Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 07, 2022

Introduction

Ukraine is one of the main world exporters of grains as well as vegetable oils. The main agriculture export products are Corn and Wheat. In 2021 Ukraine was the second largest supplier of grains for the European Union (EU) and a large food supplier for low and middle-income countries in Asia and Africa. The longer the Russia-Ukraine conflict lasts, the more insecurity about food supplies it may bring not only to the Ukraine and the region, but also to the whole world.

Key agriculture commodities exported from Ukraine

For 2021, GTAS Forecasting from S&P Global Market Intelligence estimates the exports of Ukrainian corn for 27.2 million metric tons and the export of wheat is estimated for 21.2 million metric tons. These two stand for 12.8% and 10.5% of the total world exports, respectively.

Apart from corn and wheat, which definitely play the major role here, among the top ten exported goods, we can name also the following edible goods: 'Animal and vegetable oils, excluding soybean oil', 'Sunflower seeds, rapeseed and colza seeds' as well as 'Other grains and cereals, including rye, barley oats'.

Ukraine grains exports by destination

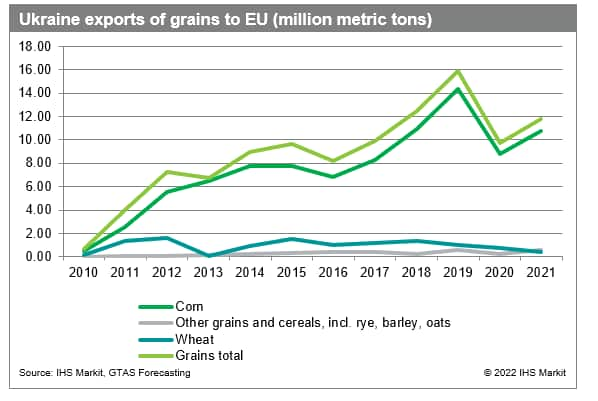

Ukraine is sometimes called 'the breadbasket of Europe'. Its grain exports to the EU have spiked from 682 thousand mt in 2010 to 15.9 million mt in 2019, mostly supported by corn exports rising from 533 thousand mt to 14.3 million mt. In terms of value, in 2019 the Ukrainian grain exports to the EU increased by 23.9% year on year, reaching over US$3 billion, then the exports dropped by 36.8% in 2020, to recover by 34.1% in 2021, reaching US$ 2.6 billion.

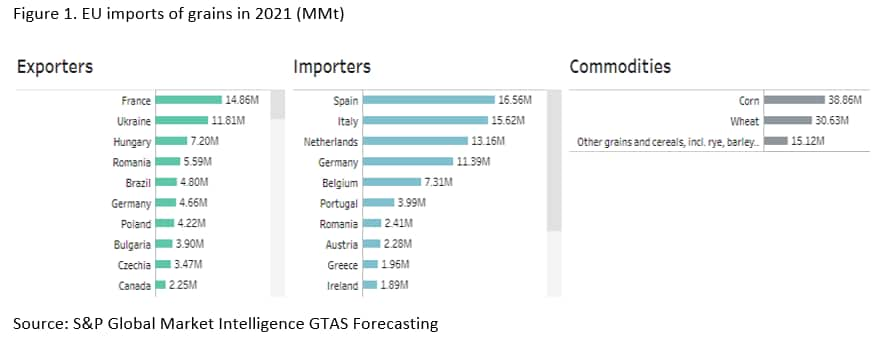

In 2021, according to GTAS Forecasting estimations Ukraine was the second largest supplier of grains (including 'Corn', 'Wheat' and 'Other grains, including rye, barley and oats') for European Union, accounting for 14% of total EU grain imports in terms of volume.

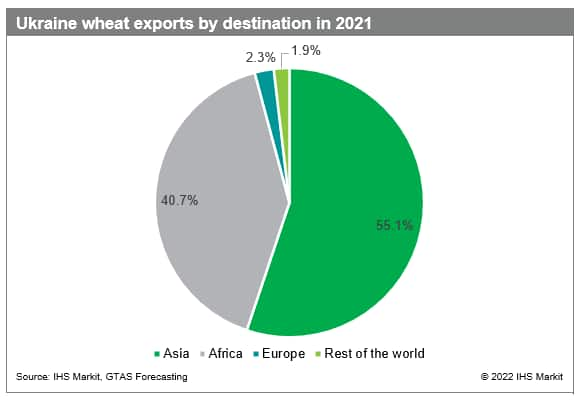

Ukraine is also a large food supplier for low- as well as middle-income countries. According to S&P Global Market Intelligence GTAS Forecasting estimations, in 2021, 55.1% of Ukrainian wheat was exported to Asia and 40.7% to African countries.

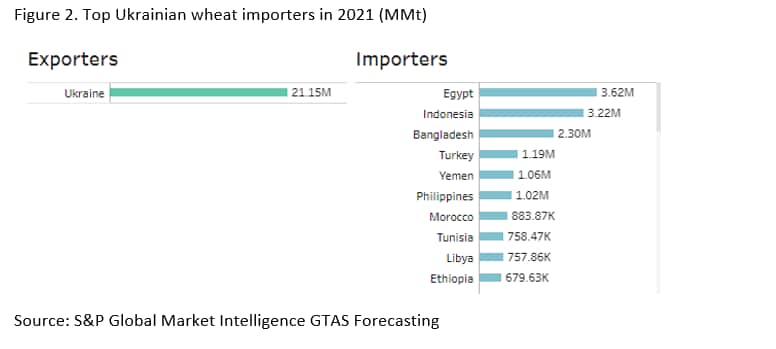

The largest importers of Ukrainian wheat in 2021 were Egypt, Indonesia, Bangladesh, Turkey and Yemen. Most of these countries rely heavily on Ukrainian wheat supplies, mainly those located in North Africa (Egypt, Libya) and Western Asia region (such as Lebanon and Yemen). For Indonesia and Bangladesh Ukraine is also the second largest supplier of wheat.

The longer the Russia-Ukraine conflict lasts, the more insecurity about food supplies it may bring not only to the Ukraine and the region, but also to the whole world. The prices of wheat and corn have already spiked before the war, but due to the conflict we may expect prices rising further, having strong implications on the poorest African economies.

Ukraine as the world's leading exporter of sunflower oil and seed

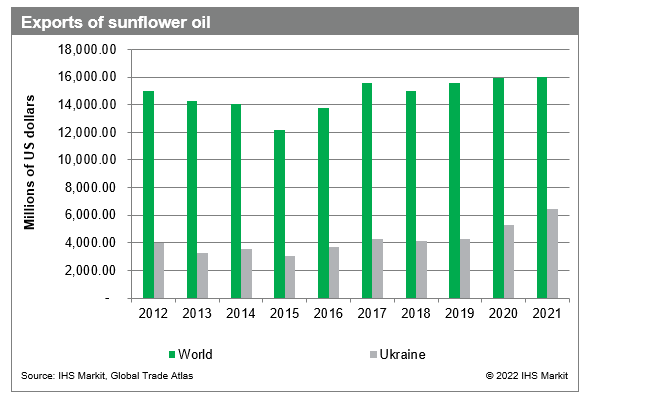

Ukraine is the largest world exporter of Sunflower Oil (HS code - 1512 Sunflower-Seed, Safflower Or Cottonseed Oil, And Their Fractions, Whether Or Not Refined, But Not Chemically Modified) with the share of 40% of global exports value in the year 2021.

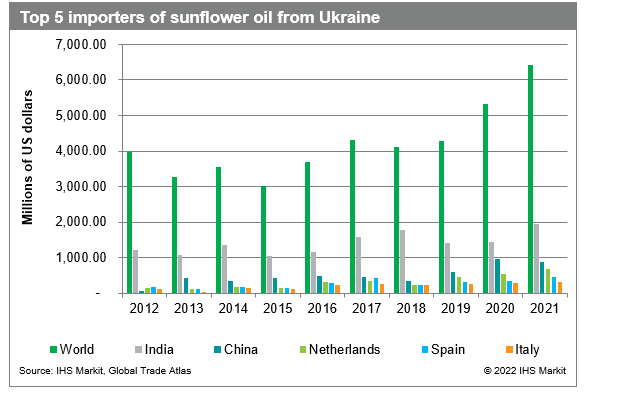

Top receivers of sunflower oil from Ukraine are India, China (mainland), Netherlands, Spain and Italy. With imports of sunflower oil stopped because of the conflict between Ukraine and Russia, India has to look for replacement in other edible oils or to source cooking oils from other countries to maintain domestic supply and prevent retail prices from rapid increases.

The biggest markets for edible oil are India and China (mainland). Over 80% of India's demand for sunflower oil was supplied by Ukraine in 2021. It seems obvious to predict that the conflict will result in huge supply chain disruptions and already high prices of edible oil in India can be raised further.

Implications

Most of the Ukrainian exports is being carried out through ports on the Black and Azov Seas-Odessa, Pivdeny, Chornomorsk, Kherson, Mariupol and Berdyansk. On February 24, when the Russian invasion began, most of the sea ports have been closed, so the ports operation has been already disrupted with no ships allowed to enter or leave the ports.

Head of Ukraine's Maritime Administration confirmed on February 28 that Ukrainian ports will remain closed until Russia's invasion ends, adding that the port of Mariupol has sustained damage from Russian shelling. Moreover, multiple shipping companies have suspended sailings to endangered Black Sea ports. Additionally, at least three commercial ships have been hit by bombs since February 24.

For a number of countries in South Asia, Western Asia and Africa cutting of the major source of supply for wheat, corn and vegetables oils will definitely rise the food insecurity and may even lead to increase in global hunger.

The conflict will also result in supply chain disruptions and rising prices of agricultural products like edible oils in South Asia and other regions.

During the latest USDA Agricultural Outlook Forum, U.S. Trade Representative Katherine Tai described the Russia-Ukraine conflict as the next potential shock to global trade and supply chains. She underlined the position of Ukraine on the global agricultural market and said that we may see the economic impacts of the situation coming soon. It is still too early to assess the long-term consequences of the conflict, but a number of agencies will work on assessing the impact on agriculture trade as well as the whole global economy.

*Methodological note: All the data for 2021 provided in this article sourced from GTAS Forecasting database are still estimates (the fourth quarter of 2021 is estimated, first three quarters already covered by actual data), as not all the countries have reported their full 2021 trade data

For more details about GTAS Forecasting please visit the product page

https://ihsmarkit.com/products/gtas-forecasting.html

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

Posted 07 March 2022 by Agnieszka Maciejewska, Associate Director, Models & Scenarios, Global Intelligence & Analytics and

Katarzyna Skrzypek, Senior Economic Research Consultant, Global Trade Forecasting, Maritime, Trade & Supply Chain, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?