Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 22, 2025

By Tim Zawacki and Husain Rupawala

The group led by State Farm Mutual Automobile Insurance Co. cautioned that it would absorb internally a significant portion of the losses incurred due to the January wildfires in California, and S&P Global Market Intelligence's review of first-quarter statutory financial statements filed by individual group members confirms the significance of the red ink.

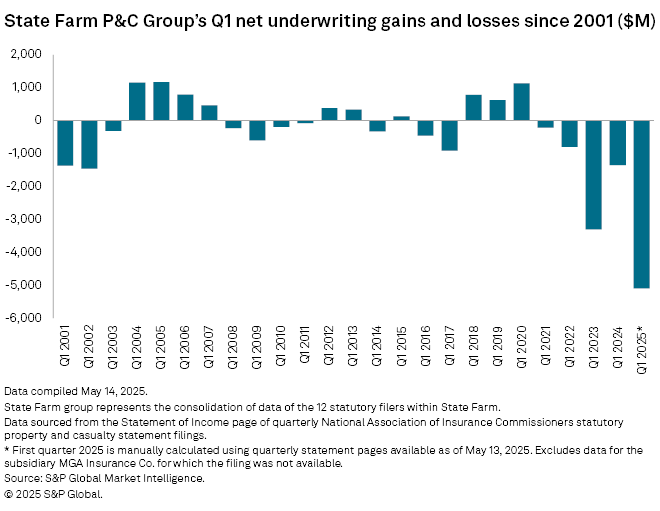

We calculate that 11 US-domiciled State Farm P&C companies combined to generate a net underwriting loss of $5.09 billion in the first quarter in a result that ranks as the group's second largest such result on record in any quarter since the start of 2001. The State Farm P&C group produced a $1.35 billion net underwriting loss in the first quarter of 2024 amid demonstrably worse conditions in its core private passenger auto insurance business.

The structure of the reinsurance program of California-focused property insurer State Farm General Insurance Co. is such that top-tier mutual company and its Oglesby Reinsurance Co. subsidiary appeared to absorb much of the fire-related loss on a net basis.

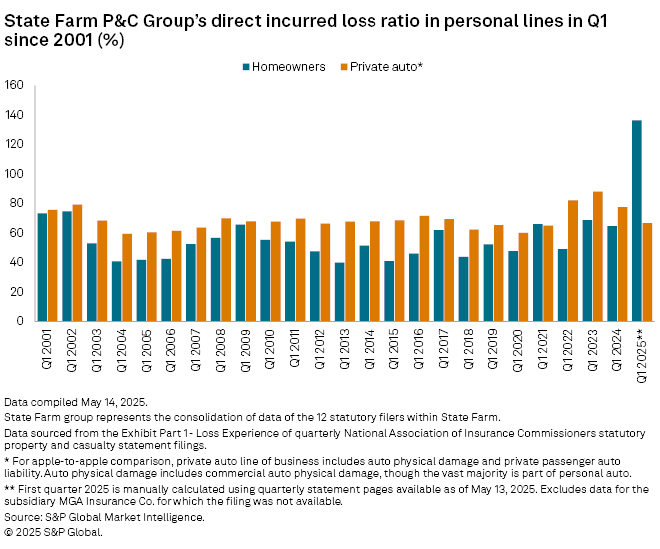

State Farm General recorded direct incurred losses of nearly $7.39 billion in the first quarter, a tally that exceeded that entity's losses in the previous 12 quarters combined. It was more than double the $3.40 billion in direct incurred losses unadjusted for inflation that the company reported in the fourth quarter of 2017. Santa Barbara and Ventura counties sustained significant destruction from the Thomas fire during that quarter, which heretofore ranked as State Farm General's largest previous loss in the 21st century. The first-quarter direct incurred loss ratio for State Farm General was 729.9% across all business lines and 859.2% in the homeowners business. The State Farm group's homeowners direct incurred loss ratio of 136.4% was its highest in any quarter since the start of 2001, eclipsing the previous highs of between 131% and 132% set in the third quarters of 2004 and 2005.

State Farm has emphasized the magnitude of the losses the entire group faced in support of the California-focused entity's pursuit of interim rate increases, and we estimate that the group's direct and assumed losses from the wildfires made the difference between a sizable underwriting profit and a historic underwriting loss.

Net underwriting losses at State Farm Mutual Auto, State Farm General and Oglesby Reinsurance totaled $3.68 billion, $636.3 million and $1.11 billion, respectively. State Farm General ceded $6.26 billion of its direct losses; State Farm Mutual Auto and Oglesby Reinsurance reported assumed losses of $6.22 billion and $1.13 billion, respectively, up from $867.9 million and $20.8 million in the first quarter of 2024. We calculate that the group would have posted a net underwriting profit of nearly $1.98 billion when holding State Farm General's direct losses and State Farm Mutual Auto's and Oglesby Reinsurance's assumed losses at levels in line with the year-earlier period.

The magnitude of the first-quarter losses led to surplus erosion at all three companies as measured on an individual, unadjusted basis. State Farm Mutual Auto's $519.1 million in net losses contributed to a $2.71 billion sequential decline in its surplus to $142.48 billion that was largely driven by a $1.94 billion negative change in unrealized capital gains and losses. Oglesby Reinsurance had surplus of $4.34 billion as of March 31, down from $5.18 billion three months prior. State Farm General, which has flagged solvency concerns in support of its pending rate filings, had just $589.5 million in surplus at the quarter's end as compared with $1.04 billion on Dec. 31, 2024, and $1.31 billion on the same date a year earlier.

An administrative law judge on May 12 found that State Farm General's requests for overall rate increases of 17% for homeowners, 15% for renters, and 38% for rental dwelling policies was "fundamentally fair, adequate, and reasonable" under the circumstances. The same day, State Farm General filed to recoup 50% of the $165.4 million assessment it had been levied by the California Fair Plan Association.

An interim rate stipulation between State Farm and the California Department of Insurance, which Insurance Commissioner Ricardo Lara adopted on May 13, contemplates State Farm General's immediate issuance of a $400 million surplus note with the top-tier mutual that would have the effect of restoring a significant portion of the surplus the company lost in the first quarter. State Farm General ended 2024 with an authorized control level risk-based capital ratio of 150.2%, slightly above the 150% threshold for a regulatory action level event. Assuming no change to the company's authorized control level risk-based capital during the first quarter, the company's ratio would have tumbled on a pro forma basis to 85.3%, well within the regulatory action level and 15.1 percentage points above the mandatory control level under the NAIC's RBC Model Act. The issuance of the surplus note would hypothetically increase the ratio to 143.2%.

The administrative law judge in the proposed decision approving the stipulation characterized the decline in State Farm General's surplus as a "massive drop" such that the company "must take action to improve its financial footing."

Fallout from the fires obscured meaningful progress achieved by the State Farm P&C group in improving underwriting results in its private auto and homeowners businesses. The homeowners direct incurred loss ratio for group members other than State Farm General was 59.8%, a result that was only 0.5 percentage points above the five-year average first-quarter homeowners direct incurred loss ratio for the group from 2020 through 2024. The private auto direct incurred loss ratio plunged by 11 percentage points on a year-over-year basis to 66.6%, which ranks as the group's best result in the previously embattled business line since the first quarter of 2021.

Methodology

First-quarter results referenced in this article were manually compiled from March 31 quarterly statutory statements for 11 State Farm P&C entities. The statement for the 12th group member, MGA Insurance Co. Inc., was not available, but the company's contribution to overall underwriting results has typically been minimal, totaling just $1.4 million in the first quarter of 2024.

We anticipate the hard copies of the relevant filings will be posted on S&P Capital IQ Pro on or before May 16. S&P Global Market Intelligence expects to release first-quarter statutory financial results for individual entities on or about May 21.

.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.