Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 24, 2021

By Chris Suckling and Dr. Marie Lechler

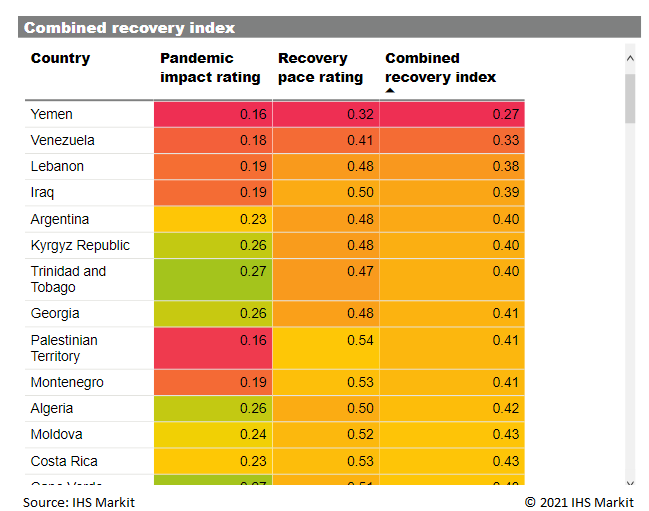

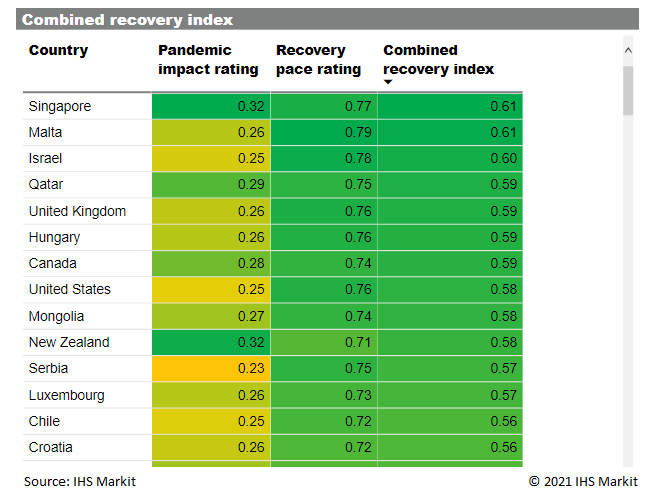

The coronavirus disease 2019 (COVID-19) pandemic has had uneven impacts across different countries and regions. The speed of recovery is also likely to differ widely, depending on a range of underlying factors, such as public health capacity, economic policies, and the political environment. To help navigate the different pathways out of the COVID-19 pandemic and understand the implications for the business environment, we produced a comparative recovery index based on the impact of COVID-19 across several dimensions and the speed of recovery to pre-pandemic levels.

Moderate impact, fast recovery

A slow initial response to the onset of COVID-19 in countries like the United State and the United Kingdom have contributed to some of the highest total case numbers. However, their recovery is among the fastest, being supported by rapid progress in rolling out vaccinations and by providing the strongest fiscal relief to households and businesses (e.g. furlough schemes), as demonstrated by comparatively low rates of unemployment. The pace of recovery in these countries is signaled by low projected GDP 'crossovers': the number of quarters of real GDP growth, based on our current projections, required to return real GDP levels to levels at end-2019, i.e. prior to the onset of the -pandemic.

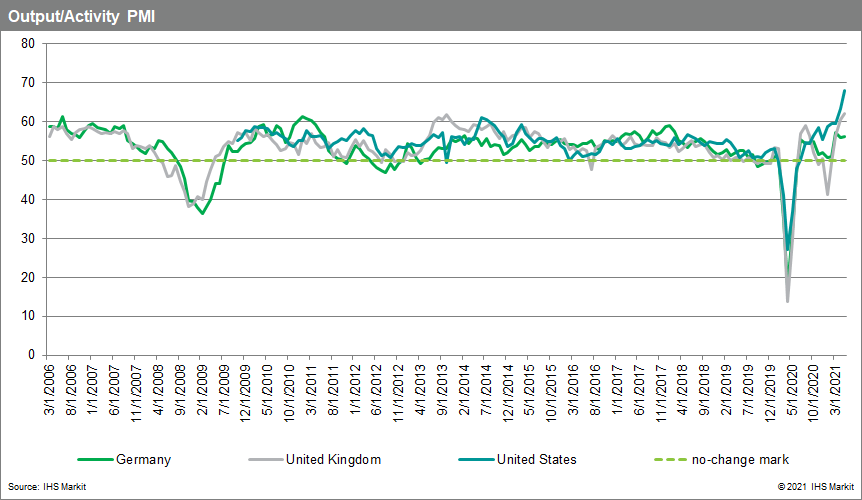

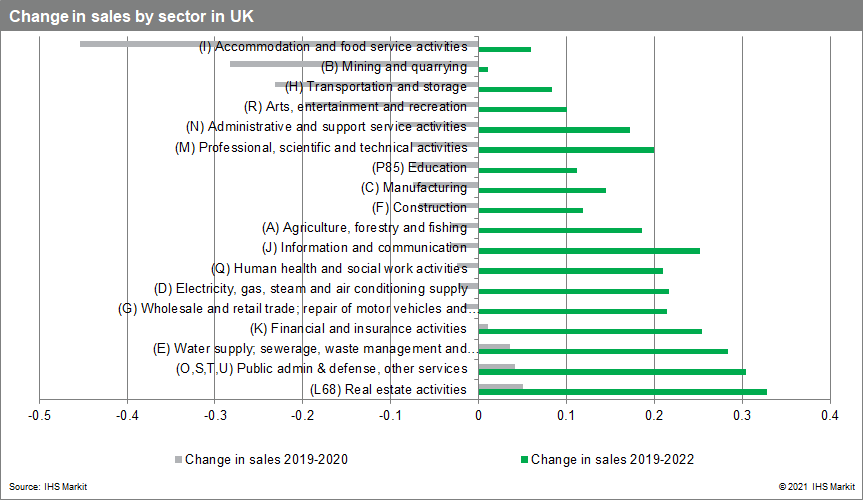

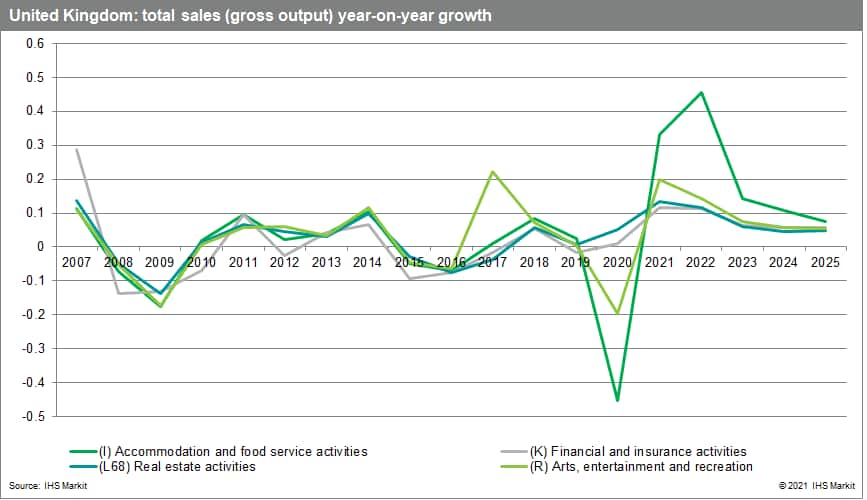

Early signs of recovery are indicated by our monthly Purchasing Managers' Index (PMI) survey of activity and output. The impact of COVID-19 was far greater than compared with the 2008-09 global financial crisis, although the subsequent rebound is sharper. However, the pace of recovery varies widely by the commercial sector, with output contracting most in sectors directly affected by lockdown restrictions, such as accommodation and food services, transportation, and arts, entertainment, and recreation. By contrast, the real estate and financial services sectors have proven to be more resilient.

Recovery for these countries is also likely to less threatened by political risk, with countries in this category having among the lowest country risk scores for government instability and policy instability. These scores indicate the risk of a change of government, whether scheduled or irregular; and whether the government's broad policy framework, including its response to COVID-19, is likely to be unstable.

High impact, slow recovery

The impact of COVID-19 was greatest in countries that have weak or no health care systems and low state capacity, like Iraq, Lebanon, Venezuela, and Yemen, as reflected in them having the highest country risk scores for state failure: the risk the state is unable to exclusively ensure law and order, and the supply of basic goods and/or is unable to respond to or manage current or likely future emergencies. Given the limited capacity for testing and tracing, and the inability or refusal to impose restrictions on movement and travel, total case numbers for countries in this group are much higher. Limited testing also implies greater uncertainty around their total number of cases. Other countries such as India that are now experiencing a 'second wave' outbreak of the COVID-19 virus or a new variant of the virus may also register within this category, despite previously showing early signs of a strong economic rebound.

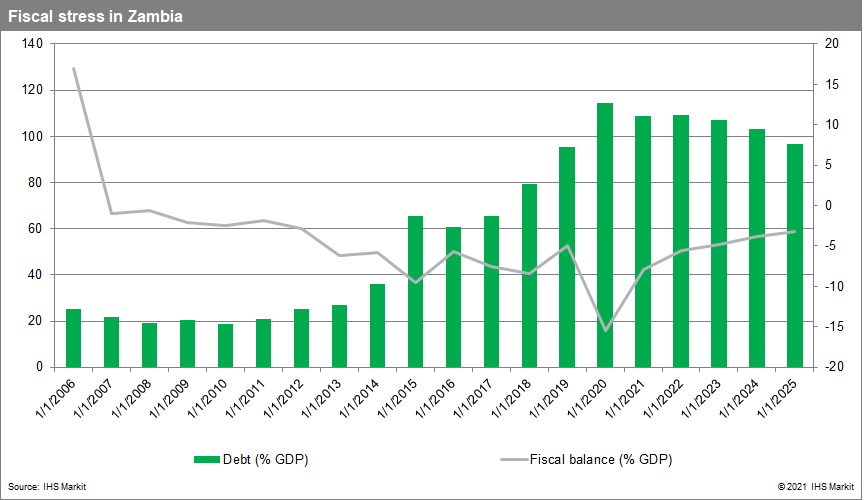

An unprecedented rise in global debt since 2010 has also increased the fiscal stress on many countries in emerging markets that have been significantly impacted by the pandemic, such as Argentina, Mozambique, and Zambia. Increases in debt servicing costs reduce the fiscal outlays available for financing public health responses and procuring vaccines, slowing the pace of recovery. Moreover, a narrow fiscal room means a rise in interest rates (perhaps spurred by inflation), higher commodity prices, and persistent twin deficient in current and fiscal accounts jeopardize the state's commitment to expenditures on which recovery depends.

Low impact, fast recovery

A smaller group of countries experienced a much more limited impact from COVID-19 in terms of total case numbers and are projected to recover quickly. The total cases per million for New Zealand, South Korea, Japan, and Taiwan are among the lowest in the world, stemming primarily from reliable testing, tracing, and statistical reporting as suggested by the low state failure risk scores for these countries. Consequently, the rate of new cases is being kept low. Given their effective containment and prevention of new virus infections, these governments could ease restrictions on businesses and movement more quickly, supporting a fast pace of recovery and reducing pressure on employment rates. For instance, New Zealand and Taiwan are both projected by our economists to return to pre-COVID-19 levels of GDP within one quarter.

About the Index

Epidemiological data is taken from Our World in Data and is updated daily. Economic data and projections are updated either monthly and/or quarterly as our Global Economics team makes scheduled revisions to their forecasts. Country Risk scores are updated ad hoc (and reviewed quarterly), depending on the analyst's developing assessment of risk.

Posted 24 May 2021 by Chris Suckling, Associate Director, Risk Quantification, S&P Global Market Intelligence and

Marie Lechler, Director, Trade and Supply Chain Product Management, S&P Global