Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 11, 2021

Given the concern over its external liquidity, Egypt's bond spread has been under pressure in recent months. From an 8 January 2021 low of 504 basis points, and 512 basis points in early June, its EMBI+ Index, which measures the average spread of its dollar-denominated reference bonds versus US Treasuries, had risen to 664 basis points in late October, clearly underperforming the wider emerging market asset class. It stood at 658 basis points at the close on 4 November, not yet having adjusted to reflect this improvement in Egypt's reserve position.

Despite the higher yields on its international public debt, Egypt is on a good path to meet its external funding needs this fiscal year. This year's budget called for USD5 billion-USD6 billion of net foreign borrowing for FY 2021/22. The government already raised USD3 billion from recent Eurobond issuance and is preparing a syndicated loan facility worth USD2 billion from commercial banks (re-financing an earlier loan that matured in August 2021).

The future external borrowing pipeline and a debut sovereign sukuk issuance is likely to be completed in Q2 2022. Additionally, the World Bank has approved a USD360-million facility to support Egypt's post-pandemic recovery. The development policy financing (DPF) loan will be used to support the private sector, increase transparency at state-owned enterprises (SOEs), and encourage female participation in the workforce. The Asian Infrastructure Investment Bank (AIIB) is also considering parallel financing of the same amount, but no detail is available on the use of proceeds or the specific timetable for the loan's approval. IHS Markit assesses that there is a strong likelihood of Egypt undertaking another modestly-sized international issuance in Q1 2022.

In addition, when Egypt is re-included on the JPMorgan bond index at the end of 2021, the measure is expected to attract USD1.4 billion-USD2.2 billion of portfolio inflows into the Egyptian treasury market from funds that track the index. Egyptian bonds were expected to become "Euroclearable" by November, but this will be delayed to Q1 2022 given an issue over how Egypt calculates the withholding tax on government securities.

Outlook

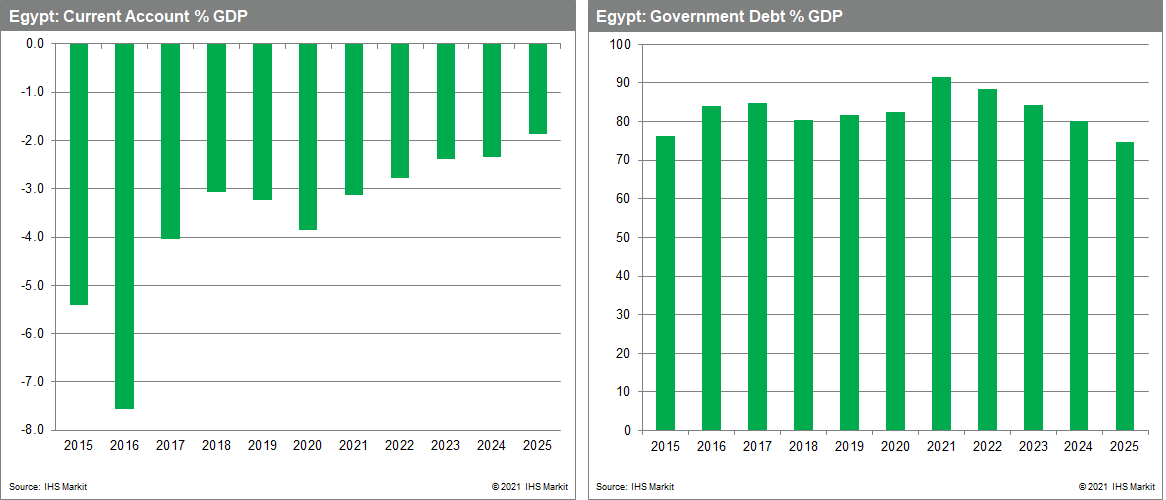

Egypt has structurally high financing needs (with a gross external requirement averaging 6% of GDP in 2021-25), which we expect to be met mainly through debt inflows. Egypt's external position has faced potential pressure from the recent widening in the current account deficit (CAD), driven mainly by rising global energy and commodity prices. The CAD widened by USD7.2 billion to USD18.4 billion in FY 2020/21 compared with USD11.2 billion in the previous year, owing to the adverse effect of the COVID-19 pandemic on tourism. The widening in the CAD is roughly the same as the drop in tourism revenues in FY2020/21.

Tourism is likely to show an accelerated recovery, thanks to the return of Russian tourists and a general revival in the tourism sector. Russian tourism at the Red Sea resorts restarted in August after a six-year hiatus (since the 2015 Metrojet crash) as Russia's flight ban finally ended. Russia is set to increase the number of weekly flights from Moscow to Sharm El Sheikh and Hurghada from early November to as many as 25 flights on a weekly basis.

The speed of the tourism recovery will be the critical factor shaping up Egypt's external balances over the next year. By end of 2022, IHS Markit expects key foreign-currency earners such as tourism to return to around their pre-pandemic levels and that hydrocarbons will be making a stronger net external contribution to the current account.

Overall, recent developments lead us to forecast a largely stable EGP over the next 12 months and stable domestic policy rates at least to the first half of 2022, despite the Federal Reserve's announcement to wind down its USD120-billion per month stimulus program from mid-November.