Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 06, 2023

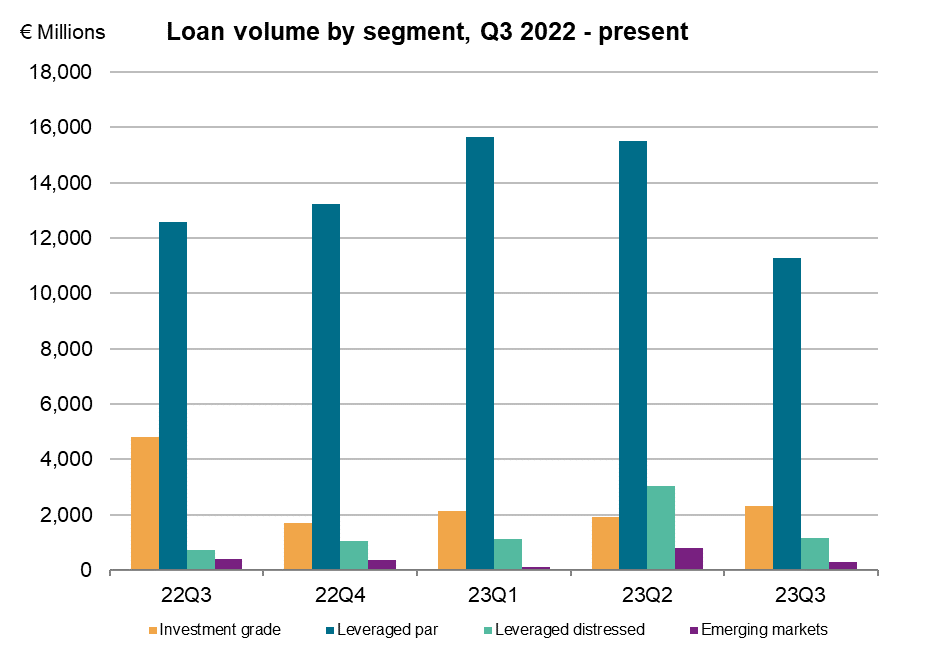

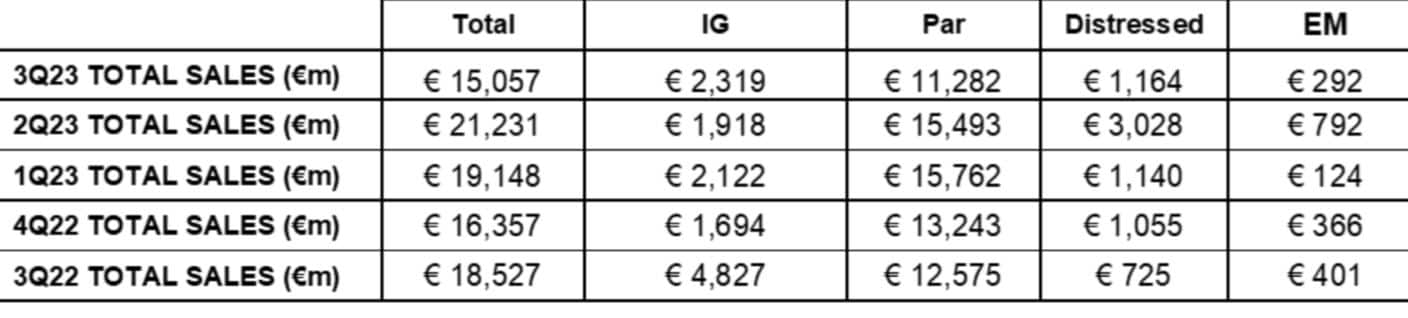

Total Volumes for Q3 2023 (€15,057m) were significantly down by 29.8% from the €21,231m for Q2 2023. The quarter was down by 18.73% on the €18,527m in Q3 2022.

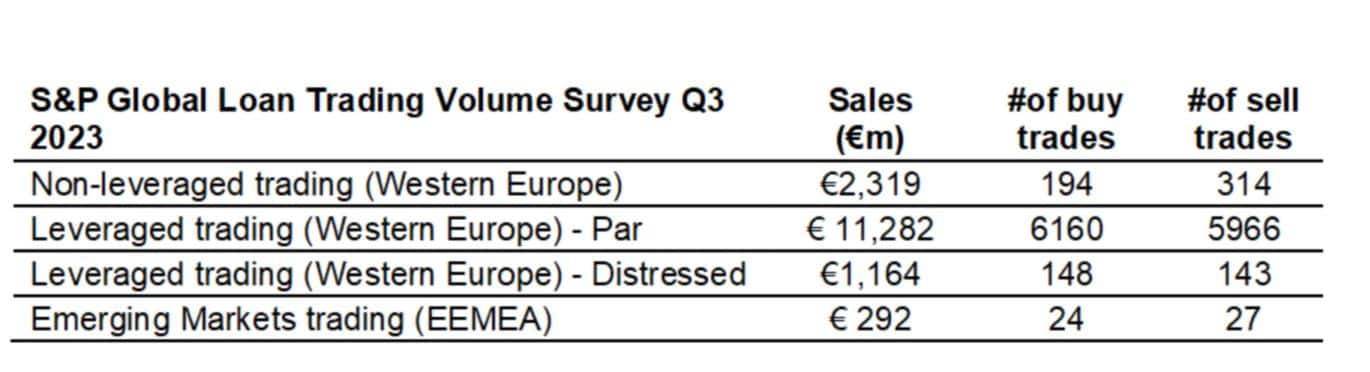

Leveraged loan trades in Western Europe constituted 82.66% of total volume, down on the 87.24% observed in the previous quarter and higher than the 71.79% in Q3 2022. Of the 82.66% this quarter, 74.92% was conducted on LMA Par documentation and 7.73% on LMA Distressed documentation.

European Investment Grade loan volumes represented 15.4% of the total, lower than the 2022 third quarter of 26% yet higher than Q2 2023 of 9%.

Emerging Market figures (EEMEA) saw a significant drop off and represented just 1.94% for Q3, which is significantly lower than the 3.73% we saw in Q2 2023, yet slightly down from the 2.16% from the third quarter of 2022.

Par figures were significantly down by 27.2% to €11,282m in Q3 2023 from €15,494m in Q2. This also represents a 10.28% decrease on the €12,575m in Q3 of 2022. There was a substantial decrease in the Distressed sector moving down by over 62% from €3,028m in Q2 2023 to € 1,164m in Q3 2023. This was however up by over 60% on the €725m Q3 2022. Investment Grade figures were up by 20.94% last quarter at €2,319m compared to the €1,918m in Q2 2023 yet down by 52% on the €4,827m Q3 last year. Emerging Markets were significantly down by 63% from €792m in Q2 2023 to €292m in Q3 2023 and still down 27% against the €401m from Q3 of 2022.

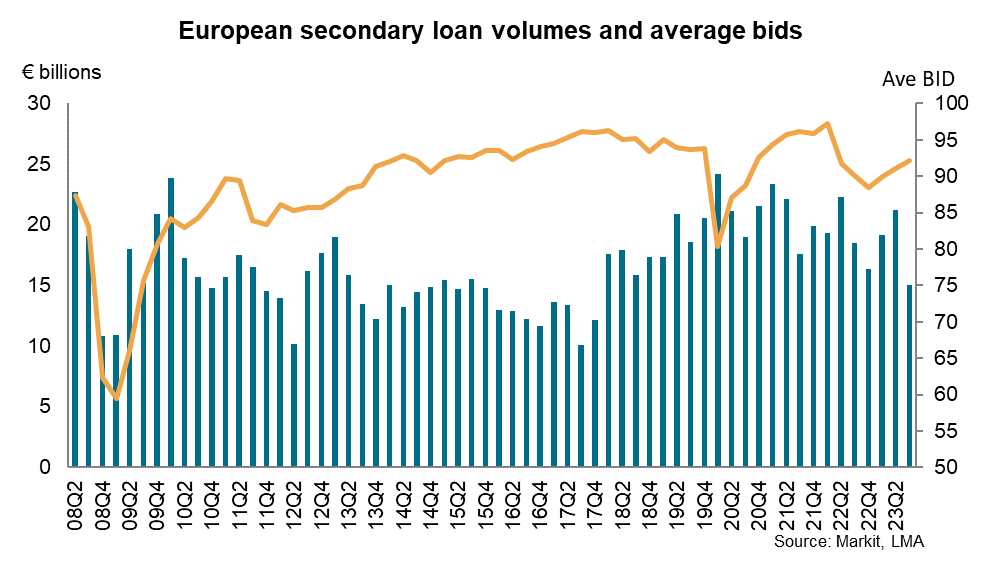

The average bid as of the end of Q3 was 92.34, which is up from the 91.37 observed at the end of Q2 2023 and significantly up from 88.49 in Q3 2022. The average bid over the quarter was 92.11, which was higher than the 91.04 of Q2 2023 and higher than the 90.705 of Q3 2022.

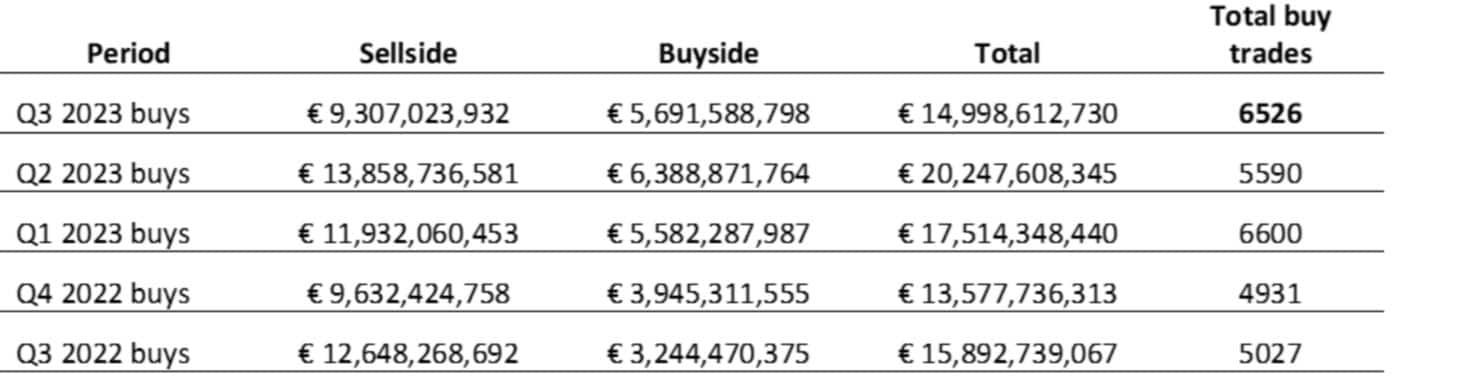

Total buy volumes in Q3 2023 were down by a significant 26% from €20,248m in Q2 2023 to €14,999m last quarter. Sellside buy volumes were down by 23% from €13,859m in Q2 2023 to €9,307m in Q3 2023. Buyside buy purchases were down by 11% in the same period, €6,389m to €5,692m. The number of actual buy trades has increased by 16.7% from 5590 in Q2 2023 to 6526 in the last quarter.

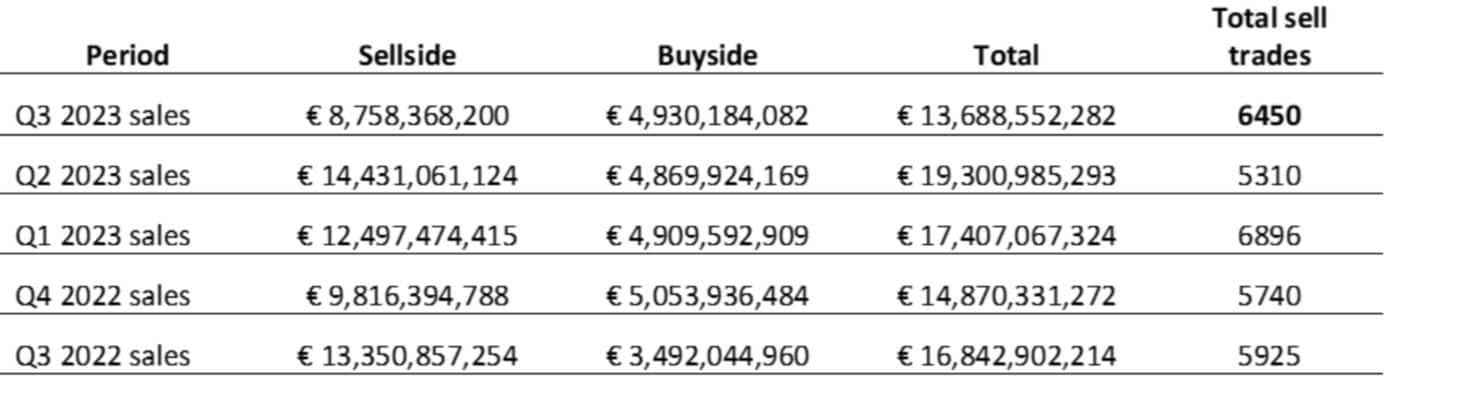

For the sale volumes, the sellside volumes were down by a significant 39.4% from €14,431m in Q2 2023 to €8,758m in Q3 2023. In the same period, buyside volumes were slightly up 1.2% from €4,870m to €4,930m. The total number of sales between Q2 2023 and Q3 2023 were significantly down by 29% from €19,301m to €14,688m. The total number of sell trades in Q3 2023 was 6450, up 21.5% from the previous quarter's 5310.

A total of 21 buyside and sellside institutions participated in this survey.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For more information, please contact:

Georgie Slater

S&P Global Fixed Income Pricing

+44 20 3367 0317

Georgie.Slater@spglobal.com

Alex Johnson

S&P Global Fixed Income Pricing

+44 20 3367 0317

alex.Johnson@spglobal.com

Rory McSwiggan

S&P Global Fixed Income Pricing

+44 20 7064 6404

rory.mcswiggan@spglobal.com

For further information

Visit spglobal.com

Email: support@spglobal.com

Copyright © 2023 by S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.