturation of CDs originated before the initial Fed rate cut in September 2024.

At the end of the first quarter, the bulk of CDs were set to mature in the next year, with 40.0% of all CDs maturing or repricing in the next three months, while 86.4% of CDs were set to mature in the next 12 months. At the end of the first quarter of 2025, CDs maturing in the next three months equated to 5.9% of the industry's deposits, while CDs maturing in the next 12 months equated to 12.7% of the industry's deposits.

When those CDs mature, most banks will have to meet market rates to retain the deposits. CD rates began declining late in the third quarter, with far fewer institutions offering the products at rates over 4%, but there has been less movement around the 3.5% level. The number of banks marketing one-year CDs over 3.5% included 1,054 institutions as of July 11, down from 1,079 as of March 28, 1,134 as of Dec. 27, 2024, and 1,266 as of Sept. 27.

The shedding of higher-cost CDs has helped banks lower their deposit costs, but banks will need to remain competitive with alternatives in the Treasury and money markets as they seek to cut costs further. The difference between the average fed funds rate and the industry's cost of deposits narrowed further in the first quarter of 2025 to the smallest gap recorded since the third quarter of 2022, when the Fed was still early in its tightening campaign. That gap should widen modestly in 2025 as banks balance lowering their deposit costs while staying competitive with higher-yielding alternatives to maintain deposit growth.

Weaker loan growth should also reduce banks' funding needs and let them move deposit costs incrementally lower. Deposits should grow further, but interest-bearing deposits will continue to grow at a quicker clip than non-interest-bearing deposits — banks' most prized source of funding.

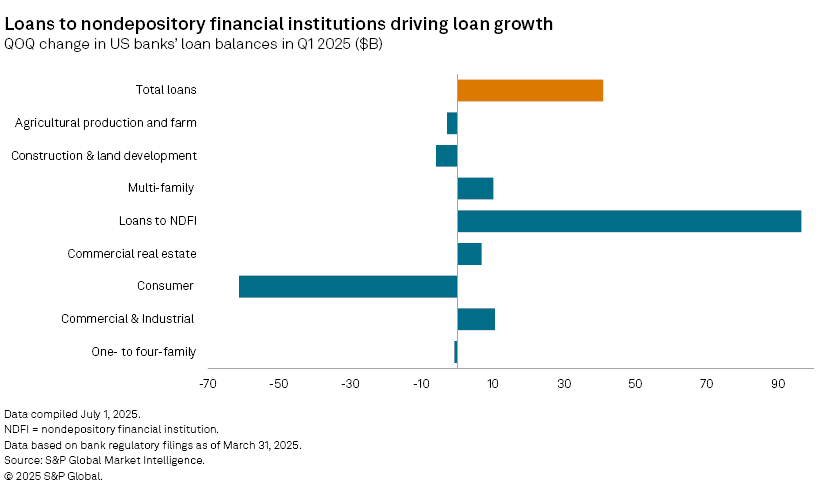

Loan growth should remain relatively weak as borrowers digest new trade policies that could change the cost of operating their businesses and households. The true impact of tariffs arguably has not been felt yet, as businesses increased inventories ahead of the landmark announcements in early April. The building of inventories has allowed some businesses to maintain prices at pre-tariff rates for now.

Notably, loans to nondepository financial institutions, including private credit firms that compete with banks, were by far the biggest driver of loan growth in the first quarter. The Fed’s H.8 data captures loans to those institutions in an “other loan” bucket. Through the end of the second quarter, growth in that category remained stronger than other lending types, such as commercial and industrial, commercial real estate and consumer loans.

Credit quality just normalizing for now, but future looks murkier

Bankers maintain that their borrower base remains healthy, and the US economy has proven resilient in the face of uncertainty created by protectionist trade policies, with job gains in June exceeding economists’ forecasts. However, credit quality continues to normalize as criticized loans increase.

Criticized loans at US public banks rose again in the first quarter, with the median ratio of criticized loans to Tier 1 capital climbing to 20.04% from 18.52%. Banks classify loans as criticized if some sign of weakness emerges, but that migration does not necessarily suggest a future loss.

Much of the weakness and concerns in the investment community have related to commercial real estate loans. Some CRE borrowers face a double whammy of lower cash flows due to the rise of hybrid work and higher debt service stemming from increases in interest rates over the last few years. CRE delinquencies have risen for 10 consecutive quarters, but losses have often been less than many feared, in part due to well-funded distressed investors and private credit firms targeting the asset class. When banks have sold CRE loans — often in connection with an acquisition — sellers have recorded relatively modest discounts to par, ranging from 8% to 10%.

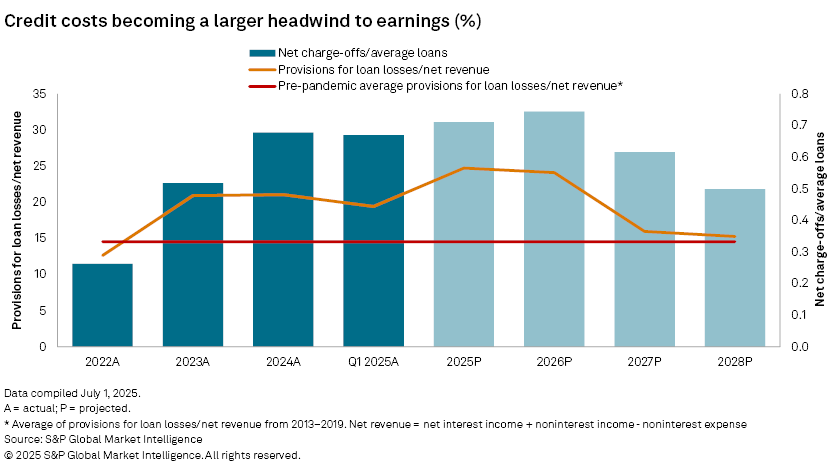

We expect related refinancing challenges to result in defaults and higher loss content in 2025, with net charge-offs continuing to rise from benign levels. We expect loss content to linger as banks provide borrowers with extensions in the face of some maturity walls.

Consumer delinquencies have also risen from historical lows. While many banks might not have sizable consumer or credit card portfolios, the consumer drives the economy. A weakened consumer could push the U.S. into a recession. The US consumer is stretched — savings rates have slowed, and excess savings accumulated during the pandemic have been exhausted — and higher prices could lie on the horizon if trade deals are not reached relatively soon.

Many banks have already set aside considerable reserves for the most troubled commercial real estate projects while preparing for normalization in consumer credit trends. Reserves rose to 1.75% of loans in 2023 from 1.59% in 2022 and held steady at 1.75% at year-end 2024 and through the first quarter of 2025. While we expect net charge-offs to rise significantly in 2025, losses and the reserves required to fund them should serve as a modest headwind to earnings rather than a severe downturn.

We expect provisions to rise to 23.3% of net revenue in 2025, up from 21.1% in 2024 and 20.9% in 2023. On average, from 2013 to 2019, banks' provisions equated to 14.6% of net revenue.

Looking ahead

Banks would be wise to price greater risk into their loan portfolios and consider rethinking their growth goals to allow them to play stronger offense when the credit cycle eventually turns.

Bankers could find strong loan growth tough to come by, and it could be prudent to avoid pressuring lenders to make new loans aggressively at this point in the cycle. Competition should remain fierce as credit is widely available to corporate borrowers through the high-yield, leveraged loan and competing private credit markets. Credit spreads widened when tariffs first surfaced in early April, but have since tightened back to near-record levels.

Rather than fighting to meet their organic growth goals, bank managers should move in the other direction and encourage lenders to tighten pricing and lending standards, increase debt service coverage ratios and move away from their least creditworthy borrowers. While lower loan volumes may reduce earnings in the near term, avoiding risk today could pay dividends further down the road and help banks minimize credit losses. The approach could also help institutions improve their funding bases, which represent the true value of a banking franchise. Slower loan growth would reduce a bank’s funding needs and allow quicker reductions in deposit costs.

A stronger funding base and continued strength in credit quality would be rewarded by investors and appeal to potential acquirers. Banks that are willing to take a step back and operate more cautiously now will also have a greater opportunity to continue growing, both organically and through acquisitions, when the next downturn occurs.

While M&A activity has remained relatively slow, the combination of modestly higher costs and slower loan growth could create more willing sellers. Greater interest could arise from institutions looking to partner with buyers, as bank valuations have recovered from the lows in April, setting the stage for much stronger dealmaking activity.

Scope and methodology

The outlook discussed in this article is based on a proprietary S&P Global Market Intelligence model that utilizes the actual results of nearly 10,000 active and historical commercial and savings banks and savings and loan associations. The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.