Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Dec, 2016 | 09:30

Highlights

A more positive outlook for iron ore and some base metals prices is seen in the aftermath of Donald Trump's victory in the U.S. presidential election.

Donald Trump's win in the presidential election made waves in several markets, including metals prices.

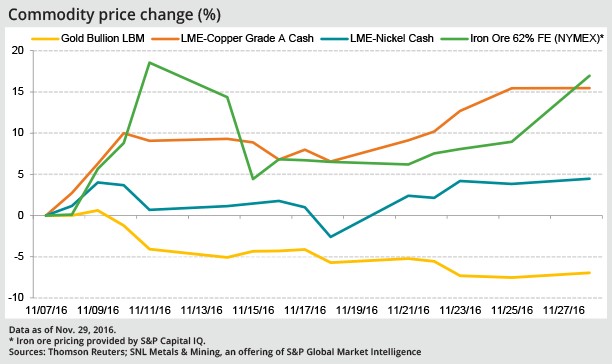

A comparison of different metal forecast prices from November 7, a day before the presidential election, compared to prices roughly two weeks after the election, shows a mix of ups and downs.

The gold price surged 4% to US$1,325 after the election results, but these gains were quick to diminish after the president-elect's pro-business acceptance speech, which calmed the markets.

After the election, almost half of the estimates compromising the gold price forecast consensus were updated. Out of the 42 estimates for 2016, 19 were updated, while out of the 41 estimates for 2017, 18 were updated after the November 8 election.

The market's optimism for gold immediately after the election is not reflected in the metal's price outlook, with average price forecasts of US$1,266, US$1,322, and US$1,323 per ounce for 2016, 2017, and 2018, respectively, as of November 21, and they were all slightly lower compared with forecasts as of a day before the elections. While gold corrected slightly on November 28, the price has seen a drop due to the threat of higher U.S. interest rates and a strengthening U.S. dollar.

The same trend can be seen with platinum and rhodium, with their price forecasts as of November 21 for 2016 and the next two years showing slight declines compared with predicted prices before the election.

Silver, iron ore and nickel, on the other hand, all have higher 2016, 2017, and 2018 S&P Capital IQ Consensus Estimates price outlooks post-election compared with the forecasts as of November 7.

Trump's big plan to rebuild infrastructure boosted the market's sentiment on several metals, particularly for iron ore and copper, and demand on both metals is expected to rise. The double digit percentage gains of iron ore and copper prices after the presidential election reflected the uplifted market sentiment.

Although copper experienced a price surge after Trump's victory, the annual price forecasts largely remained flat in the immediate weeks after the election. Nonetheless, the 2017 and 2018 forecasts of $2.30 and $2.50 per pound, respectively, are more optimistic when compared with the $2.17 per pound forecast price for the current year.

The iron ore price also experienced an increase, with the iron ore 62% Fe price index closing at US$77.09 per tonne on Nov. 28, which was 17.0% higher compared to the closing price of US$65.91 per tonne on Nov. 7, a day before the election. The commodity's price forecast for 2017 and 2018 post-election follows the upward trend. That said, only a handful of contributors have updated their estimates after the election. There were only six estimates updated out of the 25 that make up the iron ore price forecasts for 2016 and 2017 after November 8.

Nickel is also experiencing the positive post-election price effect. The metal's forecast for 2016, 2017, and 2018 of US$4.32, US$5.15, and US$5.78 per pound, respectively, as of November 21 were all higher compared with pre-election forecast numbers.

According to the Nickel Commodity Briefing Service report by S&P Global Market Intelligence, the optimistic price forecast for nickel can also be attributed to the expected nickel market deficit in the coming years due to an expected increase in stainless steel production from China and falling nickel output due to mine capacity being shuttered earlier this year.

Trump's victory certainly made an impact in the commodity market, but it remains to be seen if the immediate effects are sustained.