Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Nov 30, 2023

By Matt Chessum

Since the first securities lending transaction was completed in Saudi Arabia in March 2021, interest in the market has continued to grow. With the country boasting the region's largest and most liquid stock exchange, with a market capitalization of $3T, the country continues to attract international investment. As the Financial Sector Development Program actively engages to support activities to grow and diversify the country's economy beyond hydrocarbons, elevating the Saudi Arabian stock exchange to the global stage, continues to be a priority.

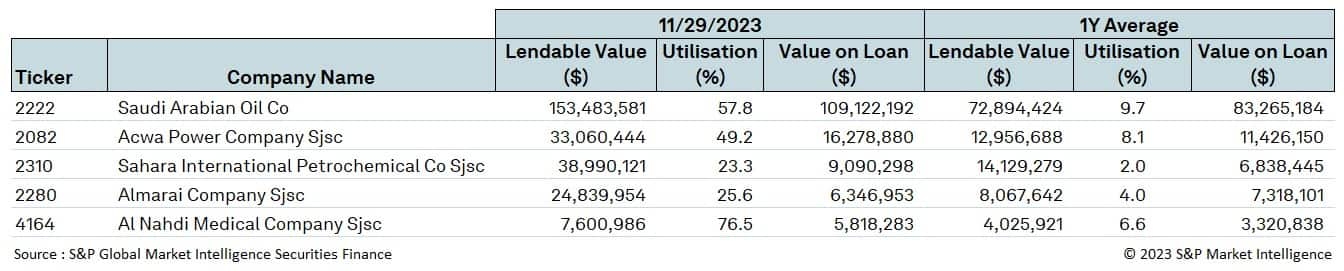

As international investment in the country has grown, so has the sophistication of the country's capital markets. Not only has an active securities lending market been implemented, but since November 2023, so have single stock options contracts based upon some of the country's largest companies. When looking at the securities lending data across all Saudi Arabian Stock Exchange listed assets, lendable value currently being reported stands at $1.7B, utilization stands at just over 12% and the average benchmark fee across all listed assets stands at 190bps. The table below shows the top five most borrowed stocks as of November 29th, 2023.

As interest in the Saudi Arabian financial market grows, the amount of financing and hedging activity, which are an essential ingredient for deep, liquid capital markets, will also grow to support an increase in trading volumes. Given the determination and progress by the Financial Sector Development Program to attract international investment, all securities lending market participants should firmly keep one eye on the data to ensure that they do not miss out on a potential opportunity.

For more information on how to access this data set, please contact the sales team at: h-ihsm-global-equitysalesspecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.