Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 12, 2021

By Rajiv Biswas

The latest GDP statistics for the second quarter of 2021 showed that the Philippines economy grew by 11.8% year-on-year, after five consecutive quarters of contraction. In the first quarter of 2021, GDP had declined by 3.9% year-on-year, following a severe contraction in GDP in the 2020 calendar year, when the Philippines economy contracted by 9.6% year-on-year.

The 2020 economic contraction was the largest annual decline ever recorded since National Accounts data series for the Philippines commenced in 1946. Household final consumption expenditure fell by 7.9% y/y in calendar 2020, while gross capital formation contracted by 34.4% y/y. Some sectors of the economy recorded severe declines in output, with the transport and storage sector recording a 30.9% y/y decline in output in 2020, while accommodation and food services output slumped by 45.4%.

Private consumption was a key driver for the return to positive year-on-year growth in the second quarter of 2021, as household final consumption expenditure rebounded by 7.2% year-on-year, although government final expenditure fell by 4.9% y/y. Exports grew by 27% y/y in the second quarter of 2021, helped by the economic rebound in key global markets, including the US, EU and China.

In June 2021, exports rose by 17.6% y/y, helped by a 12.3% y/y increase in exports of electronic products. Electronic products continued to be the country's top merchandise export in June 2021, with total earnings of USD 3.72 billion, accounting for 57.1 percent of total exports in June.

In 2020, the current account surplus reached a record high of USD 13 billion, or 3.6% of GDP, boosted by the sharp slump in imports due to the severe contraction in domestic demand. Another large current account surplus is expected in 2021. In June 2021, the Philippines central bank, Bangko Sentral ng Pilipinas (BSP), revised up its current account surplus projection for 2021 to USD 10 billion, or 2.5% of GDP.

An important stabilizing factor for the Philippines economy has been overseas worker remittances by Filipinos working abroad, which remained quite stable during 2020, down only 0.8% y/y, and equivalent to around 10% of GDP. However, an estimated 400,000 Filipino workers were repatriated during 2020 as a result of job losses in their host countries, raising concerns about the impact on remittance flows during 2021. Remittances sent home by workers are an important factor supporting domestic consumer spending in the Philippines. However, despite concerns about job losses, recent monthly data continues to show resilient remittance inflows, with remittances by workers abroad up by 13.3% y/y in May 2021. In the first five months of 2021, remittance flows rose by 6.6% y/y.

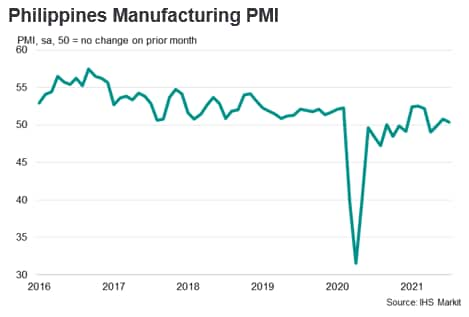

Manufacturing production contracted by 9.8% y/y in 2020, reflecting significant disruption to manufacturing output during the pandemic-related lockdown and restrictions on retail trading in Q2 and Q3 2020. Economic conditions had gradually improved in the fourth quarter of 2020 and during the first half of 2021, with manufacturing output rising by 22.3% y/y in the second quarter of 2021. However, the recent severe escalation in the pandemic has created renewed uncertainty about the momentum of economic recovery in the remaining months of 2021.

The IHS Markit Philippines Manufacturing PMI fell from 50.8 in June to 50.4 in July, still registering slightly above the 50.0 no-change threshold that separates expansion from contraction. This followed declines seen in April and May, when escalating daily new cases had resulted in protracted lockdown measures, impacting economic activity. The protracted virus-related restrictions in the Philippines have contributed to weak domestic demand and softer consumption spending in July.

A combination of raw material shortages and pandemic-related restrictions led to another marked lengthening of supplier lead times in July. Vendor performance has now deteriorated in every month since August 2019.

As a developing country with a population of 108 million, the Philippines confronts significant challenges in vaccinating its population with COVID-19 vaccines due to difficulties in obtaining sufficient vaccine supplies, as well as the logistical problems of implementing a large-scale vaccination rollout nationwide. The COVID-19 vaccination program began on 1st March 2021, after the arrival of shipments of China's Sinovac vaccine. The Philippines has contracted to acquire 25 million doses of the Sinovac vaccine, with an estimated 16.6 million doses already delivered and a further 1 million doses provided as a gift by the Chinese government. The Philippines is also due to receive 9.3 million doses of the Oxford/AstraZeneca vaccine through the global COVAX vaccine sharing initiative. So far 5.7 million doses of the AstraZeneca vaccine had been delivered to the Philippines through this COVAX facility by the mid-July 2021, including 1.1 million doses donated by the Japanese government. The UK government has also donated 415,000 doses of the AstraZeneca vaccine.

The COVAX facility has faced delays in receiving AstraZeneca vaccine supplies from the Serum Institute of India, a key manufacturer of the AstraZeneca vaccine. This is because India has also faced a sharply accelerating COVID-19 wave similar to the Philippines, and the Indian government has placed temporary restrictions on export of COVID-19 vaccines in order to accelerate the vaccination of the Indian population.

The Philippines government is negotiating with seven global COVID-19 vaccine makers to secure sufficient supplies. A contract for 13 million doses has been agreed with Moderna, with a further contract for an additional 7 million doses also having been subsequently negotiated, providing a total of 20 million Moderna vaccine doses. Furthermore, the US Government announced on 30th July that it was also donating 3 million doses of the Moderna vaccine to the Philippines through the international COVAX facility, with delivery having been completed on 3rd August. The US government had earlier provided 3.2 million doses of the single shot Johnson & Johnson vaccine to the Philippines in mid-July. The Philippines also signed a contract for 40 million doses of the Pfizer vaccine in June 2021.

The Philippines government had planned to vaccinate 70 million persons by end-2021, with a total of 23.2 million doses having been administered by late July 2021. An estimated 11.4% of the total population had received first dose vaccinations by 5th August 2021, with 9.8% of the population fully vaccinated. A key problem confronting the Philippines, like many other developing countries, is that it is relying on imported vaccine supplies and is therefore vulnerable to supply disruptions due to "vaccine nationalism", as some nations with vaccine production facilities prioritize supplies to their own domestic populations due to the mounting human toll of the pandemic.

While the Philippines economy is still expected to show a positive growth rebound in 2021, the near-term outlook for the Philippines economy has been dampened by the rising wave of new COVID-19 cases since mid-March 2021. Although daily new cases showed some decline during May and June, the impact of the Delta variant has resulted in a renewed upturn in new cases during July and early August. This is expected to constrain the pace of economic recovery in the near-term, as strict pandemic control measures have again been imposed in Metro Manila and other surrounding areas badly impacted by the latest surge in pandemic cases.

Vaccine rollout in the Philippines has also been constrained by lack of sufficient supplies of imported vaccines. Consequently, the pace of economic recovery in 2021 is likely to be more constrained than previously expected, with renewed pandemic control measures limiting the momentum of growth recovery in the near-term. Consequently, GDP growth in 2021 is expected to be in the 5% to 6% range.

The outlook for 2022 is positive, with the July IHS Markit Philippines Manufacturing PMI survey showed that sentiment amongst Philippines manufacturing firms regarding output expectations over the next 12 months had improved to a four-month high. The gradual progress of the COVID-19 vaccination program has underpinned hopes of a return to normality over the next 12 months. Stronger GDP growth of around 7.7% y/y is expected in 2022, as the pandemic is gradually restrained by widening vaccine rollout in the Philippines, resulting in more normal economic conditions.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.