Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 8, 2025

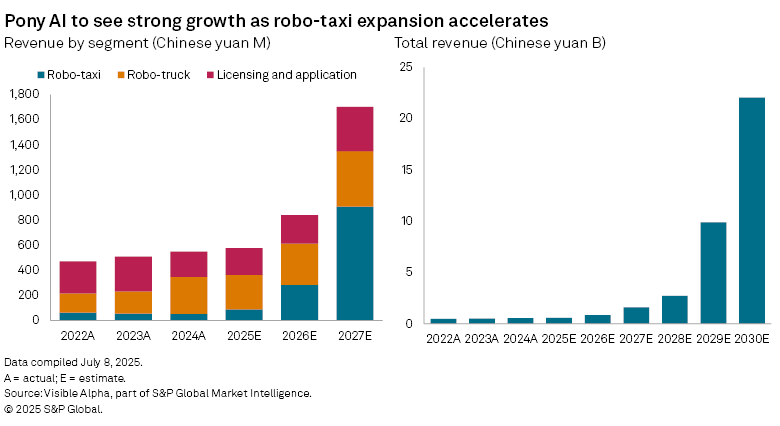

Pony AI Inc. (NASDAQ: PONY), the Chinese autonomous driving start-up backed by Toyota, is expected to ramp up its robotaxi business in 2025, with Visible Alpha consensus estimates pointing to a +68% year-on-year increase in segment revenue to CN¥88 million.

While the company began operating robotaxis in China in 2022, growth in the segment has so far been modest. That may be about to change. Pony AI plans to scale its fleet to more than 1,000 by year-end, and over 10,000 by 2028, as it positions itself for commercial deployment at scale.

The company has already secured operating permits in China, the US, South Korea and Luxembourg, and recently signed a memorandum of understanding with Dubai’s Roads and Transport Authority to explore future deployment in the UAE.

Visible Alpha estimates suggest robotaxi revenue will more than triple in 2026 to CN¥284 million as fleet monetization gains traction. Total company revenue is projected to rise +9% year-on-year to CN¥588 million in 2025, before accelerating rapidly to CN¥22 billion by 2030 — implying a compound annual growth rate of more than 100%. Analysts expect Pony AI to reach profitability by 2029.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings

Segment