Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Mar, 2016 | 10:00

Highlights

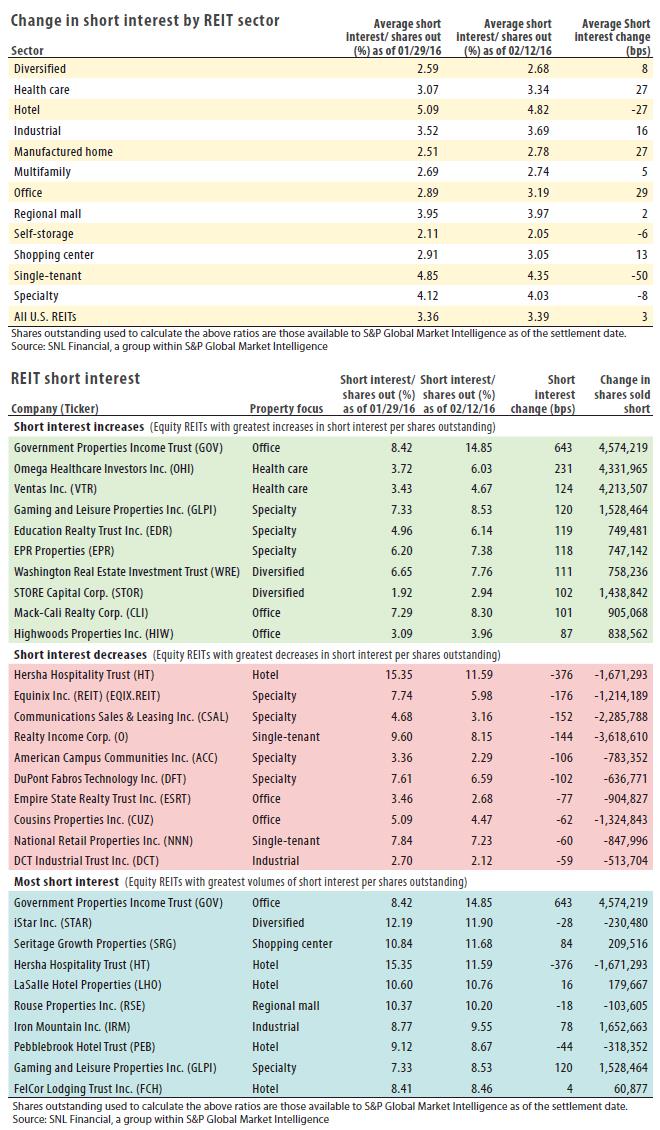

U.S. REITs recorded a 3-basis-point average short interest gain to 3.39of outstanding shares during the first half of February.

U.S. REITs recorded a 3-basis-point short interest gain on average during the first half of February, ending the period at 3.39% of all outstanding shares.

Five sectors logged double-digit growth during the period from Jan. 29 to Feb. 12, with the office sector leading the way, rising 29 basis points to 3.19% of shares shorted. Following closely were the health care and manufactured-home sectors, each with a 27-basis-point gain to 3.34% and 2.78% of shares shorted, respectively. Industrial and shopping center REITs logged 16- and 13-basis point increases, resulting in respective short bets of 3.69% and 3.05%.

Single-tenant REITs saw the biggest drop in short interest, with shorts plummeting 50 basis points to finish with 4.35% of outstanding shares held short during the period.

On a company basis, Government Properties Income Trust recorded the biggest increase in short interest during the month's first half, with shorts soaring 643 basis points to 14.85% of outstanding shares. The company also topped the list of most-shorted REITs during the period.

Hersha Hospitality Trust experienced the biggest short-interest decline during the period, with a 376-basis-point drop in short bets to 11.59% of outstanding shares.