Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 29, 2023

By Rajiv Biswas

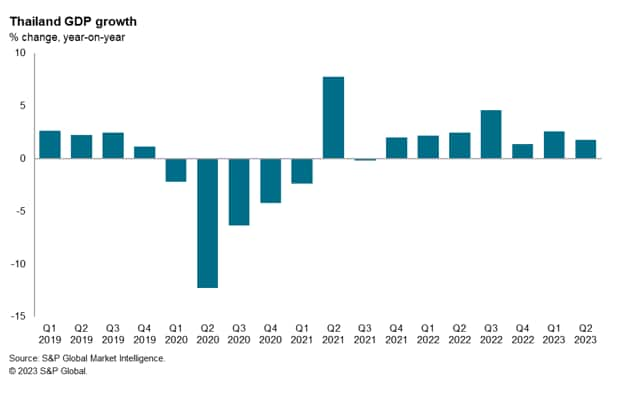

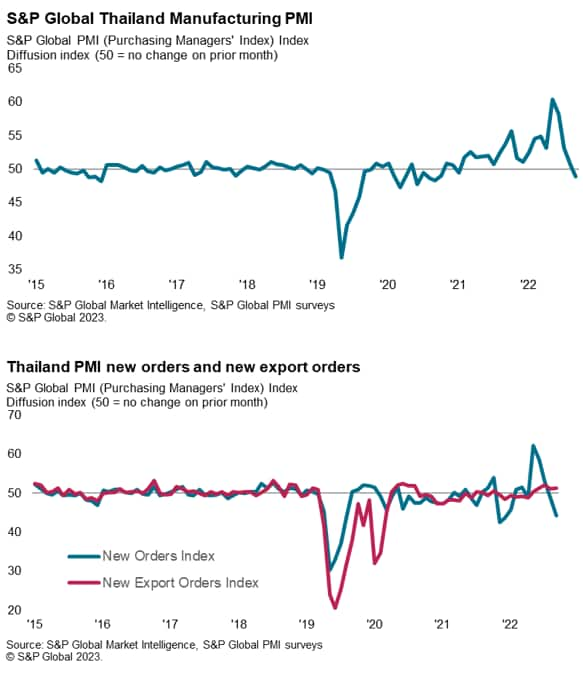

Thailand showed a gradual economic recovery from the COVID-19 pandemic during 2022, with real GDP growth having risen from 1.5% in 2021 to 2.6% in 2022. However, the manufacturing sector has experienced weakening conditions due to declining exports. The S&P Global Thailand Manufacturing PMI survey results for August signalled the first contraction of the manufacturing sector in 20 months. The Bank of Thailand has also tightened monetary policy by a cumulative total of 200 basis points (bps) since August 2022, in order to constrain potential inflationary pressures.

These headwinds have been mitigated by the rebound in international tourism inflows evident during the first eight months of 2023, which has helped to support GDP growth in 2023.

The Thai economy has shown positive economic growth momentum in the first half of 2023, with GDP growth of 2.2% year-over-year (y/y). First quarter GDP growth was up by 2.6% y/y, followed by expansion at a pace of 1.8% y/y in the second quarter of 2023. This compared with 1.4% y/y growth in the fourth quarter of 2022.

The positive GDP growth rate in the first half of 2023 was underpinned by rapid growth in private consumption, which rose by 6.8% y/y, helped by surging international tourism arrivals. This compared with private consumption growth of 6.3% in the 2022 calendar year. However, government consumption contracted by 5.3% y/y in the first half of 2023, after declining by 4.2% y/y in the second half of 2022.

Private investment grew at a modest pace of just 1.8% y/y in the first half of 2023, while public investment grew by 1.9% y/y.

Due to the significant contribution of international tourism to Thailand's GDP, an important factor that constrained the rate of recovery of the Thai economy in 2022 was the slow pace of reopening of international tourism, although this gathered momentum in the second half of 2022. Weak tourism exports due to the pandemic were a key factor contributing to large current account deficits of USD 10.6 billion in 2021 and USD 14.7 billion in 2022, compared with a pre-pandemic current account surplus of 38.3 billion. However, the gradual recovery of international tourism flows has resulted in a significant improvement in the current account, which returned to a small surplus of USD 1.6 billion in the first half of 2023, compared with a deficit of USD 5.5 billion in the second half of 2022.

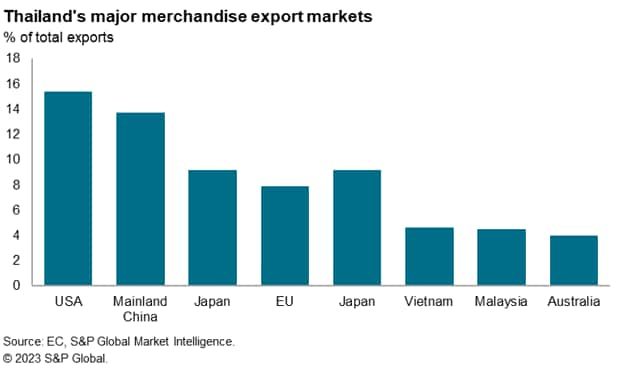

However, the manufacturing sector has been weak, contracting by 3.2% y/y in the first half of 2023, following a modest decline of 0.8% y/y in the second half of 2022. The overall export sector performance in the first half of 2023 reflected the sharp contrast in the performance of manufacturing exports compared to services exports. While exports of goods contracted by 6.0% y/y in the first half of 2023, exports of services surged, rising by 66.1% y/y. Manufacturing exports declined by 4.9% y/y in value terms in the first half of 2023, with electronics exports down by 7.1% y/y, while exports of petroleum related products fell by 19.7% y/y in value terms.

The latest S&P Thailand Manufacturing PMI survey results for August reflected the weakness of manufacturing exports. The headline S&P Global Thailand Manufacturing PMI fell from 50.7 in July to 48.9 in August. The rate of decline was the fastest since September 2021. New work placed at Thai manufacturers declined for a second consecutive month in August on the back of deteriorating economic conditions.

While supply conditions remained largely unchanged in August, some vendors offered discounts in August to retain customers, thus leading to another fall in average manufacturing sector input costs. The rate of decline was marginal, but this marked only a second time that average prices have fallen in nearly three years. However, rising cost burdens from past hikes in shipping prices and wages led to firms raising their selling prices at a marked pace in August.

Thailand's headline CPI inflation rate rose by 0.9% year-on-year in August 2023, compared with 0.4% y/y in July 2023 and a recent high of 7.9% y/y in August 2022. The Monetary Policy Committee (MPC) of the Bank of Thailand decided to raise the policy rate by 0.25% from 2.25% to 2.50% at their Monetary Policy meeting on 27 September 2023, bringing total cumulative tightening to 200 bps since August 2022. Five tightening steps in 2023 have followed three 25bp rate hikes by the MPC in 2022. In their September 2023 monetary policy meeting, the MPC assessed that average CPI inflation would decline to 1.6% in 2023, rising to 2.6% in 2024.

International tourism was a key part of Thailand's GDP prior to the COVID-19 pandemic, contributing an estimated 11.5% of GDP in 2019. However, foreign tourism visits collapsed after April 2020 as many international borders worldwide were closed, including Thailand's own restrictions on foreign visitors.

As COVID-19 border restrictions were gradually relaxed in Thailand and also in many of Thailand's largest tourism source countries during 2022, international tourism showed a significant improvement during the second half of the year. The number of international tourist arrivals reached 11.15 million in 2022, compared with just 430,000 in 2021. However, the total number of visits was still far below the 2019 peak of 39.8 million, indicating considerable scope for further rapid growth in the tourism sector during 2023.

International tourism arrivals in the first seven months of 2023 surged to a cumulative total of 15 million visitors, which was more than the total number of international tourist visits in calendar 2022. Total tourism receipts in the first seven months for both domestic and international tourism spending was estimated at 1.08 trillion baht. The Tourism Authority of Thailand has increased its estimated target for international tourism visits in 2023 to 25 million, which is more than double the total number of international tourism arrivals in 2022. In August, monthly international tourist arrivals were estimated at 2.5 million, remaining on track for the government's targeted annual tourism arrivals for 2023.

Prior to the COVID-19 pandemic, mainland Chinese tourism arrivals accounted for an estimated 27.9% of total international tourist visitors in 2019. However, the mainland Chinese tourism market has shown a relatively slow pace of recovery during 2023, albeit arrivals from mainland China did rise to 926,000 in the second quarter of 2023, significantly higher than the figure of 517,000 for the first quarter of 2023. The lifting of visa requirements for Chinese visitors from 25th September 2023 should help the further recovery of Chinese tourist arrivals during the remainder of 2023 and into early 2024.

Despite the upturn in private consumption and international tourism arrivals in 2022, the overall pace of economic expansion was relatively moderate, at just 2.6%. Easing of pandemic-related travel restrictions during 2022 has also allowed a gradual reopening of domestic and international tourism travel, which gathered momentum in the second half of 2022.

With the continued recovery of the international tourism sector helping to mitigate the impact of declining manufacturing exports, GDP growth for 2023 is expected to be at a similar pace to 2022. In their September 2023 Monetary Policy decision, the Monetary Policy Committee of the Bank of Thailand projected GDP growth to be 2.8 and 4.4 percent in 2023 and 2024, respectively, driven mainly by private consumption.

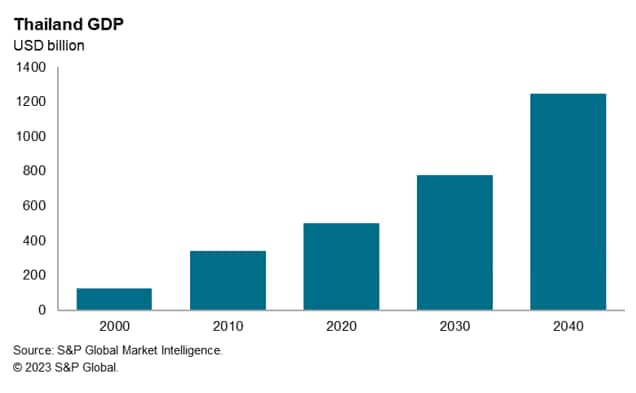

Over the next decade Thailand's economy is forecast to continue to grow at a steady pace, with total GDP increasing from USD 500 billion in 2022 to USD 860 billion in 2032. A key driver will be rapid growth in private consumption spending, buoyed by rapidly rising urban household incomes.

The international tourism sector will continue to be a dynamic part of Thailand economy, buoyed by rapidly rising tourism arrivals the populous Asian emerging markets, notably mainland China, India and Indonesia.

By 2036, Thailand is forecast to become one of the Asia-Pacific region's one trillion-dollar economies, joining mainland China, Japan, India, South Korea, Australia, Taiwan, Philippines and Indonesia in this grouping of the largest economies in APAC. The substantial expansion in the size of Thailand's economy is also expected to drive rapidly rising per capita GDP, from USD 6,900 in 2022 to USD 11,900 by 2032. This will help to underpin the growth of Thailand's domestic consumer market, supporting the expansion of the manufacturing and service sector industries.

However, rising per capita GDP levels will also put pressures on Thailand's competitiveness in certain segments of its manufacturing export industry. Therefore, an important policy priority for nation will be to continue to transform manufacturing export industries towards higher value-added processing in advanced manufacturing industries.

One of the key economic and social challenges facing Thailand is its rapidly ageing population, which will result in a rising burden of health care and social welfare costs over the next two decades. This will be a drag on Thailand's long-term potential growth rate, making investment in technology and innovation increasingly important to mitigate the economic impact of demographic ageing.

Access the Thailand Manufacturing PMI press release here.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location