Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 13, 2023

By Rajiv Biswas

After twelve successive months of declining year-on-year exports, Taiwan's September exports showed a small positive increase year-on-year. A key factor driving the downturn in exports during late 2022 and through much of 2023 has been weak demand for Taiwan's electronics exports in key global markets. However recent export data has shown signs of a significant turnaround, with September trade data showed strong positive export growth to the US, EU and ASEAN measured on a year-on-year basis.

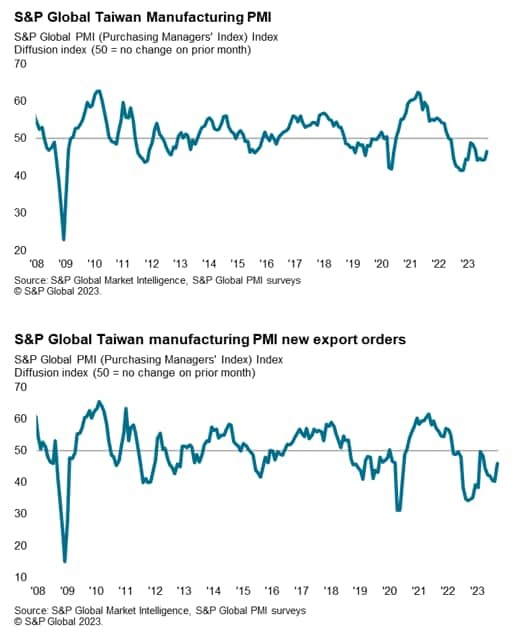

The latest S&P Global Taiwan Manufacturing Purchasing Managers' Index (PMI) reading improved to 46.4 in September, although still indicating contractionary conditions for Taiwan's manufacturing sector.

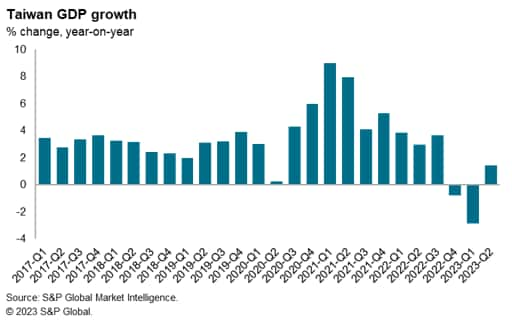

Taiwan emerged out of technical recession in the second quarter of 2023, with GDP growth of 1.7% quarter-on-quarter (q/q) after two successive quarters of GDP contraction. The rebound was driven by private consumption, which grew by 12.1% year-on-year (y/y) in the second quarter of 2023.

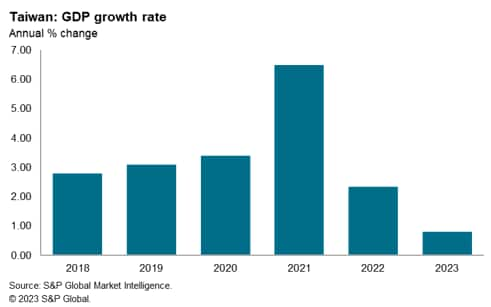

Taiwan's growth slowdown follows a period of strong economic expansion in 2021 and 2022. In 2021, annual GDP rose by 6.5% y/y. This was the fastest pace of annual economic growth since 2010, boosted by export growth of 29% y/y, with exports of semiconductors up by 27% y/y.

This was followed by continued positive GDP growth at a pace of 2.4% in calendar year 2022, helped by strong global demand for electronics exports during most of 2022. Taiwan's merchandise exports rose by 7.4% y/y in 2022, buoyed by strong expansion in exports of electronics components, which rose by 16.4% y/y, while semiconductors exports rose by 18.4% y/y.

However, since mid-2022, Taiwan's electronics sector exports, which are a key export, had weakened significantly, due to slumping electronics demand in the US, EU and mainland China. The downturn in Taiwan's exports has been a key factor contributing to its economic slowdown.

Taiwan's exports turned positive in September, rising by 3.4% y/y, after recording year-on-year declines for 12 successive months, including during the first eight months of 2023. Merchandise exports in August 2023 had contracted by 7.3% y/y, after declining by 10.4% y/y in July and an even sharper downturn of 23.4% y/y in June. Despite the improvement in September exports, Taiwan's exports fell by 13.8% during the first nine months of 2023 compared to the same period a year ago.

Exports to mainland China and Hong Kong SAR declined by 8.8% y/y in September, improving on recent declines of 14.1% y/y in August, 16.3% y/y in July and 22.2% y/y in June. Mainland China and Hong Kong SAR remained the largest export market and accounted for 35.3% of Taiwan's total exports in the first nine months of 2023.

In September, Taiwan's exports to ASEAN showed a dramatic turnaround, rising by 24.8% y/y, compared with declines of 3.9% y/y in August and 8.4% y/y in July. Exports to the US also showed a strong increase of 17.7% y/y in September after rising by 8.8% y/y in August, rebounding after a decline of 3.3% y/y in July. Exports to Europe also showed a large increase of 21.3% y/y in September, after increases of 2.1% y/y in August and 24% y/y in July due to higher exports of ICT products.

Taiwan's manufacturing sector business conditions have remained weak in August 2023. Industrial production fell by 10.5% y/y in August, with manufacturing output down by 10.7% y/y. However, the pace of decline has moderated in August in comparison with the average for the first eight months of 2023, during which industrial production fell by 16.5% y/y and manufacturing production declined by 17.1% y/y. Measured on a month-on-month (m/m) basis, industrial production showed a significant rise of 7.3% m/m in August.

The S&P Global Taiwan Manufacturing Purchasing Managers' Index (PMI) picked up to 46.4 in September from 44.3 in August, the best reading for manufacturing business conditions since April. Nevertheless, the headline PMI continued to indicate contractionary conditions for the manufacturing sector for the 16th successive month.

The latest survey results show some signs of Taiwan's manufacturing downturn easing in September, with companies noting much softer reductions in output and new orders.

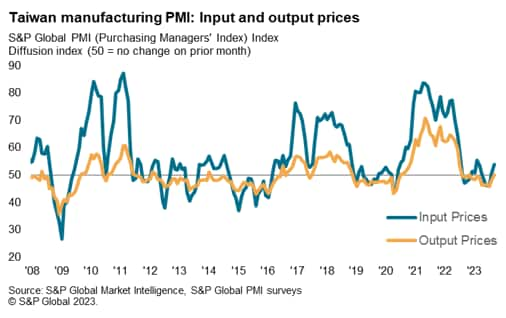

Prices data pointed to a second consecutive monthly rise in average operating expenses during September. The rate of inflation quickened to a seven-month high and was widely linked to greater raw material prices. After falling in each of the prior nine months, factory gate prices in Taiwan rose fractionally in September. While some firms mentioned passing on increased costs to customers, others indicated that competition for new work had weighed on their ability to raise their charges.

Taiwan's CPI inflation rate moderated to 1.9% y/y in July 2023, but has subsequently risen again to 2.9% y/y by September 2023 due to the impact of rising food and oil prices. Food prices for fruit and vegetables rose sharply due to heavy rains caused by recent typhoons. The core CPI measure, which excludes energy and food, rose by 2.5% y/y in September.

Due to the upturn in inflationary pressures during 2022 as a result of surging world commodity prices following the outbreak of the Russia-Ukraine war, Taiwan's central bank tightened monetary policy with a series of modest tightening steps during 2022 and early 2023 to limit potential further inflation pressures. The most recent policy rate hike was by 12.5 basis points (bps) on 23 March 2023.

The central bank started its tightening cycle in March 2022, with its tightening step of 25bps having been the first rate hike since June 2011. The previous most recent change to policy rates had been a rate cut in March 2020 in response to the global COVID-19 pandemic. The March 2022 rate hike was followed by a 12.5bps increase in June 2022, a 12.5bps hike in September 2022 and another 12.5bps in December 2022.

In September 2023, Taiwan's exports of electronics components, which accounted for around 40% of total exports, fell by 4.3% y/y, narrowing the decline of 11.2% y/y recorded in August. Semiconductors exports recorded a contraction of 2.6% y/y in September, much improved on the decline of 10.4% y/y in August. The downturn in Taiwan's ICT exports during the past 12 months reflects the slowdown in the global electronics industry since mid-2022.

However, one area of strength has been in exports of information/communication and video/audio exports, which rose by 59.8% y/y in September, helped by strong demand for computers, storage devices, convertors and routers.

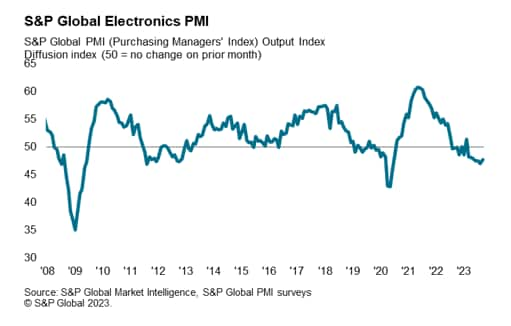

At 47.7 in September, the headline S&P Global Electronics PMI was up slightly compared with the outturn of 47.0 in August, although the September PMI reading still signalled contractionary operating conditions across the global electronics manufacturing sector at the end of the third quarter of 2023. New orders and production continued to contract according to September data.

Average cost burdens at global electronics manufacturers increased again in September. As a result of higher costs, global electronics producers continued to share their cost burdens with clients, leading to rising selling prices. Moreover, the rate at which charges rose was the quickest since March, rising further above the series average. The Industrials segment led the increase in output prices. Only the Communications sector saw average selling prices fall, albeit only fractionally.

After rapid economic growth in 2021 and continued firm expansion in 2022, Taiwan's economy has slowed in 2023, mainly due to the downturn in exports. This reflected continued weakness during the past 12 months in key markets for Taiwan's electronics exports, notably the US, EU and mainland China. However, Taiwan's September trade data showed early signs of a turnaround in exports, with strong positive year-on-year increases in exports to the US, EU and ASEAN.

Taiwan's medium-term outlook remains for sustained positive expansion at a moderate pace, underpinned by an expected upturn in global electronics demand during 2024 and 2025.

The medium-term outlook for electronics demand is underpinned by major technological developments, including continued 5G rollout over the next five years, which will drive demand for 5G mobile phones. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics. The information/communications and video/audio industry is also benefiting from growing new demand for Artificial Intelligence (AI)-related products, such as servers and graphics cards as well as chips that support generative AI functions.

Over the next decade, Taiwan's electronics industry will continue to benefit from its leading role in production of advanced semiconductors as well as from its production of a wide range of other electronics products for consumer and industrial electronics.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location