Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 27, 2023

By Michael Lin

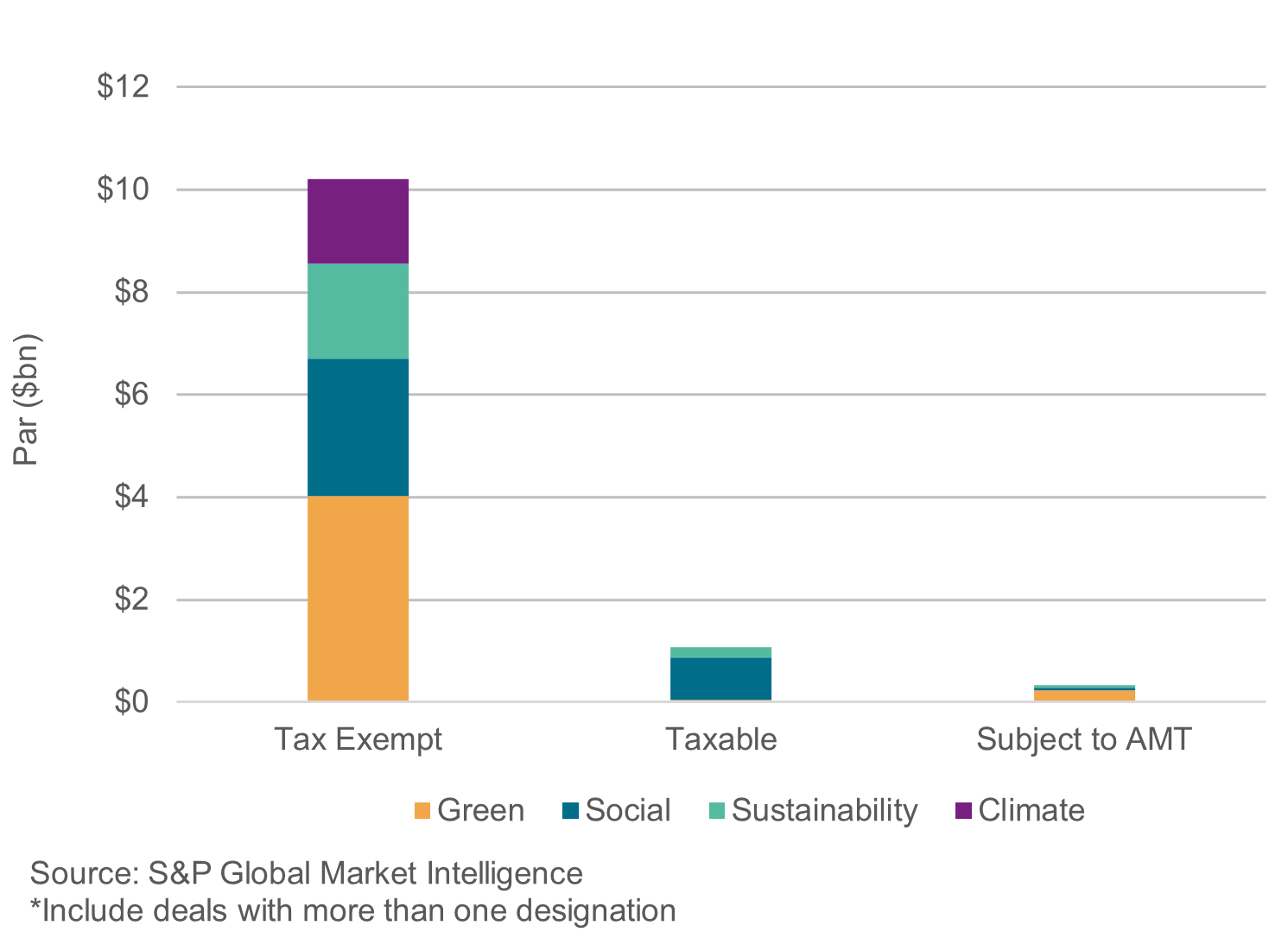

Green Bonds represented the largest share of Sustainable issuance, accounting for $4.3B, or 37% of Sustainable issuance in Q2 2023. The largest green bond issued during Q2 2023 was The California Community Choice Financing Authority's $958.29M Clean Energy Project Revenue Bonds, Series 2023D (Green Bonds) sold on 6/7/2023.

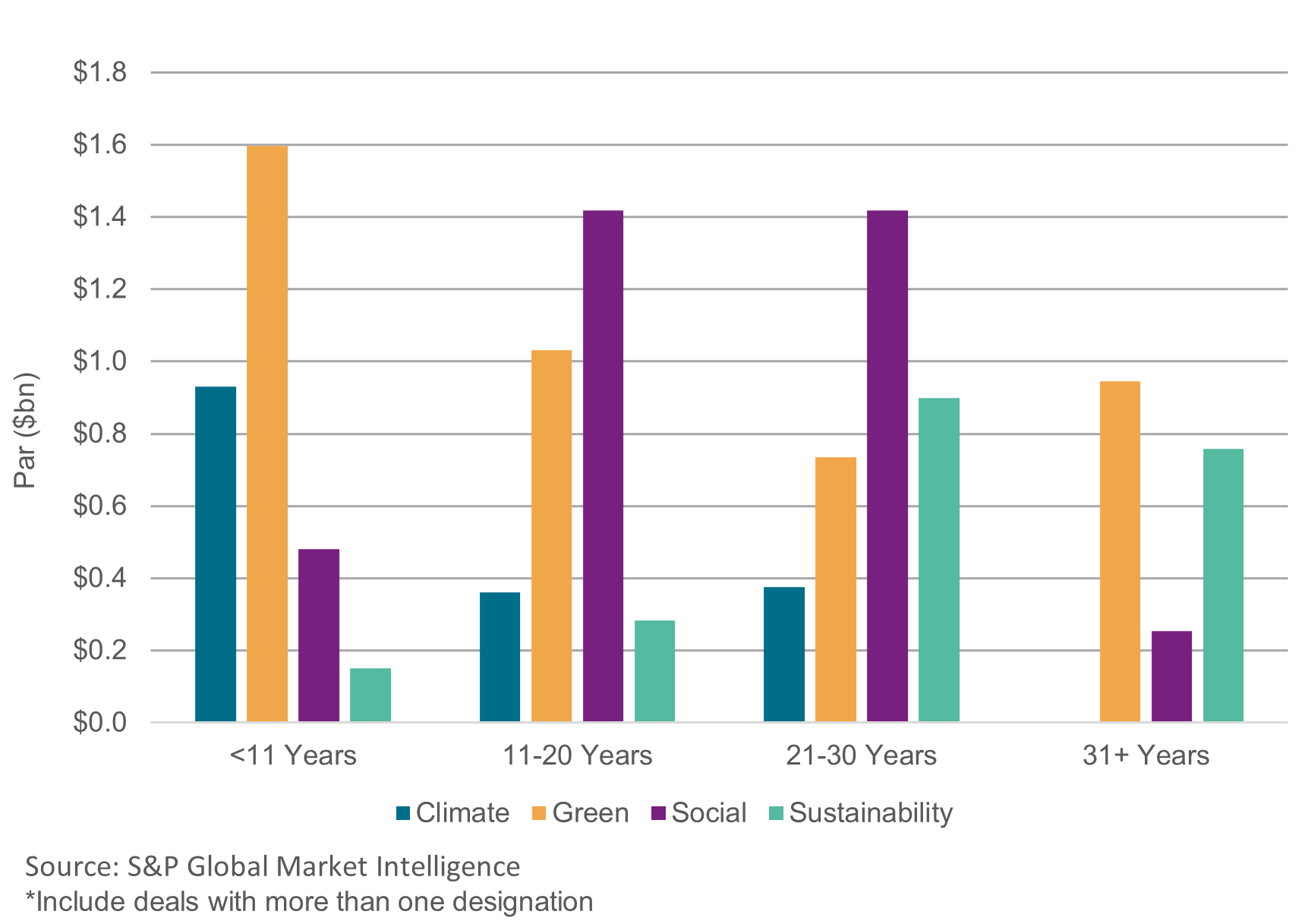

Social and Sustainability bonds' coupons were spread across 3% to 6% range while Climate and Green bonds' coupons were concentrated at the 5% to 6% cohort.

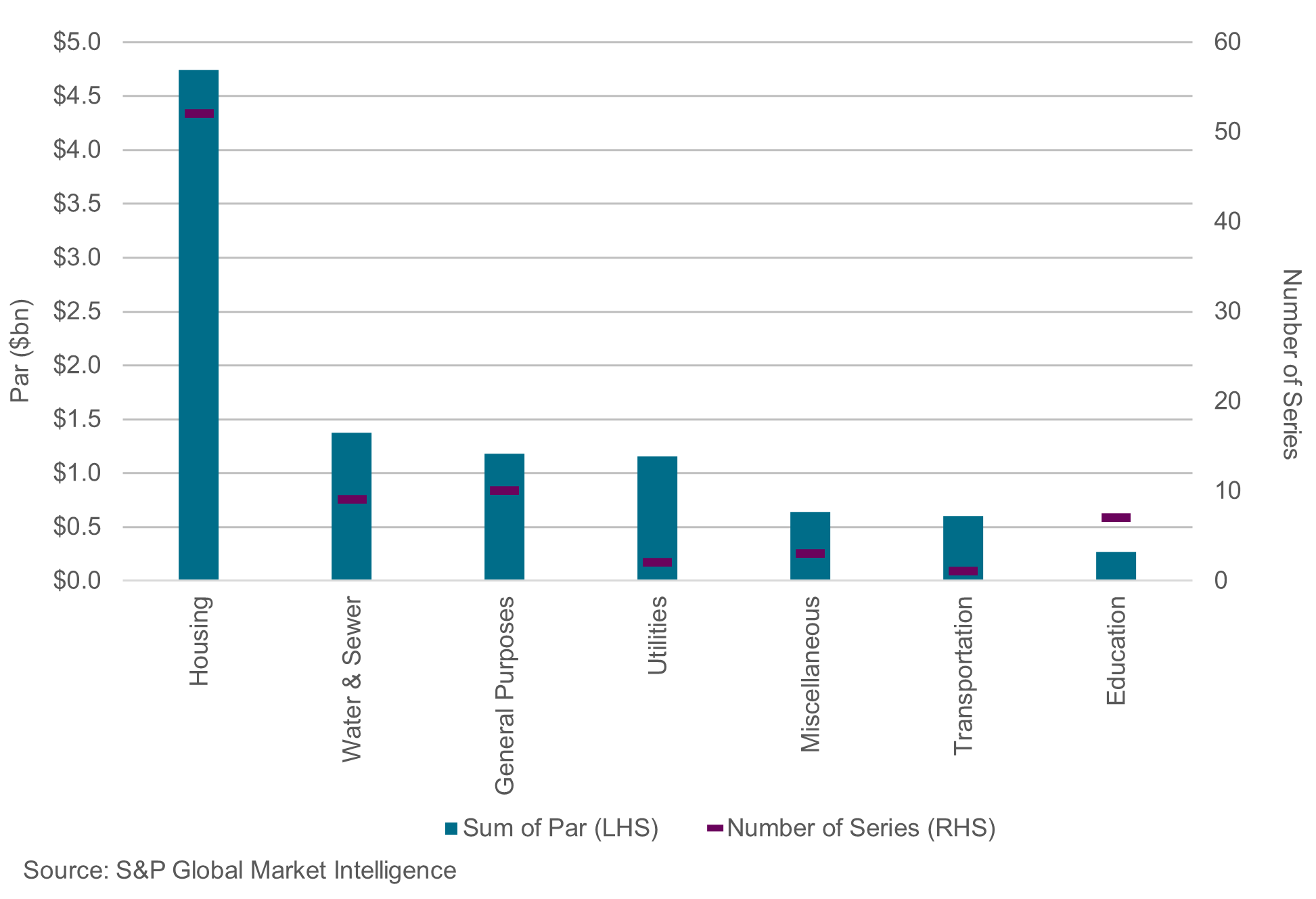

The Housing sector represented the greatest portion of Sustainable bonds by sector with $4.7B issued, led by the $592.725M New York City Housing Development Corporation, Multi-Family Housing Revenue Bonds, 2023 Series A-1 & A-2 (Sustainable Development).

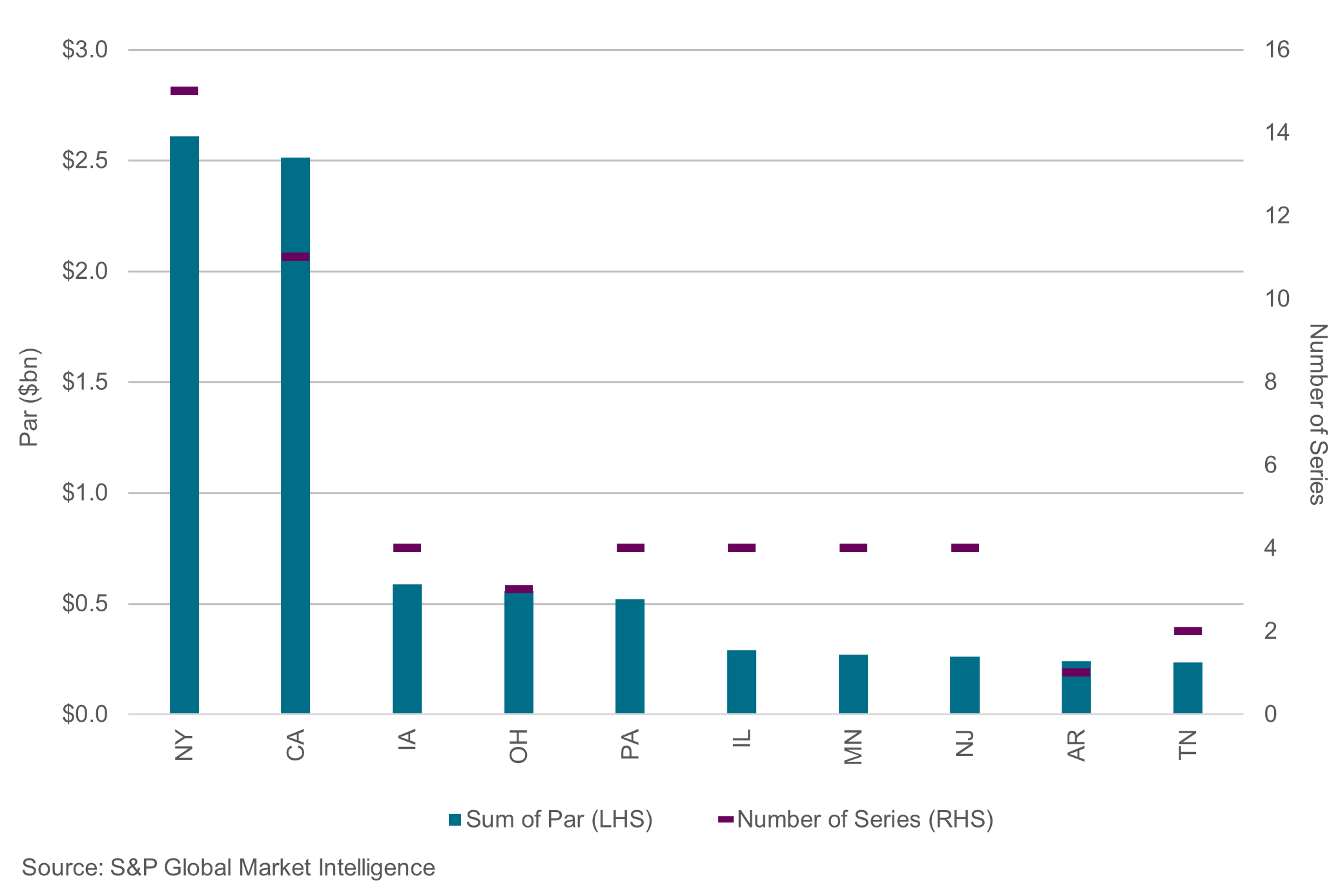

NY led the Sustainable issuance in Q2 2023 with over $2.6B of issuance.

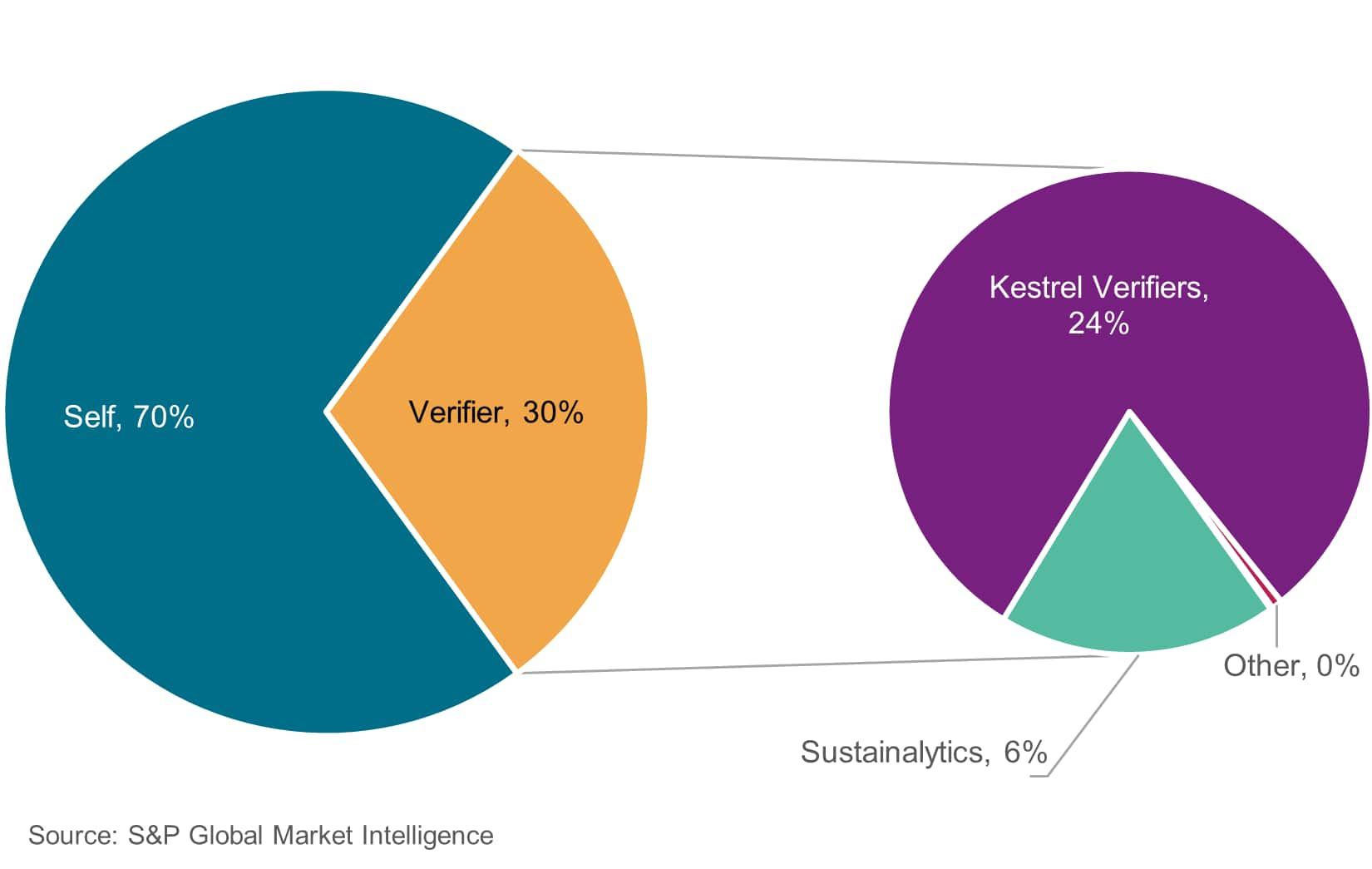

Verifier vs Self

Majority of Sustainable issuance was self-verified in Q2 2023. Meanwhile, Kestrel Verifiers accounts for the bulk of the third-party verified issuance.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.