Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Technology, Media & Telecommunications — 6 Apr, 2018

Technology, Media & Telecommunications

Highlights

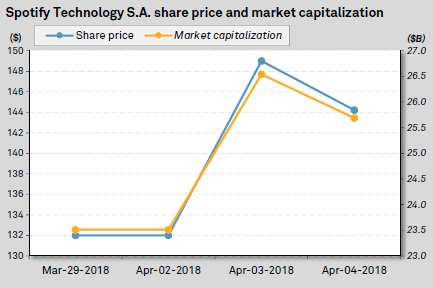

Spotify Technology SA shares rose 13% above its $132.00 reference price to close at $149.01 the day of the company’s IPO April 3, resulting in a public market valuation of 4.0x estimated 2018 revenue of €5.22 billion and 16.5x gross profit of €1.28 billion.

The following post comes from Kagan, a research group within S&P Global Market Intelligence. To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

Spotify Technology SA shares rose 13% above its $132.00 reference price to close at $149.01 the day of the company’s IPO April 3, resulting in a public market valuation of 4.0x estimated 2018 revenue of €5.22 billion and 16.5x gross profit of €1.28 billion. That compares to a trading multiple of just 1.0x revenue for Pandora as of the same date, but Spotify’s higher trading multiple is justified by its higher proportion of paying subscribers among its listeners and its growth outside the U.S.

Spotify Technology is the parent of Spotify AB, the Swedish operator of the popular Spotify streaming service.

Company guidance for full year 2018, provided in Spotify's March 26 8-K filing, is revenue of €4.9 billion to €5.3 billion, up 20% to 30% year over year, and a gross profit margin of 23% to 25%, with an operating loss of €230 million to €330 million including an estimated total cost for the direct listing of roughly €35 million to €40 million in the second quarter.

The 8-K also shows Spotify has ambitious monthly active user, or MAU, and premium subscriber growth targets for 2018, with MAUs projected to increase by 26% to 32% year-over-year to 198 million to 208 million and total premium subs growing 30% to 36% to a range of 92 million to 96 million.

At the end of 2017, Spotify had reported 157 million MAUs and 71 million premium subs. Apple Music came in second place with a reported 36 million subs as of February 2018; based on reports from the Wall Street Journal, the company is growing at a monthly rate of 5% compared to 2% at Spotify. According to a Forbes article on April 4, Apple Music just reached 40 million paid subscribers.

Amazon.com Inc. has indicated it is the third-largest on-demand streaming music company behind Spotify and Apple Inc.'s Apple Music with a reported 16 million subscribers between Prime Music and Amazon Music Unlimited. That leaves Pandora Media Inc. in fourth place with 5.5 million paid subscribers, although it has a larger ad-supported user base with 74.1 million MAUs reported at the end of 2017.

Based on reports by Music Business Worldwide on April 4, Sony Corp.'s Sony Music, which had owned 5.71% of Spotify shares prior to the first day of trading, sold 17.2% of its stake in the company, representing a little less than a 1% total share, for over $250 million based on the April 3 closing price of $149.01.

In Spotify's prospectus filed April 3, Sony Music, before the April 3 shares sale in the first day of Spotify trading, was the fifth-largest shareholder behind Spotify co-founders Daniel Ek (27.1%) and Martin Lorentzon (13.1%), followed by Tencent Holdings Ltd. (9.1%) and Tiger Global (7.2%).

As reported by Music Business Worldwide, according to a memo released by Sony, the company projects that the unrealized valuation gain and the proceeds from the sale of Spotify shares will amount to roughly 105 billion Japanese yen, approximately US$1 billion, for the first quarter of the fiscal year ending March 31, 2019.