Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 26, 2022

Recovery from the COVID-19 recession has been characterized by resilient demand amid a series of supply disruptions. The results have been the highest inflation rates in decades in the advanced economies. As monetary and fiscal policies pivot away from active stimulus to restraint, growth in aggregate demand will slow. Success in taming inflation and averting a global recession will depend on supply resilience. Russia's invasion of Ukraine and the uncertain path of COVID-19 complicate the situation. Forces contributing to better supply conditions include rising labor force participation, investments to increase productive capacity and enhance labor productivity, an easing of transportation bottlenecks, free trade agreements, and diversification of supply sources.

Russia's invasion of Ukraine and the surge in COVID-19 cases in mainland China are the latest in a series of economic shocks that have disrupted supply chains, fueled inflation, and slowed economic growth. Yet, as economies reopen, consumer spending and business investment are proving resilient. The task of subduing inflation while sustaining economic growth will depend on vigilant monetary and fiscal policies, improving supply conditions, and a bit of luck.

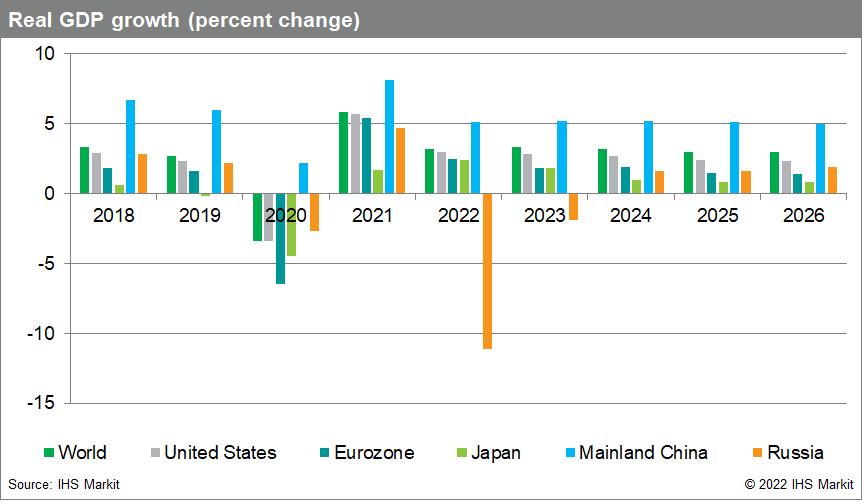

After a 3.4% contraction in 2020 and a strong 5.8% rebound in 2021, world real GDP growth will likely slow to 3.2% in 2022.

The 2022 growth forecast is marked down just 0.1 percentage point, reflecting weaker growth in the US economy in early 2022 (this follows a larger downward revision in March, to 3.3% from 4.1% in February, in response to Russia's invasion of Ukraine). The 2022 slowdown reflects tightening financial conditions, the withdrawal of pandemic-related fiscal stimulus, inflation's toll on consumer purchasing power and business costs, and substantial economic damage from the Russia-Ukraine war. On the positive side, the end of COVID-19 restrictions will give new impetus to service sectors, including travel, tourism, and entertainment. In goods industries, inventories are lean and restocking will support growth in 2022.

With industrial materials prices climbing to record highs in March, the near-term outlook for inflation has deteriorated.

Led by surging energy and food prices, global consumer price inflation will likely pick up from 3.9% in 2021 to 6.6% in 2022, its highest pace since 1995. Industrial and agricultural commodity prices are expected to peak in mid-to-late 2022 and then retreat in response to rising interest rates, softening demand, and a gradual improvement in supply conditions. The April forecast shows global consumer price inflation easing to 3.5% in 2023 and 2.7% in 2024, an outcome that also depends on solid productivity gains to keep unit labor costs in check. If inflation proves more persistent, more aggressive monetary policy tightening would be necessary, which restrains demand.

With interest rates rising, the US economy faces a cooling-off period but no recession.

US real GDP growth will likely slow from 5.7% in 2021 to 3.0% in 2022 and 2.8% in 2023. The 2022 growth forecast is revised down 0.3 percentage point, reflecting a weak first-quarter performance when drags from net exports and inventory investment nearly stalled real GDP growth. Fueled by strong gains in employment, real consumer spending is projected to increase 3.1% in 2022, which is led by services. Despite high inflation, household finances are in good shape, thanks to savings accumulated and asset appreciation during the pandemic. In response to higher inflation and further tightening of labor markets, the Federal Reserve will likely reduce asset holdings and raise the target range for the interest rates to 3.00-3.25% in mid-2023, temporarily overshooting its terminal range of 2.50-2.75%. Tightening financial conditions will lead to declines in homebuilding and nonresidential construction, but the outlook for investment in business equipment and software remains robust, supporting productivity growth.

Russia's war on Ukraine will send Emerging Europe into recession in 2022, with real GDP plunging 45.7% in Ukraine and 11.1% in Russia.

Belarus, Kyrgyzstan, and Tajikistan will also experience contractions because of close economic ties with Russia. While other countries in the region will likely avoid recession, factors like rising inflation, supply chain disruptions, and declining consumer sentiment will sap economic growth. Meanwhile, increases in defense spending and refugee support will strain public finances. While Ukraine's economic recovery is expected to take five years, Russia's recovery could take a full decade as severe sanctions take a toll on trade, finance, and private investment.

With inflation pressures building, Western Europe's real GDP growth will likely slow from 5.6% in 2021 to 2.6% in 2022 and 1.7% in 2023.

Recent economic data are mixed: S&P Global PMI™ survey data suggest resilience, but consumer confidence is collapsing in the wake of Russia's invasion of Ukraine. The forecast incorporates a modest contraction in eurozone and EU real GDP in the second quarter. Growth should resume in the third quarter, supported by a rebound in services activity in response to COVID-19 trends, excess household savings accumulated during the pandemic, and still-accommodative monetary policies. The European Central Bank is expected to start raising its deposit facility rate in December 2022 and its benchmark policy rate in March 2023, taking the policy rate to its terminal level of 2.00% at the end of 2024.

Despite new policy stimulus, mainland China's real GDP growth will unlikely reach the government's 5.5% target for 2022.

Real GDP increased 4.8% year on year (y/y) in the first quarter, up from 4.0% in the final quarter of 2021, as an acceleration in industrial and construction output was partially offset by slower growth in services. Widespread outbreaks of COVID-19 and adherence to Beijing's "dynamic zero-COVID" policy have undermined growth in March and April. The epicenter of the outbreak has shifted from Jilin Province in the Northeast to Shanghai Municipality, the nation's financial hub and a manufacturing base for high-end auto components. Smaller-scale outbreaks in other regions have largely been brought under control and production is resuming in most locations. The government is quickly ramping up infrastructure investment, which rose 8.5% y/y in the first quarter, and easing monetary policies to stabilize the real estate market. Real GDP growth is projected to slow from 8.1% in 2021 to 5.1% in 2022.

The Asia Pacific region will sustain robust economic growth, benefiting from expanding international trade.

After 6.1% real GDP growth in 2021, the region's economy will likely expand about 4.5% annually over the next three years, accounting for half of global economic growth. The region is benefitting from robust export growth and free trade agreements such as the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) and the recently launched Regional Comprehensive Economic Partnership (RCEP). These countries will also benefit from efforts by global businesses to diversify sourcing of materials.

Interest rates and public finances under pressure in Sub-Saharan Africa.

Sub-Saharan Africa's real GDP growth rate is expected to slow from an estimated 4.4% in 2021 to 3.4% in 2022. The steep rise in global food and fuel prices due to the Russia-Ukraine war have led several Sub-Saharan African authorities to introduce renewed or higher subsidies, temporary price controls, and suspension of selected import customs duties. These measures will delay the region's fiscal consolidation efforts amid rising public-sector debt levels. Escalating inflationary pressures will likely prompt faster, appropriate monetary policy responses by central banks in the region during 2022.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.