Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 27, 2023

By Greg Knowler

The alternative fuels being developed by the container shipping industry could be up to five times more expensive than current fossil fuels, costs that will need to be recovered from cargo owners, attendees at the CrossStaff BCO conference in Antwerp were told this week.

Carriers are already outlining "green surcharges" to be levied on cargo owners as early as the first quarter of next year to recover costs of complying with Europe's emissions trading system (ETS), a small taste of what is to come as shipping transitions to new fuels that will be significantly more expensive than traditional bunker fuel.

"Rising energy costs and carbon-neutral fuels will become the main driver of freight costs in the long run," Jan Tiedemann, senior consultant at Alphaliner, told the conference.

"Fuel is already a big portion of a ships' operating costs, and the new fuels will be four or five times more expensive than conventional fuels, and on top of that will be CO2 levies," he added.

The price of very low sulfur fuel oil (VLSFO) in Singapore rose to $666 per metric ton this week, up 22% since the 2023 low reached on March 20 and double the price recorded in mid-2019.

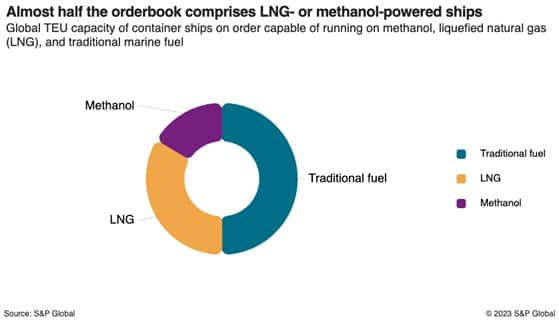

Of the more than 7 million TEUs of container ship capacity currently on order, nearly half will be capable of running on either LNG or methanol, according to data from Sea-web, a sister product of the Journal of Commerce within S&P Global. Several carriers are investing in alternative fuel plants to secure enough supply to be able to operate the new green fleets.

While the costs of meeting shipping's net-zero 2050 target are expected to run into the trillions, the ETS presents a more immediate decarbonization cost that awaits European cargo owners in the new year.

The ETS is essentially a carbon tax that will come into effect on Jan. 1, 2024. All ship operators will be required to monitor and report their emissions and surrender allowances for every ton of CO2 they emit covering all voyages within the European Economic Area and 50% of voyages ending or beginning in European ports.

The maritime industry's cost of compliance with the ETS will be more than $3.2 billion in 2024 and could rise to $9.1 billion in 2026, according to calculations by Hecla Emissions Management. Maersk and Hapag-Lloyd are so far the only two carriers to give an estimated value to their ETS "emissions surcharge" that will be applied to all relevant European bookings.

Shipping companies from 2024 will be required to buy one European Union Allowance (EUA) for every ton of reported CO2 emitted and submit it to the EU each year. The EUAs can be purchased on exchanges, such as the Intercontinental Exchange, the European Energy Exchange and the Nasdaq, as well as on the over-the-counter market between carriers and customers.

Hapag-Lloyd spokesperson Tim Seifert said the carrier has decided to buy the emission allowances for 2024 and introduce a mechanism that reflects the transport and the corresponding ETS surcharges.

"This is also to mitigate the corresponding market risks for our customers that could arise from any price increases in the EUAs," Seifert told the Journal of Commerce on Sept. 27.

While carriers are sitting on large cash reserves amassed during the supply chain congestion during the pandemic years, their sharply increasing cost base has corresponded with rapidly normalizing freight rates.

In an analysis of total operating costs using data provided by Hapag-Lloyd from its first half results as a proxy for the industry, Sea-Intelligence Maritime Analysis found that cost inflation for carriers remains far above pre-pandemic levels. Although the costs per TEU, excluding bunkers, have come down in the last six months, they were still 29% above the July 2019 level, the analyst noted.

"We should expect the carriers to aggressively tackle their costs in the period ahead," Sea-Intelligence CEO Alan Murphy warned in his Sunday Spotlight newsletter. "They have already brought the cost inflation down significantly since the apex in 2022, but more will be done."

One way to tackle voyage costs is to withdraw capacity to avoid ships sailing half empty. Carriers have already announced that 21.5% of available capacity on the Asia-North Europe trade lane will be blanked in October, removing 320,476 TEUs from the market during the month. That is up from 8.7% in September; November blanks, as of now, stand at just 6.6%, Sea-Intelligence data shows.

Trans-Pacific carriers have announced blank sailings for October totaling 20% of capacity for the month to the US West and East coasts, according to Sea-Intelligence. Carriers on the eastbound trade say capacity reductions they have implemented are likely to continue at least for the next five months with US imports from Asia expected to remain muted through the Lunar New Year in February.

However, with the newbuilding capacity flowing into service, arresting the falling spot rates will require considerably more blank sailings.

The spot rate from North Asia to the US West Coast this week was $1,600 per FEU, down 10% from the previous week, while the East Coast rate of $2,150 was also down 10%, according to Platts, a sister company of the Journal of Commerce within S&P Global. That compares with year-ago rates of $4,300 per FEU to the West Coast and $8,530 per FEU to the East Coast.

North Asia-North Europe spot rates this week of $890 per FEU were down 4.3% compared to the previous week, while North Asia-Mediterranean rates were almost 7% lower at $1,400 per FEU, according to Platts.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?