Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 31, 2025

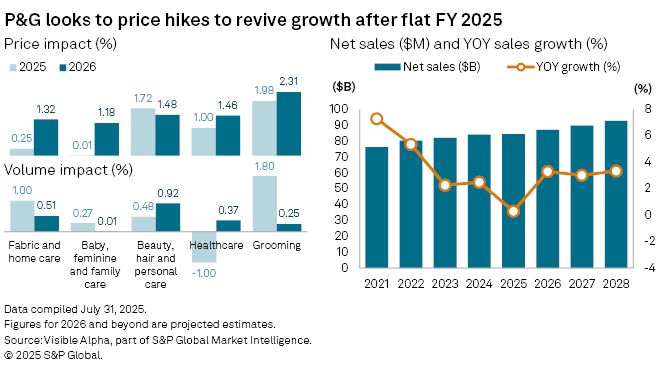

The Procter & Gamble Co. (NYSE: PG) is forecast to return to growth in 2026, with net sales expected to rise +3% year-on-year to $87 billion, following a stagnant fiscal 2025.

The world’s leading consumer goods group has faced muted demand in its core US and European markets, where economic uncertainty, shifting consumer behavior, and geopolitical volatility have dampened growth. In response, P&G plans to raise prices in the US, aiming to offset rising input costs, including those linked to tariffs.

Visible Alpha consensus shows analysts expect these price increases to drive a larger share of the company’s revenue growth as price impact across P&G’s product categories rises in fiscal 2026 compared to 2025, while volumes remain under pressure.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings

Segment