Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 24, 2025

By Jay Rathod

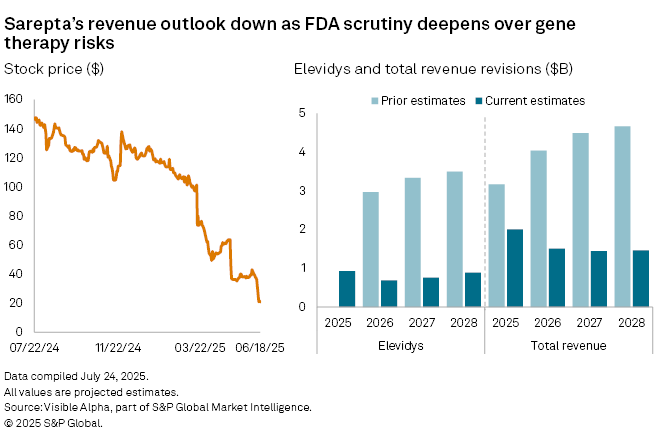

Analysts' expectations for Sarepta Therapeutics Inc. (NASDAQ: SRPT) have deteriorated sharply after fresh regulatory scrutiny cast new doubts over the future of its flagship gene therapy, Elevidys. Consensus forecasts from Visible Alpha show revenue estimates for the Duchenne muscular dystrophy (DMD) treatment in 2025 have dropped more than 55%, from $2.1 billion in March to $928 million, based on current analyst expectations. Expectations for total company revenue have also been cut—from $3.2 billion to $2 billion, highlighting uncertainty around Sarepta’s longer-term growth prospects in the gene therapy market.

The revisions follow Sarepta’s decision to pause shipments of Elevidys earlier this week, at the request of the US FDA. The move comes amid mounting safety concerns, including three patient deaths. Two teenage boys died earlier this year from acute liver injury, a known risk of the therapy, and last week the company reported a third death involving a 51-year-old patient in a separate clinical trial.

Shares in Sarepta have fallen 29% over the past week and are down nearly 90% year-to-date.

Elevidys, the first gene therapy approved in the US for DMD, initially received clearance for boys aged four and under who could still walk. The FDA later extended the approval to include older, non-ambulatory patients—broadening its commercial potential. But recent events raise questions about the durability of that opportunity as the company grapples with heightened regulatory oversight and deepening clinical risks.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings

Segment