Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Mar, 2024

By Iuri Struta

Highlights

Sports ownership is evolving as PE firms, celebrities and retired athletes invest in the business

Improved economics of sports has driven greater demand among buyers and increased the prices in recent deals

Richard Berndes, a Kagan analyst, believes women's sports is the biggest opportunity for investors over the next few years

Outsized returns are motivating a wider variety of investors to get off the sidelines and step up their investments in sports assets.

While buying teams was once mainly the purview of deep-pocketed billionaires chasing trophy assets, the sports ecosystem is now attracting private equity firms, sovereign wealth funds, celebrities and retiring star athletes. Some of these investors are purchasing teams outright; others are amassing a collection of minority investments that span leagues and geographies.

A range of changes has bolstered interest in the sports arena, including improved profitability, increased opportunity for media rights deals and a growing record of lucrative transactions.

"We have seen strong growth in the number of types of investors interested in sports, and sports tech ecosystems," said Greg Bedrosian, CEO of tech-focused investment bank Drake Star Partners, in an interview. Drake Star has advised on a number of sports and sports tech deals.

The bottom line

A couple of decades ago, sports teams were primarily viewed as risky vanity assets. Today, however, the rising value of sports media rights and changes to players' salaries have made sports an asset class that combines market-beating returns with the defensiveness often seen in low-growth utilities.

Rights payments for the National Football League Inc., for instance, have risen every year since 1982, with higher increases following contract renegotiations every eight years, according to estimates from S&P Global Market Intelligence Kagan.

In addition to registering top-line growth in the US, teams are also making changes to their expenses to boost profitability. Player salaries have been declining over the past decade as a percentage of revenue for the top four US leagues — the NFL, NBA, NHL and MLB — and now account for about half of total revenue, according to estimates from Arctos Partners LP, an investment firm focused on sports.

In Europe, revenue from sports rights has been slightly more volatile, though rights fees have grown exponentially. England's The Football Association Premier League Ltd. brought in £38 million per season from media rights two decades ago. Under its latest rights deal, beginning in 2025, the league will collect £1.6 billion per season, an increase of 4,110%, according to Kagan.

On salaries, recent rules announced by the UEFA regulatory body limited spending on player and coach wages, transfers and agent fees to 90% of revenue in 2023 and 2024. This will gradually decrease to 70% of club revenue in 2025 and 2026. The rule change promises to improve profitability for clubs long mired in financial troubles. There are also discussions to introduce salary caps similar to US leagues, which will further bolster the finances of European football clubs.

"The focus has moved from becoming primarily a winning organization on the field to developing winning businesses on a year-round basis," said Lee H. Berke, a consultant to sports organizations in the US, in an interview. "This shift along with growing visibility has driven asset valuations, particularly over the past 20 years."

Driving deals

The improving economics around sports has led to greater demand among buyers and pushed up prices in recent deals.

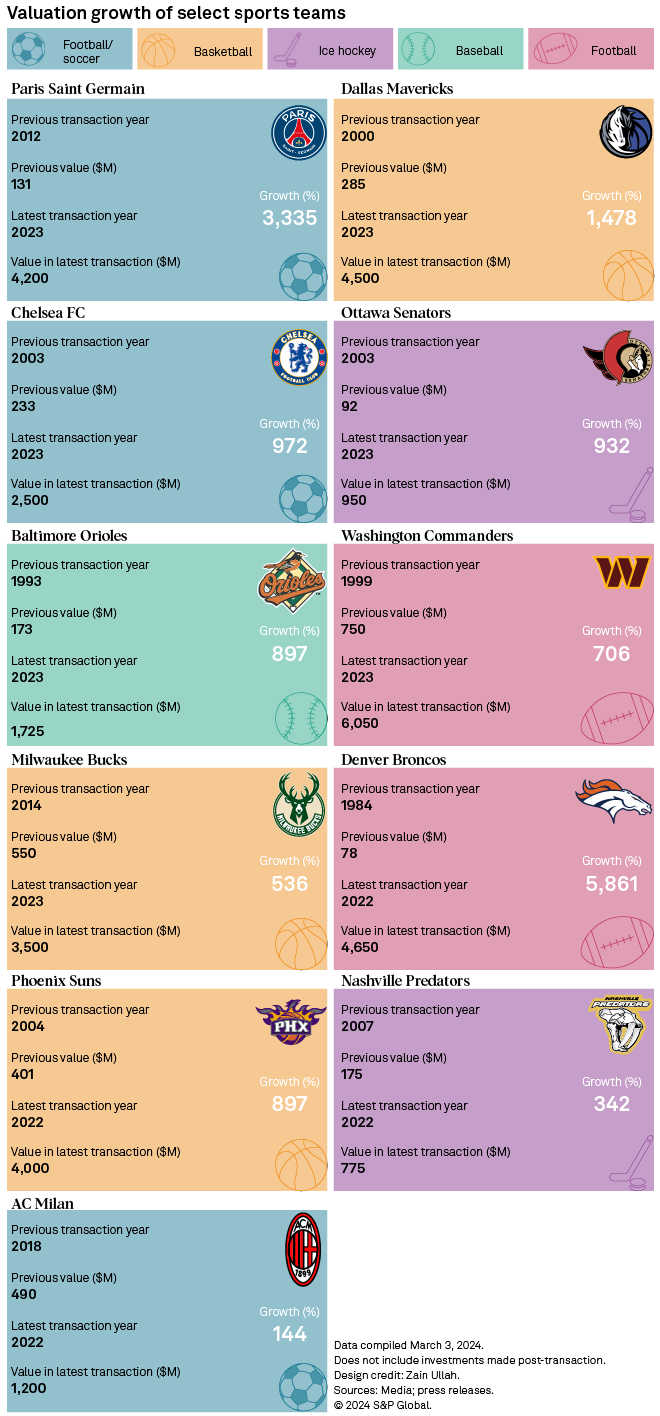

Mark Cuban sold a majority stake in the Dallas Mavericks NBA team to Las Vegas Sands Corp. in 2023 in a transaction that valued the team at $4.50 billion. Given that Cuban paid $285 million for the team in 2000, he netted a return of 1,478%, nearly six times more than the return of the S&P 500 Index during the same 23-year period.

Even over longer time frames, sports appear to have outperformed. The Denver Broncos NFL team was sold for $4.65 billion in 2022, 5,861% more than what the team was previously bought for in 1984. The S&P 500 Index appreciated by 3,083% over the same period.

New players

While the Broncos were purchased outright by a collection of billionaires led by the Walton-Penner family — with the Waltons being descendants of Walmart co-founder Sam Walton — financial sponsors have pursued more diverse investment strategies, from accumulating minority stakes in top franchises to providing capital for development.

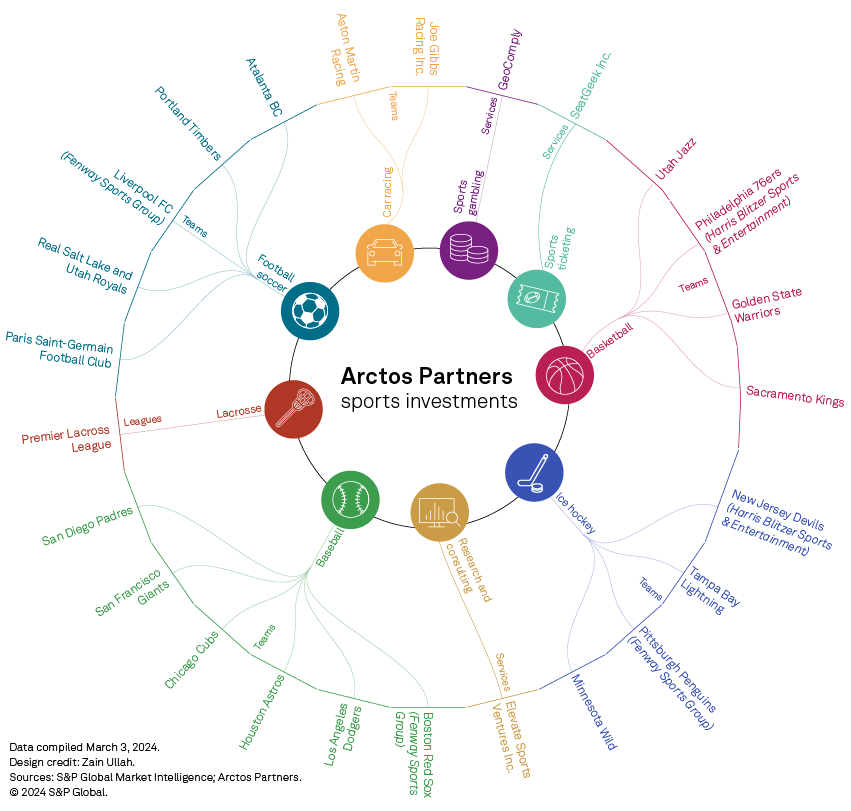

For instance, Arctos — which has interests across European football, basketball, ice hockey, sports gambling and lacrosse — typically buys minority stakes in teams. Notably, in the US, the NFL does not allow institutional investors to acquire minority stakes, only individuals, although there have been discussions to open up the pool of potential investors.

The investment firm estimates there are on average 10 owners per team in the US Big Four leagues, Major League Soccer and European football/soccer leagues under the UEFA association. A good chunk of these league owners want liquidity. Arctos, via minority investments, is there to provide it to owners who seek to exit.

The firm recently made minority investments in six MLB teams, including the Chicago Cubs and the San Francisco Giants. It also took a minority stake in French football club Paris Saint-Germain Football Club from Qatar Sports Investments.

In a white paper, Arctos says "franchises are one-of-a-kind, difficult-to-replicate brands with sticky customer relationships and highly visible, non-cyclical revenues." It also noted that minority stakes are easier to come by than controlling ones.

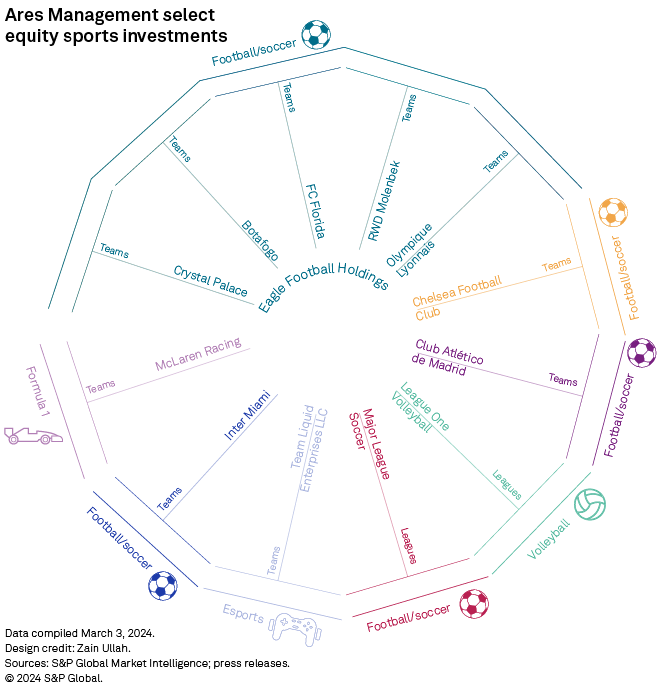

Ares Management Corp. follows a slightly different approach. The private equity firm recently raised a $3.7 billion fund to provide capital to sports franchises via debt and equity.

The private equity firm made a minority investment in Eagle Football Holdings LLC, which owns English Crystal Palace FC and French Olympique Lyonnais Groupe SA. Ares also acquired an equity stake in Chelsea Football Club Ltd. after it was sold to Clearlake Capital Group LP founder Todd Boehly.

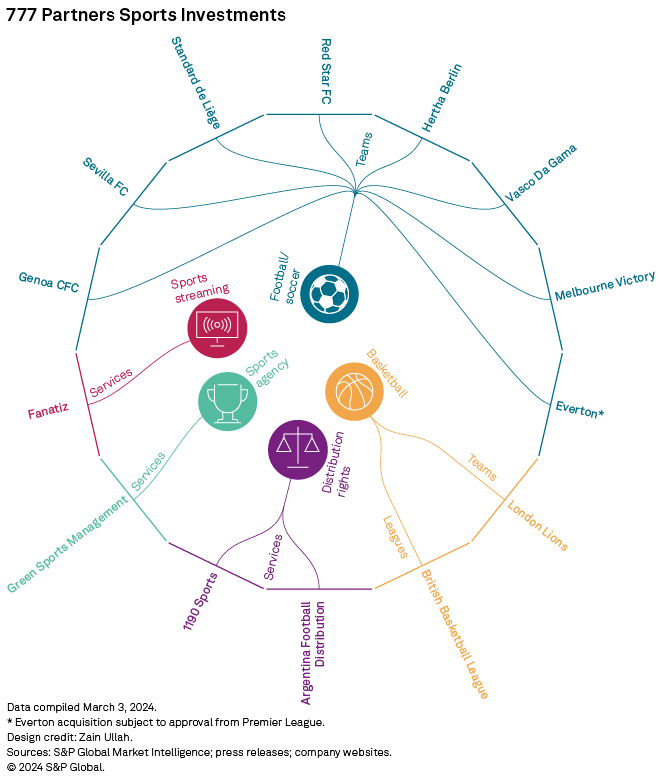

Still, some investors prefer to buy sports teams outright and are pursuing a roll-up strategy. 777 Partners LLC has been making full acquisitions of European football and basketball teams, and companies providing sports services like distribution rights management and talent management. 777 owns teams like Club De Regatas Vasco Da Gama in Brazil and Italian Serie A club Genoa CFC SpA. It also acquired English team Everton Football Club Company Ltd., but it has yet to receive approval from the Premier League.

Jonathan Lutzky, an operating partner at 777, told Market Intelligence the firm is looking to create a network of clubs that would centralize administrative tasks, share best practices and improve monetization from fan engagement — actions that would lower costs and improve profitability.

"We really believe in the nature of the multi-club network," Lutzky said. 777 plans to make more acquisitions of European football teams.

A majority of professional investors in sports have a hybrid approach, where they buy both minority and majority stakes. Red Bird Capital LLC recently acquired Italian Serie A club A.C. Milan SpA from Elliott Management Corp. for $1.2 billion, but most of its investments are minority stakes, including Formula 1 team Alpine Racing, and the US' United Football League. Both Red Bird and Arctos made minority investments in Fenway Sports Group Inc, which owns franchises like Premier League club Liverpool FC, the Pittsburgh Penguins NHL team and the Boston Red Sox MLB team.

Digging down

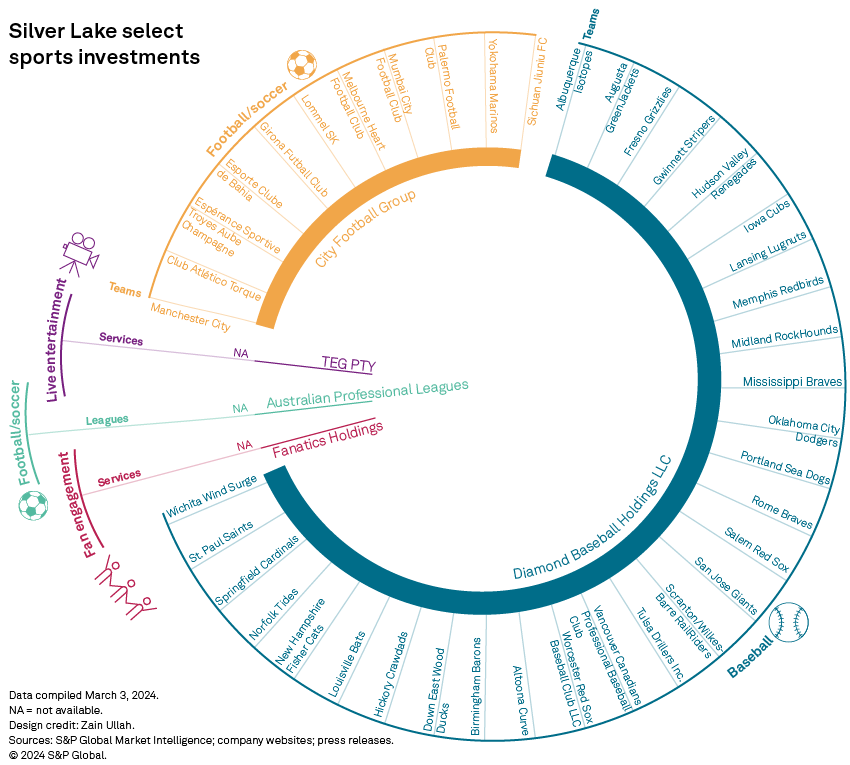

Notably, interest in M&A goes far beyond the major leagues and teams. Investors are also acquiring teams in niche sports like lacrosse or franchises in lower leagues. Private equity firm Silver Lake Technology Management LLC purchased Diamond Baseball Holdings LLC, an acquirer of Minor League Baseball teams, in 2021. So far, Diamond Baseball has acquired 29 teams.

Sixth Street Partners LLC, which owns stakes in Spanish clubs Real Madrid C.F. and Futbol Club Barcelona and basketball team San Antonio Spurs, acquired American women's soccer team Bay Football Club. In a LinkedIn post, Sixth Street co-founder and CEO Alan Waxman said National Women's Soccer League viewership almost equaled that of the Major League Soccer championship, yet women's sports currently sees just about 1% of the advertising, sponsorship, media and investment dollars.

"Similar to the global men's soccer franchises, we will start to see professional women's teams become national and global consumer brands," Waxman wrote.

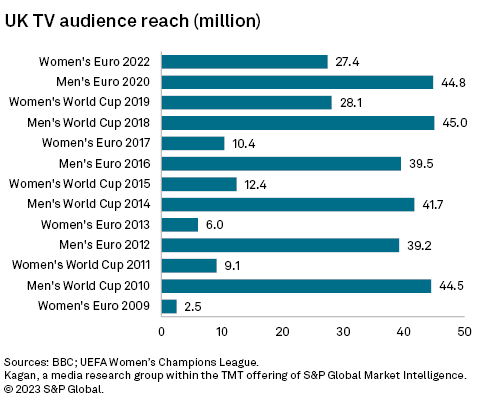

According to Kagan, viewership for women's World Cup in the UK tripled from the 2009 event to the latest one in 2022 to 27.4 million, while men's World Cup largely remained the same at 45 million.

Additionally, the WNBA total contract value increased from $18 million in the 2003-2008 seasons to $225 million in the 2017-2025 period. While the men's sports values are higher, women's sports is growing faster, making it more attractive for growth-oriented investors.

Follow the growth

Richard Berndes, a Kagan analyst, believes women's sports is the biggest opportunity for investors over the next few years given the rapidly rising attendance.

The US Women's National Soccer team "has probably been the most successful women's soccer team ever," Berndes said. However, the challenge for women's sports is to find a slot where it does not compete with men's sports, according to Berndes.

The advent of streaming platforms should make it easier for niche sports to monetize their fan engagement.

"In the past, the value in sports was driven by media deals, and they cared about the biggest leagues," said Drake Star's Bedrosian. "Now, there are other ways of monetizing everything from pickleball to pro surfing via alternative distribution channels like streaming."

Research

Research

Products & Offerings