Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

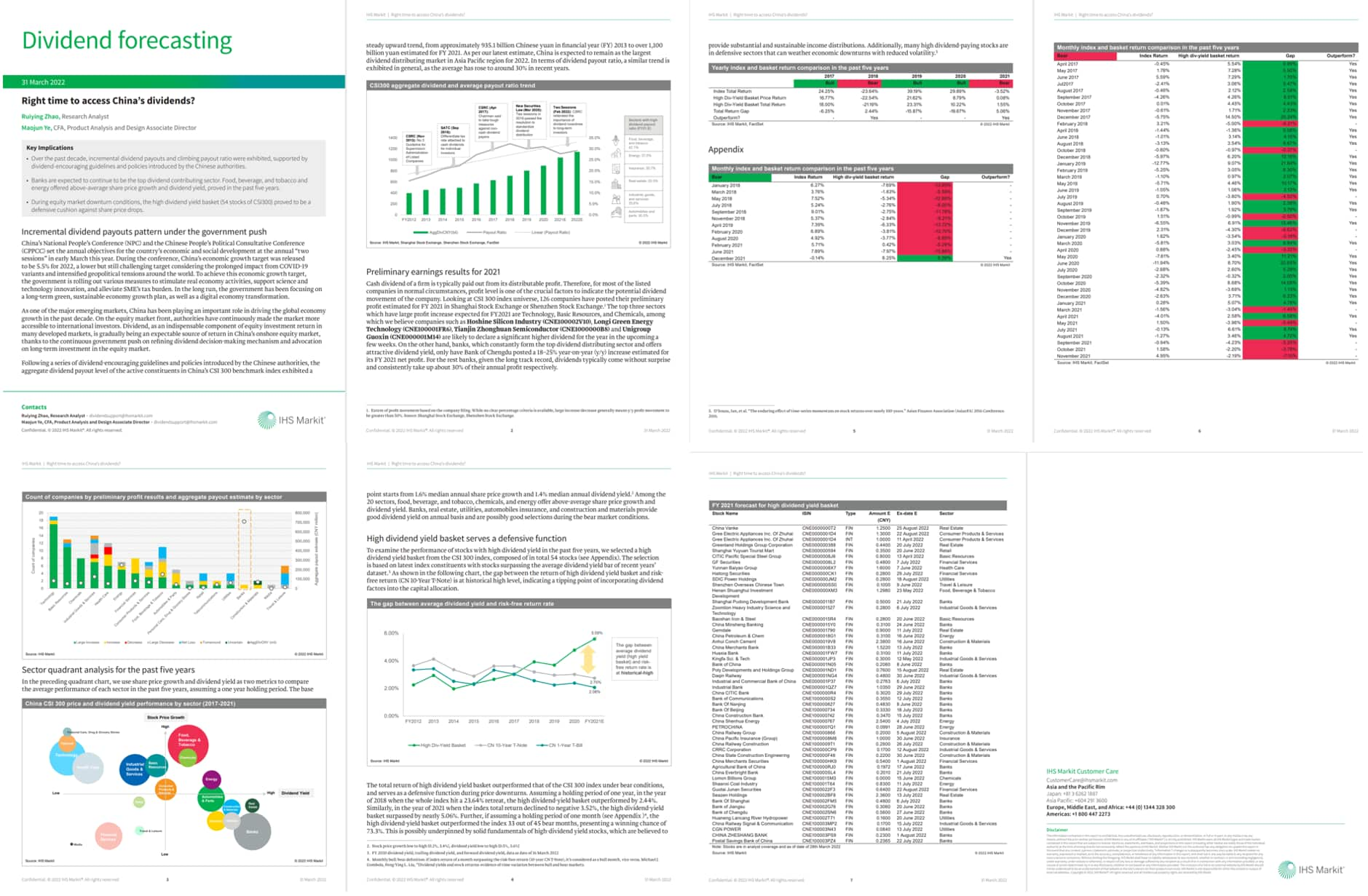

PUBLICATION — Mar 31, 2022

By Maojun Ye and Ruiying Zhao

As one of the major emerging markets, China has been playing an important role in driving the global economy growth in the past decade. Dividends, as an indispensable component of equity investment return in many developed markets, is gradually being an expectable source of return in China's onshore equity market. However, recently we have seen China's moderating GDP growth, supply chain disruptions from geopolitical tensions and another wave of Covid-19 outbreak in mainland, pouring uncertainty to the market. What is the prospect for China's dividend outlook under current conditions? And more importantly, is it the right time to access China's dividends now?

To find out more, please join us now at a recorded session [click to join] with Mohammad Hassan, our APAC Dividend Forecasting Head, Maojun Ye, our APAC Dividend Product Analysis and Design Associate Director and Ruiying Zhao, our Research Analyst. Further, we provide you our analysis over the high dividend yield basket with a full list of 54 names in the report [click to download].

For more information, please contact dividendsapac@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.