Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 9, 2025

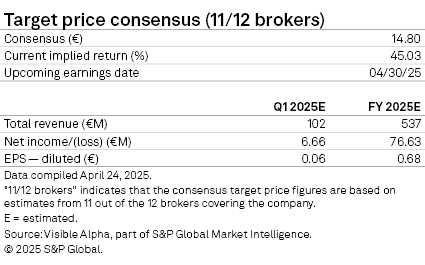

AIXTRON SE (ETR: AIXA), the German chip systems manufacturer, is set to report first-quarter results on Wednesday, April 30, amid growing investor unease following a revenue warning in February that triggered the stock’s steepest one-day drop in a year.

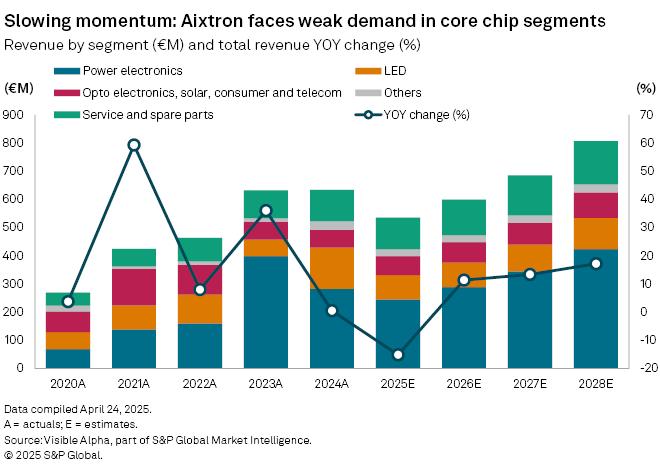

Visible Alpha consensus estimates forecast Q1 revenues at €101.9 million, down nearly -14% from a year earlier and sharply lower than the €383 million reported in the fourth quarter of 2024. The company's performance highlights a sharp divergence between business lines. While its Opto Electronics, Solar, Consumer, and Telecom division is expected to post a robust +23% year-on-year increase in sales, revenues from its two largest segments—Power Electronics and LED—are projected to fall -25.7% and -16.9%, respectively.

Aixtron's slowdown reflects broader industry pressures. Despite surging demand for chips used in artificial intelligence, overall market conditions remain weak, with sluggish sales in the automotive, PC, and memory sectors. The result: Aixtron’s annual revenue growth cooled to +0.5% in 2024, a sharp deceleration from the +36% expansion seen in 2023.

The outlook for 2025 appears even bleaker. Analysts expect a -15% drop in full-year revenues to €537 million, as U.S. trade policy uncertainty weighs further on sentiment.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Theme

Location

Products & Offerings

Segment