Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Dec, 2017 | 09:45

Highlights

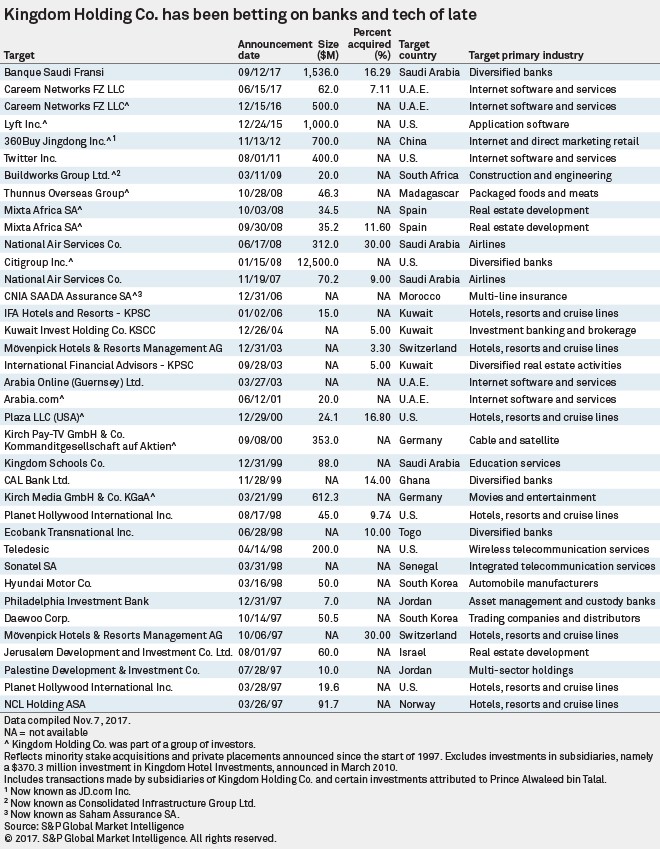

The banking and tech sectors should keep an eye on Prince Alwaleed's arrest, as these are areas where he and his company had recently been making large investments.

The arrest of Prince Alwaleed bin Talal on anti-corruption charges presents complications for companies seeking or currently receiving funding from the deep-pocketed member of the Saudi royalty. The banking and tech sectors should be particularly on watch, as these are areas where Prince Alwaleed and Kingdom Holding Co., the company he chairs, had lately been making relatively large investments.

For instance, Kingdom Holding struck a recent deal in the banking sector, agreeing in September to purchase a 16.3% stake in Banque Saudi Fransi for $1.5 billion. Within the past decade, Prince Alwaleed also notably participated in a $12.5 billion private offering of Citigroup Inc.convertible preferred securities. The exact amount of his investment is not known, but it is less than half of that amount, since Citigroup disclosed that $6.9 billion came from Singapore's sovereign wealth fund.

Over the past 10 years, Kingdom Holding Co. has also made some noteworthy investments in tech companies. The group is evidently drawn to the ride-hailing model, as it participated in a $1 billion fundraising round for Lyft Inc. at the end of 2015. Kingdom Holding and its affiliates contributed approximately $250 million to the San Francisco-based startup, and they were joined by, among others, automaker General Motors Co., which invested $500 million.

As we wrote about in September, Lyft is one of the most well-funded U.S. tech startups in the past decade, though the amount it has raised pales in comparison to rival Uber Technologies Inc.

Kingdom Holding has backed a ride-hailing company nearer to home as well. In June, it upped its bet on Dubai-based Careem Networks FZ LLC, acquiring a 7.1% stake through a $62 million transaction. Prior to that, Kingdom Holding participated in a funding round for Careem that raised $500 million in December 2016 from a group of investors. Established in July 2012, Careem operates in more than 50 cities in the Middle East and North Africa region, according to a March press release.

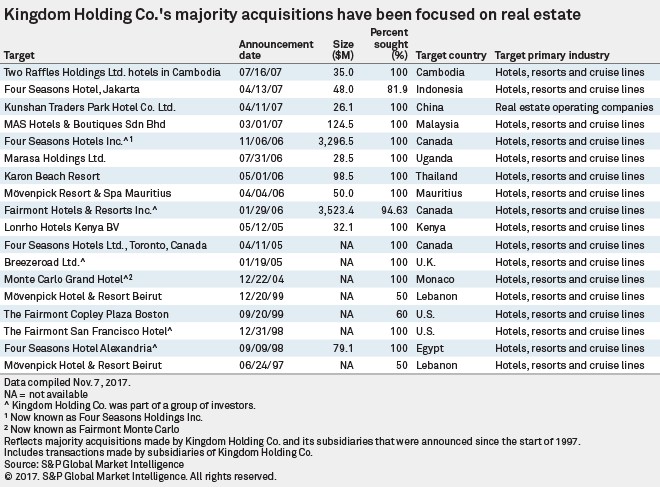

With regard to taking majority stakes, Kingdom Holding appears to have cooled off since 2007. But in the years from 1997 to 2007, it announced more than a dozen transactions, all in the hotel sector, according to S&P Global Market Intelligence data.

Keeping track of Kingdom Holding's investments, not to mention Prince Alwaleed's personal investments, is no easy task, as regular, standardized disclosures of their equity holdings is not available. For instance, in addition to the investments listed above, the group reportedly bought shares in the General Motors IPO, and S&P Global Market Intelligence has records of Kingdom Holding having invested in the stock of Apple Inc., eBay Inc., and Time Warner Inc., to name a few. Even though Kingdom Holding is publicly traded, reporting standards are not as stringent in Saudi Arabia, as a Forbes reporter found out in 2013.

Some personal holdings of Prince Alwaleed can be found via SEC disclosures. Within the past few years, he has reported ownership of News Corp., 21st Century Fox Inc. and Twitter Inc. stock in Schedule 13G filings. As of year-end 2016, he beneficially owned approximately 34.9 million shares of Twitter, which represented about 5% of common shares outstanding, and as of the prior year's end he owned about 39.7 million class B shares of 21st Century Fox, which accounted for roughly 5% of the class B shares outstanding. As of the end of 2014 he reported owning two million class B shares of News Corp., which made up about 1% of the outstanding B shares.

Kingdom Holding does not seem too fazed by the developments, with CEO Eng. Talal Al Maiman saying November 5 that the Saudi government's support of the company is a "badge of honor" and that its "successful strategy remains intact," according to a statement.

The potent question for banks and tech companies, then, is how much Prince Alwaleed influenced the investments they made. Judging by the examples we've noted, where personal and Kingdom Holding investments seemed entwined, that influence was likely significant.