Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Nov 11, 2021

By Paul Wilson

Global securities finance revenues totaled $943m in October, a 32% YoY increase. The return drivers which were in place for Q3 remained consistent except the decline in APAC equity balances and a surge in America equity revenue after a slow September. ADRs and ETPs saw YoY increases in revenues, fees, and utilization in October. In this note we'll discuss the drivers of October revenue.

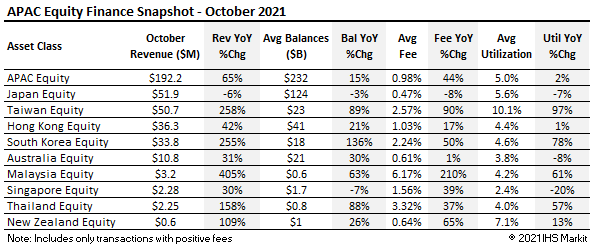

APAC Equity Finance revenues totaled $192m for October, a 65% YoY increase. Seasonal income was still prevalent in Japan at the start of the month, whilst China Evergrande and other property developers continued to boost revenue in the region. Overall, after a bumper September delivering the most revenue for any month YTD, October demonstrated a decline in some of the key equity special balances.

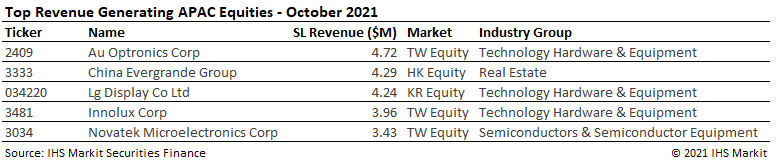

Taiwan replaced Hong Kong SAR as the second most revenue generating country with revenue of $50.7m, driven by strong borrow demand. Taiwan was a bright spot for APAC offering some revenue opportunities in the technology & hardware sector as well as Novatek (3034 TT) in the semi-conductor space.

Hong Kong SAR revenues dropped to $36.3m in October but are still up 43% YoY.

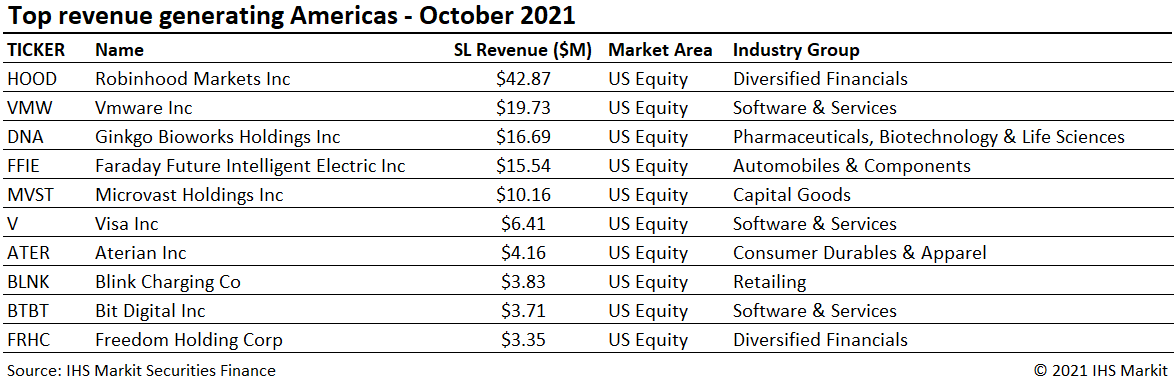

Americas Equity Finance revenues totaled $346m for October, a 23% YoY increase. Average fees were down 15% YoY, utilization was down 2% YoY, but the average balances increased by 45% YoY. Trends on a MoM perspective showed an uptick of 19% in revenues with an increase of 15% in average fees and steady average balances as compared to September.

US Equity revenues totaled $322m for October, a 24% YoY increase, and a 22% MoM increase in average daily revenues. Demand spiked for former SPAC name Ginkgo Bioworks (DNA) after a short activist report on 6 October saw the average balances jump 139% MoM and average fees increase by 450% MoM. Robinhood Markets (HOOD) remained a popular borrow name with balances remaining steady ahead of the potential lock up expiry while average fees increased by 67% MoM. VMWare Inc (VMW) saw an uptick in revenue of 93% MoM in anticipation of the spin-off deal with Dell Technologies (DELL) closing in late October.

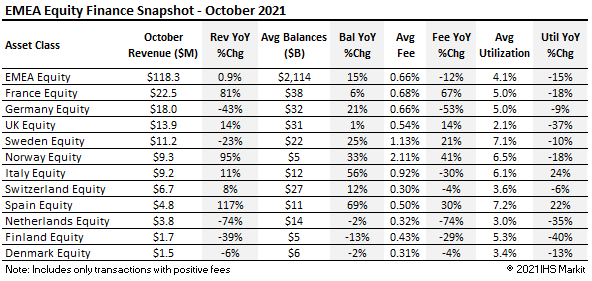

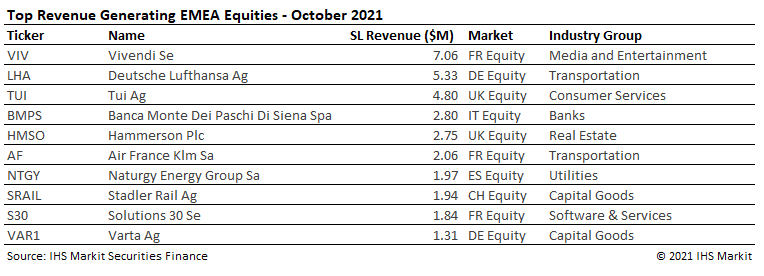

Following the soaring revenue in September from the Vivendi spin off trade, EMEA Equity Finance revenue tailed off by $64.2m to $118.3m in October. French Equity revenue still topped the list in Europe at $22.5m. UK Equity finance was buoyed last month by the Tui convertible bond hedge but suffered from a lack of new specials demand in October.

The rest of Europe shows familiar top earning names in airlines Lufthansa (LHA) and Air France (AF), as well as software service Solutions 30 (S30) and Italian bank BMPS. The energy and utilities sectors offered some revenue potential from Naturgy Energy (NTGY) and Totalenergies (TTE). Naturgy entered the EMEA top 10 and delivered lending returns of $1.97m and 41% of the total revenue in Spain for October. Totalenergies was just outside the top 10 generating $1m. There was also increasing demand in the UK for Itm Power (ITM), who announced it is looking to raise cash for a second factory and overseas expansion.

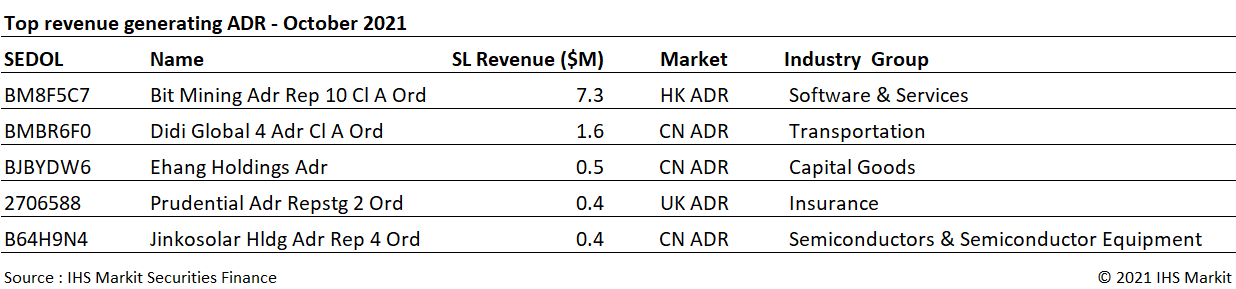

Revenues from lending American Depository Receipts (ADRs) increased 70% YoY, totaling $23m in October, extending the broad YoY revenue uptrend for the second consecutive month. ADR revenues declined 4% MoM from September, which delivered the second highest monthly revenue YTD for the last quarter. The decline in MoM revenue could be attributed to the fact that the demand in Bitcoin mining firm Bit Mining (BTCM) declined 15% in addition to a decline of 2% in average borrow fees. The primary drivers for October's surge were a 36% YoY increase in balances while fees and utilization experienced a similar rise with 26% and 32% YoY growth respectively.

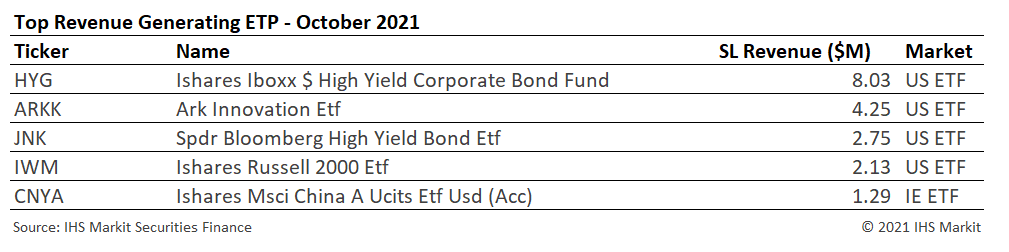

Global ETP revenues totaled $54m for October, a 64% YoY increase. The strong increase in revenue was driven primarily by an uptick in balances, which grew 54% YoY and averaged $99b during the period. Fees increased by 6% YoY, contributing to an overall 18% YoY growth in utilization for the asset class.

As in previous months, the iShares iBoxx $ High Yield Corporate Bond Fund (HYG) continued to generate the most revenue in the ETP asset class, returning $8.03m which is almost double the next ranked product. The Ark Innovation Fund ETF (ARKK) also delivered significant lending revenue for investors, however, quantity on loan decreased during the period, peaking at 9.27m at the beginning of the month and ending at 7.78m shares.

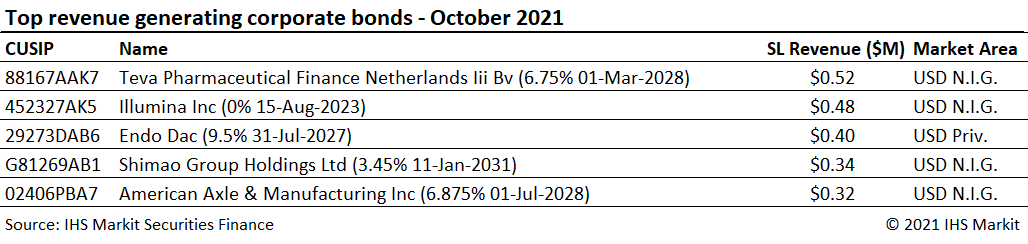

The yearlong uptrend in Corporate Bond revenue continued into October with the most monthly revenue YTD, $53.4m, a 62% YoY increase. Corporate loan balances averaged $265b in October, an increase of 49% YoY and in step with average monthly revenues, a new YTD high.

Total corporate bond lending revenue for agency programs including reinvestment returns and negative fee trades increased by 27% YoY as a result of a 54% YoY increase in intrinsic fee income and 19% YoY decline in reinvestment returns. Average balances were up 40% YoY as well as a 13% YoY increase in average borrow costs.

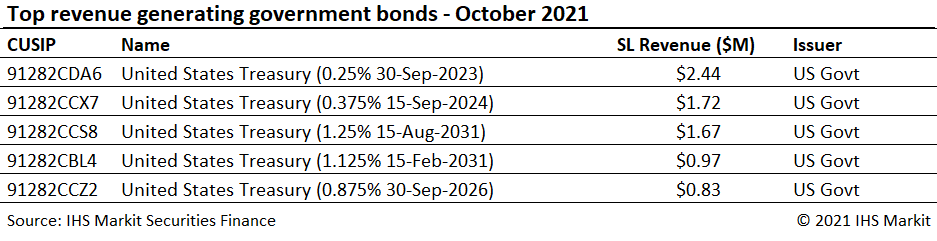

Fee-spread revenues of global sovereign debt totaled $136.8m for October, a 21% YoY increase and a 6% MoM increase. Average balances remain strong at $1.24T in value which is a 32% YoY increase and a 3% MoM increase for positive-fee trades. Monthly revenue enjoyed the issuance of new 2's, 3's and 10's that contributed to the 6% MoM increase.

Total government bond lending revenue for agency programs including reinvestment returns and negative fee trades increased by 7% YoY as a result of a 37% YoY increase in intrinsic fee income and 11% YoY decline in reinvestment returns. Average balances were up 19% YoY as well as a 19% YoY increase in average borrow costs.

Global securities finance revenues increased by 32% YoY in October, which is a step down from September which delivered the largest percentage gain YTD. Borrow demand for ADRs and ETPs continued to boost global returns in what is likely to be a record setting year for revenues in both asset classes. Borrow demand for corporate bonds continued to increase with seven consecutive months of YoY increases in intrinsic income, with October having the most monthly revenue YTD. The uptrend in APAC revenues saw a slight drop compared to last month but that said, emerging markets such as Taiwan did climb up a spot for the second most revenue generating country. Equity finance revenues for America saw a bump which can be partly attributed to an improvement in borrow fees and balances pointing towards growth favouring results in the upcoming quarter.

Stay tuned for monthly revenue snapshots from IHS Markit Securities Finance!

Posted 11 November 2021 by Paul Wilson, Manging Director, Securities Finance, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.