Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 24, 2022

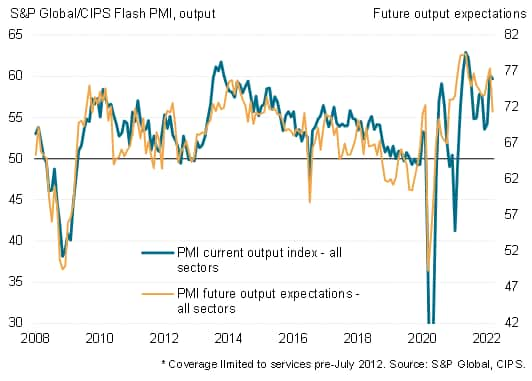

The UK PMI surveys indicated a sustained robust pace of expansion in March as the further reopening of the economy from COVID-19 containment measures helped offset headwinds from the Ukraine war, Brexit and rising prices. However, the outlook darkened as concerns over Russia's invasion exacerbated existing worries over soaring prices, supply chains and slowing economic growth. Business expectations are now at their lowest for almost one and a half years, pointing to a marked slowing in the pace of economic growth in coming months.

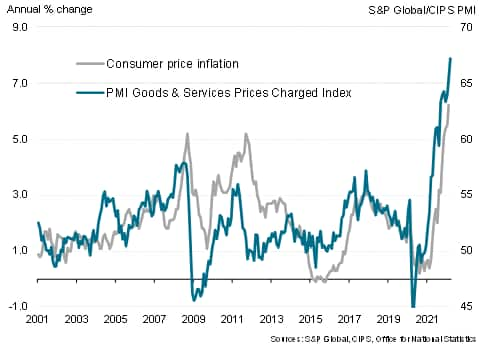

Meanwhile, prices pressures have spiked higher due to increased energy and commodity prices resulting from the invasion. With March seeing by far the largest rise in selling prices for goods and services ever recorded by the survey, consumer price inflation is set to rise further in the months ahead.

The survey indicators point to potentially sharply slower growth in the coming months, accompanied by a further acceleration of inflation and a worsening cost of living crisis, which paints an unwelcome picture of 'stagflation' for the economy in the months ahead.

UK PMI current and expected output

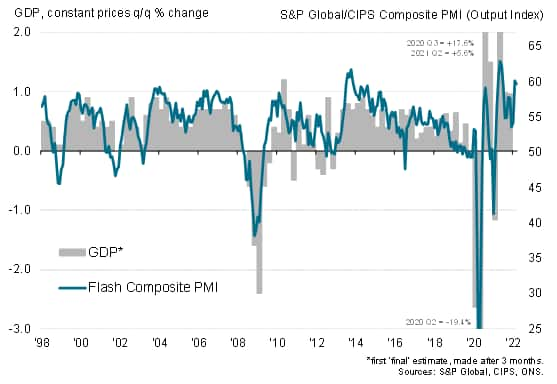

The S&P Global/CIPS composite PMI™ registered 59.7 In March, according to the preliminary 'flash' reading, down only marginally form 59.9 in February to indicate a rate of expansion which is among the strongest recorded over the survey's quarter of a century history. Only two brief spells, namely the opening up of the economy from lockdowns in the second quarter of 2021 and the growth surge seen mid-2013, have seen stronger performances in terms of output growth.

UK PMI and GDP

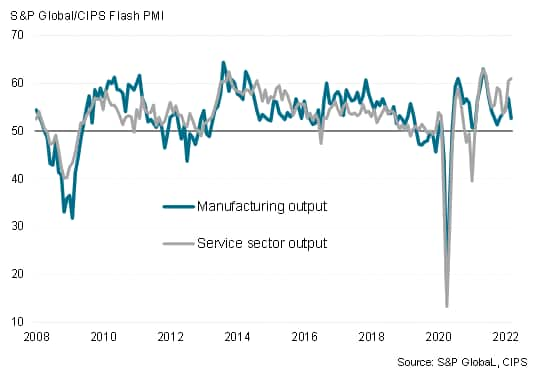

The past two months of buoyant growth contrast with a sluggish start to the year in January, when tightened COVID-19 related health precautions stymied growth, notably in the service sector. With these restrictions having now been lifted, service sector growth has rebounded strongly to reach the fastest since June of last year.

Service sector growth was led by hotels and restaurants and other consumer-facing services, where business activity accelerated amid the near-complete removal of pandemic containment measures. Business services likewise continued to expand at a solid pace, but growth weakened for financial services and the transport & communications sector, which reported a fourth successive monthly decline.

It was a different story in manufacturing, however, where output growth faltered in March to the lowest since last October, down sharply from February's seven-month peak.

Output by sector

The diverging growth rates between manufacturing and services can be linked to varying order book trends. Whereas new business inflows into the service sector continued to rise very strongly - registering the fifth-largest monthly increase in demand seen over the past seven years despite a drop in overseas sales -growth of new orders in manufacturing sank to a one-year low, dented by sluggish domestic sales and near-stalled exports. Both sectors saw companies reporting weakened demand for services due to the war in Ukraine. However, while in services this was offset by the further opening up of the economy, in manufacturing many companies reporting ongoing additional issues related to Brexit.

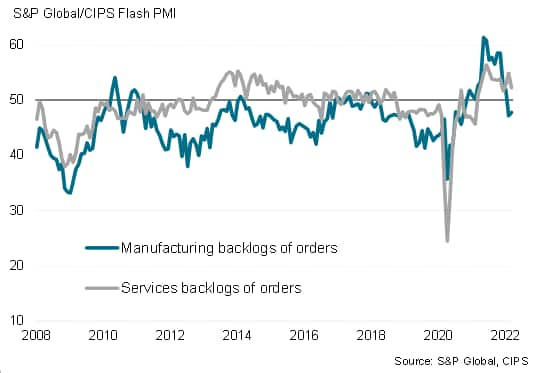

Backlogs of orders by sector

These differing trends in inflows of new work in turn led to a further divergence in backlogs of orders by sector, which is an important gauge of how much work companies have on their books to sustain output and employment levels in coming months. Although backlogs of work rose in the service sector in March, backlogs in manufacturing fell for a second month.

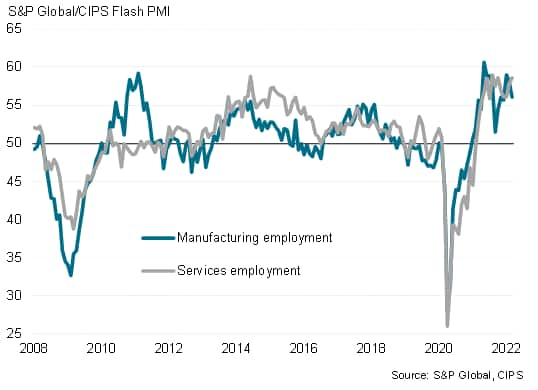

In line with the diverging trend in backlogs of accumulated work, service sector job creation accelerated in March to one of the fastest rates yet recorded by the survey, but manufacturing payroll growth slowed.

Employment by sector

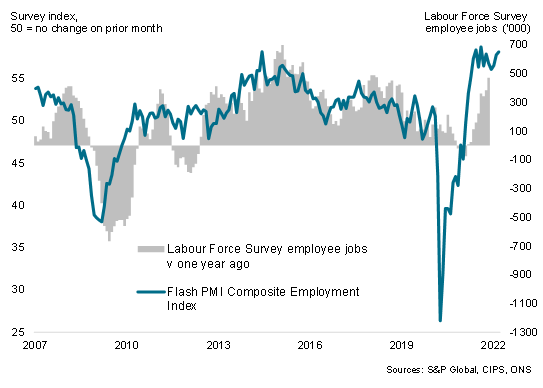

However, despite the slowing in factory jobs growth, the overall level of employment signalled by the survey remained very robust by historical standards. With the exception of the hiring surge seen after the lockdowns of 2021, March's jobs gain was one that has not been exceeded since comparable survey data were available in 1998.

Employment v. labour force survey jobs

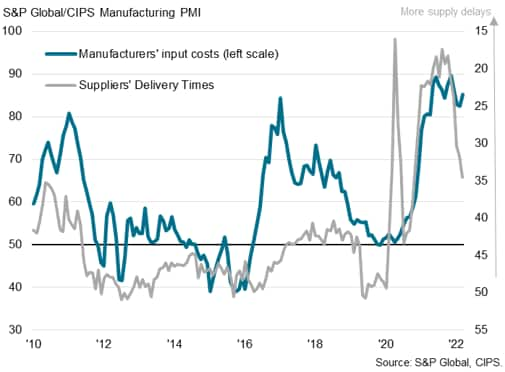

The March survey also showed an easing of supply constraints, with the net number of manufacturers reporting delays falling to the lowest since October 2020. However, materials prices continued to rise sharply, the rate of inflation accelerating during March. Many supply lines remained disrupted - worsened by China's latest lockdowns and the war - lending pricing power to suppliers. Soaring energy prices likewise added to firms' costs.

Manufacturing supply chains and input prices

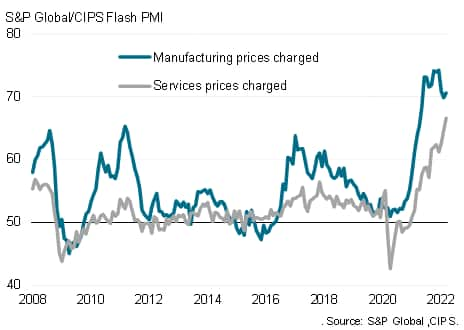

These higher costs fed through to higher selling prices in manufacturing, albeit with the rate of inflation remaining below recent record peaks. Service sector selling price inflation also accelerated, buoyed by input purchase costs, increasing wage bills and spiking energy prices to reach the fastest yet recorded by the survey.

Selling price inflation by sector

Measured across both sectors the increase in selling prices for goods and services in March was far in excess of any prior increase recorded in 25 years of survey history, and points to a further - potentially marked - acceleration of consumer price inflation in coming months.

PMI selling prices and consumer price inflation

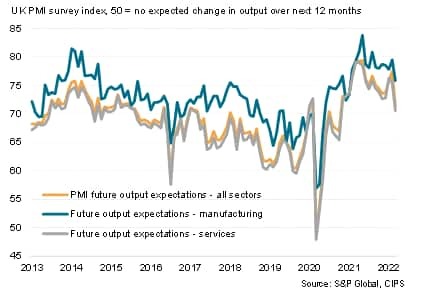

Anecdotal evidence from the survey revealed some initial impact of the Ukraine war on current output and demand levels, where there was a more discernible impact on business confidence in the outlook. Future output expectations were scaled back to the lowest since October 2020 as concerns over the conflict exacerbated existing concerns over Brexit, supply chains, prices and economic growth. Expectations of output growth over the coming year fell to the lowest since January 2021 in manufacturing and hit the lowest since October 2020 in the service sector.

Future output expectations

Sign up to receive updated commentary in your inbox here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.