Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 01, 2021

By Rajiv Biswas

With world GDP forecast to rebound to positive growth of 4.4% y/y in 2021 after a contraction of 4.0% y/y in 2020, this is expected to provide a boost to the export sectors of many export-driven Asia-Pacific (APAC) economies. The rebound in economic growth in advanced economies such as the US, EU, UK and Canada linked to the rapid rollout of vaccination programs during the first half of 2021 is expected to support improving APAC new export orders to key export markets in North America and Europe.

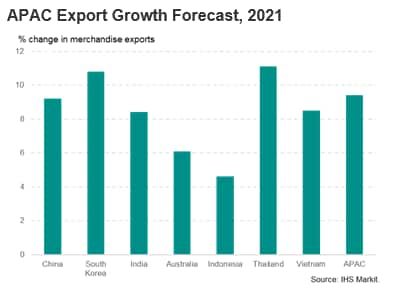

This is expected to support the growth of exports of manufactured goods and commodities through the course of 2021. APAC merchandise exports are forecast to show a strong rebound of 9.4% y/y in 2021, after contracting by 3% y/y in 2020. IHS Markit estimate that global trade volume contracted by -11.2% in 2020. A recovery is forecast in 2021 and 2022, with global trade volume to recover by 7.5% and 4.1%, respectively.

However international travel restrictions are still expected to remain a major impediment to the recovery of international tourism and travel in the APAC region during 2021. This is expected to result in a more protracted and gradual recovery path for trade in services for many APAC economies.

Recovery in APAC exports

The Asia-Pacific (APAC) region experienced a severe recession in 2020 due to the COVID-19 pandemic, with APAC GDP contracting by an estimated 1.5% year-on-year (y/y). Pandemic-related lockdowns and travel bans had a severe negative impact on the economies of most APAC nations during the first half of 2020. However, during the second half of 2020, many Asia-Pacific economies had shown a significant recovery in economic momentum. This upturn was driven both by strengthening global export demand as well as the rebound in domestic consumption spending as a result of the easing of pandemic-related restrictions in many countries.

A strong economic recovery is expected in 2021, with APAC GDP growth forecast at 5.7% y/y, based on expectations that the progressive rollout of COVID-19 vaccines during 2021 will help the gradual recovery of economic activity in many OECD and APAC economies.

A key factor underpinning the strong economic rebound in the APAC region is expected to be buoyant economic growth in China, which is forecast to grow at 7.5% y/y in 2021. The Asia-Pacific recovery is expected to be broad-based, with most major Asia-Pacific economies forecast to show rapid growth in 2021.

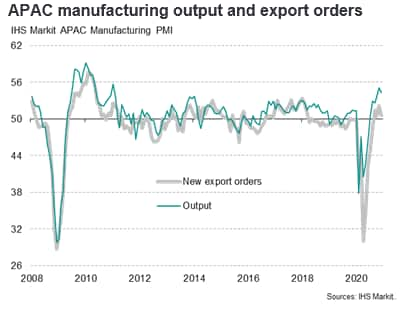

The improving economic momentum in the APAC region has been reflected by IHS Markit's APAC PMI survey index of manufacturing output, which has recovered strongly in recent months. The index has signaled the most robust expansion of production in a decade during the closing months of 2020, albeit with the rate of expansion cooling slightly in December 2020, though this was in part due to shipping delays caused by the sheer strength of demand.

The export rebound has been reflected in recent trade data from many APAC economies. For mainland China, merchandise exports rose by 18.1% y/y in December 2020, following a 21.1% y/y growth rate in November. South Korea's exports have also rebounded, rising by 12.6% y/y in December 2020. Taiwan's exports rose by 12% y/y in December, the sixth consecutive month of positive export growth, buoyed by a 22.2% y/y rise in exports of electronics.

In the ASEAN region, Singapore's non-oil domestic merchandise exports have also shown an upturn, rising by 6.8% y/y in December, helped by a 13.7% y/y rise in electronics exports. Vietnam's merchandise exports showed buoyant growth in December, rising by 22.7% y/y, helped by rapid growth of 24.1% y/y for exports of computers and electrical equipment.

The recovery of APAC trade in services is expected to be much slower and protracted than for merchandise exports. International travel restrictions are still expected to remain a major impediment to the recovery of international tourism and business travel for many economies in the APAC region during 2021. The re-opening of international travel is expected to be more selective in the APAC region, on a bilateral basis between countries that have implemented widespread vaccination programs.

The path of APAC export recovery is therefore likely to be uneven across different industry sectors, with manufacturing and commodities exports leading the recovery, while some service sector exports such as the tourism and commercial aviation sectors are expected to have more gradual recovery paths.

APAC electronics sector exports rebound

The electronics manufacturing industry is an important part of the manufacturing export sector for many ASEAN economies, including Malaysia, Singapore, Philippines, Thailand and Vietnam. Furthermore, the electronics supply chain is highly integrated across different economies, with China being an important supplier of intermediate electronics parts for a number of Southeast Asian electronics sectors.

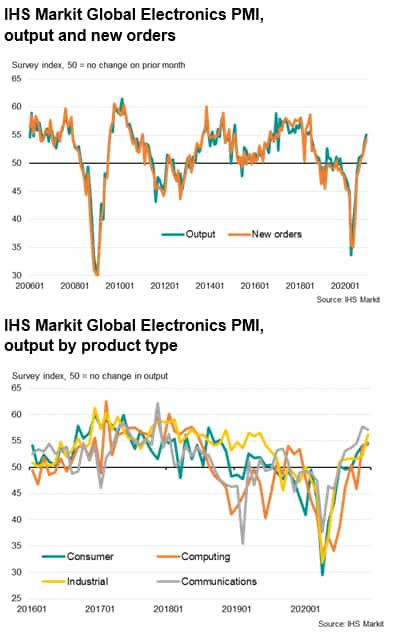

Despite severe disruptions to Asian electronics production and to global demand due to the pandemic during the first half of 2020, the IHS Markit Global Electronics PMI has signaled a rebound since mid-2020. The global electronics PMI new orders index rose from a calendar year-to-date low of 35.0 in May to a level of 54.3 by December, reflecting a significant recovery in new orders. The electronics sector rebound is making an important contribution to the recovery of manufacturing exports and industrial production in many ASEAN industrial economies.

This rebound in global electronics demand has been reflected in Singapore's electronics manufacturing exports. Singapore's domestic electronics exports rose by 13.7% y/y in December 2020, with electronics exports to the US up 20.4% y/y while exports to the EU rose by 17.5% y/y.

In Vietnam, exports of computers, electrical equipment and parts rose by 24.4% y/y in the eleven months to November 2020, as global demand for computer equipment surged due to the pandemic and the shift towards remote working by workers worldwide.

In Malaysia, exports of electrical and electronic products, which accounted for 40% of total merchandise exports, were up 23.6% y/y in November 2020. Malaysia's exports of electrical and electronic products to the rest of ASEAN rose by 36.6% y/y.

The Ministry of Trade, Industry and Energy announce that Korea's November exports of information and communications technology (ICT) goods amounted to USD 16.6 billion, up 15.8% compared to the same period last year.

APAC trade outlook

The central case global economic scenario for 2021 is positive, with the world economy forecast to show improving momentum through the course of 2021 as COVID-19 vaccination programs are rolled out. Many of the world's largest economies, including the US, EU, Japan, China and India, are expected to be rapidly progressing with vaccination programs during the first half of 2021. This should allow domestic demand to strengthen in these nations, with gradual easing of lockdown conditions in countries in this grouping that are currently experiencing significant new waves of COVID-19 cases. Consequently, this should help to support the strong rebound in world merchandise exports during 2021, which are forecast to grow at a pace of 11.3% y/y following a severe contraction of 9.2% y/y in 2020.

With many of the East Asian economies, such as China, Japan and South Korea, having large manufacturing export sectors, the upturn in global trade will help to support the rebound of manufacturing exports. This will also support demand for industrial raw materials from APAC commodity-exporting nations such as Australia and Indonesia.

However, the recovery of APAC trade in services is expected to be delayed and protracted, as international travel restrictions continue to constrain any early recovery in exports of tourism and commercial aviation, which are an important component of total services exports for many APAC economies.

Over the medium-term outlook, APAC exports are expected to grow at a rapid pace, helped by the sustained strong growth of intra-regional trade within APAC, as China, India and ASEAN continue to be among the world's fastest-growing emerging markets.

The rapid growth of APAC exports is also expected to be strengthened by the regional trade liberalization architecture. A wide range of bilateral and multilateral trade liberalization initiatives have either been implemented or are planned in APAC. This includes the large recent CPTPP and RCEP multilateral trade agreements and an increasing number of major bilateral FTAs such as the recent EU-Vietnam FTA and the Indonesia-Australia Comprehensive Economic Partnership Agreement.

However regional geopolitical tensions do pose risks to bilateral trade development between some APAC nations. The recent China-India border clash has impacted on bilateral trade and investment flows, while the China-Australia trade war has hit Australian exports of a wide range of commodities to China. Nevertheless, the long-term outlook for APAC trade growth remains very positive, boosted by the continued rapid long-term growth forecast for the APAC region over the next decade.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location