Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 27, 2025

By Ehteesham Ansari and Kanika Garg

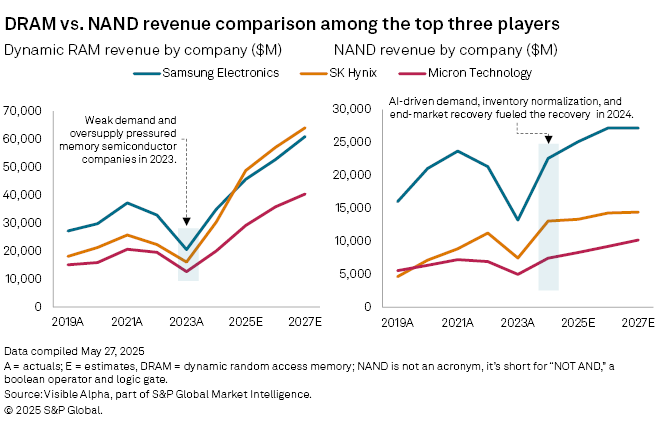

The global memory semiconductor market—dominated by Samsung Electronics (KRX: 005930), SK Hynix (KRX: 000660), and Micron Technology (NASDAQ: MU)—is seeing a significant shift. SK Hynix is poised to overtake Samsung as the leading DRAM supplier by revenue in 2025, according to Visible Alpha consensus estimates, marking a shift in the industry’s competitive landscape.

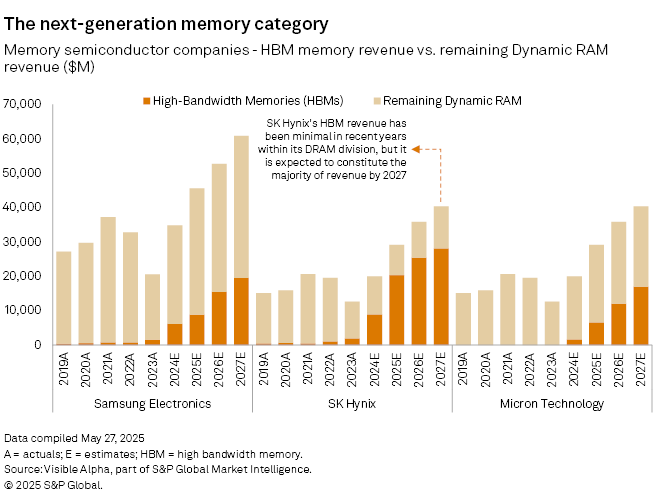

Long the dominant force in DRAM, Samsung is now facing intense competition from its smaller domestic rival. SK Hynix’s ascent has been supercharged by the explosive growth of high-bandwidth memory (HBM), a premium segment of DRAM critical for AI workloads. HBM chips offer significantly faster data transfer speeds, making them a crucial component for training and running large language models such as OpenAI’s ChatGPT and Google’s Gemini. SK Hynix is also the key supplier to Nvidia.

In 2019, HBM accounted for just 3% of SK Hynix’s DRAM revenue. By 2025, that figure is projected to jump to 42%, or $20.7 billion, marking a dramatic shift in the company’s revenue mix. Overall DRAM revenue at SK Hynix is forecast to reach $49.6 billion in 2025—surpassing Samsung’s expected $46.4 billion.

Samsung, while still a major HBM supplier, is projected to generate $9.0 billion in HBM sales in 2025, representing 19% of its total DRAM revenue. Micron, a key US DRAM producer, is also pivoting towards HBM, which is forecast to comprise 23% of its DRAM sales, or $6.6 billion.

Content Type

Products & Offerings

Segment