Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 23 2025

By Shaily Jain

The US Food and Drug Administration (FDA) last month approved UroGen Pharma Ltd. (NASDAQ: URGN) Zusduri, the first and only treatment approved for adults with recurrent low-grade, intermediate-risk non-muscle invasive bladder cancer.

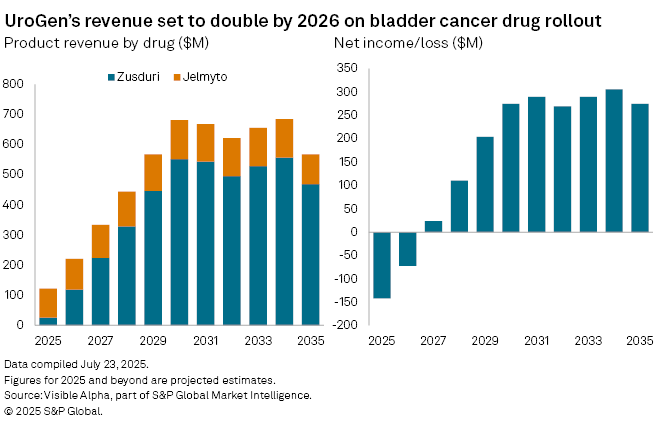

Analysts expect Zusduri to become a central pillar of UroGen’s revenue base. Visible Alpha consensus forecasts show the drug generating $26 million in revenue in 2025, rising to $118 million in 2026 and reaching $224 million by 2027. Peak global sales are projected to hit $557 million by 2034, underpinned by patent protection through the end of 2031.

As Zusduri gains traction, its contribution to the top line is expected to grow from 21% of total company revenue in 2025 to 51% in 2026, and 75% by 2030.

That momentum is expected to flow through to the bottom line. The company’s net loss is forecast to narrow from $142 million in 2025 to $72 million in 2026, before swinging to a $24 million profit in 2027. Revenue growth is also expected to accelerate, climbing +36% year-on-year to $123 million in 2025 and surging +88% to $232 million in 2026.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings